Frasers Centrepoint Trust (FCT) Preferential Offering: What should unitholders do?

REITs

By Gerald Wong, CFA • 09 Apr 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The Frasers Centrepoint Trust (FCT) preferential offering will offer entitled unitholders the right to buy 54 new units at S$2.05 each for every 1,000 units held.

Frasers Centrepoint Trust to acquire Northpoint City South Wing

Frasers Centrepoint Trust (FCT) is acquiring Northpoint City South Wing from its sponsor Frasers Property Limited (FPL), for a total acquisition cost of approximately S$1.17 billion.

The manager intends to fund the acquisition via proceeds from an equity fundraising (EFR) comprising a private placement to raise around S$200 million and a preferential offer to raise another S$200 million, debt financing, and the issuance of perpetual securities to raise an additional S$200 million.

About Northpoint City South Wing

Northpoint City South Wing (NPCSW) is located in Yishun and has a net lettable area (NLA) of 301,579 square feet with a two-storey retail complex and two basement levels. NCSW enjoys a committed occupancy of 100% and is the largest prime suburban mall in the north region of Singapore.

The property is also seamlessly integrated with the Yishun Transport Hub which includes Yishun Mass Rapid Transit (MRT) station and bus interchange, via an underground pedestrian link and Nee Soon Central Community Club. These connections make the property easily accessible to the public.

NPCSW also boasts the highest shopper traffic within FCT’s retail portfolio which grew at a compound annual growth rate (CAGR) of 9.6% over 2020 to 2024.

Impressively, NPI for NPCSW grew at 8% CAGR between FY2020 to FY2024. The mall also has a high-quality tenant base that includes NTUC Fairprice, Harvey Norman, and Uniqlo.

Rationale for the acquisition of Northpoint CIty South Wing

The manager justified this acquisition by stating several key benefits.

#1 - Strong performance with a dense and growing catchment

NPC is an attractive asset with a quality tenant base across its North and South Wings. NPI for NPCSW grew at an 8% CAGR from FY2020 to FY2024, going from S$128 million to S$174 million.

The healthy trading performance of its major tenants, along with its strategic location, helped the mall to achieve this feat.

Tenant sales also did well, growing at an 8.8% CAGR from calendar year 2020 to 2024, outperforming comparable malls such as Causeway Point and Waterway Point.

Using 2019 as a starting index, tenant sales grew by a third by 2024, compared to slightly more than one-fifth for comparable malls.

In addition, NPC’s catchment area has a population density that is around 2x the national average, implying that there is a large pool of potential shoppers for the mall.

Being the largest integrated development in the north, NPC serves as a lifestyle, recreation, and transportation hub that attracts high levels of footfall.

#2 - Strengthens FCT’s market position

This acquisition also strengthens FCT’s position further as a prime suburban mall owner. Post-acquisition, the REIT will own a 10.3% market share of private shopping centres by NLA, making it the largest single owner of suburban retail, beating CapitaLand Integrated Commercial Trust which has an 8.6% market share.

Moreover, the acquisition will also boost FCT’s essentials trade mix, bumping it up from the present 52.9% to 53.4%, making the REIT more resilient to downturns.

NPC will also contribute nearly 27% of the REIT’s NPI post-acquisition, up from the current 14.4%, making the mall the single largest NPI contributor after Causeway Point’s 20.1%.

#3 - Northpoint City under a single owner

With this acquisition, FCT is now the owner of both the North and South Wings of NPC.

This single ownership will allow the REIT to execute comprehensive asset enhancement initiatives (AEIs) to optimise retail performance, thereby unlocking value for unitholders.

The diagram below shows the potential strategies that can be utilised.

By executing value-added initiatives, FCT could potentially add up to 8,000 square feet of additional retail NLA, resulting in higher rental income for NPC.

The re-mixing of tenancies should result in higher potential rental yields and an increase in shopper traffic.

Finally, the consolidation of M&E (mechanical and electrical) systems across both wings should lead to operating efficiencies and lower operating expenses.

As a result, NPC’s NPI margin could increase further from the current 72.7% to 74.2%.

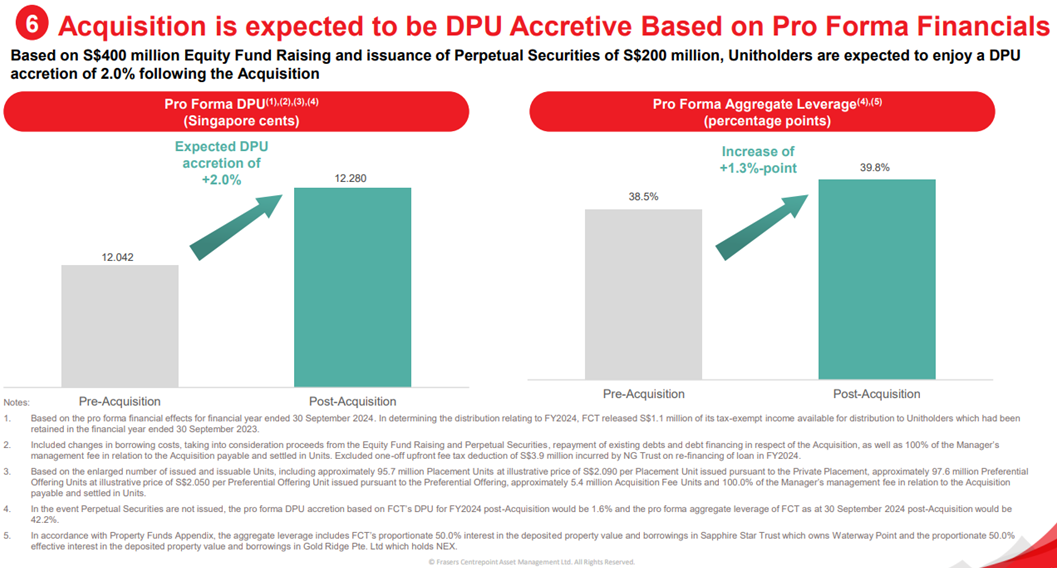

#4 - Transaction expected to be DPU-accretive

Based on the S$400 million EFR and the proposed issuance of S$200 million of perpetual securities, the accretion to DPU is expected to be 2.0% based on FY2024’s DPU of S$0.12042.

However, if the perpetual securities are not issued, then the DPU accretion is expected to be 1.6%.

Despite the EFR, the manager expects FCT’s pro-forma aggregate leverage to rise from 38.5% to 39.8%. If the perpetual securities are not issued, this gearing level could potentially rise to 42.2%.

Equity fundraising announced

As mentioned, FCT announced an EFR exercise to partially raise funds for the NPCSW acquisition.

On 25 March 2025, this EFR was launched comprising a private placement which aims to raise around S$200 million along with a preferential offer that will also raise around S$200 million.

There could also be a potential issuance of perpetual securities to raise no more than S$200 million, with the remainder of the acquisition outlay being funded by debt financing.

The final funding structure for the total acquisition cost will be announced by the manager at a later time after accounting for prevailing market conditions and FCT’s aggregate leverage.

Private placement – already completed and units were listed on 4 April, 9 a.m.

The private placement was completed on 4 April with a total of 105,264,000 new units issued at an issue price of S$2.09 per unit.

With this issuance, the total number of FCT units in issue will rise to 1,923,517,220. The private placement will result in a 5.8% dilution. These units are already listed and trading began for the new units on 4 April at 9 a.m.

Preferential offering – last date and time of acceptance on 16 April, 5:30 p.m.

As for the preferential offering, FCT’s units have already gone ex-entitlement for this offer, and entitled unitholders are given the right to buy 54 preferential units at S$2.05 each for every existing 1,000 units held.

The opening date and time for this preferential offer is 8 April 2025 at 9 a.m., and the last date and time to accept the offer is 16 April 2025 at 5:30 p.m.

Payment of cumulative distribution

FCT will pay out a cumulative distribution for the period from 1 October 2024 to 3 April 2025.

The next distribution will be from 4 April 2025 till the end of fiscal 2025 (30 September 2025). Half-yearly distributions will resume thereafter.

The manager estimates that the cumulative distribution should be between S$0.0613 to S$0.0617. This distribution will be determined at a later date and paid out on 30 May 2025.

FCT’s current share price is close to preferential offering price

The acquisition will consolidate Northpoint City Mall under a single owner, allowing FCT to undertake more extensive and comprehensive asset enhancement initiatives to unlock value through tenant mix strategies and operating efficiencies.

The acquisition is expected to be 2.0% accretive to FCT’s fiscal 2024 (FY2024) DPU, assuming the issuance of S$200 million of perpetual securities.

Following the completion of the acquisition and EFR, FCT’s aggregate leverage is expected to rise to 39.8% from the current 38.5%. If the perpetual securities are not issued, this gearing level could potentially rise to 42.2%.

With the volatility in global markets, FCT’s share price of S$2.08 as of 9 April 2025 is just slightly above the preferential offering price of S$2.05.

Should the share price fall below the preferential offering price of S$2.05, investors will be able to purchase units of FCT directly in the market at a lower price.

FCT currently trades at a historical distribution yield of 5.8% and 0.91x its book value of S$2.29 as of 30 September 2024.

If you are interested to learn more about the outlook of Singapore REITs amidst the current market volatility, join us for our upcoming free webinar on 16 April, where we will discuss if the share prices of Singapore REITs will recover with falling bond yields. Register for free here.

Related links:

- Frasers Centrepoint Trust share price history and share price target

- Frasers Centrepoint Trust history and dividend forecasts

Download the full report here.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments