How to value SaaS companies? A Guide for Investors

Stocks

Powered by

By Gerald Wong, CFA • 28 Apr 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Discover key operational and valuation metrics to evaluate SaaS companies

Earlier, we shared that Software-as-a-service (Saas) is changing the way businesses and individuals use software.

Instead of buying software as a one-time purchase and installing it on a single device, SaaS allows users to access applications through the internet on a subscription basis.

This means greater convenience, flexibility, and often lower costs for users compared to traditional software.

In this guide, we will share the key metrics when evaluating SaaS companies, as well as the valuation metrics to identify opportunities in SaaS stocks.

Key metrics to evaluate SaaS companies

SaaS companies operate differently from traditional software providers. Instead of one-time software sales, they use a subscription-based model, which generates recurring revenue.

SaaS companies generate revenue through different pricing strategies, including:

Subscription-based: Customers pay monthly or annually, ensuring a steady revenue stream for the company.

- Freemium: Basic features are free, with premium features requiring payment (e.g., Zoom’s free basic plan with paid upgrades.

- Usage-based: Fees are charged based on actual usage, such as cloud storage or API calls (e.g., Twilio and Snowflake

Annual Recurring Revenue (ARR)

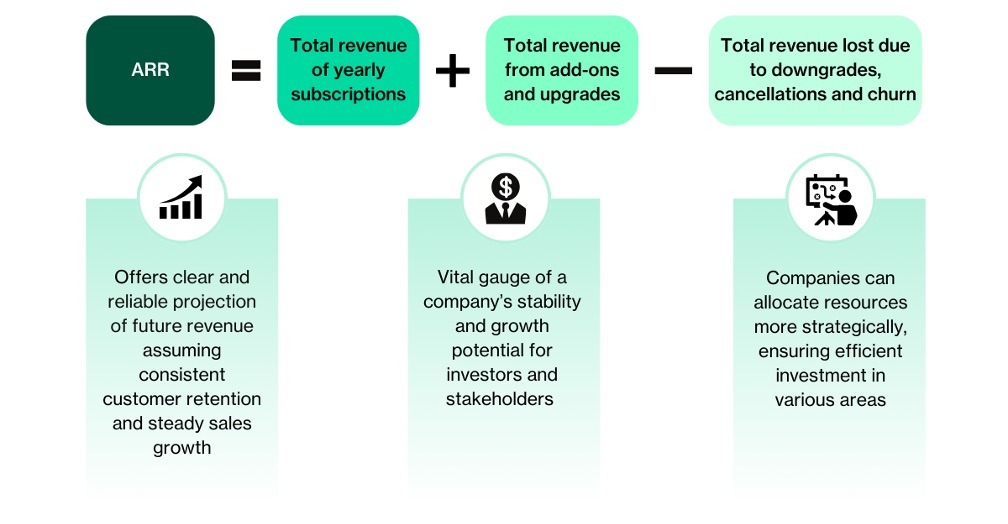

Annual Recurring Revenue (ARR) measures the predictable revenue a SaaS company earns from subscriptions over a year.

ARR is calculated by adding total revenue of yearly subscriptions with the total revenue from add-ons and upgrades, less the total revenue due to downgrades, cancellations and churn.

It offers a clear and reliable projections of a SaaS company’s future revenue, assuming consistent customer retention and steady sales growth.

Companies grow ARR by acquiring new customers, upselling existing customers, or expanding their product of offerings

Recurring Revenue Mix

Recurring Revenue Mix, an extension of the Annual Recurring Revenue (ARR) concept, is the percentage of revenues that are subscription-based, out of a SaaS company’s total revenue.

The higher the recurring revenue mix, the larger the amount of consistent and predictable revenue stream a company has.

This may have a compounding effect on revenue, as businesses are able to benefit from sustained engagement and value delivery through the customer life cycle.

For publicly listed SaaS companies, recurring revenue mix range from 66% to 89%, with the average public SaaS company having an average of 80% recurring revenue mix, according to analysis from Shea & Company.

Retention Rate

Retention rate measures how well a SaaS company keeps its customers over time. Retention rate serves as a crucial metric for evaluating customer satisfaction, service quality, and the long-term health of the business.

There are two main types:

Gross Retention Rate: Measures the ability to retain existing customers, and measured by the current period ARR, less the downgrade ARR (decrease in revenue caused by existing customers) and less the Churn ARR (revenue lost due to customer cancellations).

Net Retention Rate: Measures the ability to expand with existing customers, and measured by the current period ARR, less the downgrade ARR, less the Churn ARR and with the addition of LTM net expansion (expansion revenue from upsells, cross-sells, and add-ons from current customers).

The benchmark dollar-based gross retention rate for Enterprise-focused SaaS companies is 87%, while the benchmark for Small and Medium Businesses (SMB)-focused SaaS companies is 72%, according to analysis from Shea and Company.

Lifetime Value (LTV) vs Customer Acquisition Cost (CAC)

LTV: Estimates the total revenue a company can earn from a customer over their lifetime.

CAC: Measures how much a company spends to acquire a new customer.

A strong SaaS business typically maintains an LTV to CAC ratio of at least 3:1, meaning the revenue earned from a customer should be at least three times the cost of acquiring them.

Valuing SaaS Companies

The “Rule of 40” is a critical metric in assessing SaaS companies, where the sum of a company’s revenue growth rate and profit margin should exceed 40%.

The Rule of 40 is widely recognised as a metric for evaluating growth, with companies that have exceeded 40% on this metric demonstrating strong growth potential.

Companies exceeding this threshold are generally viewed as financially healthy and tend to trade at higher valuations.

Data suggests a strong relationship between the rule of 40 with stock prices. As of January 2025,, SaaS companies which have exceeded the Rule of 40 trade at an average Enterprise Value-to-Revenue (EV/Sales) ratio of 11x, compared to companies whose sum of revenue growth rate and profit margin are between 30% to 40%.

Beyond standard financials, SaaS-specific KPIs like ARR growth and retention rates are essential for evaluating a company’s long-term success.

Traditional valuation metrics like price-to-earnings (P/E) ratios are less relevant for SaaS companies, many of which operate at little or no profit. Instead, the Enterprise Value-to-Revenue (EV/Sales) ratio is widely used. This measures how many times annual revenue a company is worth.

Historically, SaaS companies have traded at higher EV/Sales multiples compared to the broader market due to their recurring revenue and strong growth potential.

During the 2020–2021 tech boom, public SaaS companies saw valuations soar, with median EV/Sales multiples reaching 15–18x, and some exceeding 30–50x revenue. However, rising interest rates in 2023 brought these multiples down.

Learn more about the SaaS industry with our interview with Chief Strategy Officer of Avepoint

If you are keen to find out more about SaaS and key factors to look out for when evaluating SaaS companies, we recently spoke to Mario Carvajal, AvePoint's Chief Strategy & Marketing Officer.

As AvePoint’s Chief Strategy & Marketing Officer, Mario is responsible for all aspects of the AvePoint brand and marketing approach for customers, partners and investors, while maintaining responsibility for developing the Company’s growth strategy and initiatives such as corporate development, strategic planning, mergers and acquisitions, and strategic partnerships.

Watch the recorded interview below.

Learn more about the SaaS industry by downloading our guide for investors here.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Beansprout was appointed by Singapore Exchange Limited via a third party platform provider and received monetary compensation from SGX via such third party platform provider to provide independent research. Beansprout is solely responsible for the contents of this document. Singapore Exchange Limited and/or its affiliates, including Singapore Exchange Regulation Pte. Ltd. (collectively, SGX Group Companies) assume no responsibility (whether under contract, tort (including negligence) or otherwise), directly or indirectly, for the contents of this document. The general disclaimers and jurisdiction specific disclaimers found on SGX’s website at http://www.sgx.com/terms-use are also incorporated into and applicable to this document.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments