T-bill yield dives to 2.5% as demand bounces

Bonds

By Gerald Wong, CFA • 10 Apr 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The cut-off yield for the latest 6-month Singapore T-bill on 10 April declined to 2.50%.

What happened?

The days of being able to enjoy a high yield for Singapore T-bills appear to be over.

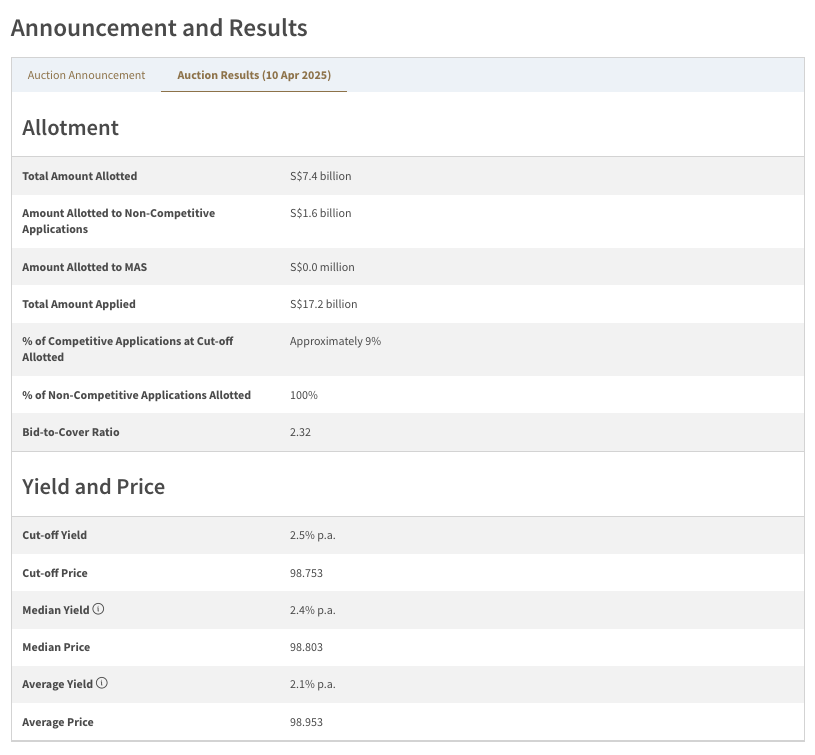

The cut off yield for the 6-month Singapore T-bill (BS25107W) auction on 10 April fell to 2.50% from 2.73% in the previous auction.

This marks the lowest 6-month T-bill yield since June 2022, and comes amid a fall in global short term bond yields in recent weeks with the trade tariff uncertainty.

In this post, I will dive deeper to find out more about the results of the latest 6-month Singapore T-bill auction.

What we learnt from the latest 6-month Singapore T-bill auction

#1 - Demand for the Singapore T-bill rose

The total applications for the 6-month Singapore T-bill rose to S$17.2 billion from S$15.8 billion in the previous auction.

This represents a fairly elevated level of demand for the T-bill, even though it is lower than the recent high of S$23.3 billion during the auction on 13 February 2025.

The amount of competitive bids increased to S$15.6 billion from S$14.4 billion in the previous auction.

If you placed a competitive bid below 2.50%, you would receive 100% of your requested T-bill allocation.

If you bid at exactly 2.50%, the allocation would be around 9%.

The amount of non-competitive bids rose to S$1.6 billion from S$1.4 billion in the previous auction.

Since the amount of non-competitive bids was within the allocation limit, all eligible non-competitive bids received full allocation for the T-bill.

#2 - T-bills issued remains unchanged

The amount of T-bills issued was at $7.4 billion, unchanged from the previous auction.

With total applications sharply increasing from S$15.8 billion in the previous auction to S$17.2 billion, the ratio of applications to T-bills issued increased from 2.14x to about 2.32x

The higher number of T-bill applications relative to the unchanged issuance size likely contributed to the fall in the cut-off yield.

#3 - Median yield of bids submitted fell

The median yield of bids submitted decreased to 2.40% from 2.60% in the previous auction.

The average yield of bids submitted also fell to 2.1% from 2.54% in the previous auction.

The fall in the median and average yield of bids submitted would be consistent with the fall in short term bond yields we have seen in recent weeks.

Given the median yield and the cut-off yield, this suggests that a substantial number of bids were placed in the 2.40% to 2.50% range, slightly below the best 6-month fixed deposit rate in Singapore.

What would Beansprout do?

The decline in the T-bill cut-off yield to 2.50% appears to be driven by stronger demand with by the higher yield seen in the previous auction.

At the same time, short-term government bond yields have fallen in the past two weeks with the flight to safety amid the tariff uncertainty.

With this fall in the cut-off yield on the T-bill, it is now on par with the best 6-month fixed deposit rate in Singapore as banks have cut their interest rates in April 2025.

It would also be below the break-even yield for CPF OA applications, based on calculations using our CPF T-bill calculator.

As such, I would still be looking for ways to allow my savings to earn a higher yield in a relatively safe way.

For example, many in the Beansprout community have been discussing the UOB Stash account, which offers an interest rate of up to 3.0% p.a. for $100,000 of deposits.

I also shared how bond funds allow us to gain exposure to a basket of bonds which may see potential price appreciation if interest rates come down.

I would also consider selected high quality Singapore REITs which may offer a higher dividend yield compared to the T-bill yield too. Find the best Singapore REITs here.

If you are interested in applying for the T-bill, the next 6-month T-bill auction will be on 24 April. There will also be a 1-year T-bill auction on 16 April.

You can set a reminder by signing up for our free email alert below.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments