Moomoo Singapore Review (2026): My likes and dislikes of this trading platform

Brokerage Account

By Gerald Wong, CFA • 05 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Read our review of Moomoo to find out more about how you can invest in the US, Singapore, or Hong Kong stock market. Learn about the different features, fees, and the smart investment tools available on the platform.

What happened?

With so many trading platforms and brokerages to choose from, I know many of you are wondering which one might be worth trying out.

Since Moomoo Singapore launched in 2021, it’s been gaining popularity among local investors.

I’ve been using the Moomoo SG app myself since 2021 to trade, and I’ve had a good experience with it so far.

In this review, I’ll be sharing what I like about using Moomoo SG, along with some areas where I think there’s room for improvement.

If you’re like me and want a trading platform that’s packed with features but still super easy to navigate, keep reading to find out more!

What I like about Moomoo SG: Low commissions for US and Singapore stocks, user-friendly mobile app, offers CDP linkage for Singapore stocks, and education resources

What I would like to see on Moomoo SG: Trading on London Stock Exchange and web trading platform

🎁 Want to get started with Moomoo and receive an exclusive S$50 FairPrice voucher? Find out how to claim it.

Moomoo SG at a Glance

- Moomoo SG is a low-cost digital stock-trading platform that gives users access to US, Hong Kong, and Singapore stock markets

- Fees for Singapore stocks: 0.03% commission fee, minimum S$0.99; 0.03% platform fee, minimum S$0.99

- Fees for US stocks: US$0.99 platform fee per order

What I like about Moomoo SG

#1 - Low commissions

Fees for trading US Stocks on moomoo SG

Moomoo charges just US$0.99 per order when for trading US stocks. I like that this is a flat fee, no matter how big or small my trade is. This is unlike other brokers that charge a percentage of the trade value.

One thing I really appreciate is that Moomoo doesn’t charge any maintenance or inactivity fees, so if I’m not actively trading for a while, I won’t get hit with extra costs.

This is especially helpful for someone like me, or any first-time investor, who might take things slow when it comes to investing.

Fees for trading Singapore Stocks on moomoo SG

For Singapore stocks, I get to enjoy zero commissions in the first year. Though, there’s still a 0.03% platform fee (with a minimum of S$0.99) per trade.

After the first year, a 0.03% commission (also with a S$0.99 minimum) kicks in on top of the platform fee.

So I will have to keep in mind that I’ll be paying at least S$1.98 per trade for Singapore stocks after the first year.

In short, the fees I’m incurring with Moomoo SG is affordable, which is a big plus for my investing strategy.

| Market | Total fees (commission + platform fees) | Minimum fee per transaction |

| US | US$0.99 per order | US$0.99 |

| Singapore | 0.03% per order value in the first year (0.06% per order value thereafter) | S$0.99 in the first year, S$1.98 thereafter |

| Hong Kong | 0.03% of the transaction amount or HK$3 (whichever is higher) + HK$15 | HK$18 |

| Source: moomoo Singapore | ||

#2 - Easy account opening, no minimum deposit, no deposit fee

Another thing I really appreciate about Moomoo SG is that it’s an excellent online brokerage for both beginner investors and professional traders seeking a robust platform.

I found it incredibly easy to get started, as I was able to open an account digitally in just 1 to 3 days.

What’s even better is that there’s no minimum funding amount required to register an account, which makes it accessible for everyone.

Plus, I won’t be charged any deposit fees for the money I put into my brokerage account, which is a nice bonus.

#3 - User-friendly mobile trading app

I’ve found the Moomoo SG mobile app to be incredibly intuitive and user-friendly, even for those of us who haven’t used any brokerage platforms before.

It provides access to various charting tools and market-related data that I can use for my own research.

The interface is designed to present market information in a way that’s both accessible and digestible, whether it’s organized by ETFs, sectors, or themes.

I also love the helpful features, like the heat map, which offers a great visual representation of the latest price movements in the market.

Overall, I think the Moomoo SG app has an interface that is really easy to navigate, making my trading experience much smoother.

#4 - Access to funds

Another great feature of Moomoo SG is the access it provides to various asset classes beyond just stocks.

One standout option is Moomoo Cash Plus, which allows me to invest in money market funds. This is particularly useful because it lets me earn a higher yield on my cash holdings that aren’t currently allocated to stock investments.

What I really appreciate about Moomoo Cash Plus is its flexibility. I can easily manage my cash, making it a smart way to maximize my returns while keeping my funds accessible.

Additionally, Moomoo Cash Plus offers a level of safety, as money market funds typically invest in low-risk, short-term instruments. This enhances my investment strategy by providing a reliable way to grow my cash holdings without locking them away.

#5 - Offers CDP linkage for Singapore stocks

One of the strongest upgrades for moomoo SG in 2025 is its support for direct CDP linkage.

With this feature, I can now hold SGX shares directly in my own Central Depository (CDP) account while still enjoying everything that makes moomoo great: low fees, a modern mobile interface, and powerful research and data tools.

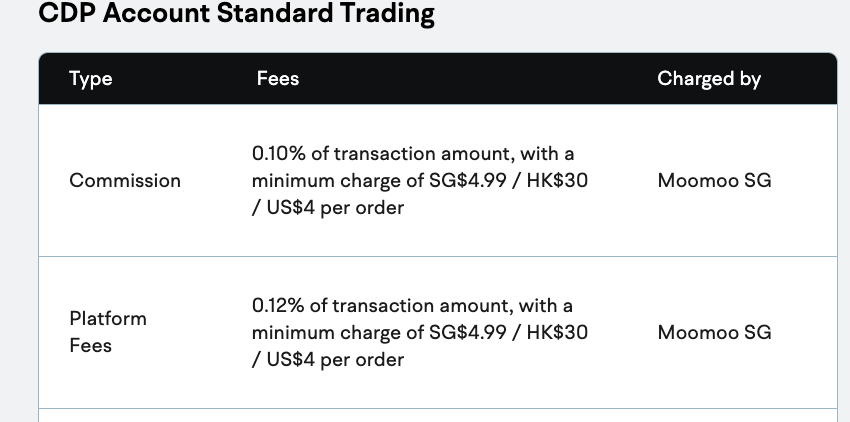

Moomoo charges a minimum commission of S$4.99 (or 0.10% of trade value), plus a platform fee of S$4.99 (or 0.12% of trade value) per trade.

This is lower compared to the other CDP-linked brokerage accounts I’ve used previously, where the minimum commission fee is around S$25 or S$27 per trade.

This new feature makes Moomoo one of the few low-cost broker platforms that lets you buy and sell directly into your CDP.

Learn more about how to link your CDP account to Moomoo here.

#6 – Community and educational resources

Lastly, I really enjoy the community and learning resources available on Moomoo SG.

There’s a wealth of educational materials, including news articles, webinars, video guides, tutorials, and demo accounts that I can access at any time.

In the ‘Discover’ tab, I find four widgets: Moo, Learn, News, and Papertrade. Moo is the platform’s online community, boasting over 19 million users across more than 200 countries, which creates a great environment for sharing insights.

The Learn section shows Moomoo’s commitment to enhancing financial wellness by providing valuable educational content.

With the Moomoo SG app, I also get free access to financial news from reliable sources like CNBC, Dow Jones Newswires, and the Moomoo SG news team.

Plus, the Papertrade function allows me to practice trading with a simulated account, which is perfect for honing my skills without any financial risk.

For users who prefer more hands on guidance with the app, Moomoo also has a physical store, which serves as a high touch avenue for retail investors to engage with Moomoo and have their questions answer by Moomoo representatives in-person.

Find out more about our experience visiting a Moomoo store here

What I would like to see on Moomoo SG

#1 - No trading on London Stock Exchange

Currently, Moomoo SG does not offer trading on the London Stock Exchange, which means I can’t buy Irish-domiciled ETFs on the platform.

This is a bit of a downside, especially for investors like me who might want a low-cost way to dollar-cost average into popular options like the Vanguard All-World or VWRA ETF.

If I’m using the Moomoo SG platform, I’ll need to consider looking for a global ETF that’s listed in the US instead, which may not be as ideal for my investment strategy.

#2 - No web trading platform

Unfortunately, Moomoo SG doesn’t offer a web trading platform that allows me to log in and out seamlessly.

If I want to access Moomoo on my laptop, I’ll need to download the Moomoo SG desktop platform instead.

On the bright side, the desktop platform comes with a solid suite of tools and functions that can definitely help me in my investing journey, making it worth the extra step of downloading.

Is Moomoo SG safe and trustworthy?

While the name might sound a bit goofy, Moomoo SG is definitely a licensed broker. It’s run by Futu Singapore Pte Ltd, which is a subsidiary of the fintech company Futu Holdings Limited.

They hold 43 operating licenses across major financial markets, including the United States, Hong Kong, and Singapore.

So, if you were wondering, yes, Moomoo SG is licensed and regulated by the Monetary Authority of Singapore, giving me peace of mind about the platform’s credibility. Source: MAS FI Directory

Source: MAS FI Directory

🎉 Bonus for new users: Get a S$50 Fairprice voucher when you open a Moomoo account via Beansprout.

Moomoo SG vs Tiger Brokers vs Webull: Which would I choose?

If you're curious about how Moomoo SG stacks up against other popular brokers like Tiger and Webull, I’d recommend checking out the comparison table below.

Moomoo SG is cheaper than Tiger Brokers for trading US stocks when you factor in both commission and platform fees.

Furthermore, Moomoo offers a flat US$0.99 platform fee, regardless of trade value. This puts Moomoo ahead of Webull when it comes to trades larger than US$2,000.

When it comes to trading Singapore stocks, Moomoo charges a total of 0.06% (0.03% commission + 0.03% platform fee), with a minimum of S$1.98 per trade. While the commission is identical to Tiger Brokers', the latter has a slightly higher minimum of S$1.99.

It’s worth mentioning that Moomoo Singapore is currently running a promotion that offers zero commissions for trades in the Singapore market for the first year. This brings down the total fee to 0.03%, with a S$0.99 minimum in the first year.

| Online Broker Platform | Moomoo SG | Tiger Brokers | Webull |

| Commission fee | US stocks: US$0 | US stocks: US$0.005 per share, min US$0.99 per trade, max 0.5% per order | US stocks: US$0.90 per order (limited time only) or 0.025%, min. US$0.50 |

| SG stocks: S$0 for 1 year. Thereafter, 0.03%, min S$0.99 | SG stocks: 0.03%, min S$0.99 | SG stocks: S$0 for 1 yea. Thereafter 0.025%, min S$0.80 | |

| Platform fee | US stocks: US$0.99 per order | US stocks: US$0.005 per share, min US$1 per trade, max 0.5% per trade | US stocks: US$0 |

| SG stocks: 0.03%, min S$0.99 | SG stocks: 0.03%, min S$1 per order | SG stocks: 0.025% (min S$0.80) | |

| Markets accessible | Singapore, US, Hong Kong, Japan | Singapore, US, Hong Kong, China, Australia | US, HK, Singapore, China |

| Products offered | Stocks, ETFs, options, futures, FX, mutual funds | Stocks, ETFs, mutual funds, futures, options, warrants, DLCs | Stocks, ETFs, options, mutual funds, DLCs, ADRs |

| Source: Moomoo, Tiger Brokers, Webull, as of 5 December 2025 | |||

💡 Thinking of joining Moomoo, sign up via Beansprout to get S$50 Fairprice voucher.

What would Beansprout do?

Moomoo SG definitely come up one of our top choices if you’re looking for a low cost broker which gives you access to the US, Singapore, and Hong Kong stock market.

What I really like about Moomoo SG are the low commissions for US and Singapore stocks, the user-friendly mobile app, and the range of educational resources available, which is great for both new and experienced investors.

However, I would love to see Moomoo SG offer trading on the London Stock Exchange, as well as introduce a web-based trading platform for those of us who prefer trading on a desktop or laptop.

Moomoo SG offers an attractive sign-up promotion, which is a bonus for new users who are looking to try out the brokerage platform.

Moomoo Exclusive Promotion

Learn more about the Moomoo promotion here

Ready to start your investing journey? Sign up for a Moomoo SG account here.

If you have a question about Moomoo SG, ask us in the Q&A section below.

This article contains affiliate links. Beansprout may receive a share of the revenue from your sign-ups to keep our site sustainable. You can view our editorial guidelines here.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

4 questions

- Ben • 09 Aug 2025 04:17 AM

- Stella • 18 Jul 2025 01:03 PM

- Richard • 02 Feb 2025 04:16 AM

- Jay • 03 Oct 2024 02:00 AM

- Alvin • 11 Oct 2024 04:19 AM