Is the 1-year T-bill better than the 6-month T-bill and fixed deposits?

Bonds

By Gerald Wong, CFA • 17 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The closing yield on the 1-year Singapore T-bill of 1.37% is on par with the 6-month T-bill yield. However, investors of the 1-year T-bill may face lower re-investment risks.

What happened?

The yield on the 6-month Singapore T-bill has fluctuated by a fair bit in the past few months.

After bouncing to 1.6% in December, the cut-off yield on the most recent 6-month T-bill (BS26101E) fell to 1.39%.

On the other hand, fixed deposit rates in Singapore have rebounded from the lows.

As a result, there has been a fair bit of discussion in the Beansprout community about where is the best place to park cash for higher yields.

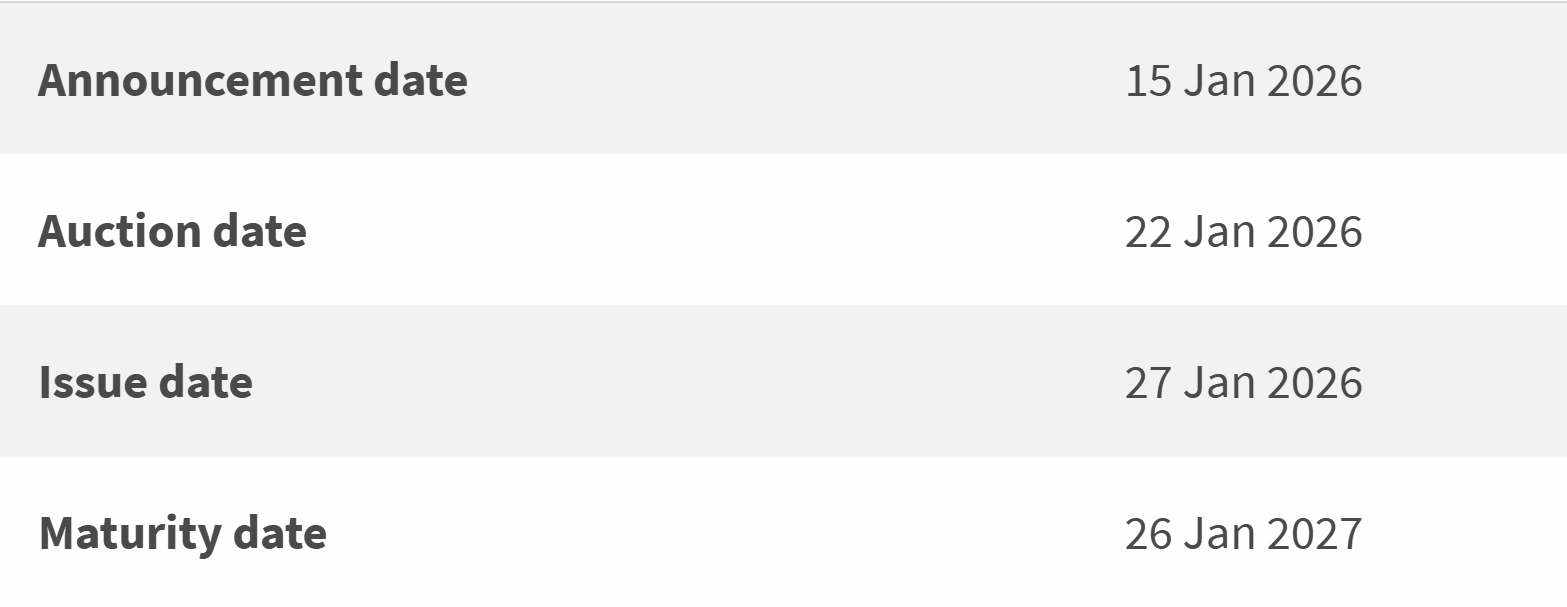

In this article, I will I will be looking at some of the latest indicators to find out if it is worthwhile applying for the upcoming 1-year Singapore T-bill auction (BY26100S) on 15 January 2026, and how it compared to the 6-month Singapore T-bill and fixed deposits.

What is the likely yield on the 1-year Singapore T-bill?

Like the 6-month Singapore T-bill yield, the 10-year Singapore government bond yield has fluctuated in recent months.

After reaching a low of below 1.8%, the Singapore 10-year government bond yield bounced to above 2.3% in December, before moderating to about 2.1% as of 16 January 2026.

This movements in the Singapore 10-year government bond yield reflects shifting expectations of interest rate cuts by the US Federal Reserve.

We have seen less significant movements for the 1-year Singapore T-bill yield.

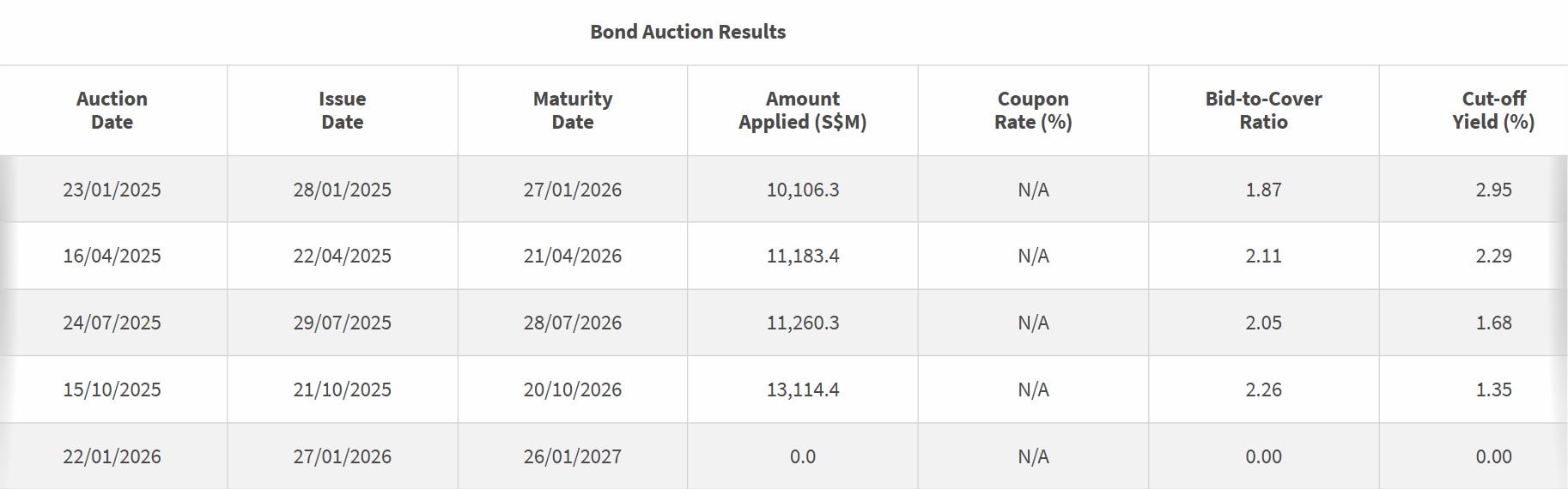

The closing yield on the 1-year T-bill was 1.37% as of 15 January 2026, hovering near the 1.35% cut-off yield seen in the last year October 1-year T-bill auction.

However, it is worth noting that the eventual cut-off yield in the auction may differ from the closing yield, as it will depend on the bids in the auction.

From the past few rounds of the 1-year T-bill auctions, we can see that demand for the T-bill has been fairly elevated.

This has put pressure on the cut-off yield of the 1-year T-bill.

Buying Singapore 1-year T-bill – better than 6-month T-bill?

Rather than applying for the 1-year T-bill, one option to consider is to invest in two consecutive tranches of 6-month T-bills.

Specifically, we could invest in the upcoming 6-month T-bill auction on 29 January 2026, and reinvest the funds again when the T-bill matures in August 2026.

If we apply for the next 6-month T-bill which will be issued on 3 February, the maturity date would be on 4 August 2026. We could then choose to reinvest based on the prevailing interest rates at that time.

However, there’s a risk that yields may fall further in the coming months, especially if the U.S. Federal Reserve continues to cut interest rates.

In this scenario, locking in the 1-year T-bill now may come with less reinvestment risk.

While the current closing yield of 1.37% on the 1-year Singapore T-bill is close to the cut-off yield of 1.39% in the most recent 6-month T-bill auction, I will ask myself if I would want to lock in the rate now for 12 months, or take on reinvestment risk with the 6-month T-bill if yields drop further by August 2026.

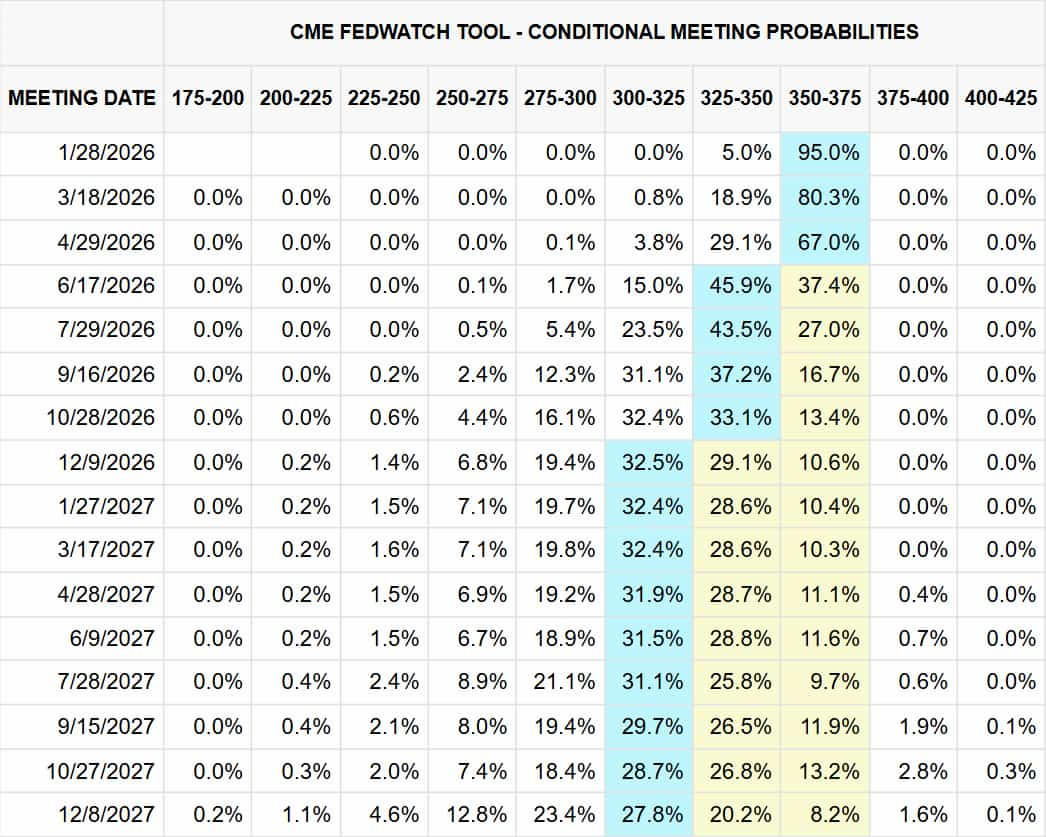

According to the latest US interest rate expectations, markets now expect the US Federal Reserve to cut interest rates by another 0.50% (50 basis points) in 2026.

This means that we may get a potentially lower yield on the 6-month T-bill, when we are re-investing the proceeds from the first 6-month T-bill.

However, with significant economic uncertainty with global geopolitical developments, we will have to keep a close watch on interest rate trends.

Buying 1-year T-bill using cash – better than fixed deposit?

Some Singapore banks have raised their fixed deposit rates in January. Currently, the best 1-year fixed deposit rate we found is at 1.30% p.a.

This would then be lower than the latest closing yield of 1.37% on the 1-year T-bill.

For shorter tenure, the best 6-month fixed deposit rate is at 1.35% p.a.

However, we will require a minimum deposit of S$20,000 to earn the rate of 1.35%.

Buying 1-year T-bill – better than Singapore Savings Bonds?

The current issuance of the Singapore Savings Bonds (SSB) offer a 1-year return of 1.35%.

This is close to the current closing yield on the 1-year Singapore T-bill.

Apart from offering a 1-year return of 1.35%, the latest SSB also allows us to lock-in a rate of 2.25% over 10 years, while having the flexibility to redeem prior to maturity.

What would Beansprout do?

The current closing yield of the 1-year Singapore T-bill is 1.37%, which is close to the recent 6-month T-bill cut-off yield of 1.39%.

However, it might still be worthwhile considering the 1-year T-bill over the 6-month T-bill to avoid the uncertainty of reinvesting six months later, especially if further rate cuts were to come through in the coming months.

The 1-year T-bill yield is also higher than the best 1-year fixed deposit rate, which is currently at 1.30% p.a.

One of the ways to secure a potentially higher yield is to consider the Singapore Savings Bonds (SSB), which offers a 1-year return of 1.35% and average annual return of 2.25% over 10 years, while having the flexibility to redeem prior to maturity.

To explore these alternative places to park your cash, check out our comparison of T-bills, fixed deposits and SSBs to find the best place to park your cash.

To find out other ways to make your savings work hard, check out our guide to best ways to earn a passive income in Singapore.

[Beansprout Exclusive Longbridge Promotion] Get bonus S$50 FairPrice voucher within 5 working days, plus 12% p.a. interest boost coupon for 120 days (worth ~S$78) with Longbridge Cash Plus when you sign up for a Longbridge account via Beansprout. Plus, stand a chance to win S$180 CapitaVouchers! Promo ends on 31 January 2026. Learn more about the Longbridge promo here.

The 1-year Singapore T-bill auction is currently open.

As cash applications for the T-bill close one business day before the auction date, we would need to put in our cash applications for the T-bill by 9pm on 21 January (Wednesday).

Applications for the T-bill using CPF-OA will close 1-2 business days before the auction date, and the dates differ across the three local banks.

- Applications for T-bills online using CPF OA via DBS close at 9pm on 21 January (Wednesday). Read our step-by-step guide to applying via DBS.

- Application for T-bills online using CPF OA via OCBC close at 9pm on 21 January (Wednesday). Read our step-by-step guide to applying via OCBC

- Applications for T-bills online using CPF OA via UOB close at 9pm on 20 January (Tuesday) Read our step-by-step guide to applying via UOB.

To learn more about T-bills and find out how to apply, check out our Comprehensive Guide to T-bills.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments