Singapore Savings Bonds (SSB) complete guide: How they work and how to buy

bonds-101

By Beansprout • 18 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Everything you need to know about Singapore Savings Bonds (SSB) in 2025. Read our comprehensive guide to find out how SSB works, how to apply, payout schedule, smart strategies and whether SSB fits your portfolio.

What happened?

Recently, many in the Beansprout community have been asking about Singapore Savings Bonds (SSBs).

With savings account rates dropping and stock markets staying volatile, people are looking for a safe place to park their cash without the stress of price swings.

If you want to earn stable returns while still having the flexibility to withdraw your money anytime with no penalty, SSBs could be worth considering.

What are Singapore Savings Bonds (SSBs)?

SSBs are government-backed savings products launched by MAS in 2015 to give everyday savers a safe, low-cost and flexible way to grow their money.

Think of them as a safe, long-term savings option:

- You lend your money to the Singapore Government for up to 10 years

- In return, you receive interest every six months

- You can redeem your money anytime with no penalty

You only need S$500 to start, and can hold up to S$200,000 across all SSBs.

Because they’re backed by the government, SSBs are considered one of the safest investment products available in Singapore.

You can buy SSBs if you are at least 18 years old, whether you are a Singapore Citizen, Permanent Resident or foreigner.

However, you must have a CDP account, a bank account linked to CDP (DCS), and internet banking access with DBS/POSB, OCBC or UOB.

Also, CPF funds cannot be used, but SRS funds are allowed.

How Singapore Savings Bonds (SSBs) earns interest

Singapore Savings Bonds (SSBs) work differently from a normal savings account.

Instead of paying a flat interest rate every year, they use a step-up interest system — this means the interest rate increases the longer you hold the bond.

When you buy an SSB, the Monetary Authority of Singapore (MAS) gives you a fixed 10-year interest schedule upfront.

The schedule shows the exact rate you will earn each year from Year 1 to Year 10.

The interest rate is lower at the start and increases each year you hold the bond.

Interest is paid every six months directly into your bank account.

Even if you redeem your SSB early, you will still receive all the interest you have earned up to that point, and your full principal will be returned.

SSB interest rates change every month and are based on the market yields of Singapore Government Securities (SGS) which are longer-term government bonds.

MAS sets SSB rates so that:

- The average return over 5 or 10 years is close to the return of SGS with similar maturity periods

- You still get flexibility to redeem anytime without losing your principal or past interest

Because SSB interest rates change from month to month, you can use our SSB interest rate projection tool to find out the projected returns for upcoming SSB issues.

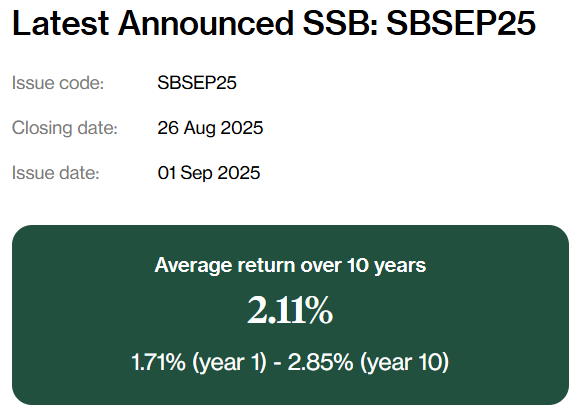

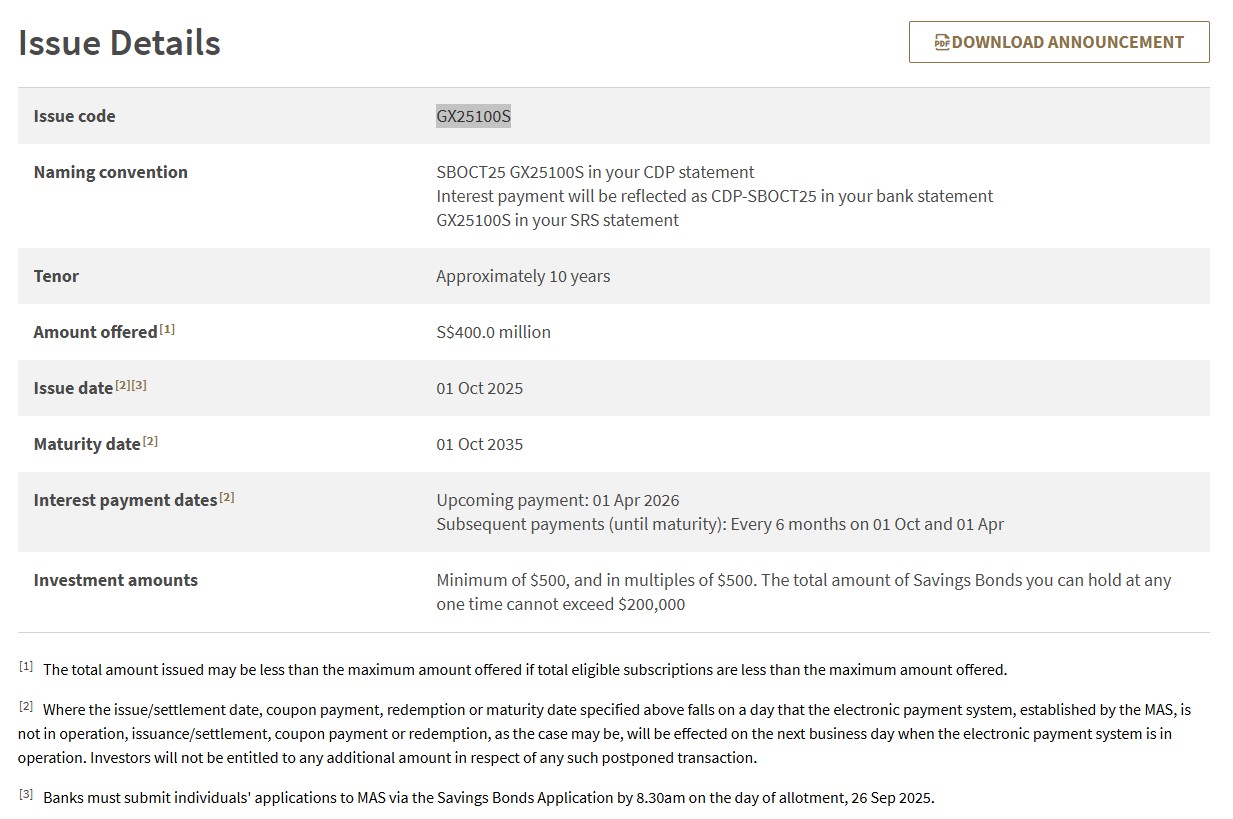

How to read the SSB Issue Details on the MAS Website

Each month’s SSB has an Issue Details page on the MAS website.

This page lists all the key information about that particular SSB issue.

Here’s how to understand it (example values shown):

- The Issue Code (e.g. GX25100S) is the unique code for that bond. You’ll see it in your CDP, bank and SRS statements.

- The Tenor is 10 years, which is how long the bond lasts if held to maturity.

- The Amount Offered shows how much is available that month (e.g. S$400 million). If demand is high, MAS may give everyone a smaller allocation.

- The Issue Date is when your bond starts, and the Maturity Date is when it ends if you hold it for 10 years.

- The Interest Payment Dates show when you’ll be paid. Payments come every six months starting about six months from the issue date.

The thing to keep in mind is that you can redeem any month before maturity.

This means you don’t have to hold it for 10 years.

