Guide to Mutual Fund Pricing and Fees

Mutual Funds

By Nicole Ng • 21 Mar 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Mutual fund fees can significantly impact your returns. Learn about expense ratios, sales charges, total expense ratio (TER), and other costs to make smarter investment decisions.

As you research different mutual funds from various providers, you may find multiple options that align with your investment goals.

For instance, you might notice various “versions” of the PIMCO Income Fund on several different platforms.

But how do you compare them effectively?

One key factor to consider is the fees associated with buying and holding a mutual fund.

While fees shouldn’t be the sole determinant in choosing a mutual fund (since other factors like performance, risk, and investment strategy matter) they do directly impact your returns.

In this article, we’ll break down the different fees involved in mutual fund investing and explain how they affect your overall investment.

What are the fees involved when buying a mutual fund or unit trust?

#1 – Management fee

The management fee is an annual charge imposed by the fund manager for overseeing the fund’s portfolio, making investment decisions, and ensuring its smooth operation.

Rather than being billed directly to investors, this fee is deducted from the Net Asset Value (NAV) of the fund, typically at the end of the year.

These fees help cover the cost of research, market monitoring, and portfolio rebalancing in response to market conditions.

This is especially important in actively managed funds, where the manager aims to deliver returns that outperform the market, also known as “alpha.”

Management fees are usually calculated as a percentage of the fund’s assets under management (AUM) and typically range from 1% to 2% annually.

Suppose you invest $10,000 in a mutual fund with $200 million AUM and a 1% annual management fee. You will incur an annual fee of $100.00.

It’s important to note that the management fee differs depending on which share class of the fund you are looking at.

Take the PIMCO Income Fund, for example. The Institutional share class has a 0.55% annual management fee whereas E share class has a 1.45% annual management fee.

The management fee can be found on the fund’s factsheet and Prospectus listed on the fund’s website.

#2 – Total Expense Ratio (TER)

Many investors often confuse The Total Expense Ratio (TER) for the annual management fee, thinking that they’re one and the same.

However, the TER represents the total costs incurred by a mutual fund as a percentage of its total assets, of which the annual management fee is only one component of it.

The TER includes:

- Management fees – The largest component of TER.

- Administrative expenses – Costs for legal, audit, marketing, and regulatory filings.

- Custodian and trustee fees – Fees for safekeeping assets and overseeing the fund’s operations.

- Other operational costs – Expenses such as office rent, utilities, and staff salaries.

A lower TER generally indicates a more cost-efficient fund.

Comparing TERs across similar funds or share classes of a single fund will help you assess overall costs and make more informed decisions, as it reflects a fund’s true performance after fees.

Since the management fee is a component of TER, the TER will always be higher and provide a more comprehensive view of a fund’s total expenses.

Taking the PIMCO Income Fund again as an example. You’ll notice that some of the share classes have fees such as trail fees, and service fees. These fees are included in the TER.

These expenses are deducted from the fund’s returns and directly impact an investor’s net gains.

A fund’s TER can typically be found in its Product Highlights Sheet (PHS) or Annual Report.

#3 – Fees Charged by Fund Distributors

Besides the Total Expense Ratio, you have to consider fees that are charged by the fund distributors.

Mutual funds are typically purchased through distributors such as banks, financial advisors, or online investment platforms.

These intermediaries charge various fees, which may include:

Initial sales charge (Subscription fee)

A one-time fee when purchasing a mutual fund, usually a percentage of the initial investment, ranging from 0% to 5%.

Redemption fee

A one-time fee charged when selling or redeeming your investment.

If an initial sales charge was applied, a redemption fee is typically not imposed. This fee can range from 0% to 5% and may decrease over time if you hold the fund for an extended period.

Switching fee

Charged when switching from one fund to another managed by the same provider, usually around 1% of the investment amount.

If a switching fee applies, no additional sales charge is typically levied for that transaction.

Wrap fee

A recurring fee for investors enrolled in a "wrap" account with their distributor.

This fee covers advisory services and transaction costs payable to the distributor for managing your investment portfolio. This fee is usually around 1% per annum of the total assets managed by the distributor.

Upfront fee (wrapped)

Investors using wrap accounts may be charged a one-time upfront fee of 2% to 3% on new investments. However, they typically avoid initial sales charges, redemption fees, or switching fees for transactions within the wrap account.

Platform fee

A recurring fee charged by investment platforms for account maintenance and fund access, ranging from 0% to 3% of total fund holdings.

Other fees

Additional one-time or recurring fees set by the distributor, depending on the platform and services provided.

These fees vary across different platforms, so it is important to compare costs before investing.

Checking with fund providers such as POEMS, FSMOne, Moomoo Singapore or other investment platforms in Singapore can help you determine the best option based on your investment needs.

Source: POEMS

Why is knowing the fees on mutual funds and unit trusts important?

Even a small percentage in fees can have a significant impact on your investment returns over time.

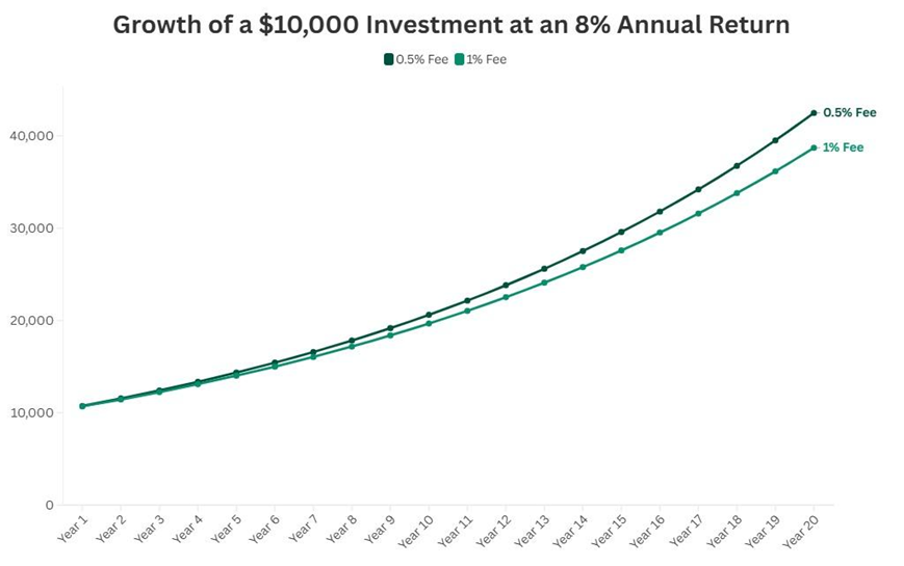

For example, if two funds generate the same 8% annual return, but one charges a 0.5% fee while the other charges 1%, the difference in final returns over decades can be substantial.

Suppose you invest $10,000 in each fund for 20 years:

- Fund A (0.5% fee): Grows to approximately $42,478

- Fund B (1% fee): Grows to approximately $38,697

That’s a difference of over $3,781 just due to fees! This is why understanding and comparing fees is crucial when selecting a mutual fund.

How do mutual fund and unit trust fees differ from ETFs and stocks?

Mutual funds charge recurring fees for professional management, which are typically higher than the fees for ETFs.

You would also incur one-time transaction costs when purchasing stocks and ETFs through a brokerage and trading platform.

- Mutual funds: Actively managed by professionals, leading to higher fees, including management fees and TER.

- ETFs (Exchange-Traded Funds): Passively managed, designed to track an index, and typically have lower fees than mutual funds.

- Stocks: Investors pay commissions to brokers when buying or selling stocks, but there are no ongoing management fees.

To compare the fees for trading mutual funds, ETFs and stocks, check out our guide to the best online trading and stock brokerage account in Singapore.

How are mutual funds priced?

When investing in mutual funds, you may notice that they don’t trade like stocks or ETFs.

Unlike these investments, mutual funds are priced based on Net Asset Value (NAV), which is calculated once per day and determines how much investors pay when buying or selling fund units.

What is Net Asset Value (NAV) of a mutual fund?

NAV represents the per-unit value of a mutual fund and is calculated using the following formula: NAV (Total Assets – Liabilities) / Outstanding Shares.

- Total Assets: The combined market value of the fund’s holdings, including stocks, bonds, and cash reserves.

- Liabilities: Any expenses the fund owes, such as management fees, custodial costs, and operational expenses.

- Outstanding Shares: The total number of units investors hold in the fund.

Since NAV is calculated once per day after market close, all buy and sell orders for the fund are processed at that day’s NAV rather than fluctuating throughout the trading day like stocks.

How mutual fund pricing works

Mutual funds are priced based on their NAV, which will only be calculated after the market closes and will not be affected as much due to supply and demand of the fund itself.

- All buy and sell orders are executed at the end-of-day NAV. If you place an order during market hours, you won’t know the exact price until the NAV is determined after the market closes.

- Unlike stocks, mutual fund prices don’t fluctuate throughout the day. A stock’s price moves based on supply and demand, but a mutual fund’s NAV is determined solely by the value of its holdings.

- Market movements impact NAV. If the stocks and bonds in the fund’s portfolio rise in value, the NAV will increase. If they decline, so will the NAV.

- More investors buying into a mutual fund doesn’t push its price up. Instead, it increases both the fund’s total assets and the number of shares proportionally, keeping the NAV relatively stable. This is very different from stocks, where higher demand typically drives prices higher.

Why NAV matters for investors

NAV is a crucial metric, but many investors misunderstand its role. Here’s why it matters:

- It’s not an indicator of whether a mutual fund is “cheap” or “expensive.” Unlike stock prices, which can be influenced by market speculation, NAV simply reflects the actual value of the fund’s holdings.

- A rising NAV signals portfolio growth. If a fund’s NAV increases over time, it means its underlying investments are performing well.

- It helps investors track performance. You can compare NAV movements against a benchmark index to see if the fund is delivering good returns.

Source: Nikko Asset Management

For example, as of 31 December 2024, the Nikko AM Shenton Emerging Enterprise Discovery Fund has delivered a 5.97% return since its inception, outperforming its benchmark, the MSCI Asia ex-Japan Small Cap Index, which returned 4.70% over the same period.

When assessing whether a mutual fund is “cheap,” it may be more relevant to examine its fees instead, as high costs can significantly impact overall returns.

A useful metric to evaluate a fund’s actual performance is its NAV after charges, which reflects the net returns investors receive.

For instance, as of 31 December 2024, the Nikko AM Shenton Emerging Enterprise Discovery Fund had a 5.97% return before charges, but after accounting for fees, its actual return was 5.77% since its inception.

Despite the deduction, the fund still outperformed its benchmark, suggesting that its fees are reasonable given its strong performance and solid fundamentals.

What would Beansprout do?

Understanding mutual fund fees is essential to maximising your investment returns.

While fees shouldn’t be the sole deciding factor, they directly affect your long-term gains.

By comparing fees across different funds and considering alternatives like ETFs or stocks, you can make better investment decisions and optimise your portfolio for cost efficiency.

To learn more about mutual funds, check out our guide to unit trusts here.

Join the Beansprout Telegram group get the latest insights on Singapore REITs, stocks, bonds, and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments