Bonds

T-bill yield steady at 3.74%. Here's why it has remained high

By Gerald Wong, CFA • 25 Apr 2024 • 0 min read

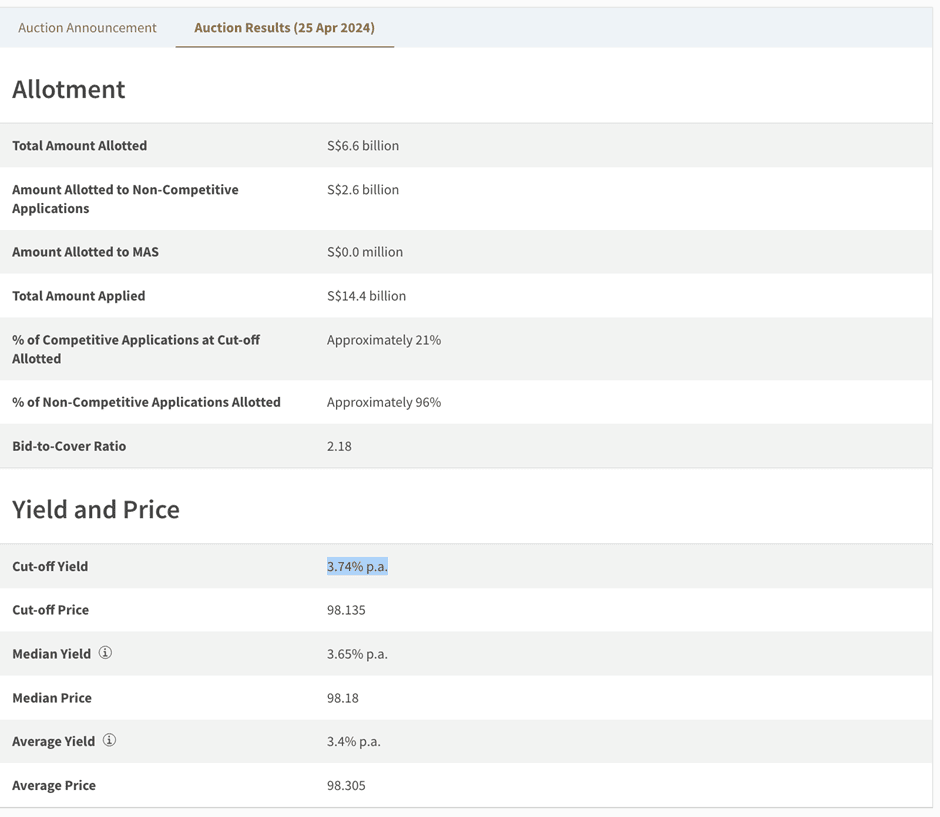

The cut-off yield on the latest 6-month Singapore T-bill auction on 25 April remained high at 3.74%.

In this article

What happened?

I was pleasantly surprised to see the result of the latest Singapore T-bill auction.

The cut-off yield for the 6-month Singapore T-bill auction on 25 April (BS24108V) was at 3.74%, little changed from the previous auction.

Some investors in the Beansprout community were also pleased to see that the Singapore T-bill yield has remained elevated, even with a fall in fixed deposit rates recently.

This follows a trend we have seen in recent weeks, where the cut-off yield for the recent 1-year T-bill auction has also stayed high.

In this post, I will be sharing more about what is helping to support the yield for the Singapore T-bill.

What we learnt from the latest Singapore T-bill auction

#1 - Demand for Singapore T-bill declines

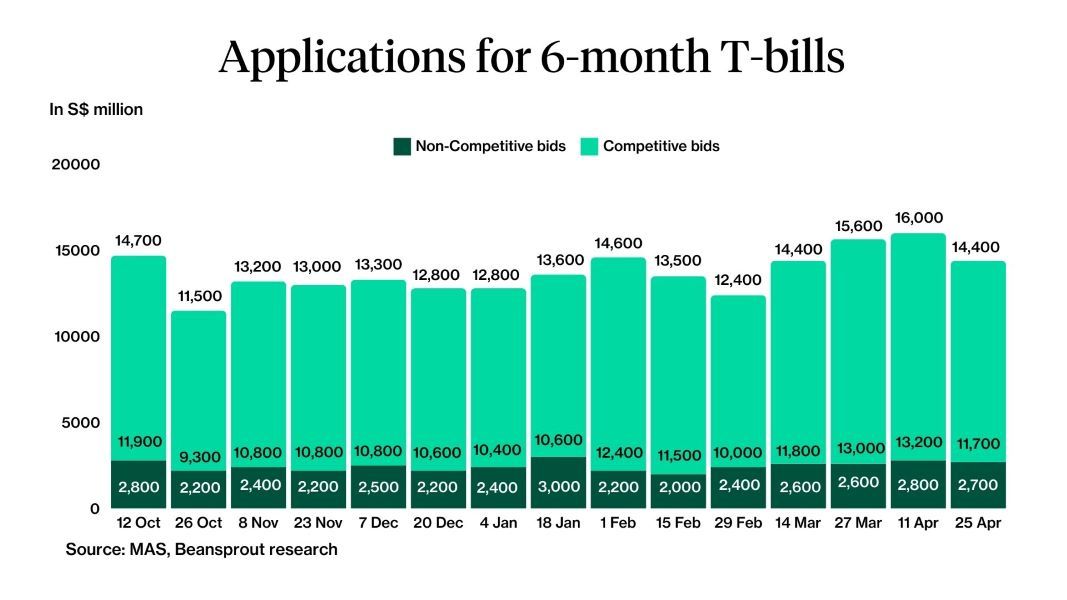

The total amount of applications for the 6-month Singapore T-bill fell to S$14.4 billion after reaching a record high of S$16.0 billion in the previous auction.

Applications fell across both competitive and non-competitive bids.

The amount of competitive bids fell to S$11.7 billion from S$13.2 billion in the previous auction.

If you had submitted a competitive bid at 3.73% or below, you would receive 100% allocation of your T-bill bid amount.

If you had submitted a competitive bid at 3.74%, you would receive approximately 21% of your T-bill bid amount.

The amount of non-competitive bids fell to S$2.7 billion from S$2.8 billion in the previous auction.

As the amount of non-competitive bids exceeded the allocation limit, eligible non-competitive bids were only able to get approximately 96% allocation.

However, as T-bills are allocated in a minimum denomination of S$1,000, this means that you may end up with a S$9,000 allotment for a S$10,000 non-competitive bid.

This would also mark the fourth consecutive auction that non-competitive bids were not able to receive full allocation.

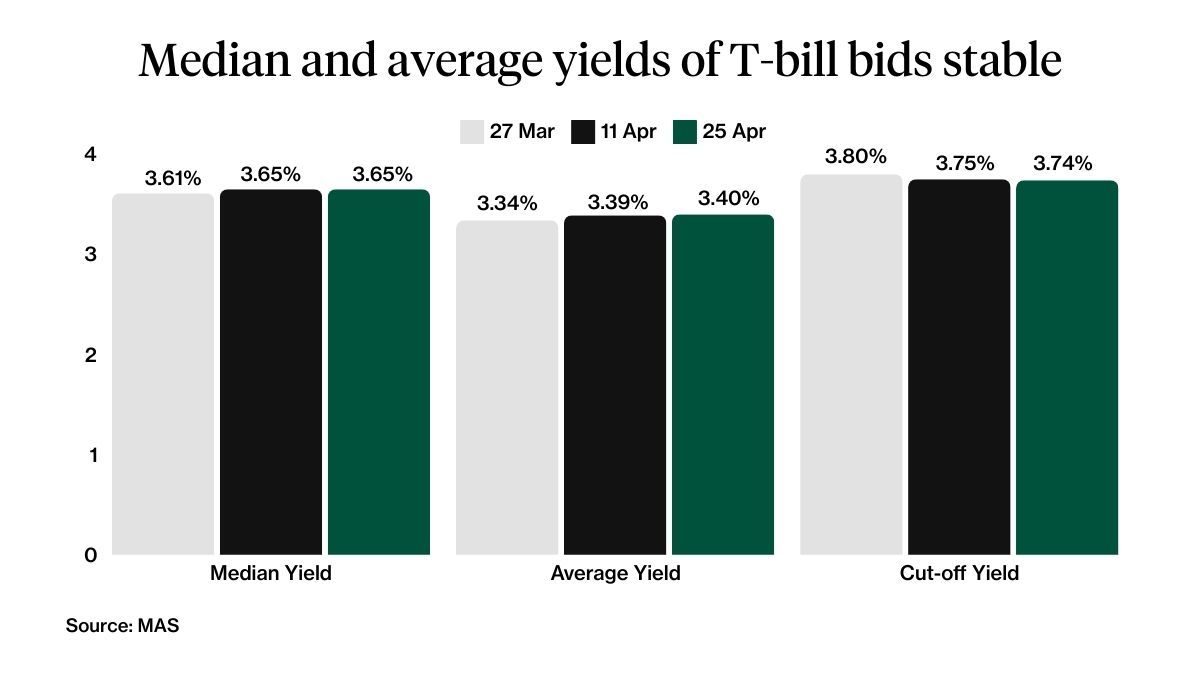

#2 - Average and median yield of bids submitted stable

The median yield of bids was at 3.65%, unchanged from the previous auction.

The average yield of bids was at 3.40%, also little changed from the previous auction.

What this indicates to me is that investors have continued to put in fairly high bids, as US government bond yields have increased with persistent inflation.

Also, it would appear that the fall in fixed deposit rates have had little impact on the median and average yields of bids being submitted.

Larger issuance size also supported T-bill yield

Earlier, we shared that the amount of T-bills issued in the latest auction will increase to S$6.6 billion.

This represents an increase of S$300 million compared to issuance size of S$6.3 billion in the previous auction.

The increase in T-bill issuance compared to the previous auction also appears to have helped support the cut-off yield in the latest auction.

What would Beansprout do?

The 6-month T-bill yield has stayed fairly high in the latest auction, just like what we saw in the recent 1-year T-bill auction.

Based on what I see, this appears to be driven by a fall in applications, larger amount of T-bills issued, as well as elevated median yield of bids submitted by investors.

With the T-bill yield remaining steady while fixed deposit rates have been declining, we now have a big gap in the interest rates offered.

The best 6-month fixed deposit rates was recently cut to 3.25%, significantly below the cut-off yield of 3.74% in the latest auction.

The latest cut-off yield of 3.74% would also be quite similar to the returns on selected cash management accounts and Syfe Cash+ Guaranteed.

Overall, we consider the T-bill to be a safe way to earn a higher return on our savings in the short term.

If you managed to subscribe to the 6-month T-bill using CPF OA funds, find out how much more interest you can potentially earn compared to the OA interest rate using our CPF T-bill calculator.

The next 6-month T-bill auction on 9 May 2024, and you can set a reminder by signing up for our free email alert below.

If you are new to investing in the T-bill, check out our comprehensive guide to Singapore T-bills to learn more.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Use our CPF-Tbill calculator to find out how much more interest you can potentially earn by investing in the Singapore T-bill using your CPF OA savings.

Read also

Want to learn more? Discover more Bond-related insights here.

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

0 comments