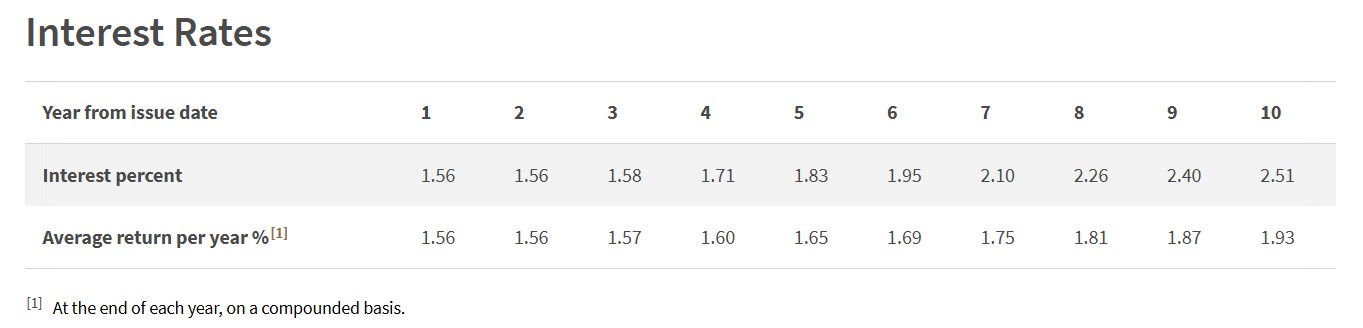

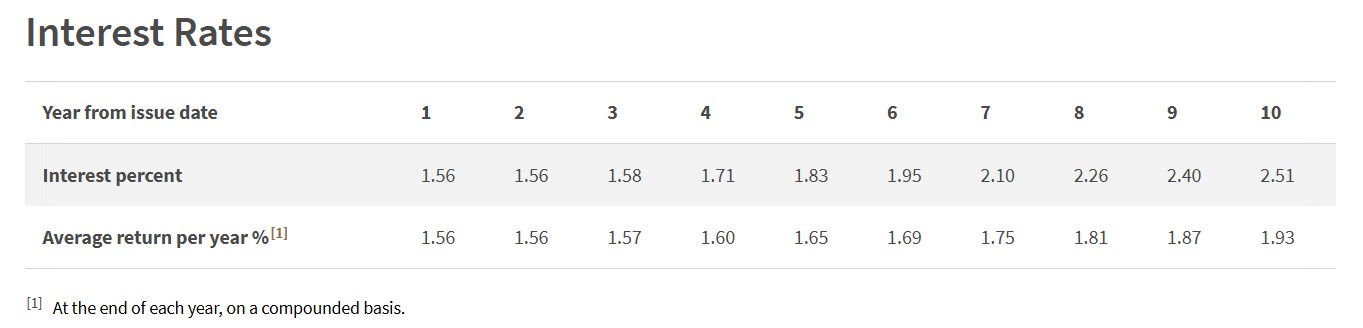

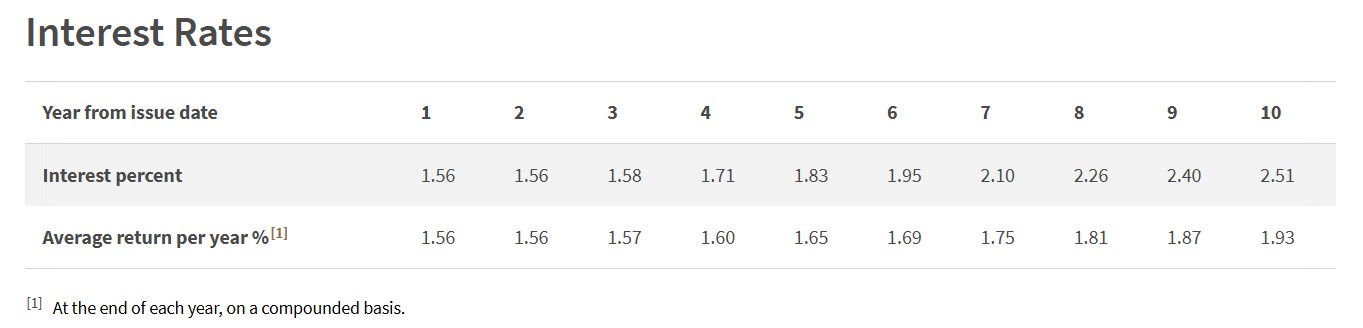

How to read the 10-year interest rates schedule

As mentioned, each SSB issue comes with a 10-year interest schedule.

This shows the exact interest you’ll get each year as well as averagely over the years on an annual basis if you keep your money in the bond.

You’ll see two rows:

Year-by-year interest percent

These are the actual rates for each year.

They are fixed when you buy and usually increase (“step up”) over time.

You’ll be paid twice a year, with each payment equal to half that year’s rate.

Average return per year (% p.a.)

This is shown at the bottom of the table.

It tells you the average annual return if you hold the bond for all 10 years.

This is shown as a compounded annual rate to help compare with other products like fixed deposits or T-bills.

But, it is important to remember that although this figure is shown, SSB interest does not actually compound automatically.

This is because the interest payments are paid out to your bank account every six months and are not added back to your SSB balance.

What this means is that your future interest is always calculated based only on your original amount.

For example, if you invest S$10,000 and receive S$80 every six months, the S$80 goes into your bank account. It won’t earn further interest unless you manually reinvest it into new SSBs, which may have different rates.

It is helpful to think of SSBs as an income-style product that pays you regular interest, not a compounding savings account where your interest grows on itself.

You can use our SSB Swap Calculator to find out if you can earn more by swapping your previous Singapore Savings Bonds with the upcoming ones.

Source: MAS

How to calculate SSB interest rates?

Here’s the easiest way to figure out how much you’ll earn:

Step 1: Get the 10-year schedule

Go to the MAS SSB website and look at the 10-year table for that month’s bond. Note the yearly rates (Year 1, Year 2, … Year 10).

Step 2: Choose how long you plan to hold it

Decide how many years you’ll keep your money inside — for example, 1, 3, 5, or 10 years.

Step 3: Calculate total interest by adding the yearly rates and multiply by your amount

Example: S$10,000 × (1.56% + 1.56% + 1.58%) = S$10,000 × 4.7% = S$470 total interest earned if you redeem after 3 years.

Step 4: Understand payout timing

Remember that the interest is paid twice a year.

So if Year 3’s rate is 1.58%, you’ll get S$158 in total interest for Year 3, which is S$79 every six months.

How to buy SSBs (step-by-step)

Buying SSBs is simple once you know the process. Here’s exactly how I did it:

Step 1: Open a CDP Account

You need a Central Depository (CDP) account to hold your SSBs.

Find out how to open a CDP account here.

You can apply online via SGX using Singpass/MyInfo. It usually takes a few days to be approved.

This is where your SSB holdings will be stored electronically.

Step 2: Link your bank account to CDP (DCS)

Set up Direct Crediting Service (DCS) so your interest payments and redemption proceeds go directly to your bank account.

Then, Log in to CDP Internet to activate or update DCS. The supported banks include DBS/POSB, OCBC, and UOB

Step 3: Apply for SSB during the monthly window via your bank

Once your CDP account is ready, you can apply via internet banking or ATMs from DBS/POSB, OCBC, or UOB during the monthly issue window:

- Application opens: 6:00pm on the 1st business day of the month

- Closes: 9:00pm on the 4th last business day of the month

- Minimum: S$500 (in multiples of S$500)

- Application fee: S$2 per request

You can also buy SSBs using your Supplementary Retirement Scheme (SRS) account, but not with your CPF money.

Step 4: Wait for allotment results

If the month’s issue is oversubscribed, you may not get your full amount.

As MAS allocates SSBs fairly using a quantity ceiling system, this means you might receive less than the amount you applied for, but everyone will get at least a small allocation.

The allotment results are announced on the 3rd last business day of the month. By then, you can check the results on MAS’ website.

Step 5: Track your SSB holdings

Once issued, your SSBs will appear under the “My Savings Bonds” section on the MAS website.

The interest will be paid into your DCS-linked bank account (or into your SRS account if purchased using SRS).

As mentioned, the interest payments happen every six months from the issue date.

You can sign up for a email reminder to be reminded of future SSB closing dates.

How to redeem Singapore Savings Bonds (SSBs)

If you ever need the money, you can redeem your SSB anytime (in S$500 blocks), with no penalty.

You’ll get your full principal plus any interest earned so far.

As the redemptions proceeds are not instantly disbursed, so don’t rely on SSBs for urgent cash.

Here are the steps:

- Submit your redemption request via your bank during the monthly window which is from the 1st business day of the month until 4 business days before the end of the month.

- There will be a S$2 fee per redemption request.

- Redemption proceeds (plus any accrued interest) will be credited to your bank or SRS account on the 2nd business day of the following month.

Summary of SSB application

| Who can apply | Individuals, including non-residents. You need to be at least 18 years old to open a CDP account. |

| Ways to apply | For cash – DBS/POSB , OCBC or UOB ATMs or internet banking, and OCBC’s mobile application. For Supplementary Retirement Scheme (SRS) – internet banking portal of your SRS operator. Note: CPF funds are not eligible for Savings Bond purchases. |

| Investment amount | Minimum of S$500, and subsequent multiples of S$500. Maximum individual investment limit: S$200,000. |

| Frequency of issuance | A new bond is issued every month. Check out this month’s bond or view the issuance calendar for the year. |

| Application period | Opens at 6pm on the 1st business day of the month. Closes at 9pm on the 4th last business day of the month. Operating hours: 7am to 9pm, Monday to Saturday (excluding Public Holidays). |

| Fees | S$2 non-refundable transaction fee for each application. |

Source: MAS

Strategies for using Singapore Savings Bonds

Many people use SSBs as a safe place to grow their money passively while keeping flexibility. Here are a few ways to go about it:

1. Build an emergency fund with it

Because SSBs are safe and redeemable anytime, you can park money that you might not need immediately to earn interest but don’t want sitting idle.

2. Laddering your purchases over multiple months

Instead of buying a large amount in one month, you can spread purchases over several months.

This creates a “ladder” that gives you more regular redemption options and smooths out differences in monthly interest rates.

If you’d like to explore how laddering works in more detail, check out our full guide on how to build an SSB and T-bill bond ladder.

3. Using SRS funds

SSBs can be bought using SRS funds for the same low risk, while helping you maximise your SRS contributions for tax relief.

Pros and cons of SSBs

Singapore Savings Bonds are often used by people who want to grow their savings with low risk while keeping the flexibility to withdraw if needed.

Beginners who want a stress-free way to grow their first S$5,000–S$10,000 can also consider starting out with SSBs.

They can also be one of the ways to build a source of passive income through regular interest payouts, especially for those looking to grow their savings gradually.

They are commonly included as part of an emergency fund, or used to earn steady returns on the first few thousand dollars of savings while learning about other investment products.

But, they may be less practical for those who need immediate access to their money or are aiming for higher short-term returns, as redemptions are not instant and may take up to several weeks depending on when the redemption request is submitted.

Pros | Cons |

Government-backed (very safe) | Lower returns than riskier investments |

Can redeem anytime with no penalty | Only redeemable monthly (not instant) - liquidity risk |

Start from as little as S$500 | Capped at S$200,000 per person |

Interest is tax-free | Interest does not compound automatically |

Simple to apply and manage, and low-cost | S$2 fee for each application and redemption |

What would Beansprout do?

Singapore Savings Bonds offer a simple and secure way to grow your money without taking on investment risk.

It is a safe starting point to grow your cash while exploring other investment products with higher risk and returns.

While the returns are modest, the flexibility, safety, and ease of use make them a practical option for anyone who wants to protect their savings and earn stable interest.

We also like the SSB as it allows us to lock-in interest rates for longer maturities.

With the uncertain interest rate environment ahead, it also provides flexibility as a place for you to park your money somewhere before deciding to commit to other fixed income assets.

You can also find out what are the best ways to generate passive income, including alternative options such as T-bill and fixed deposit accounts.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments