Interest rates are down. Here's another way to earn income on your idle cash

Cash Management

Powered by

By Nicole Ng • 11 Jul 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

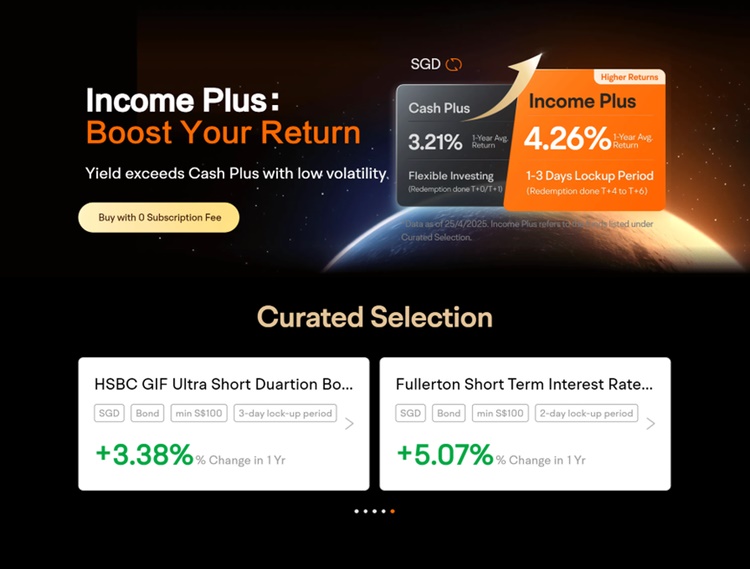

Moomoo Income Plus offers a way for you to generate income on your idle cash by investing in bond funds.

This post was created in partnership with Moomoo. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

Recently, I’ve been trying to figure out the best place to park my idle cash.

With 6-month T-bill yields falling to 2.0% p.a, I have been looking at alternative ways to grow my passive income streams without having to lock it up for months at a time.

I came across Moomoo Income Plus recently. It’s a cash management feature within the Moomoo Singapore app that gives you access to a curated list of SGD and USD bond funds.

It’s not a fixed deposit or savings account, but it offers a way to potentially earn higher returns with relatively lower risk compared to stocks or longer-term bond funds.

If you’re sitting on idle funds, it might be worth a closer look.

What is Moomoo Income Plus?

Moomoo Income Plus is a flexible cash management solution that allows you to invest in short-term bond funds denominated in SGD or hedged to SGD.

These funds aim to generate stable income with lower volatility compared to stocks.

Conservative investors who want to earn more from their cash, without diving into high-risk investments, could consider this option.

Importantly, Moomoo does not bundle these funds into a fixed portfolio, unlike portfolios with robo-advisors.

Instead, you can choose from a curated list of individual short-term bond funds within the app.

This gives you more control over your target yield, risk level, and fund strategy:

What funds power Moomoo Income Plus?

The funds in Moomoo Income Plus are managed by reputable managers. You get to choose from a curated list of professionally managed short-term bond funds, all of which are SGD or USD-denominated.

For context, short-term bond funds invest in fixed income instruments such as government securities, corporate bonds, and certificates of deposit.

These funds focus on bonds with shorter maturities, usually less than two years, and often maintain an average duration from 1.5 to 2.18 years, as of 31 May 2025, based on the various funds’ factsheets.

Their shorter duration makes them less sensitive to interest rate changes compared to longer-term bonds, though some price volatility may still occur.

At the same time, they tend to offer higher potential yields compared to money market funds. Just like money market funds, they carry investment risk, and returns are not guaranteed.

This balance of stability and income makes short-term bond funds a popular choice for conservative investors who want steady a relatively stable returns, while accepting a relatively lower risk.

You can also find out important information like the Product Highlights Sheet, Prospectus and other key information via the “Income Plus” section in the moomoo app, which I will cover later on in the How to get started section of this article.

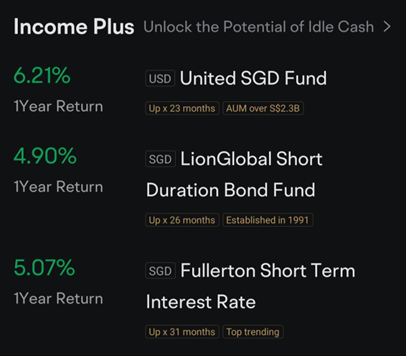

As such, here are some of the funds currently available on Moomoo Income Plus:

- UOB AM United SGD Fund:

One of Singapore’s most established bond funds with over S$2.2 billion in AUM and a 26-year history as of 31 May 2025. It invests in short-duration, investment-grade bonds, aiming to offer stability and income. Available in both SGD and USD share classes. - Fullerton Short Term Interest Rate Fund:

Managed by Fullerton Fund Management (linked to Temasek), this SGD-denominated fund focuses on high-quality, short-term bonds from Singapore and the region. It aims for low volatility and stable returns as well. - LionGlobal Short Duration Bond Fund (SGD Class I):

Backed by OCBC’s asset arm, this actively managed fund has shown strong recent performance, returning 4.90% over 1 year as of 25 Jun 2025. It invests in global, investment-grade bonds with short duration and is denominated in SGD, helping shield you from FX swings. - Nikko AM Shenton Short Term Bond Fund (SGD Class)

Aims to maintain liquidity while seeking to outperform the 3-month Singapore Overnight Rate Average (SORA) by investing in a diversified portfolio of quality, short-term bonds and money market instruments.

These funds aim to deliver relatively stable returns through investments in fixed income instruments. You can easily view their past performance, duration, and risk profile directly within the Moomoo app.

What are the returns of Moomoo Income Plus?

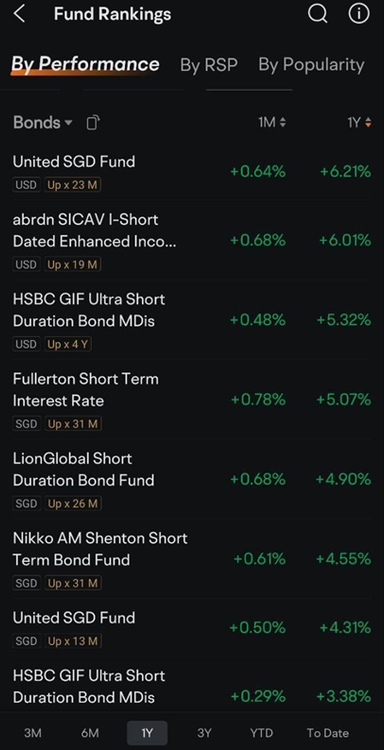

There is a range of performance for different funds in Moomoo Income Plus.

As of 25 June 2025, the United SGD Fund (USD) had the highest 1-year historical return of 6.21%. The 1-year return of other funds range from 3.38% to 6.01%.

These are historical returns, and past performance is not an indication of future performance.

The actual return you receive will depend on the performance of the fund, which will vary according to various factors such as how interest rates change.

Fees and costs

Moomoo Income Plus is designed to be a fuss-free way to earn relatively stable returns with minimal fees.

There are no platform fees, subscription charges, or redemption fees when you invest in Income Plus through Moomoo Singapore.

This makes it especially attractive for cost-conscious investors who want their money to work harder without worrying about hidden charges.

The underlying fund management fees are already embedded in the fund’s Net Asset Value (NAV) and reflected in the displayed yield.

In other words, what you see is what you get.

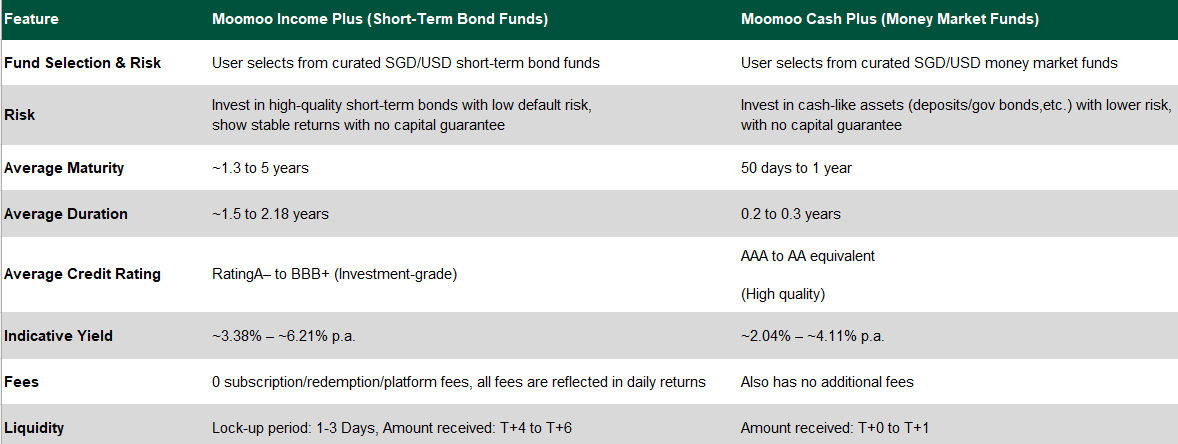

How is Income Plus different from Moomoo Cash Plus?

Moomoo also offers Cash Plus, which works similarly to Income Plus.

You choose from a curated list of money market funds (MMFs), mostly in SGD or USD. These funds aim for relatively stable returns, high liquidity, and low volatility.

Here’s a quick comparison:

Both products are flexible and unbundled, as you can choose exactly where your money goes.

I personally prefer Income Plus for idle cash I won’t touch soon, and Cash Plus for funds I may need at short notice.

How to get started

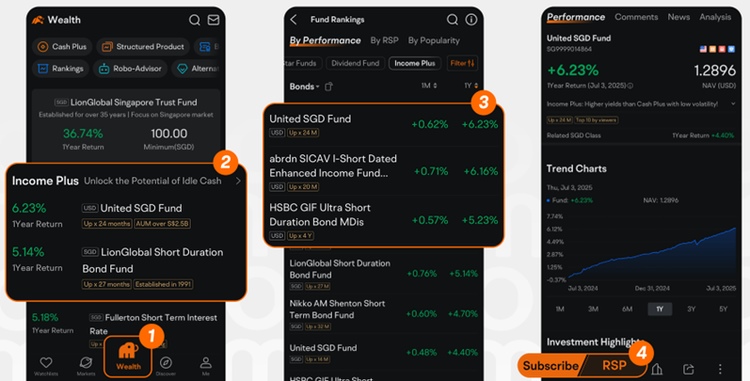

Subscribing to Income Plus is quick. Here’s what I did:

- Opened the Moomoo app and tapped into the “Wealth” tab (Or click "Discover" - "Wealth").

- Click on “Income Plus”.

- Reviewed and researched the available bond funds Product Highlight Sheet, Prospectus and other key information by clicking on the fund name.

- Picked the one that matched my investment goals and risk appetite. Tapped “Subscribe/RSP”, entered my amount in SGD (minimum S$100), and confirmed.

Redemptions are similarly easy, but take note—your funds typically take up to T+6 days to be returned after redemption, depending on the specific fund.

What to consider when investing using Moomoo Income Plus

#1 – Not capital guaranteed

Even though these are typically lower-risk investments compared to stocks, Moomoo Income Plus is not capital guaranteed, and the funds are not protected under the Singapore Deposit Insurance Corporation (SDIC).

#2 – Returns may fluctuate with interest rates and market conditions

Because these are bond funds, there is interest rate risk, and your returns may be lower than expected.

You may also experience daily fluctuations in your investment’s value.

Rising interest rates could cause bond prices to drop, though the short duration of the funds helps cushion the impact.

#3 – Credit risk of issuers

There is also credit risk, that is, if a bond issuer defaults, the fund could be negatively impacted.

That said, most of the funds invest in investment-grade bonds, which lowers the potential risk of default.

#4 – Redemption period

Lastly, there’s a redemption timeline of up to T+6 business days, meaning Income Plus is not suitable for emergency cash. Make sure to plan ahead if you’re going to redeem.

What Would Beansprout Do?

If you’re like me and have spare SGD cash sitting around doing nothing, Moomoo Income Plus offers a viable alternative.

You get to choose from curated bond funds, and decide exactly where your money goes.

It’s not a place for emergency savings, but it can be considered for funds I’m setting aside for a few months.

As always, read through the fund details before subscribing. Understand that there’s no capital guarantee, and that redemptions take time.

But if you want your cash to work a little harder while still managing risk, Moomoo Income Plus is definitely worth a look.

Moomoo Exclusive Promotion

Learn more about the Moomoo promotion here

Ready to start your investing journey? Sign up for a Moomoo SG account here.

Come join us at MooFest Singapore 2025

Join us for a full-day festival of learning, inspiration, and all things investing on 12 July 2025 at Suntec Convention Centre, Level 4.

Whether you're just getting started or looking to level up your strategy, MooFest has something for everyone—expert talks, workshops, and plenty of interactive booths to explore. Sign up for free here.

All views expressed in the article are the independent opinions of Beansprout. Neither Moomoo Singapore or its affiliates shall be liable for the content of the information provided. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Join our Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

0 questions