Bank of China SmartSaver Account: Does it give the highest interest rate?

Savings Account

By Gerald Wong, CFA • 04 Nov 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The Bank of China SmartSaver savings account offers an interest rate of up to 4.60% per annum on the first S$100,000. Find out if it’s the right savings account for your financial goals.

Summary

- The Bank of China (BOC) SmartSaver Savings account offers a base interest of 0.10% p.a. for your first S$100,000.

- When you spend, pay and credit your salary, you can earn up to 1.60% p.a. with the Bank of China SmartSaver Savings account on your first S$100,000.

- You can earn an additional 3% p.a. with the purchase of eligible wealth products to unlock the highest interest tier of 4.60% p.a. for your first S$100,000.

What is the Bank of China SmartSaver Savings Account?

The Bank of China’s SmartSaver savings account is a multi-currency, high-yield account that offers an impressive interest rate of up to 4.60% per annum (p.a.) on your first $100,000.

However, obtaining this attractive rate requires meeting several conditions.

Let’s explore the details of the Bank of China SmartSaver account and how you can maximise its benefits.

What is the interest rate with Bank of China SmartSaver Savings?

The BOC SmartSaver Savings account offers a base interest rate of 0.10% per annum.

By meeting additional criteria, you can earn an interest rate of up to 4.60% per annum on the first $100,000 in the account.

The interest rate you earn on the BOC SmartSaver Savings account depends on how many of the following categories you meet:

- Card Spend Bonus Interest

- Salary Crediting Bonus Interest

- Payment Bonus Interest

- Wealth Bonus Interest

| Bank of China SmartSaver Bonus Interest Categories | Interest Rate |

|---|---|

| Prevailing interest rate | Up to 0.10% p.a. |

| Card Spend Bonus Interest - Applicable to BOC Debit or Credit Cards | S$750 to $2,500: 0.60% p.a. S$2,500 & above: 0.90% p.a. |

| Salary Crediting Bonus Interest for BOC MCS Account | $3,000 and above: 0.50% p.a. |

| Bill Payment Bonus Interest | 3 bill payments via GIRO or BOC online/mobile banking of min. S$30 per bill: 0.10% p.a. |

| BOC Wealth Products | 3.00% p.a. With purchase of eligible wealth products |

| Source: Bank of China as of 4 November 2025 | |

I've done the calculation for you to breakdown the interest rate you would be able to earn depending on the criteria you can meet.

For example, if you are able to deposit your salary of S$3,000 and above, spend S$2,500 monthly on your credit card, and make 3 bill payments, you would be able to earn an interest rate of 1.60% p.a.

If you meet all of the above criteria and purchase eligible wealth products of certain minimum purchase amount, you can earn an interest rate of 4.60% p.a. on the first S$100,000.

- Salary: EIR of 0.60% p.a.

- Salary + Bill Payment: EIR of 0.70% p.a.

- Salary + Spend: EIR of 1.50% p.a.

- Salary + Spend + Bill Payment: EIR of 1.60% p.a.

- Salary + Spend + Bill Payment + Wealth Product: EIR of 4.60% p.a.

If you have balances of more than S$100,000, you will just earn an interest rate of up to 0.50% p.a. for your balances from S$100,000 to S$1 million.

| Bank of China SmartSaver Bonus Interest Categories | Interest Rate |

|---|---|

| Prevailing interest rate | 0.10% p.a. |

| Extra Savings Interest (above S$100,000) | 0.50% p.a. upon fulfilling any 1 of the requirements for card spend, salary crediting or payment bonus interest. If not, the base interest of 0.10% p.a. will be earned. |

| Source: Bank of China as of 4 November 2025 | |

What else do I need to know about the Bank of China SmartSaver Savings Account?

Since the Bank of China SmartSaver account is a multi-currency account, bonus interest will only be credited for amounts held in Singapore dollar sub-accounts.

If you have multiple multi-currency savings accounts with Bank of China, only one account will be eligible for SmartSaver benefits.

For more details, you can click here to review the terms and conditions.

How does the Bank of China SmartSaver Savings Account compare to the other bank account?

At first glance, the Bank of China SmartSaver Savings account appears to offer a higher interest rate compared to other flagship bank accounts by the local banks.

You will receive a higher interest rate if you earn a salary above S$3,000 and spend more than $2,500 on your card.

By crediting your salary with the bank, spending, and paying your bills, you can earn bonus interest of up to 1.60% p.a.

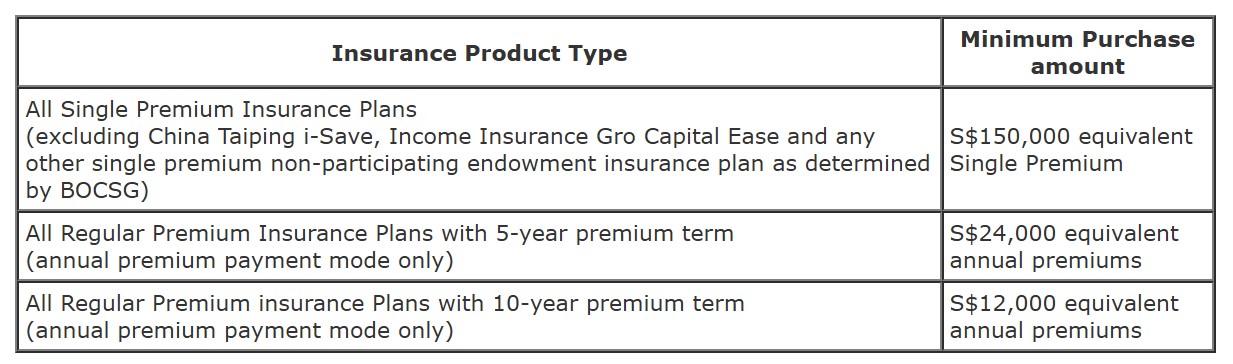

However, to unlock the highest interest tier of 4.60% per annum on your first S$100,000, you must purchase an eligible wealth product from the bank.

It's also important to note that the bonus interest rate from the wealth product category is only applicable for the first 6 months.

What are the disadvantages of the Bank of China SmartSaver Account?

I've noticed that Bank of China has a relatively limited branch network in Singapore.

Beyond its main branch at 4 Battery Road, Bank of China operates around 10 branches across the island, which is fewer compared to local banks.

If you frequently require in-person banking services, this limited branch presence might pose some inconvenience.

How to apply for the Bank of China SmartSaver Savings Account

To open a Bank of China SmartSaver Account, you must be at least 18 years old and have a minimum initial deposit of S$200.

New-to-bank customers have several options to apply for the Bank of China SmartSaver account:

- apply online

- via BOC Mobile Banking app

- or visit the nearest BOC branch

For a faster application process, we recommend applying online and pre-filling your application using MyInfo with Singpass.

Step #1 - Submit application online

Click on “Personal Account” to continue application for Savings and Current account:

Select for BOC SmartSaver (Multi-Currency Savings Account).

Step #2 - Retrieve information with MyInfo to Pre-fill Application

Final verdict on Bank of China SmartSaver Account

I think the Bank of China SmartSaver Account could be a solid option if you’re a high earner or can meet the criteria for bonus interest as it offers up to 4.60% p.a., which is pretty compelling.

That said, unlocking these higher rates requires effort—such as meeting spending requirements, salary crediting, and potentially buying wealth products—which might not be feasible for everyone.

Without purchasing wealth products, the interest rate is up to 1.60% p.a. even if you meet the other conditions.

This rate is comparable to the OCBC 360 account.

If you’re unable to meet any of the conditions, the low base rate of 0.10% p.a. makes it less appealing.

Additionally, balances above S$100,000 earn just up to 0.50% p.a., so it might be better to park your balances above S$100,000 in another no-frills savings account instead.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights on savings, investing and retirement planning.

Find out which savings account allows you to earn the highest interest rate on your savings.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

0 questions