DBS, UOB and OCBC raise dividends. Still attractive at 6% yield?

Stocks

By Gerald Wong, CFA • 21 Mar 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

DBS, UOB, and OCBC reported record earnings in 2024 and raised their dividend payouts. We explore whether they’re still worth buying with close to 6% dividend yield.

What happened?

The strong share price performance of Singapore banks has caught the attention of many investors.

For example, DBS' share price reached an all-time high of S$46.85 recently after the bank reported its 2024 earnings.

Likewise, UOB and OCBC's share prices have edged higher so far this year too.

Over the past 1 year, Singapore banks have performed better than the benchmark Straits Times Index (STI).

However, with growing concerns of an economic slowdown and a fall in interest rates, I have seen discussion in the Beansprout community about whether it might still worthwhile investing in Singapore banks.

In this article, I will look at the recent financial performance of DBS, UOB and OCBC to understand what is supporting their share price, and find out more about their prospects in the year ahead.

Setting new income records in 2024

All three Singapore banks saw record net profits in 2024, with strong growth for the full year 2024 even as growth moderated in 4Q24.

DBS reported a 10% year-over-year (YoY) increase in net profit for the fourth quarter, totalling S$2.62 billion. This growth was driven by robust performance in both the commercial book and markets trading divisions. 2024 full year net profit rose to a record of S$11.4 billion (+11% YoY).

UOB reported 4Q24 net profit of S$1.5 billion, up 9% YoY, bringing 2024 full year net profit to a record of S$6.0 billion. This represents a 6% increase compared to the previous year. This growth was largely driven by increased income from fees and solid performance in trading and investment activities.

OCBC net profit of S$1.69 billion in 4Q24 was 4% higher compared to the previous year, while net profit reached record S$7.6 billion in FY24, up 8% YoY.

Moderation in loan growth

Loans growth continue to moderate in 4Q24 across the Singapore banks. OCBC led with a 5% QoQ loan growth led by Singapore and Greater China, followed by DBS at 3% QoQ led by non-trade corporate loans while UOB saw a modest 1% QoQ led by Greater China.

For the full year, loans growth was 8% YoY for OCBC, 5% YoY for UOB and 4% YoY for DBS.

Moderation in loan growth in 4Q24

Modest net interest margin compression

In 4Q24, DBS saw a 4% QoQ increase in net interest income, supported by both loans growth and an expansion in net interest margin. Net interest income growth at UOB and OCBC were flat and up a marginal 1% respectively in the quarter, however, due to the effects of a compression in the net interest margin (NIM).

DBS’s NIM rebounded from 2.11% in 3Q24 to 2.15% in 4Q24, as higher markets trading more than offsets lower commercial book NIMs. UOB’s NIM compressed five basis points to 2.00% due to lower loan margins. OCBC’s NIM narrowed by three basis points to 2.15%, as funding costs rose faster than asset yields.

Strong growth in non-interest income

The fourth quarter is seasonally a slower quarter for non-interest income, due to softer trading and wealth-related activities.

DBS’ 4Q24 fee income moderated 6% QoQ to S$1.2 billion due to seasonality, although total fee income was still up a strong 16% YoY, led by wealth management which saw a 41% YoY growth. For the full year, fee income rose to a record S$5.1 billion, up 23% YoY on an overall basis and 45% YoY for wealth management.

UOB 4Q24 net fee income similarly moderated 10% QoQ to S$567 million but was flat YoY. For the full year, net fee income rose 7% YoY to S$2.4 billion.

For OCBC, non-interest income was down 30% QoQ, but up 18% YoY to S$961 million in 4Q24. For the full year, non-interest income was up 22% YoY to S$4.7 billion, representing 32.6% of group income.

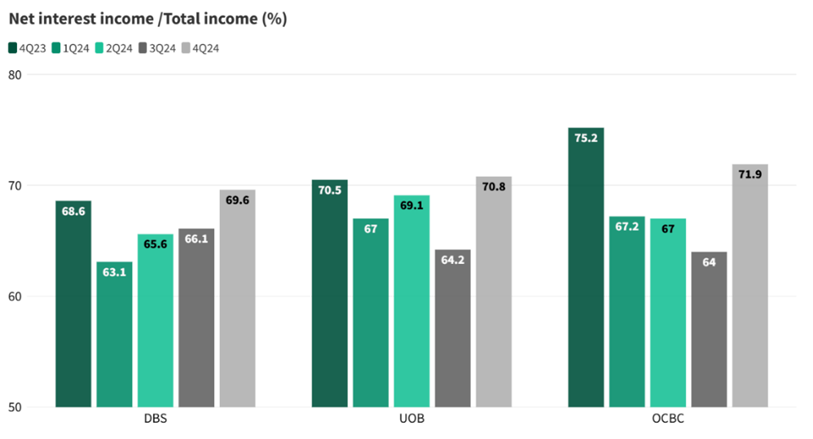

Across all three banks, net interest income’s share of total income has been hovering at the 70-72% mark.

Fee income will continue to take a bigger share of total income with larger assets under management. All three banks gathered more AUM in 2024, with 4Q24 AUM increases led by DBS at S$25 billion, followed by OCBC at S$15 billion and UOB S$5 billion.

Credit costs remain manageable

Asset quality remains healthy, with stable non-performing loan (NPL) ratios.

For UOB, credit costs continue to increase QoQ, up 16 basis points in 4Q24 to 52 basis points, after a 15 basis points QoQ increase in 3Q24, driven primarily by the Thailand retail portfolio. DBS credit costs rose marginally by 6 basis points QoQ to 20 basis points, while OCBC credit costs rose 9 basis points QoQ to 15 basis points.

Strong capital ratios support sustainable dividend

The improved earnings and continued strong asset quality of the banks have helped to sustain healthy Common Equity Tier 1 (CET1) ratios, which have all improved meaningfully YoY across all three banks. While DBS CET1 ratio dipped marginally from 17.2% to 17.0% as at 4Q24, this was higher than 14.6% as at 4Q23. For UOB, CET1 ratio was flat QoQ at 15.5%, but higher than 13.4% as at 4Q23. For OCBC, CET1 ratio dipped from 17.2% to 17.1%, albeit higher than 15.9% as at 4Q23.

Even after considering the full effects of the Basel III regulatory reforms for banks, which is to be fully phased in on 1 January 2029, the three local banks’ remain well capitalised compared to their target operating range of 12 to 14%, and well above regulatory requirements set by the Monetary Authority of Singapore (MAS).

DBS fully phased-in CET1 ratio stands at 15.1%, UOB at 15.4% and OCBC at 15.3%.

Dividends and capital management

DBS announced Capital Return dividend

DBS announced a final quarterly dividend per share (DPS) of 60 cents per share, a six-cent increase from the 54 cents per share in from 1Q to 3Q24. In addition, the bank has unveiled an innovative 'Capital Return' dividend, set at 15 cents per share quarterly for the duration of 2025. In the subsequent two years, it expects to pay out a similar amount of capital either through this or other mechanisms, barring unforeseen circumstances.

The Capital Return dividend is the latest in a series of capital management initiatives undertaken by the Board in recent years, which included regular increases in the ordinary dividend including through a bonus issue, occasional special dividends and a share buyback programme which was announce earlier.

DBS continues to consider all forms of returning excess capital to shareholders.

Read also: DBS reports 10% profit growth and unveils capital return dividend: Our Quick Take

UOB announced special dividend

For UOB, a final dividend of 92 cents per share was announced, in addition to an interim dividend of 88 cents per share previously announced. This brings total dividend of S$1.80 per share for FY24, an increase from S$1.70 per share for FY23.

To celebrate its 90th anniversary, UOB is also proposing a special dividend of 50 cents per share in 2025, distributing a total of S$0.8 billion.

The special dividend will be paid out over two tranches in 2025, with the first tranche of 25 cents per share to be paid in May 2025, and second tranches of 25 cents per share to be paid in August 2025.

Furthermore, UOB will initiate a S$2 billion share buyback program, aimed at returning a total of S$3 billion in surplus capital (including special dividends) over the next three years.

Read also: UOB profit rises by 6% and announces special dividend: Our Quick Take

OCBC also announced special dividend

For OCBC, the board has proposed a final ordinary dividend of 41 cents per share for FY24, slightly lower than 42 cents per share for FY23. This would bring the total ordinary dividend for FY24 to 85 cents per share with a payout ratio of 50%.

A special dividend of 16 cents per share is recommended, raising the total dividend payout for FY24 to 60% of net profit.

OCBC has also announced a strategic capital return plan totalling S$2.5 billion over FY24 and FY25, benefiting shareholders through both special dividends and share buybacks. That said, the special dividends, set at a 10% payout ratio, would represent the bulk of the S$2.5 billion plan.

To recap, OCBC and UOB pays dividends on a semi-annual basis, unlike DBS which does so on a quarterly basis. Given the continued strong capital position of all three banks and prospects of earnings growth, there is scope for dividend increases in the upcoming earnings announcement in 2025.

Read also: OCBC profit rises by 4% and announces special dividend: Our Quick Take

Stable outlook in 2025 despite geopolitical complexities

DBS expects group net interest income to be slightly above 2024 levels, with a slight decline in Group NIM offset by loan growth. While credit costs are expected to normalise to 17-20 bps, management is not seeing signs of stress so far. Overall, 2025 pretax profits are expected to be around 2024 levels, with net profit lower due to the global minimum tax of 15%.

For UOB, it expects high single-digit loan growth, double-digit fee growth and higher total income in 2025. At the same time, costs are likely to be contained with the cost-to-income ratio at around 42%, while credit costs are expected to be benign in the 25-30 basis points (0.25-0.3%) range.

OCBC expects a further decline in its net interest margin to about 2% from 2.20% in 2024. The decline in net interest margin is expected to be partly cushioned by mid-single digit loan growth. OCBC also expects its cost-to-income ratio in 2025 to be in 'low-40s', which will mark a further increase from the 39.7% in 2024.

Singapore banks offer a potential dividend yield of 5.9% above in 2025

While DBS was the standout performer in 2024, the three local banks have a comparable share price performance in the year to date, with DBS up 3.3%, UOB up 3.4% and OCBC up 2.3% as at 20 March 2025.

This is likely driven by their strong earnings in 2024, as well as expectations for stable profits in 2025.

DBS is now trading at a price-to-book ratio of 1.9x, while UOB and OCBC are trading at a price-to-book ratio of 1.3x. The price-to-book valuations for all three Singapore banks are currently above their historical averages.

Annualising the last announced ordinary dividends, DBS is projected to provide the highest yield at 5.3%, followed by UOB at 4.9% and OCBC at 4.8%.

Annualising their latest announced dividends and adding the announced special dividends, DBS is expected to offer a potential dividend yield at 6.6%, followed by UOB at 6.2% and OCBC at 5.9%.

As this is above the dividend yield of the Straits Times Index (STI), Singapore banks continue to look attractive for dividend investors.

Keen to learn more about what's ahead for Singapore banks? Join us for our free webinar on 26th March (Wed) at 7.30pm where we will share more about DBS, UOB and OCBC. Register for free here.

Related links:

- DBS Group Holdings Ltd share price history and share price target

- United Overseas Bank Limited share price history and share price target

- Oversea-Chinese Banking Corporation Limited share price history and share price target

Download the full report here.

Upcoming Webinar:

Curious about Software-as-a-Service (SaaS) and its rapid rise in the digital economy? Join Beansprout for an exclusive webinar on 27 March where we break down what makes SaaS a fastest-growing sector, and what it means for investors like you! Sign up for free here.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

1 comments

- Edward Houng • 24 Mar 2025 11:17 AM