Daily Leverage Certificates (DLCs) in Singapore: A Complete Guide for Investors

DLCs

By Gerald Wong, CFA • 29 Oct 2024

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Learn how to trade Daily Leverage Certificates (DLCs) in Singapore with this complete guide. Discover how DLCs work, their benefits, risks, and strategies for investors.

What happened?

Lately, I’ve noticed more products being rolled out on the SGX, offering new ways for investors in Singapore to trade and diversify portfolios.

One product that caught my attention is the Daily Leverage Certificates (DLCs).

First introduced in 2017, DLCs allow investors to amplify both gains and losses by tapping into the market’s daily movements.

This provides opportunities for traders to act fast in a constantly shifting market and take advantage of short-term trends.

In this guide, I’ll share what I’ve learned about DLCs—how they work, the risks to watch out for, and how you can use them to level up your trading strategy.

What are Daily Leverage Certificates?

Daily Leverage Certificates (DLCs) are a type of financial product that offers investors leveraged exposure to the daily performance of an underlying asset, which can be an index or stock.

It is important to note that DLCs reset daily, meaning the leverage applies only for that day’s performance. As such, DLCs are best suited for short-term trading, predominantly intra-day trading.

They come with predefined leverage factors, typically 3x, 5x, and 7x, with 7x being the maximum. This means that investors’ returns are amplified by the respective multiplier.

For instance, if the underlying asset moves by 1%, from its previous trading day closing price, the value of a 3x DLC will move by 3%.

DLCs are issued by a third-party financial institution, usually banks. In Singapore, DLCs are listed on SGX, making them easily accessible for investors via their brokerage accounts.

If you are new to DLCs, there are generally two types of DLCs – long DLCs and short DLCs.

With long and short DLCs, traders can capitalise on market volatility, regardless of the market direction.

However, if an investor bought a 3x long DLC and the market falls instead of rising, the DLC will amplify losses in the same way. For example, if the underlying asset falls by 1%, the investor will face a 3% loss.

DLCs are not capital guaranteed, meaning the investor’s entire capital is at risk, although the maximum loss will not exceed the invested capital amount.

How do Daily Leverage Certificates work?

#1 - Daily Long

On Monday the underlying asset closed at a level of 100 and the 3x Long DLC closed at S$2.00 per unit.

Assuming you believe that the underlying asset is set to rise on Tuesday and purchased 1,000 units of the 3x Long DLC at a total cost of S$2,000 at the close on Monday.

If at the start of trading on Tuesday, the underlying asset increases by 1% to a level of 101, the value of the 3x Long DLC would have risen by 3% to S$2.06 and the 7x Long DLC would have risen by 7% to S$2.14.

In the same example, if the underlying asset were to decrease by 1% in a day, the value of the 3x Long DLC would have decreased by 3% to S$1.94 and the 7x Long DLC would have decreased by 7% to S$1.86.

The returns when the DLC is bought and sold on the same day is fairly straightforward. However, the calculations get more complicated if you hold your position longer than a day.

Let us analyse the compounding effects of holding a long position for a week. There are 3 possible scenarios: 1. compounding in a clear upward trend, 2. compounding in a clear downward trend and 3. compounding in a sideway moving market

Compounding in a Clear Upward Trend

Assume you hold a long position for a week and the underlying asset registers 5 consecutive days of gains. A 3x Long DLC will have a return greater than 3 times the performance of the underlying asset due to the daily reset feature and the compounding effect.

The figures below show that if the underlying asset rises by a total of 5.1% over five days, the 3x Long DLC would gain 15.9%, which is 3.1 times (15.9/5.1) the asset's performance.

Similarly, the 7x Long DLC would grow by 40.26%, equating to 7.9 times (40.26/5.1) the asset’s return.

This amplified outcome results from the compounding effect, where each day’s value, along with any gains, is reinvested with the same leverage factor of 3 or 7, depending on the product.

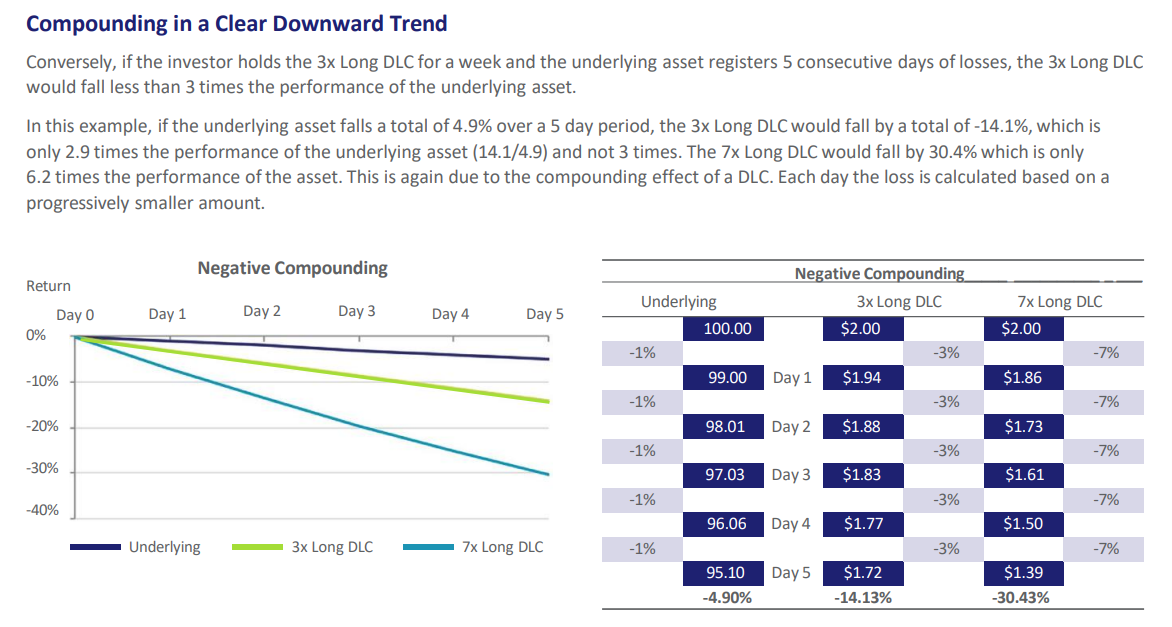

Compounding in a Clear Downward Trend

Assume you hold a long position for a week and the underlying asset registers 5 consecutive days of losses instead. A 3x Long DLC will fall less than 3 times the performance of the underlying asset.

The figures below show that if the underlying asset falls by a total of 4.9% over five days, the 3x Long DLC would fall by -14.1%, which is 2.9 times the asset's performance (14.1/4.9).

Similarly, the 7x Long DLC would fall by 30.4%, equating to 6.2 times (30.43/4.9) the asset’s return.

This is once again due to the compounding effect where each day’s loss is calculated based on a progressively smaller amount.

Compounding in a Sideway Moving Market

The compounding effect of a DLC may not result in favourable returns in a sideway moving market.

Again, assume you hold a long position for a week, however, the underlying asset registers 2 consecutive days of gains, followed by 3 consecutive days of losses.

The 3x Long DLC would register a loss of 1.0% at the end of 5 days instead of breaking even.

Total return = (1.03*1.06*0.91*0.94*1.06) - 1 ≈ -0.01 (1.0%)

The 7x Long DLC would register a loss of 5.5% instead of breaking even.

Total return = (1.07*1.14*0.79*0.86*1.14) - 1 ≈ -0.055 (5.5%)

Thus, the risk in trading DLCs is that the more the DLC falls, the harder it is to recover losses as subsequent gains are based on a lower value.

DLCs are as such not designed to be traded over the long term or in markets that display a sideways pattern.

What is the Airbag Mechanism?

An airbag mechanism in DLCs is a protective feature designed to limit extreme losses during periods of high market volatility.

When the underlying asset experiences a sharp price movement in a single day, this mechanism temporarily reduces the leverage of the DLC to prevent a full loss of capital.

This trigger is usually activated upon a predetermined percentage movement of the underlying asset as shown:

| Underlying Asset | 3x DLC | 5x DLC | 7x DLC |

|---|---|---|---|

| Index | 20% | 10% | 10% |

| Stock | NA | 15% | NA |

The airbag mechanism is activated only when the underlying asset moves in the opposite direction of the DLC.

It is important to note that the airbag can only be triggered during the trading hours of the relevant stock exchange where the underlying index or stock is listed.

For instance, the airbag for a DLC on the Hang Seng Index will only be triggered during HKEX trading hours, while for a DLC on the S&P 500 Index, it will be triggered during US trading hours when the index is actively quoted.

Investors should carefully review all listing documents provided by the issuer to understand the specific airbag mechanism for each product.

When triggered, the airbag mechanism can limit the product's ability to recover losses.

The airbag reduces the product’s exposure to the underlying asset if the asset continues to fall (for a long DLC) or rise (for a short DLC) beyond a predetermined trigger level.

However, even if the underlying asset begins to rise (for a long DLC) or fall (for a short DLC) after the airbag has been triggered, the exposure remains reduced, which can hinder its capacity to recover losses.

The airbag mechanism does not guarantee protection from total loss:

- In the event of an extreme overnight movement in the underlying asset, such as a fall (for a long DLC) or rise (for a short DLC) of 20% or more for a 5x DLC, or 14.3% or more for a 7x DLC, the airbag will only activate after the market reopens the following day.

- Similarly, if there’s a sharp intraday movement of the same magnitude, the airbag mechanism might not fully prevent a total loss during the observation period after the trigger.

What are the risks of Daily Leverage Certificates?

DLCs are leveraged investment products and are not capital guaranteed.

Hence, you need to make sure you understand the product well and are aware of the risks before investing.

Some of the risks of investing in DLCs include issuer risk and compounding effects, amongst others.

#1 - Issuer Risk

DLCs are issued by third-party financial institutions, usually investment banks.

When you purchase a Structured Certificate, you are taking on a credit risk relating to the issuer.

Hence, you must be comfortable taking on this counterparty risk.

In the event that the third-party financial institution faces financial challenges, your investment in the Structured Certificate may be impacted.

#2 - Daily Reset and Compounding Effects

If an investor trades over a few days, holding DLCs over multiple days can lead to compounding effects.

The performance of a DLC over several days may not reflect the simple daily leverage as DLCs reset at the end of each trading day.

Gains and losses accumulate over periods longer than a single trading day, causing deviations from the leveraged performance of the underlying asset.

In volatile, sideways-trending markets, where price movements lack a clear direction, this difference can be magnified, potentially leading to substantial losses for investors.

Who may consider Daily Leverage Certificates?

You will need to be qualified to invest in Specified Investment Products (“SIP”) to be able to buy structured certificates.

To qualify, you will need to complete a customer account review with your broker.

Your broker will assess if you have the relevant knowledge and experience to invest in SIPs, using criteria consisting of educational qualifications, work experience and investment experience. You will need to satisfy at least 1 of the 3 criteria above to qualify.

Investors who are keen to invest in SIPs but do not have the relevant knowledge and experience can access the SIP Online Learning module here.

What would Beansprout do?

Daily Leverage Certificates (DLCs) allow active traders flexibility in capturing magnified gains (or losses) on daily market fluctuations.

However, due to the leverage involved in DLCs, we will need to make sure that we understand the product features before we invest in them.

You will also need to be qualified to transact in Specified Investment Products (SIPs) to buy DLCs.

If you are keen to find out more about US stock DLCs, learn more at the SGX product page here or Societe Generale’s DLC website here.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Disclaimer

Any information provided in this article is meant purely for informational and investor education purposes and should not be relied upon as financial or investment advice, or advice on corporate finance.

This article is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to purchase any financial product or subscribe or enter any transaction. This article also does not take into account your personal circumstances, e.g. investment objectives, financial situation or particular needs and shall not constitute financial advice. You should consult your own independent financial, accounting, tax, legal or other competent professional advisors.

The information provided in this article are on an “as is” and “as available” basis without warranty of any kind, whether express or implied. Beansprout does not recommend any particular course of action in relation to any investment product or class of investment products. No information is presented with the intention to induce any person to buy, sell, or hold a particular investment product or class of investment products.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments