T-bill yield falls further to 2.56% as demand stays high

Bonds

By Gerald Wong, CFA • 13 Mar 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

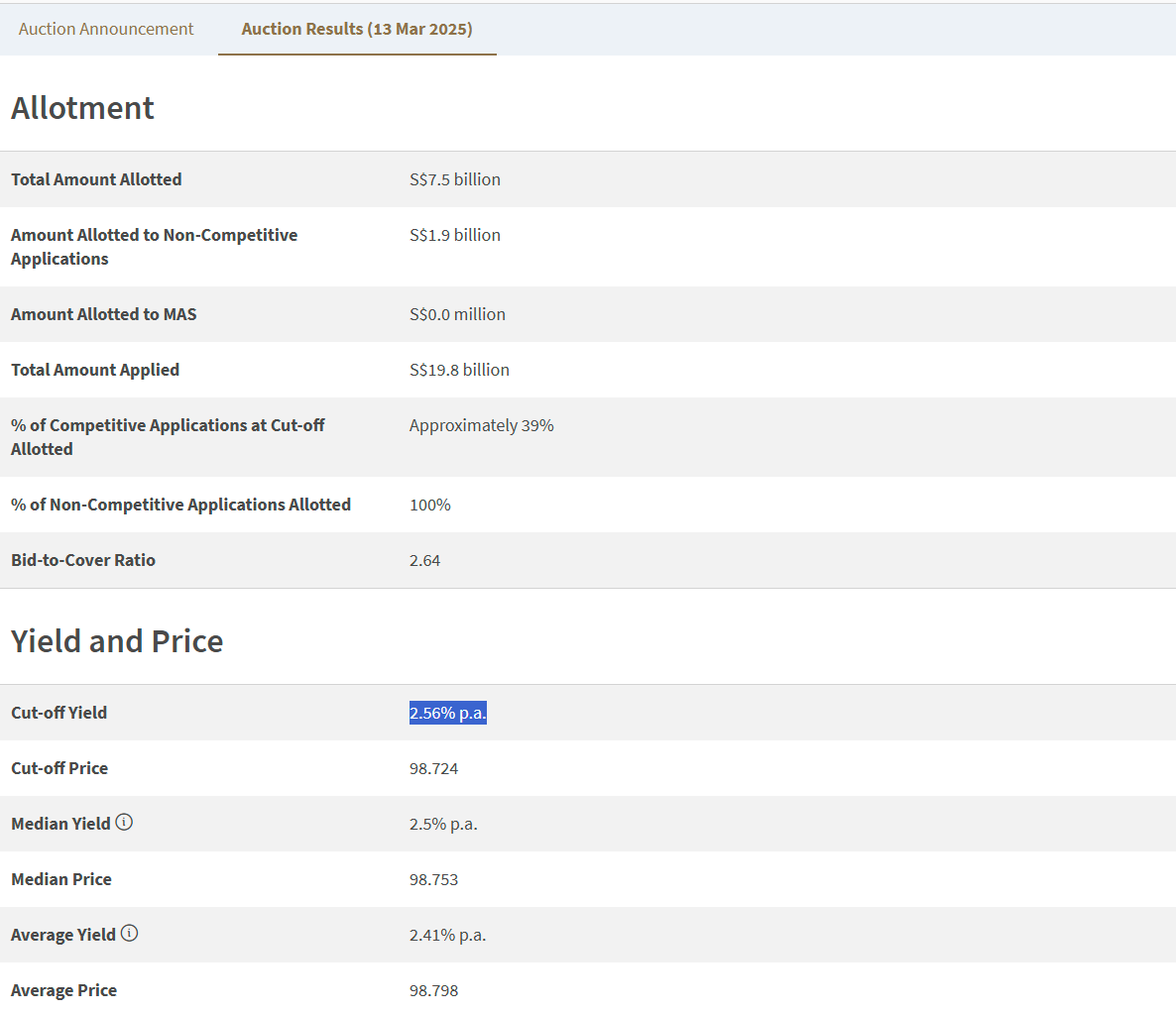

The cut-off yield for the latest 6-month Singapore T-bill on 13 March declined further to 2.56%.

What happened?

Like some investors in the Beansprout Telegram community, I was surprised by the result of the latest T-bill auction.

The cut off yield for the 6-month Singapore T-bill (BS25105T) auction on 13 March declined further to 2.56% from 2.75% in the previous auction.

This would represent the lowest yield on the 6-month Singapore T-bill since June 2022.

In this post, I will look at what is driving the sharp fall in the T-bill yield, as well as some alternatives to consider to earn a higher interest rate.

What we learnt from the latest 6-month Singapore T-bill auction

#1 - Demand for the Singapore T-bill remains high

The total applications for the 6-month Singapore T-bill was at S$19.8 billion, stable from S$20.1 billion in the previous auction.

While demand has fallen slightly from the previous auction, this still represents the third-highest application amount in history, just below the S$23.3 billion of applications in the auction on 13 February 2025.

In fact, the amount of competitive bids increased slightly to S$17.9 billion from S$17.3 billion in the previous auction.

If you placed a competitive bid below 2.56%, you would receive 100% of your requested T-bill allocation.

If you bid at exactly 2.56%, the allocation would be around 39%.

On the other hand, the amount of non-competitive bids fell to S$1.9 billion from approximately S$2.8 billion in the previous auction.

Since the amount of non-competitive bids was within the allocation limit, all eligible non-competitive bids received full allocation for the T-bill.

#2 - Applications stay elevated compared to T-bills issued

The amount of T-bills issued was unchanged from S$7.5 billion in the previous auction.

With total applications falling from S$20.1 billion to S$19.8 billion, the ratio of applications to T-bills issued fell slightly from 2.69x to 2.64x

However, the ratio of T-bill applications to T-bill issued remains high compared to the historical average. For example, the ratio was at 2.55x in the auction on 16 January 2025 when the T-bill yield dipped to 2.99%.

#2 - Median yield of bids submitted fell

The median yield of bids submitted fell to 2.50% from 2.69% in the previous auction.

The decline in the median yield likely reflects the recent drop in global bond yields, as investors now expect three interest rate cuts by the US Federal Reserve in 2025 with rising recession risks.

However, the average yield of bids submitted increased to 2.41% from 2.36%. The rise in the average yield is likely due to less applications using CPF-OA funds in the latest auction, as the cut-off yield for the T-bill has fallen below the breakeven yield in the previous auction.

Given the median yield and the cut-off yield, this suggests that a substantial number of bids were placed in the 2.50% to 2.56% range, below the best fixed deposit rate in Singapore.

What would Beansprout do?

The decline in the T-bill yield to 2.56% seems to be driven by continued strong demand, as well as a fall in global bond yields over the past few weeks.

With this further decline in the cut-off yield, it would be below the break-even yield for CPF OA applications, based on calculations using our CPF T-bill calculator.

With the fall in the Singapore T-bill yield, I would be looking for ways to allow my savings to earn a higher yield in a relatively safe way.

For example, the best 6-month fixed deposit rate in Singapore of 2.85% would be above the T-bill yield.

Many in the Beansprout community have also been discussing the UOB Stash account, which offers an interest rate of up to 3.0% p.a. for $100,000 of deposits. In addition, you can earn up to S$688 in guaranteed cash with the UOB Lunar New Year pot of gold promotion.

I also shared how bond funds allow us to gain exposure to a basket of bonds which may see potential price appreciation if interest rates come down.

I would also consider selected high quality Singapore REITs which may offer a higher dividend yield compared to the T-bill yield too.

If you are still interested in applying for the T-bill, the next 6-month T-bill auction will be on 27 March. You can set a reminder by signing up for our free email alert below.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments