Singapore stocks reach record highs: Weekly Market Recap

By Gerald Wong, CFA • 30 Mar 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Singapore stocks hit a record high while the T-bill yield bounced

Over the long weekend, while catching up with friends from school, I was reminded of something DBS’ outgoing CEO Piyush Gupta once said:

“The best way to stay grounded is to go back and spend time with the friends you had in school… Within 20 minutes of meeting you, they bring you back to the kind of person you used to be.”

It’s a timely reminder—not just about staying grounded in life, but in investing too.

After 15 years at the helm, Gupta officially stepped down on 28 March. Under his leadership, Under his leadership, DBS’ share price surged 270%, proving that a company can deliver both growth and dividends.

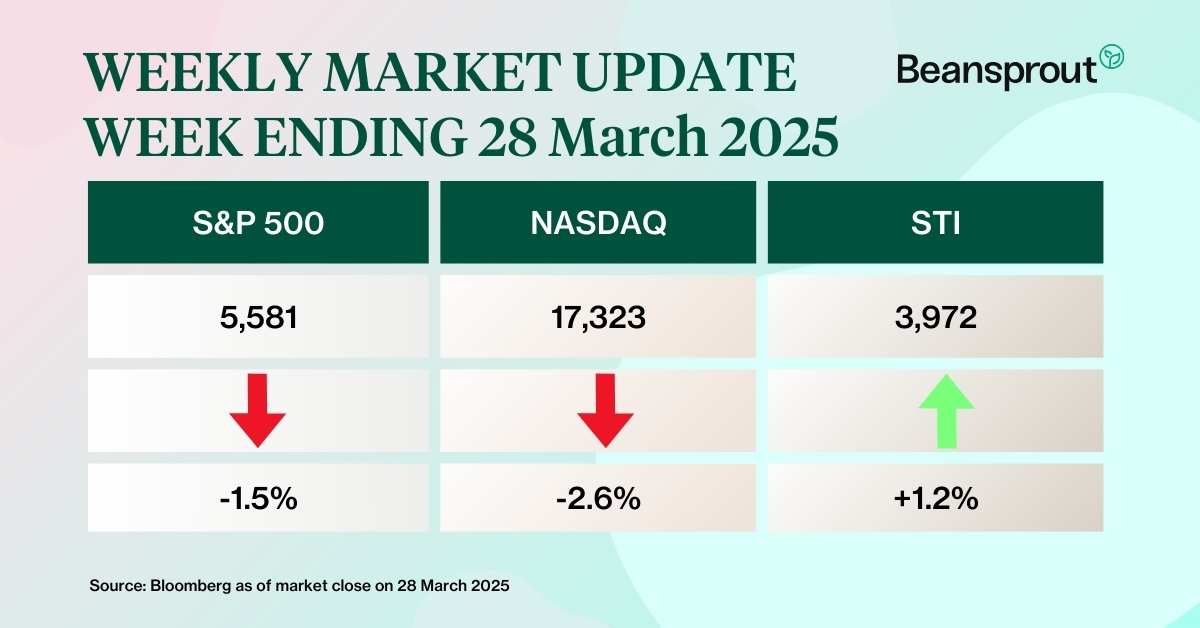

Fittingly, this week the Straits Times Index (STI) reached a record high of over 4,000 points. One major driver? The stellar performance of Singapore’s banks. DBS alone has jumped 42% in the past year to hit its own all-time high.

We discussed these trends in more detail during our recent webinar on Singapore banks. If you missed it, you can watch the replay here.

With demand for the latest 6-month T-bill cooling, more investors seem to be exploring other ways to grow their money. We dive deeper into the United SGD Fund, one of Singapore’s most established fixed income funds with a aim of delivering a higher yield than Singapore dollar deposits.

As we continue our journey to grow our wealth, it’s worth pausing to reflect—who are we doing this for, and what truly matters?

To quote Piyush Gupta again, “When it’s all done and dusted, people will remember you for how you made them feel and what you did for them.”

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🏛 Consumer sentiment falls amid inflation fears

What happened?

The announcement of new auto tariffs by President Donald Trump reignited fears of an escalating trade war, adding fresh uncertainty to global markets.

At the same time, inflation worries deepened as the core personal consumption expenditures (PCE) price index—the Federal Reserve’s preferred inflation gauge—rose by 2.8%, exceeding market expectations and staying well above the Fed’s long-term target of 2%.

What does this mean?

Tariff uncertainty and persistent inflation are starting to weigh heavily on consumers.

According to the Conference Board, the U.S. consumer confidence index fell for the fourth straight month in March, dropping to 92.9 from 100.1 in February. The decline reflects growing concerns about the economy and personal finances.

The expectations index, which tracks consumers’ short-term views on income and the job market, fell sharply by 9.6 points to 65.2. That’s the lowest in 12 years and the second consecutive month it’s stayed below 80, a threshold often seen as a potential signal of a coming recession.

Why should I care?

The S&P 500 slipped as investors grappled with persistent inflation, escalating tariff tensions, and mounting concerns about global growth.

In contrast, Singapore’s Straits Times Index (STI) surged to a new all-time high, climbing above the 4,000 mark for the first time ever as investors are increasingly viewing Singapore as a relative safe haven amid the market turbulence.

Gains were led by DFI Retail Group, CapitaLand Investment and ST Engineering.

🚗 Moving This Week

- DBS should be able to hit its return on equity (ROE) target of 15 to 17 per cent through its growth strategy in the years ahead, said the bank’s new chief executive, Tan Su Shan. The target accounts for the four interest-rate cuts in 2024, as well as the lender’s expectations for another four reductions this year and next, said Tan at DBS’ annual general meeting (AGM) on Friday (Mar 28). Read more here.

- SingPost has completed the divestment of Freight Management Holdings (FMH) to Pacific Equity Partners for an enterprise value of A$1.02 billion ($867 million). The sale follows the approval at the EGM held on March 14 where 99% of shareholders voted in favour of the divestment. The divestment has resulted in an expected gain of $289.5 million for the group. Read more here.

- The Independent Financial Advisor (IFA) to Paragon REIT are of the opinion of that the terms of the scheme are fair and reasonable. Earlier, Cuscaden Peak and the manager of Paragon REIT jointly announced the proposed privatisation and delisting of Paragon REIT at a scheme consideration of S$0.98 in cash per unit. Read more here.

- DFI Retail Group announced the divestment of its Singapore food business to South-east Asian retail conglomerate Macrovalue (Malaysia). Macrovalue will fully acquire Cold Storage Singapore, which comprises 48 Cold Storage stores (under the Cold Storage, CS Fresh and Jason’s Deli brands), 41 Giant stores, as well as two distribution centres for an initial purchase price is S$125 million. The transaction expected to complete in the second half of 2025. Read more here.

- Keppel DC REIT plans to capitalise on sponsor Keppel’s intended expansion of its portfolio of data centres to a gross power capacity of 1.2 gigawatts (GW) in the near term. In its annual report, the REIT manager said that this will form a pipeline of assets that Keppel DC Reit may potentially acquire.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

What is SaaS? Software-as-a-Service Guide for Investors

Discover how Software-as-a-Service (SaaS) works, its key benefits, and growth prospects in this guide for investors.

🤓 What we're looking out for next week

- Monday, 31 March: Singapore Public Holiday

- Tuesday, 1 April: Nikko AM Asia Ex-Japan REIT ETF ex-dividend

- Wednesday, 2 April: Frasers Centrepoint Trust ex-dividend

- Friday, 4 April: US non-farm payroll data

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Join the Beansprout Telegram group and Facebook group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments