Best Fixed Deposit Rates in Singapore [March 2026]

Savings

By Gerald Wong, CFA • 02 Mar 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Compare the best fixed deposit rates in Singapore for March 2026. Get the latest promotional fixed deposit rates from DBS, UOB, OCBC, Bank of China, MariBank and more.

What happened?

Fixed deposit rates shifted again.

Several banks refreshed their fixed deposit promotions after the Chinese New Year public holidays.

These changes have prompted the Beansprout community to check the latest fixed deposit rates for suitable places to park their cash and ang bao money.

If you’re thinking of locking in your funds, it’s now more important than ever to compare and keep track of the latest fixed deposit rates.

To make comparisons easier, I’ve compiled the best fixed deposit rates in Singapore as of 2 March 2026.

I’ll keep this list updated regularly, so be sure to revisit often to maximise your savings!

The best fixed deposit rate in Singapore (As of 2 March 2026)

- The best 3-month fixed deposit rate we found was 1.35% p.a. by ICBC.

- The best 6-month fixed deposit rate we found was 1.50% p.a. offered by HL Bank.

- The best 9-month fixed deposit rate we found was 1.32% p.a.^ offered by Maybank.

- The best 1 year fixed deposit rate we found was 1.40% p.a. offered by Bank of China (BOC).

| Bank | Interest rate per annum | Tenure | Minimum amount |

| HL Bank | 1.50% (online banking) | 6 months | S$10,000 |

| 1.30% (online banking) | 12 months | S$10,000 | |

| Bank of China | 1.40% (mobile banking) | 12 months | S200,000 |

| 1.35% (mobile banking) | 12 months | S$500 | |

| 1.20% (mobile banking) | 9 months | S$500 | |

| 1.35% (mobile banking) | 6 months | S$500 | |

| 1.30% (mobile banking) | 3 months | S$500 | |

| ICBC | 1.35% (E-banking) | 3 months | S$200K and above |

| 1.15% (E-banking) | 3 months | S$500 to < S$200K | |

| 1.15% (E-banking) | 6 months | S$200K and above | |

| 1.10% (E-banking) | 6 months | S$500 to < S$200K | |

| 1.05% (E-banking) | 9/12 months | S$200K and above | |

| 1.00% (E-banking) | 9/12 months | S$500 to < S$200K | |

| Maybank | 1.32% (Deposits Bundle Promo)^ | 9/12 months | S$20,000 |

| 1.30% (online banking) | 6/9/12 months | S$20,000 | |

| GXS | 1.30% (Boost Pocket) | 8/12 months | S$100 (max S$85,000) |

| 1.22% (Boost Pocket) | 1/3 month | S$100 (max S$85,000) | |

| CIMB | 1.25% | 3 months | S$10,000 |

| 1.30% | 6 months | S$10,000 | |

| 1.10% | 9 months | S$10,000 | |

| 1.30% | 12 months | S$10,000 | |

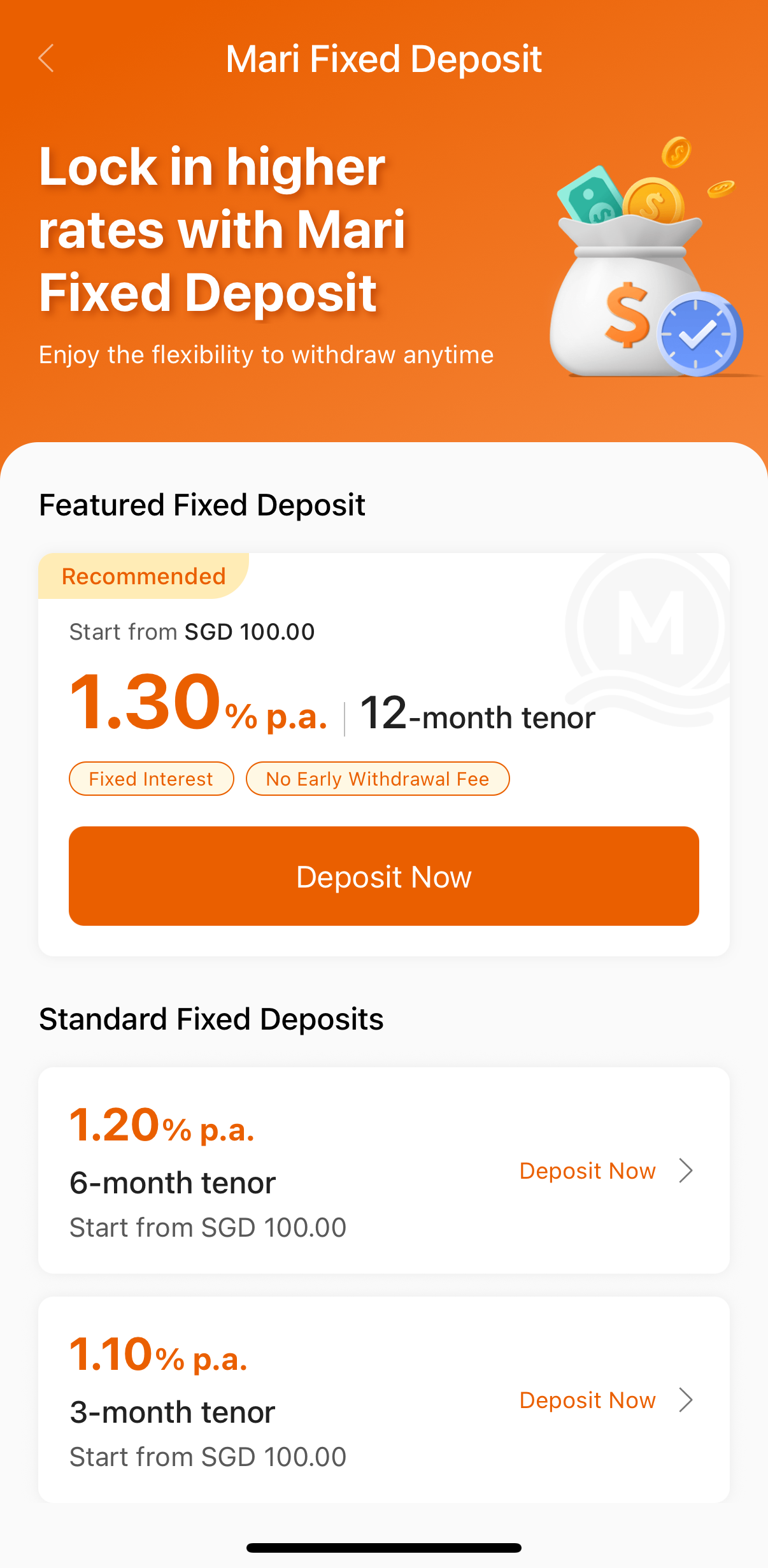

| MariBank | 1.30% | 12 months | S$100 (max S$100,000) |

| 1.20% | 6 months | S$100 (max S$100,000) | |

| 1.10% | 3 months | S$100 (max S$100,000) | |

| Hong Leong Finance | 1.25% (online banking) | 5/6/8/11/13 months | S$20,000 and above |

| 1.25% (online banking) | 8 months | S$5,000 to < S$20,000 | |

| 1.20% (online banking) | 5/6/11/13 months | S$5,000 to < S$20,000 | |

| RHB | 1.25% | 12 months | S$20,000 |

| 1.20% | 6 months | S$20,000 | |

| 1.20% | 3 months | S$20,000 | |

| Standard Chartered | 1.20% (Fresh Fund Promo) | 9 months | S$25,000 (fresh funds) |

| UOB | 1.20% | 6 months | S$10,000 (fresh funds) |

| 1.00% | 10 months | S$10,000 (fresh funds) | |

| OCBC | 1.10% (online banking) | 12 months | S$20,000 |

| 1.15% (online banking) | 18 months | S$20,000 | |

| SBI | 1.15% | 6 months | S$50,000 |

| DBS/POSB | 1.00% | 9/12 months | S$1,000 (max S$19,999) |

| 0.80% | 6 months | S$1,000 (max S$19,999) | |

| HSBC | 0.85% | 12 months | S$30,000 |

| 0.75% | 6 months | S$30,000 | |

| 0.70% | 3 months | S$30,000 | |

| Citibank | 0.60% | 3/6 months | S$10,000 |

| 0.70% | 12 months | S$10,000 | |

| Source: Various bank websites as of 2 March 2026 ^Based on a blended rate for S$100,000 Time Deposit with 10% of the time deposit amount earmarked in a Maybank savings account earning a base rate of 0.05% p.a. | |||

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

What are the fixed deposit rates offered by banks in Singapore?

🌱 HL Bank fixed deposit rates

| Tenure | Banking type | Promotional Interest rate (p.a.) | Minimum Placement Amount |

| 6 month | Online* | 1.50% | S$10,000 |

| 12 month | 1.30% | ||

| 6 month | Branch | 1.45% | S$100,000 |

| 12 month | 1.25% | ||

| Source: HL Bank website as of 2 March 2026 *Available on HLB Connect only. | |||

HL Bank is now offering a promotional interest rate of 1.50% p.a. and 1.30% p.a. for a 6-month and 12-month fixed deposit respectively for online banking customers. You will need to place a minimum of S$10,000 and apply via HLB Connect.

HL Bank adjusts its fixed deposit rate fairly regularly and may offer promotional rates from time to time, you can find out the latest fixed deposit rate offered by HL Bank here.

🌱 Bank of China fixed deposit rates

| Via Mobile Banking Placement (new placement) (Min S$200,000) | Via Mobile Banking Placement (new placement) (Min S$500) | |

| Tenor | Interest rate per annum (%) | Interest rate per annum (%) |

| 3 months | - | 1.30 |

| 6 months | - | 1.35 |

| 9 months | - | 1.20 |

| 12 months | 1.40 | 1.35 |

| Source: Bank of China website as of 2 March 2026 | ||

The advantage of placing your fixed deposit with Bank of China is that the minimum deposit amount to get the 6-month and 12-month fixed deposit rate of 1.35% p.a. is relatively low at just S$500.

To lock in the interest rate of 1.40% p.a. on the 12-month tenure, you'll need to place a minimum of S$200,000.

To earn any promotional fixed deposit rate, you will need a new placement with the bank.

The Bank of China adjusts its fixed deposit rate fairly regularly and may offer promotional rates from time to time, you can find out the latest fixed deposit rate offered by Bank of China here.

🌱 ICBC fixed deposit rate

| Via E-banking | Via E-banking | |

| S$500 to S$200,000 | S$200,000 and above | |

| Tenor | Promotion Rates per annum | Promotion Rates per annum |

| 1 month | 1.10% | 1.15% |

| 3 months | 1.15% | 1.35% |

| 6 months | 1.10% | 1.15% |

| 9 months | 1.00% | 1.05% |

| 1 year | 1.00% | 1.05% |

| Source: ICBC website as of 2 March 2026 | ||

ICBC is currently offering a 3-month fixed deposit rate of 1.15% p.a. for deposits with a minimum amount of S$500.

To lock in the higher interest rate of 1.35% p.a. on the 3-month tenure, you'll need to place a minimum of S$200,000 and above.

The promotional rate is only applicable via online banking deposits.

ICBC adjusts its fixed deposit rate fairly regularly, and you can find out the latest fixed deposit rate offered by ICBC here.

🌱 Maybank fixed deposit rate

| Tenure | iSAVvy Promotional Rate (p.a.) |

| 9-month, 12-month | 1.45% (Via Deposits Bundle Promotion^, effective interest return at 1.32%) |

| 6-month | 1.30% |

| 9-month | 1.30% |

| 12-month | 1.30% |

| Source: Maybank website as of 2 March 2026 | |

Maybank is currently offering a standalone interest rate of 1.30% per annum across their 6-, 9- and 12-month fixed deposit when placed online, with a minimum deposit of S$20,000.

You can get an even higher competitive rate of 1.45% p.a. on their 9-month and 12-month Singapore Dollar Time Deposit through their new Deposits Bundle Promotion.

To access the promotional rate of 1.45% p.a., you will need to "bundle" your deposit by placing fresh funds into a Time Deposit and a savings account simultaneously at a specific 1:10 ratio.

This means for every S$10,000 you invest in the Time Deposit, you are required to lock up an additional S$1,000 in a savings account for the 6-month duration.

Because the savings portion earns a much lower base interest rate, your combined effective interest return across both accounts averages out to approximately 1.32% p.a.

You can find out the full terms and conditions of the Maybank fixed deposit promotion here.

🌱 GXS Boost Pocket rates

| Tenor | Base Interest Rate( p.a.) | Bonus Interest (p.a.) | Total interest rate (p.a. |

| 1 month | 1.08% | 0.14% | 1.22% |

| 3 months | 0.14% | 1.22% | |

| 8 months | 0.22% | 1.30% | |

| 12 months | 0.22% | 1.30% | |

| Source: GXS website as of 2 March 2026 | |||

GXS Bank’s Boost Pocket offers a base interest rate of 1.08% p.a., credited daily, with optional bonus interest if you hold your funds to maturity.

Depending on the tenure selected, you can earn up to an additional 0.22% p.a., bringing the total return to:

- 1.22% p.a. for the 1- or 3-, month tenure

- 1.30% p.a. for the 8-, or 12-month tenures

There is no penalty for early withdrawal, and you’ll still receive the base interest of 1.08% p.a. up to the date you withdraw.

Find out more about GXS Savings Account here.

🌱 CIMB fixed deposit rates

| Tenure | Personal Banking | Preferred Banking |

| Interest rate per annum (%) | Interest rate per annum (%) | |

| 3 Months | 1.25 | 1.30 |

| 6 Months | 1.30 | 1.35 |

| 9 Months | 1.10 | 1.15 |

| 12 Months | 1.30 | 1.35 |

| Source: CIMB website as of 2 March 2026 | ||

CIMB is offering a 6-month and 12-month fixed deposit rate of 1.30% p.a. for online placements. Preferred banking customers can enjoy a higher rate of 1.35% p.a. for the same tenure.

To earn the promotional interest rate, the minimum deposit required is S$10,000. You can find out more here.

🌱 MariBank fixed deposit rate

MariBank is currently offering up to 1.30% p.a. on a 12-month tenure and 1.20% p.a. on a 6-month tenor, starting from as little as S$100.

Do note that the maximum amount of deposit you can maintain in your Mari Savings Account, which includes any Fixed Deposits would be S$100,000.

This means if have deposited S$5,000 in your Mari Savings Account, the maximum amount you can hold across all your Mari Fixed Deposits is S$95,000.

Be sure to check your MariBank app for the latest fixed deposit rates that apply to your account.

Find out more about MariBank Savings Account here.

🌱 Hong Leong Finance fixed deposit rate

Under Hong Leong Finance online fixed deposit promotion, if you’re depositing a smaller amount below S$20,000 (minimum S$5,000), you’ll receive 1.20% p.a. on 5-, 6-, 11- and 13-month fixed deposits and 1.25% p.a. on 8-month fixed deposit.

If you're depositing an amount above S$20,000, you'll receive 1.25% p.a. on 5-, 6-, 8-, 11- and 13-month fixed deposits

| Tenure | S$5,000 to < S$20,000 | S$20,000 and above |

| Interest rate per annum (%) | Interest rate per annum (%) | |

| 5/6/8/11/13 Months | 1.20 | 1.25 |

| Source: Hong Leong Finance website as of 2 March 2026 | ||

Hong Leong Finance adjusts its fixed deposit rate fairly regularly, and you can find out the latest fixed deposit rate offered by Hong Leong Finance here.

🌱 RHB fixed deposit rates

| Tenure | Personal Banking Online Placement | Premier Banking Online Placement |

| Interest rate per annum | Interest rate per annum | |

| 3 Month | 1.20% | 1.30% |

| 6 Month | 1.20% | 1.30% |

| 12 Month | 1.25% | 1.35% |

| Source: RHB website as of 2 March 2026 | ||

RHB is currently offering a 3-month and 6-month fixed deposit rate of 1.20% p.a.. You can get a slightly higher fixed deposit rate of 1.25% for longer tenure of 12 months.

Premier banking customers of RHB can earn an even higher rate of 1.30% p.a. for a 3-month and 6-month fixed deposit and 1.35% p.a. for a 12-month fixed deposit.

The minimum deposit amount to enjoy the RHB promotional fixed deposit rate is S$20,000.

However, do note that the fixed deposit rates offered by RHB are promotional rates that are subject to change without prior notice.

You can find out the latest fixed deposit rate offered by RHB here.

🌱 Standard Chartered fixed deposit rate

| Tenure | Promotional personal banking rate | Promotional priority banking rate | Minimum Placement Amount (Fresh Funds in SGD) |

| 9 months | 1.20% p.a. | 1.25% p.a. | S$25,000 |

| Source: Standard Chartered website as of 2 March 2026 | |||

Standard Chartered Fresh Funds Time Deposit Promotion is on-going from 01 March 2026 to 09 March 2026.

For a 9-month time deposit, Standard Chartered is currently offering a rate of 1.20% p.a. for Personal Banking customers with a minimum placement of S$25,000.

Priority Banking customers can enjoy a higher rate of 1.25% p.a. for the same 9-month tenure.

You can find the latest promotional fixed deposit rates offered by Standard Chartered here.

🌱 UOB fixed deposit rate

| Tenure | Promotional Interest rate (p.a.) | Minimum amount |

| 6-month | 1.20% | S$10,000 (fresh funds) |

| 10-month | 1.00% | S$10,000 (fresh funds) |

| Source: UOB website as of 2 March 2026 | ||

UOB is offering a promotional interest rate of 1.20% p.a. for a 6-month fixed deposit using fresh funds of S$10,000.

You can find the latest fixed deposit rate offered by UOB here.

The fixed deposit rate of 1.20% p.a. is still lower than the highest effective interest rate that can be earned on the UOB One account.

🌱 OCBC fixed deposit rate

| Tenure | Banking type | Promotional Interest rate (p.a.) |

| 12 month | Branch | 1.05% |

| 18 month | 1.10% | |

| 12 month | Online | 1.10% |

| 18 month | 1.15% | |

| Source: OCBC website as of 2 March 2026 | ||

OCBC is now offering a promotional interest rate of 1.10% p.a. and 1.15% p.a. for a 12-month and 18-month fixed deposit respectively for internet banking customers.

You will need to place a minimum of S$20,000.

You can find the terms and conditions of the OCBC fixed deposit here.

🌱 SBI fixed deposit rates

| Tenor | Promotional Interest Rate (p.a) | Minimum Deposit |

| 6 months | 1.15% | S$50,000 |

| Source: SBI website as of 2 March 2026 | ||

SBI is offering a promotional rate of 1.15% p.a. for a 6-month fixed deposit, respectively.

The minimum deposit required to earn the higher promotional rate is S$50,000, and the promotion applies to new SGD fixed deposits.

You can find the latest fixed deposit rates offered by SBI here and their latest promotional fixed deposit rates here.

🌱 DBS fixed deposit rate

| Interest rate per annum (%) | |||||||

| Tenure | S$1,000 - S$9,999 | S$10,000 - S$19,999 | S$20,000 - S$49,999 | S$50,000 - S$99,999 | S$100,000 - S$249,999 | S$250,000 - S$499,999 | S$500,000 - S$999,999 |

| 1 mth | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 2 mths | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 3 mths | 0.1500 | 0.1500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 4 mths | 0.2500 | 0.2500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 5 mths | 0.4000 | 0.4000 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 6 mths | 0.8000 | 0.8000 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 7 mths | 0.9500 | 0.9500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 8 mths | 1.0000 | 1.0000 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 9 mths | 1.0000 | 1.0000 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 10 mths | 1.0000 | 1.0000 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 11 mths | 1.0000 | 1.0000 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| 12 mths | 1.0000 | 1.0000 | 0.0500 | 0.0500 | 0.0500 | 0.0500 | 0.0500 |

| Source: DBS website as of 2 March 2026 | |||||||

You can earn an interest rate of 0.80% p.a. for a 6-month fixed deposit and 1.00% p.a for a 9-month and 12-month fixed deposit with a maximum deposit amount of S$19,999.

I also noticed some sharing in the Beansprout community about the senior citizen fixed deposit rate offered by DBS.

If you are 55 years and above, you can earn an additional 0.10% p.a. interest on your fixed deposit for tenors of at least six months with the Premier Income Account (PIA), and a minimum deposit of S$10,000 per placement.

This means that you can get a 1-year fixed deposit rate of 1.10% p.a. instead of 1.00% p.a. for deposits of S$10,000 to S$19,999 with DBS.

Unlike other banks, DBS offers a higher fixed deposit interest rate for smaller deposit amounts.

For example, the interest rate you would earn falls to just 0.05% p.a. for deposits of S$20,000 and above.

You can find the latest fixed deposit rate offered by DBS here.

🌱 HSBC fixed deposit rates

| Types of customers | Tenure | Interest rate per annum |

| Personal banking | 3 month | 0.70% |

| 6 month | 0.75% | |

| 12 month | 0.85% | |

| Source: HSBC website as of 2 March 2026 | ||

HSBC is offering a 0.70% p.a. fixed deposit rate with a minimum deposit of S$30,000 for personal banking customers for 3-month.

You may get an even higher HSBC promotional fixed deposit rate at 0.75% p.a. and 0.85% p.a. for longer tenures of 6- and 12- months respectively.

HSBC is running a limited-time mobile offer for Premier and Premier Elite customers with wealth holdings or FX Engaged customers, where placements may earn up to 1.40% p.a. on a 3-month SGD time deposit with a minimum placement of S$30,000 in fresh funds.

The promotion is available exclusively via the HSBC Singapore app and ends on 31 March 2026.

You can find out more about the fixed deposit rate offered by HSBC here.

🌱 Citibank fixed deposit rate

| Tenure | Board Rate (p.a.) |

| 3 months | 0.60% |

| 6 months | 0.60% |

| 12 months | 0.70% |

| Source: Citi website as of 2 March 2026 | |

Citibank is now offering a fixed deposit rate of 0.60% p.a. for 3-month. The minimum deposit required is S$10,000, up to a maximum of S$3 million.

If you are a Citigold client, you are able to earn up to 1.30% p.a. for a 3-month tenure.

You can find the latest fixed deposit rates offered by Citi here.

What are fixed deposits?

Fixed deposits earn you a guaranteed amount of interest for the money you put in over a specific period of time.

Typically, you will lock in a sum of money (usually a minimum of $10,000) and the bank will pay you interest after a fixed period.

The downside to a fixed deposit is that you will have to pay a penalty fee if you want to withdraw your money early.

Hence, Fixed deposits tend to work best as part of your Liquidity Pot, especially for money you do not need for the next few months.

How do fixed deposit accounts compare to best savings accounts?

As seen from the Telegram group, many people are also interested in the best savings accounts apart from fixed deposit accounts.

However, do note that the interest rates offered by savings accounts are subject to change, and you are not able to ‘lock-in’ the interest rates like for fixed deposits.

The highest maximum effective interest rate offered by savings accounts currently is 7.05% p.a., above the best fixed deposit rate.

Check out the best savings accounts with the highest interest rates here.

How do fixed deposit rates compare to Singapore T-bill?

Beansprout has written enough on the Singapore treasury bill (T-bill) , so I will not be going into too much detail on them.

The yield for the most recent 6-month Singapore T-bill auction was 1.36% is lower than the 6-month promotional fixed deposit rate of 1.50% p.a. offered by HL Bank.

What is also important to note is that fixed deposits are covered under the Deposit Insurance Scheme.

This means that in the event that the bank faces problems repaying your money, all your insured deposits will be insured up to S$100,000 by the Singapore Deposit Insurance Corporation Limited (SDIC).

The Singapore T-bill is backed by the Singapore Government, but this does not make them entirely risk free.

For example, you may lose part of your capital if you decide to sell your T-bill before six months. In this case, it might not just be the interest rates you are losing out on!

I have summarised my thoughts comparing fixed deposit rates with the Singapore T-bills below.

Learn more about the Singapore T-bill here.

| What I like | What I do not like | |

| Singapore 6-month T- bill | Principal sum is locked up for 6 months only Low risk of default Minimum investment of S$1000 | May not be liquid in the secondary market |

| Fixed Deposits | Low risk of default | Principal sum is locked up for at least 6-12 months Potential penalty for early withdrawal Usually higher deposit amount |

How do fixed deposit rates compare to Singapore Savings Bonds (SSBs)?

The Singapore Savings Bond (SSB) provides you with a simple and low-cost way to generate safe returns. Backed by the Singapore government, the SSB allows you to lock in long-term interest rates while offering flexibility of redeeming with no penalty.

The 1-year average return on the most recent issuance of the Singapore Savings Bonds (SSB) is 1.38%, lower than the best 12-month fixed deposit rate offered by the banks.

The minimum investment amount for the SSB is S$500, while the minimum fixed deposit amount is typically S$5,000 and above.

Learn more about Singapore Savings Bonds here.

| What I like | What I do not like | |

| Singapore Savings Bond | - Step-up interest rate of up to 10 years - Redeemable at any point but have to wait for up to a month for payment - Low risk of default - Minimum investment of S$500 | - 1-year return is lower than best fixed deposit interest rate |

| Fixed Deposits | - Low risk of default | - Deposit is typically locked up for at least 3 months - Potential penalty for early withdrawal - Typically higher deposit amount |

How do fixed deposit rates compare to cash management accounts?

You might have heard of Moomoo Cash Plus or Webull Moneybull discussed amongst investors in recent months.

These are all cash management accounts that are seen as relatively safe and highly liquid alternatives to cash in the bank.

By putting your money in a cash management account, you will be investing in money market funds or bond funds.

These professionally managed funds will put your cash in instruments such as bank deposits or short-term debt to earn higher interest rates.

Cash management accounts offer a relatively low-risk option for us to earn a potentially higher return on our cash.

For example, the indicative 7-day annualised yield of the Fullerton SGD Cash Fund was about +1.30% as of 27 February 2026.

Learn more about the Fullerton SGD Cash Fund here.

Compared to fixed deposits, cash management accounts offer more flexibility as they can be redeemed at short notice, usually in a few days.

Unlike fixed deposits, cash management accounts are not capital guaranteed and are not insured under Singapore Deposit Insurance Corporation (SDIC).

Check out our comprehensive guide to cash management accounts in Singapore to select the best cash management account for your portfolio.

Some robo-advisors have also introduced cash management solutions that offer guaranteed rates. They generate the returns by investing your funds into fixed deposits products provided by banks in Singapore.

For example, Syfe Cash+ Guaranteed is the cash management solution offered by Syfe which offers investors guaranteed rates for their idle cash.

Learn more about Syfe Cash+ Guaranteed here.

In addition, StashAway Simple Guaranteed also offers a cash management solution for 1 month, 3 months, 6 months or 12 months.

Learn more about StashAway Simple Guaranteed here.

How do fixed deposit rates compare to best USD fixed deposit rates?

Some of you may have noticed that foreign currency fixed deposit accounts are now offering a higher interest rate compared to Singapore dollar fixed deposit accounts.

While USD fixed deposit rates are higher compared to Singapore dollar fixed deposit rates, you should beware of foreign currency risk. Also, foreign currency fixed deposits are not covered by the Singapore Deposit Insurance Scheme.

Check out our guide to the best USD fixed deposit rates in Singapore to get the latest foreign currency fixed deposit rates.

Are there better fixed deposit rates for priority banking accounts?

Some banks may also offer priority banking customers a higher interest rate for fixed deposit accounts.

For example, CIMB offers preferred banking customers a promotional interest rate of 1.35% p.a. for 6- and 12- month fixed deposits, above its normal fixed deposit rate of 1.30% p.a.

HSBC is currently offering their Premier and Premier Elite customers with wealth holdings or FX Engaged customers up to 1.40% pa on 3-month SGD Time Deposits with a minimum deposit of SGD30,000 in fresh funds.

To find out the best fixed deposit interest rates for priority banking accounts, check out our comprehensive guide to priority banking accounts in Singapore.

What would Beansprout do?

I find it useful to think of fixed deposits as a Liquidity Pot tool, because they sit in that middle ground between fully liquid cash and longer-term investments.

I use them to earn a predictable return on cash that I do not need immediately, while keeping my safety net intact so I never have to sell investments at the wrong time.

I start by sizing my Liquidity Pot at around three to six months of living expenses, then I only lock up money that I am confident I will not need before maturity.

Since breaking a fixed deposit early can reduce returns, I may consider to ladder my placements across different tenures so some cash matures regularly.

Here's the summary of best fixed deposit rate across different tenures as of 2 March 2026:

- 3-month tenure: 1.35% pa. (ICBC)

- 6-month tenure: 1.50% p.a. (HL Bank)

- 9-month: 1.32% p.a.^ (Maybank)

- 12-month tenure: 1.40% p.a. (Bank of China)

If I want more flexibility, I also compare fixed deposits against cash management accounts offered by brokerages such as Longbridge, Moomoo, Tiger Brokers, or Webull. These accounts typically invest in money market funds and can offer yields that are competitive with many fixed deposits, while allowing me to access my cash without a fixed lock-in period.

If I am opening a new account anyway, I also check whether there are sign-up rewards or temporary yield boosts that can improve my overall return.

For example, Longbridge is running a promotion that offers a 5% p.a. interest boost on S$2,000 placed in Longbridge Cash Plus for 365 days (worth up to S$100), along with a S$50 Fairprice voucher for new accounts opened via Beansprout. Promo ends on 31 March 2026. T&Cs apply. Learn more about the Longbridge promo here.

You can check out the latest brokerage promotional sign-up offers here.

Some robo-advisors, such as Syfe and StashAway, also offer short-term guaranteed cash management solutions that invest in bank deposits, providing fixed returns with no minimum deposit requirements.

In practice, I find it helpful to compare the rate, the lock-up period, the minimum amount, and any promo conditions, then choose what fits my liquidity needs rather than forcing a higher rate that reduces flexibility.

Once my Liquidity Pot is fully built, I may consider looking beyond fixed deposits and other cash tools.

If I want my money to grow meaningfully over time, I know that I usually need to move beyond Liquidity Pot tools, because the trade-off for safety and stability is that returns tend to be limited.

If I am aiming for higher long-term returns, I will look to my Growth Pot, where I focus on patient compounding over five years or more through diversified equity and index funds, such as the VWRA ETF and S&P 500 ETF, as I stay consistent through regular investing rather than trying to time the market.

For steadier payouts, I may look to start building my Income Pot with reliable dividends, coupons, and distributions from blue chip stocks, REITs, bonds, income funds, where consistency matters more than the highest headline yield.

If you are new to investing and want a simple framework and guide to build your Liquidity Pot, Growth Pot and Income Pot, start here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments