Bonds

SSB 10-year return jumps to 3.33%. Better than fixed deposits?

By Gerald Wong, CFA • 05 May 2024 • 0 min read

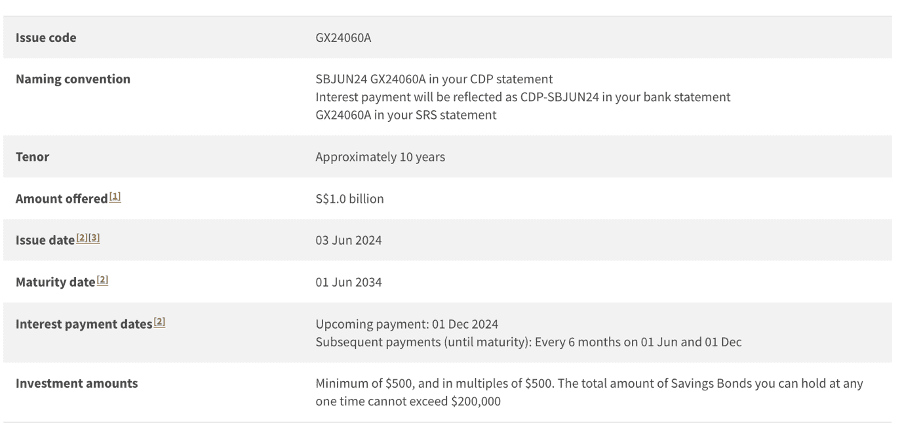

The latest Singapore Savings Bond (SSB) offers a 1-year return of 3.26% and 10-year average return of 3.33%. We find out how it compares against T-bills and fixed deposits.

In this article

What happened?

It seems like investors are taking a look at the Singapore Savings Bonds (SSBs) once again.

I believe this could be because the latest SSB (SBJUN24 GX24060A) offers a 1-year interest rate of 3.26%, and 10-year average interest rate of 3.33%.

The 10-year average return would be quite close to our projection shared earlier.

This led to some excitement in the Beansprout community, as well as questions about whether the SSB will be oversubscribed.

Indeed, as one member summed it up – “The key question is how much SSBs we will be able to get.”

Let us find out if the latest SSB is better than T-bill and fixed deposits, and how realistic it will be to get full allocation of the SSB.

Is it worth applying for the latest Singapore Savings Bonds (SSBs)?

#1 – 1 year and 10 year interest rate higher than previous issuance

The 1-year interest rate on the latest SSB has increased to 3.26% from 2.99% in the previous issuance.

The average 10-year return has also gone up to 3.33% from 3.06% in the previous issuance.

The 10-year average interest rate of 3.33% for the latest SSB would be one of the highest in recent years.

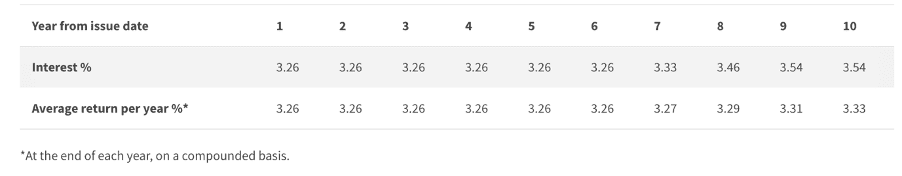

The jump in the SSB interest rate reflects the higher Singapore government bond yields over the past month.

This is due to persistent inflation which led investors to expect the US Federal Reserve to keep interest rates higher for longer.

As a background, SSB interest rates are linked to the yield of Singapore Government Securities (SGS) like the 10-year Singapore government bond.

The jump in 10-year average return of the SSB would hence correspond to the higher yield on the 10-year Singapore government bond in the previous month.

#2 – SSB 1-year return higher than fixed deposits

What I noticed is that the 1-year interest rate of 3.26% on the latest SSB is now above the best 1-year fixed deposit rate.

With banks lowering their fixed deposit rates in recent months, the best 1-year fixed deposit rate is now at 3.20% p.a.

Apart from being able to earn a higher interest rate over 1-year, the SSB also allows us the additional benefit of having the flexibility to redeem before maturity.

However, the 1-year interest interest rate on the latest SSB of 3.26% is still below the cut-off yield for the latest 6-month Singapore T-bill auction of 3.74%.

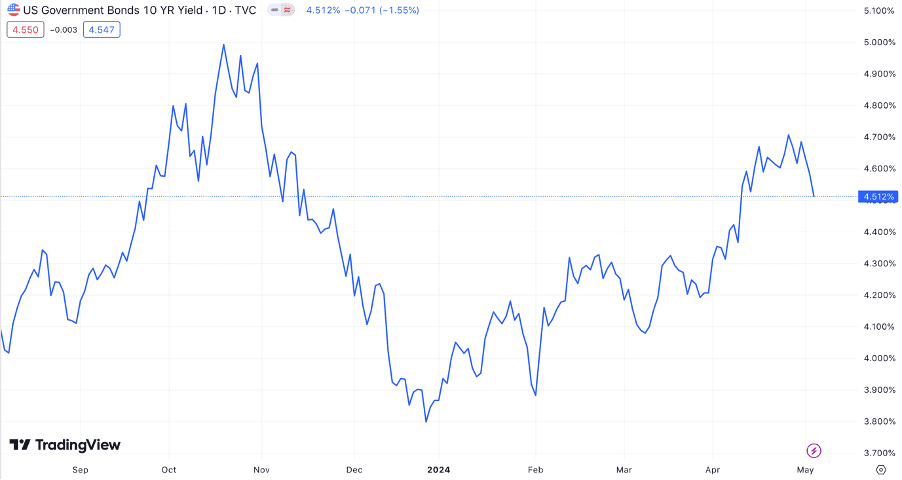

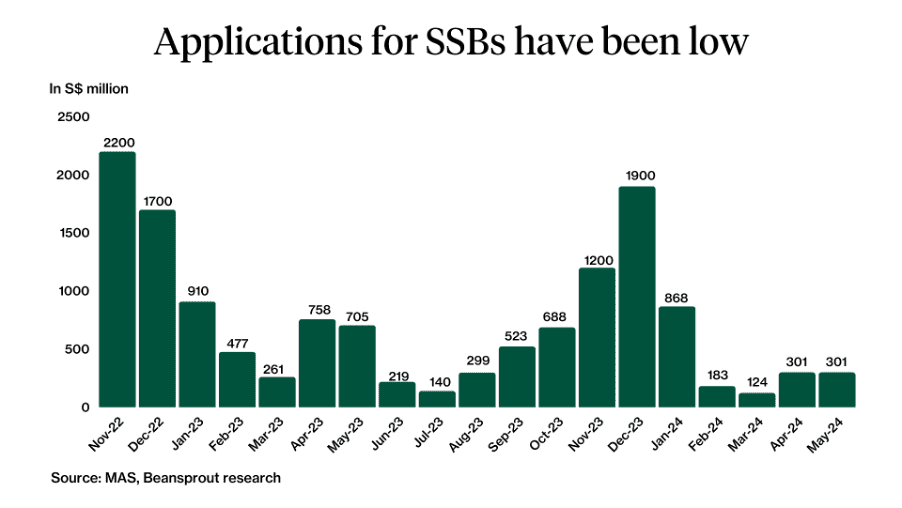

#3 – Demand may surge with higher yield

In the previous SSB issuance which offered a 10-year average return of 3.06%, applications remained steady at S$301 million.

With S$900 million of SSBs offered, all eligible applicants within their individual allotment limits were able to get full allocation of the previous SSB.

Overall, it would seem like the slightly higher SSB interest rate did not affect demand significantly.

With the higher interest rate offered for the latest SSB, demand may increase compared to the previous issuance.

In the SSB issuance for November 2023 when the 10-year average return was at 3.32%, there were S$2.2 billion of applications for the SSB. The maximum amount of SSB allotted was S$47,500.

In the SSB issuance for October 2022 when the 10-year average return was at 3.21%, there were S$2.2 billion of applications for the SSB. The maximum amount of SSB allotted was S$10,500.

What would Beansprout do?

I think the SSB is a good option to consider to lock in a 10-year average interest rate of 3.33% per annum.

In fact, the 1-year interest rate on the latest SSB of 3.26% is also higher than the best 1-year fixed deposit rate of 3.20% p.a.

In addition, SSBs offer us the flexibility to redeem before maturity.

However, we should be aware that we may not be able to get our intended allotment if the SSB becomes oversubscribed with the higher interest rates offered.

In previous SSB issuances where the 10-year average interest rate was at about 3.2% to 3.3%, the maximum allotment of the SSB ranged from S$10,000 to S$47,000.

If you are looking to earn a higher yield in the short term, the latest 6-month Singapore T-bill also offers a higher yield compared to the 1-year interest rate on the SSB.

As the Singapore government bond yield has remained elevated, I will also be monitoring if the interest rate for the next SSB might be higher than the latest SSB.

The 10-year Singapore government bond yield was at 3.38% as at 4 March 2024, higher than the 10-year average return of 3.33% offered by the latest SSB issuance.

You can check out our SSB interest rate projection to help you to decide whether to apply for the current SSB or to wait for the next issuance.

With the 10-year average return on the latest SSB remaining above its historical average, you can also use our SSB swap calculator to decide if it is worthwhile swapping your existing SSB with the latest SSB issuance.

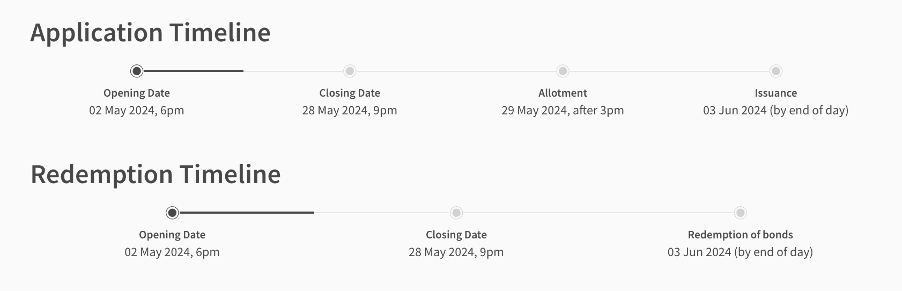

Applications for the latest issuance will close on 28th May 2024. Learn more about how to apply for the SSB with our comprehensive guide to the SSB.

Join the Beansprout Telegram group to get the latest insights on Singapore bonds, stocks, REITs, and ETFs.

Discover the projected interest rate for the next Singapore Savings Bond (SSB) issuance.

Read also

Want to learn more? Discover more Bond-related insights here.

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

0 comments