Bonds

Singapore T-Bills: What you need to know to invest

By Beansprout • 29 Mar 2024 • 0 min read

Learn more about Singapore T-Bills, including what they are, how to apply, as well as their benefits and risks before you invest.

In this article

Guide to Singapore T-bills

- Singapore Treasury Bills (T-bills) are fully backed by the Singapore government, and offer you a sound way to earn a regular interest payment.

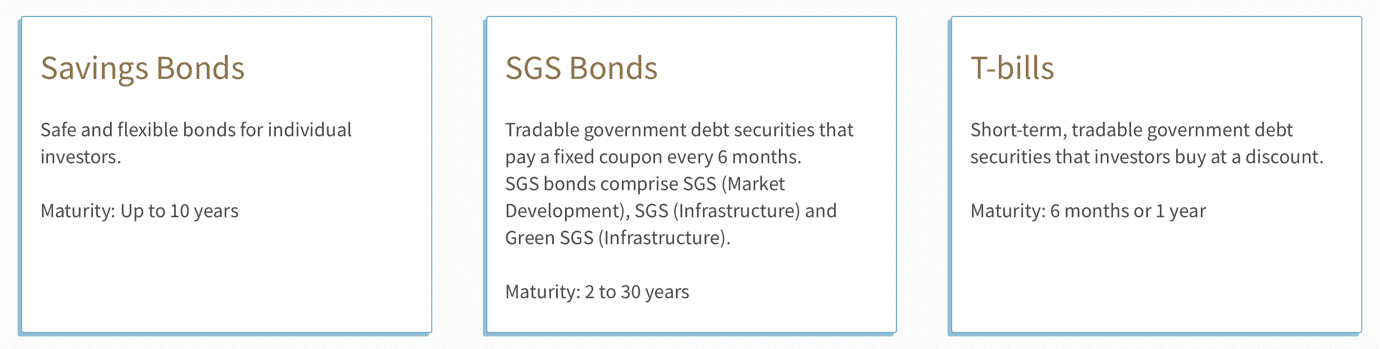

- Singapore T-bills have a short maturity period of 6 or 12 months, compared to SGS bonds which have a maturity of 2 to 30 years.

- The 6 month Singapore T-bill offers a yield of 3.80% in a recent auction held in March 2024.

- Compared to the SSB, investors of Singapore T-bills may face less flexibility to transact after issuance. As such, investors should be prepared to hold the Singapore T-bills till maturity.

Introduction to Singapore T-bills

Like the Singapore Savings Bonds, Singapore T-bills are fully backed by the Singapore Government.

They offer a sound way for you to diversify your investment portfolios, while earning a regular interest payment.

Singapore T-bills have a maturity of 6-months or 1 year.

This is shorter than SGS Bonds which have a maturity of 2 to 30 years, and pay a fixed coupon every 6 months.

Essentially, to decide between a Singapore T-bill and SGS bond, you just need to think about whether you would want to hold on this bond for a short period of time (6 months/1 year), or for a longer period of time.

Latest T-bill yield in Singapore

Demand for T-bills in Singapore has grown as interest rates remained high over the past year.

The yield on the 6-month T-bill in Singapore was at 3.8% in a recent auction on 27 March 2024.

| Auction Date | T-bill | Cut-off yield |

| 27 Mar 2024 | BS24106W | 3.80% |

| 14 Mar 2024 | BS24105X | 3.78% |

| 29 Feb 2024 | BS24104T | 3.80% |

| 15 Feb 2024 | BS24103H | 3.66% |

| 1 Feb 2024 | BS24102S | 3.54% |

| 18 Jan 2024 | BS24101Z | 3.70% |

| Source: MAS | ||

Comparing T-bills with SGS Bonds

SGS bonds have a maturity of 2 to 30 years, while T-bills have a shorter maturity of 6 or 12 months.

SGS bonds pay interest every 6 months. T-bills do not have coupon payments; instead they are issued at a discount to the face value of the bond.

| SGS bonds | T-bills | |

| Available tenor | 2, 5, 10, 15, 20, 30 or 50 years | 6 months or 1 year |

| Type of interest rate payment | Fixed coupon | No coupon; issued and traded at a discount to the face (par) value |

| How often interest is paid | Every 6 months, starting from the month of issue | At maturity |

| Secondary market trading | At DBS, OCBC or UOB main branches; on SGX through brokers | At DBS, OCBC or UOB main branches |

| Source: MAS | ||

Comparing Singapore T-bill with fixed deposit

The minimum investment amount for T-bills is S$1,000, while the minimum amount for fixed deposits is usually higher.

T-bills are issued and backed by the Singapore government. Fixed deposits are insured up to S$75,000 by the Singapore Deposit Insurance Corporation Limited (SDIC).

Find out what the latest fixed deposit rates are here.

Risks of buying Singapore T-bills

All investments come with risks, even for T-bills which are backed by the Singapore government.

#1 - Singapore T-bill has less flexibility compared to SSBs

Like any other bonds, the Singapore T-bill is subject to interest rate risks. This means that when interest rates go up, the price of the bond may come down. Hence, you might suffer capital losses if you were to sell the bond before its maturity date.

If liquidity is important to you, this is something you will need to be aware of before buying the SGS bonds.

This is where the Singapore T-bills might come in handy, as they have a shorter maturity period compared to the SGS bonds.

As a result, you are committing to a shorter period of 6 months or 1 year, where hopefully the likelihood of you having to sell the bond is also lower.

If you want the flexibility of redeeming your investment in any given month, do consider the Singapore Savings Bonds as an alternative.

| T-bills | Savings Bonds | |

| Available tenor | 6 months or 1 year | Up to 10 years |

| Frequency of issuance | Fortnightly or quarterly, according to the issuance calendar | Monthly, for at least 5 years |

| Minimum investment amount | S$1,000, and in multiples of S$1,000 | S$500, and in multiples of S$500 |

| Maximum investment amount | None; up to the allotment limit for auctions | S$200,000 overall |

| Buy using SRS and CPF funds? | Yes | SRS: Yes; CPF: No |

| Type of interest rate payment | No coupon; issued and traded at a discount to the face (par) value | Fixed coupon, steps up each year |

| How often interest is paid | Upon maturity, investors receive face value | Every 6 months, starting from the month of issue |

| Secondary market trading | At DBS, OCBC or UOB main branches | No |

| Transferable | Yes | No |

| Maturity and redemption | No early redemption. Investors receive the face (par) value at maturity (i.e. price of S$100). | Can be redeemed in any month, with no penalty. Investors receive the face (par) value plus accrued interest upon redemption. |

| Source: MAS | ||

#2 - Singapore T-bills are less easy to buy and sell after issuance

After you have been issued the Singapore T-bill, it may not be easy to buy or sell them in the secondary market before they mature.

While subscription can be done online, to sell your short-term notes, you will have to visit the main branches of the banks (DBS, OCBC or UOB), or you may save the hassle and perform your transaction online via the FSMOne platform. However do note that if your T-bills were not purchased on FSMOne.com, you will need to allow some time to transfer-in your T-bills before selling them.

#3 - No certainty on interest rate of T-bill at the point of subscription

If you were subscribing to the Singapore T-bill, you would not know what is the yield you are getting at the point of subscription.

It is eventually determined based on demand and supply at the auction. If there is sudden spike in demand for the T-bill in Singapore, then you might be getting a lower yield.

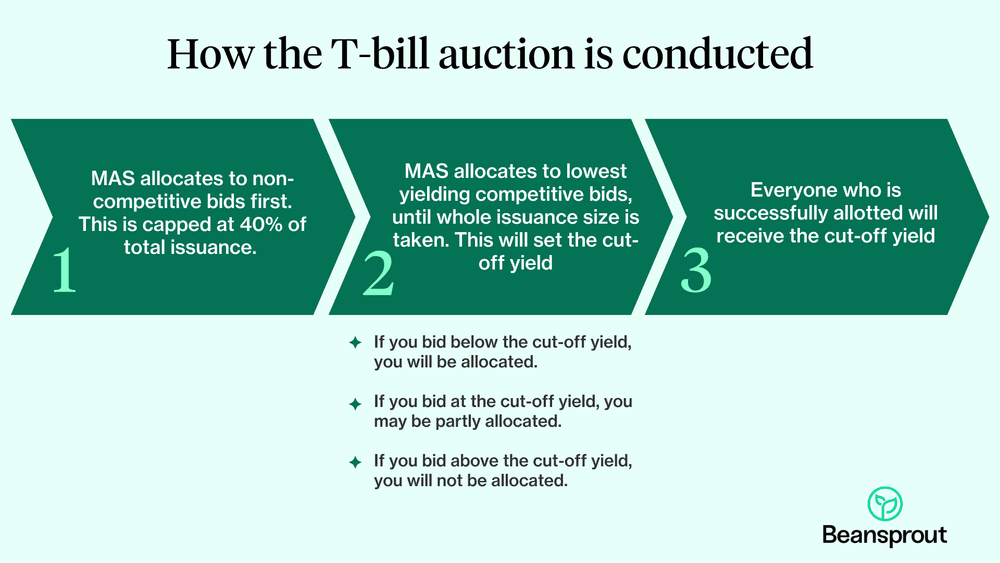

Difference between a competitive and non-competitive bid in a T-bill auction

In a non-competitive bid, you only need to specify the amount you want invest, but not the yield. You may choose this option if you wish to invest regardless of the interest rate or if you are unsure of the yield to bid. By putting a non-competitive bid, you will be receiving the bond at the cut-off yield.

In a competitive bid, you can specify the yield you are willing to accept. You may submit a competitive bid if you wish to invest in the bond only if the yield is above a certain level. However, you may not get the full amount you applied for, depending on how your bid compares to the cut-off yield.

MAS will allocate to non-competitive bids first but cap this at 40% of the total issuance.

Thereafter, MAS will allocate to the lowest yielding competitive bids, until the whole issuance size is taken. This will set the cut-off yield for the auction.

To help you decide between a competitive bid and a non-competive bid, we have summarised the differences in the table below.

To find out more about how the T-bill auction process works and what to consider when making a competitive bid, read our guide here.

| Competitive bids | Non-competitive bids | |

| What is it? | Specify the yield you are willing to accept | Specify the amount you want to invest, not the yield |

| Who should choose this? | If you will only invest in the T-bill when the cut-off yield is above the level | If you wish to invest in the bond regardless of the return or are unsure of what yield to bid |

| Pros | Will have option to invest elsewhere if the cut-off yield in the auction is lower than the bid yield | Will be allocated first, up to 40% of the total issuance amount |

| Cons | May not get allocated if bid yield is above the cut-off yield | - May not get full allocation if total non-competitive bids exceed allocation limit - Will have to invest in the T-bill even if the cut-off yield is very low in the auction |

Interest rate you would receive in a T-bill auction

All successful competitive and non-competitive bids will receive the cut-off yield. The cut-off yield is the highest accepted yield of successful competitive bids.

The other thing to note here is that Singapore T-bills do not have coupon payments; instead, they are issued to you at a purchase price that is below the face value of the bond. Therefore, the yield that you get at maturity is the difference between the purchase price and the face value.

Sounds complicated? Here's how it works.

Using the 1-year T-bill in Singapore as an example, it has a face value of S$100. This is the amount of money you will receive for holding the bond till maturity, which in this case is 1 year.

If you pay $98 for purchasing the bond, your yield for holding on to the bond for one year can then be calculated as (S$100-S$98) / 98 x 100 = 2.04%.

In other words, you would have earned a return of 2.04%, having paid S$98 upfront, and receiving S$100 in one year's time.

Secondary market for T-bills

If you missed out on previous T-bill auctions, you can still buy them in the secondary market.

To buy or sell the T-bill in the secondary market, you will have to visit the main branches of the banks (DBS, OCBC or UOB), and indicate whether you are using cash, SRS or CPF Investment Scheme (CPFIS) funds. Thereafter, the bank will provide you with a quote on the Singapore T-bill.

Alternatively, you may also buy and sell the T-bill on the FSMOne platform at the prevailing market price. The full list of tradeable T-Bills and Singapore Government Bonds can be found here.

However, it is worth remembering that you may suffer capital losses if you were to sell the T-bill before its maturity date.

Buying the Singapore T-bill with CPF

The yield on the T-bill in Singapore is now higher than the prevailing CPF interest rate. Read our analysis on whether it makes sense to invest in the T-bill Singapore using your CPF.

Also, do note that the use of CPFIS funds for investing in T-bills in Singapore is subject to CPF investment guidelines.

You can invest your OA savings after setting aside $20,000 in your OA. And you can invest your SA savings after setting aside $40,000 in your SA.

Check out our CPF T-Bill calculator to find out how much more interest you can potentially earn by investing in the Singapore T-bill using your CPF Ordinary Account (OA) savings.

How to buy T-bills in Singapore

These are the upcoming key dates you need to know. You may check the full schedule of upcoming auction here.

What you will need for cash application: You can apply through DBS/POSB, OCBC and UOB ATMs and internet banking portal. You will also need an individual CDP account with Direct Crediting Services activated . This allows coupon and principal payments to be credited directly into your bank account.

What you will need for SRS application: You can apply through the internet banking portal of your SRS Operator (DBS/POSB, OCBC, or UOB).

What you will need for CPFIS Application:

- Read our step-by-step guide to applying via DBS.

- Read our step-by-step guide to applying via OCBC

- Read our step-by-step guide to applying via UOB.

For CPFIS-OA investments, you will need a CPF Investment Account with one of the three CPFIS agent banks (DBS/POSB, OCBC, and UOB). There is no need to open any CPF Investment Account if you wish to invest CPFIS-SA funds.

Applications through ATMs and internet banking may close 1 to 2 business days before the auction, as your bank will need to process the application before the auction closes. Do check with your bank for the exact cut-off time for the different application channels.

For new T-bill issues in Singapore, the full bid amount will be deducted from your account at the point of application. So do make sure you have sufficient funds in the account you are using to apply.

If your bid is unsuccessful, the money will be refunded into the account used to make the application. The refund will be shown in your account 1-2 business days after the auction day.

Minimum and maximum subscription amount for the T-bill

The minimum bid amount for T-bills in Singapore is S$1,000. So you need to start by deciding how much you want to invest, in multiples of S$1,000.

There will be no limit on how much T-bill an investor can own, however there are allotment limits for auctions that are above S$1 million.

Checking if your T-bill subscription is successful

After an auction closes, you can check the aggregate results of the auction about an hour later on the issuance calendar.

The T-bills in Singapore are issued 3 business days after the results are announced.

If your bid is successful, the securities will be reflected in your respective accounts after the issuance date.

- For cash applications: You can check your CDP statement

- For SRS application: You can check the statements from your SRS Operator (DBS/POSB, OCBC and UOB are SRS operators)

- For CPFIS-OA application: You can check the CPFIS statement sent by your agent bank (DBS/POSB, OCBC and UOB are CPFIS agent banks)

- For CPFIS-SA application: You can check your CPF statement

Fees for buying T-bills

For cash and SRS applications at the auction, there are no application charges as the fee is waived by DBS, UOB and OCBC.

For CPF OA applications at the auction, there will be a charge of of $2.50 + GST for DBS and OCBC, and $2.00 + GST for UOB per transaction. In addition, there is a $2 service fee every quarter per counter. This would mean that the total fees would add up to about $6.50 + GST for each successful application of the 6-month T-bill using CPF OA via DBS and OCBC.

Key dates for T-bill application

For retail investors, cash applications through ATMs and internet banking typically close at 9pm the day before the auction date.

Applications using CPF can close even earlier, depending on the processing time required by the bank.

The results of the auction are typically known about 1 hour after the auction.

T-bills are issued 3 business days after the auction. In this example, the issue date is on 18 October, 3 business days after the auction date on 13 October.

The maturity date is the date you will receive the amount you invested.

For the latest T-bill issuance calendar, please refer to the MAS auctions and issuance calendar.

Additional resources on the T-bill

You can find more resources about the T-bill on the MAS website.

Get the latest insights on T-bills on Beansprout's Telegram group.

Use our CPF-Tbill calculator to find out how much more interest you can potentially earn by investing in the Singapore T-bill using your CPF OA savings.

This article was first published on 09 June 2023 , and was updated on 29 March 2024.

Read also

Want to learn more? Discover more Bond-related insights here.

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

0 comments