How to Choose the Best Mutual Funds in Singapore

Mutual Funds

By Nicole Ng • 31 Mar 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Learn how to choose the best mutual funds in Singapore with this comprehensive guide. Understand key considerations when choosing a mutual fund and find the right investment for your financial goals.

If you're used to investing in stocks and ETFs, mutual funds might feel a bit unfamiliar—or even a little complex.

Lately, I’ve seen more questions from the Beansprout community about how to choose the right mutual fund, especially with so many options out there.

After all, it’s not as simple as picking a familiar company name and checking its financials like you would with stocks.

That’s why I put together this guide—to walk you through a step-by-step approach on how I personally go about choosing a mutual fund that fits my portfolio. Let’s dive in!

What is a mutual fund?

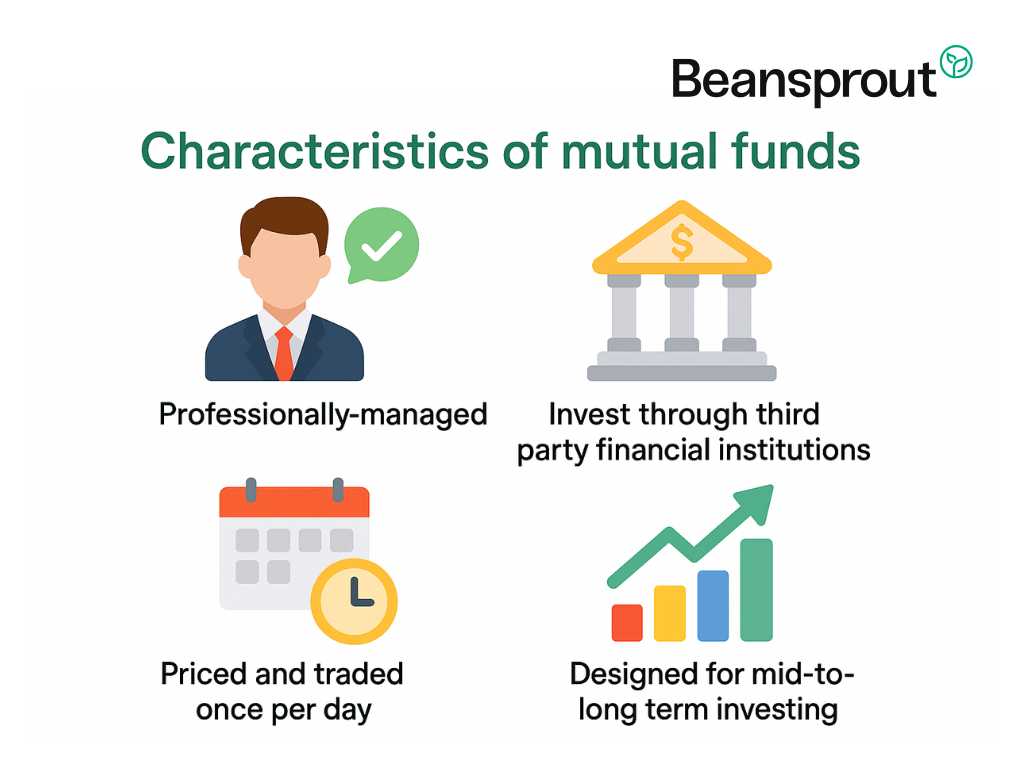

Mutual funds are investment products that pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other assets.

These funds are managed by professional fund managers who make investment decisions on behalf of investors, aiming to achieve specific financial goals.

One of the biggest advantages of mutual funds is diversification—since your money is spread across multiple assets, it reduces the risk of any single investment performing poorly.

They also offer convenience, as you don’t need to actively manage your portfolio yourself.

However, mutual funds come with management fees and expense ratios, which can impact returns.

To learn more about mutual funds, check out our comprehensive guide here.

What to consider when choosing a mutual fund

Often when I speak to investors, there appears to be a tendency to simply pick the mutual fund with the highest past returns.

However, there are a few other things I would consider before making my decision on which mutual fund to choose.

- Type of mutual fund

- Track record

- Fund size

- Fund fees

- Fund management fee

- Fund share class

#1 - Type of mutual fund

First, I would compare different types of mutual funds to find the best fit for my risk tolerance and financial goals.

For example, if I'm risk-averse or nearing retirement, a fixed-income mutual fund might be a better option, as it tends to be less volatile and provides a stable stream of income.

On the other hand, if I'm investing for long-term growth, equity funds may be a better choice despite their higher risk.

Here’s a quick guide to the different types of funds, their objectives and risk level:

Money market funds

For those looking to preserve capital with minimal risk and high liquidity, you can look into investing in a money market fund.

These funds invest in very short-term debt instruments, usually fixed deposits or T-bills and are a relatively safe place to park cash while earning modest returns.

An example of a money market fund is Fullerton SGD Cash Fund.

Bond funds

Bond or income funds are designed for investors looking for consistent income.

These funds invest primarily in bonds or debt instruments, offering predictable payouts with typically lower volatility than stocks.

A short-term bond fund is a viable choice if you want moderate returns over a few years with relatively low risk. These funds invest in short- to medium-duration bonds, making them more stable than equity funds.

For example, Fullerton Short Term Interest Rate Bond Fund invests in short-term high quality corporate and government bonds of 1 to 3 years maturity.

Equity funds

If you’re looking for long-term capital growth, equity funds can be one option. These funds typically invest in stocks, which could give a higher potential return than bond funds, but also tend to come with higher volatility. The abrdn Singapore Equity fund is one such example.

Balanced funds

These funds offer a mix of stocks and bonds, striking a balance between growth and stability, providing diversification in a single fund.

For instance, the AXA Asian Balanced Fund is a balanced fund investing in Asian assets.

Specialised funds

These funds focus on specific sectors or themes, such as technology, ESG, commodities, or cryptocurrencies.

They can be riskier but offer opportunities for targeted growth. Funds like the Eastspring Investments Unit Trusts – Global Technology Fund, for instance, would invest in a high-growth sector like tech.

To learn more about the different types of mutual funds, check out our comprehensive guide here.

#2 – Track record

A fund’s past performance can offer insights into how it has fared across different market conditions.

While past returns aren’t a guarantee of future performance, they can indicate the fund’s ability to beat the benchmark historically.

Hence, it’s always a good idea to compare a fund’s returns against relevant benchmarks (like the S&P 500 or STI) to see if it has consistently delivered above-average results.

For example, the PIMCO Income Fund has generated a 10-year return (net of fees) of 2.39% per annum as of 31 January 2025.

This is above the benchmark return of 0.73% per annum over the past 10 years.

#3 – Fund size

Size matters—but bigger isn’t always better.

Larger funds often benefit from economies of scale, allowing them to negotiate lower costs with service providers like trading platforms.

This can help reduce operating expenses and improve investor returns. For example:

- The Fullerton SGD Cash fund has an expense ratio of 0.15% as the largest money market fund in Singapore with an asset under management of above S$6 billion as of 31 January 2025.

- The smaller Phillip SGD Money Market Fund has an expense ratio of 0.49% with an asset under management of about S$1.9 billion as of 31 January 2025.

That said, large funds also come with trade-offs. For example, they may struggle to invest in smaller opportunities without significantly moving the market price.

#4 – Fund fees

Fees eat into your returns, so keeping an eye on management fees and expense ratios is crucial.

For example, both the Nikko AM Shenton Thrift Fund and the Aberdeen Singapore Equity Fund primarily invest in Singapore equities and are benchmarked against the STI.

However, their fees and performance tell very different stories:

The Nikko AM Shenton Thrift Fund has a management fee of 0.75%, while the Aberdeen Singapore Equity Fund charges a higher management fee of 1.5%.

- As of 28 February 2025, the Nikko AM Shenton Thrift Fund delivered a 5-year return before sales charge of 10.29% per annum.

- As of 28 February 2025, the Aberdeen Singapore Equity Fund delivered a 5-year return before sales charge of 8.47% per annum.

In this case, the higher fees on the Aberdeen Singapore Equity Fund potentially contributed to its lower returns compared to the Nikko AM Shenton Thrift Fund.

Always check the expense ratio and management fees, and compare them to similar funds.

Learn more about mutual fund pricing and fees here.

#5 – Fund management team

The people behind the fund are just as important as the fund itself.

A strong, experienced management team with a proven investment approach can make a huge difference—especially for equity and specialised funds.

If you’re investing in an actively managed fund, it’s worth looking into the fund manager’s track record, investment philosophy, and past performance.

To understand more about the fund management team, check out our interviews with the mutual fund managers here.

Choosing the right share class of mutual fund

If you’ve ever browsed a platform like FSMOne, you might have noticed that a single mutual fund such as the PIMCO Income Fund can appear in different “versions.”

Funds often have multiple share classes, denoted by different letters (A, B, C, H, Dis, Acc) or currency labels.

#1 – Mutual Fund Share Class

Some share classes are designed for retail investors like you and me, while others cater to institutional investors, such as pension funds and asset managers.

Each share class comes with a different pricing structure, which affects how and when fees are charged.

- Some have a front-end load fee (sales charge), meaning a percentage is deducted from your initial investment.

- Others have a back-end load fee, where the charge is deferred and applied when you sell your shares.

- Some may include a trail fee or service fee, which is an ongoing cost paid to advisors or distributors.

These fees vary depending on factors like distribution costs, management expenses, and whether the share class is designed for retail or institutional investors.

The best places to find detailed information include the product highlight sheet (PHS), Fund prospectus, or fund fact sheet.

For example, if you check PIMCO’s product highlight sheet, you’ll notice the share class options and fees listed out.

Meanwhile the prospectus lays out the definitions of each share class.

Using the example of the PIMCO Income Fund, we can see that each share class have a different fee structure:

Let’s break down the share classes in the example above:

| Share class | Description | Typical minimum investment amount |

| Institutional | Intended for institutional investors such as pension funds, sovereign wealth funds, charities, foundations. | US$5 million |

| H Institutional | Intended for institutional investors | US$1 million |

| Investor | Offered through brokers or dealers, or intermediaries. Includes a service fee paid by the distributors to the fund manager. | US$1 million |

| Administrative | Offered through intermediaries, brokers or dealers. Includes a trail fee | US$1 million |

| E | Intended for retail investors | US$1,000 |

| M Retail | Intended for retail investors seeking monthly payout (denoted by “M”) | US$1,000 |

When comparing share classes of the same fund, two key factors to consider are the minimum investment amount and the expense ratio.

For most retail investors, the available share classes will typically be those designed for individual investors, whether purchased through an online platform (FSMOne, POEMS), a financial advisor, or a robo-advisor.

Traditionally, institutional share classes were reserved for large investors, such as pension funds and asset managers, due to their higher minimum investment requirements—often in the hundreds of thousands or even millions.

However, some platforms have leveraged economies of scale, pooling client funds together to negotiate access to lower-cost institutional share classes at reduced minimums.

For example:

- Endowus offers access to the institutional share class of the PIMCO Income Fund, with a lower expense ratio of 0.55%, compared to the E Class shares available to retail investors at 1.45%.

- FSMOne and POEMS provide access to the Administrative share class, which comes with a 1.05% expense ratio—lower than the E Class but higher than the institutional share class.

However, beyond just expense ratios, it’s equally important to consider minimum investment requirements.

For instance:

- While the Administrative share class offers a lower expense ratio than the E Class, it requires a minimum investment of $1,000.

- In contrast, the E Class requires only $100 on FSMOne, or as little as $1 on POEMS.

#2 – Currency Denomination

Funds may be available in SGD, USD, EUR, or other currencies to accommodate investor preferences

To put share classes into perspective, let’s analyse the share class label for this particular PIMCO Income fund: PIMCO GIS Income Fund E Class SGD (Hedged) Inc.

- E Class – This denotes the specific share class, which is a retail share class with its own fee structure.

- SGD (Hedged) – This share class is denominated in Singapore dollars and hedged to reduce currency risk, as its base currency is in US dollars.

- Inc (Income/Distribution) – This means the fund distributes a payout instead of reinvesting it.

#3 – Hedging

A fund marked with “H” or “Hedged” means it’s hedged to reduce currency risk.

If you live in Singapore and spend primarily in SGD, investing in a SGD-hedged share class can help reduce currency fluctuations.

This is particularly useful if the fund’s base currency is in USD or EUR. In these cases, hedging minimises the impact of exchange rate movements on your returns.

However, hedging does come at cost (which is typically factored into the total expense ratio) so weigh whether the stability it provides outweighs any potential extra cost.

#3 – Accumulation (Acc) vs. Distribution (Dis)

Acc funds reinvest dividends, while Dis funds pay out dividends.

Depending on the fund, “distributing” could be exchanged with another word like “Income” as is the case with the PIMCO Income Fund’s distributing share classes.

To decide, you will have to think about your investment objectives. Are you looking for regular income or build a long-term portfolio?

This will determine your preference for a distributing share class or an accumulating share class.

Choosing the right mutual fund by understanding mutual fund name and share class

Mutual fund names and share classes offer a quick snapshot of what you’re investing in.

Think of them as a sneak peek into a fund’s strategy, risk level, and asset allocation at a glance.

When scrolling through a long list of funds on a platform, recognising these naming patterns helps you filter options efficiently, saving you time and ensuring you focus on funds that align with your investment goals.

Knowing what’s behind a fund’s name also allows you to:

#1 – Ensure it matches your investment strategy

At a glance, a fund’s name and share class can reveal whether it fits your investment goals.

Terms like “growth,” “value,” “income,” or “balanced”, "accumulating", "SGD" hint at what you can expect.

#2 – Compare funds easily

Deciphering fund names makes it easier to stack them side by side and spot differences.

For instance, two funds may both include “Large Cap” in their names, but one might focus on blue-chip dividend payers, while the other targets high-growth stocks.

By understanding what each name signals, you can make apples-to-apples comparisons and choose the fund that best aligns with your portfolio.

If you’re browsing for mutual funds and aren’t focused on a specific fund yet, it helps to decode fund names beyond just the share class.

Mutual fund names usually consist of several key components that describe the fund’s provider, strategy, asset class, region, and share class.

Most mutual fund names follow a general format:

[Fund Provider] + [Fund Strategy] + [Asset Class & Region] + [Share Class] + [Currency] + [Payout]

We’ll use the example of the PIMCO GIS Income Fund E Class SGD (Hedged) Inc to share more about each component.

Fund Provider

The first part of a fund’s name typically identifies the asset management company responsible for managing the fund.

Examples include:

- Nikko AM (Nikko Asset Management)

- Fidelity

- BlackRock

- Schroders

- LionGlobal

In our example, PIMCO is the fund provider, meaning they handle investment decisions and fund management.

Fund Strategy

This portion of the name gives insight into the fund’s investment approach, such as:

- Growth Fund: Focuses on companies with high growth potential (e.g., Nikko AM Shenton Thrift Fund).

- Dividend Fund: Targets companies that pay regular dividends (e.g., Nikko AM Singapore Dividend Equity Fund).

- Balanced Fund: Holds a mix of equities and bonds for diversification (e.g., Allianz Income and Growth Fund).

In our example, the PIMCO GIS Income Fund follows an income strategy, meaning it is designed to generate regular payouts for its investors.

Asset Class and Region

This part indicates what the fund invests in and where, such as:

- Equity Fund: Invests in stocks. (e.g., Nikko AM Shenton Singapore Dividend Equity Fund).

- Bond Fund: Invests in fixed-income securities (e.g., Nikko AM Shenton Short Term Bond Fund).

- Global Fund: Invests across multiple international markets (e.g.,Schroders ISF Global Credit Income).

- Singapore Equity Fund: Primarily invests in Singapore-listed companies (e.g., Nikko AM Shenton Singapore Dividend Equity Fund).

In our example, the PIMCO Income fund is a global fund invested in bonds or other credit instruments.

Read our complete guide to the best bond funds in Singapore.

How to buy a mutual fund

You’ve done your research, compared your options, and found a mutual fund that fits your investment goals. Now comes the next step, where do you actually buy it?

In Singapore, there are a few ways to purchase mutual funds

To find the best platform to buy a mutual fund, check out our guide to the best mutual fund and unit trust platform in Singapore

What would Beansprout do?

Picking the right mutual fund isn’t just about choosing one with good past performance.

It’s about finding one that truly fits your financial goals and risk appetite.

After researching different funds, I’ve found that a few key factors can make a big difference in the decision-making process.

First, the type of mutual fund matters—whether it’s an equity fund, bond fund, or a balanced fund, each comes with different risks and potential returns. Learn more about mutual funds with our comprehensive guide here.

Looking at a fund’s track record can also give insight into how consistently it has performed over time, though past performance isn’t a guarantee of future results.

Fund size is another important factor, as larger funds may offer stability but could also be less agile in adapting to market conditions.

Then, there are the fees, including fund management fees, which impact returns over time, and other costs that can eat into profits if you’re not careful. Learn more about mutual funds fees and pricing here.

Lastly, understanding the fund’s share class is crucial, as different classes come with varying fee structures, payout options, and accessibility depending on your investment platform.

By considering these factors, I can make a more informed decision and choose a mutual fund that aligns with my investment strategy.

To find a mutual fund that allows you to earn a higher potential yield in a relatively safe way, check out our guide to the best money market fund in Singapore.

To find a mutual fund that allows you to generate income, check out our guide to the best bond funds in Singapore.

To find the best platform to buy a mutual fund, check out our guide to the best mutual fund and unit trust platform in Singapore

Join the Beansprout Telegram group get the latest insights on Singapore REITs, stocks, bonds, and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments