Beginner's guide to start investing in Singapore (2025)

Stocks 101

By Nicole Ng • 29 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Learn how to start investing in Singapore with simple steps and practical tips. Discover the best investment options, from stocks and REITs to bonds and ETFs, to grow your wealth with confidence.

What happened?

When I first thought about money and the future, I assumed keeping my savings in the bank would be enough.

But with prices going up over time, just leaving money in a savings account means it slowly loses value because of inflation. That’s why investing matters.

For beginners, investing is really about helping your money grow steadily, keeping up with inflation, and reaching your goals with confidence.

In this guide, I’ll walk you through the basics of how to start investing in Singapore. We’ll look at what investing really means, the simple steps to take before you begin, and how to think about your goals, timeline, and comfort with risk.

Finally, we’ll explore some of the most common investment options available in Singapore, so you can start your journey feeling clear and confident.

Why should you invest? The power of compounding

To me, investing is about making your money work harder by putting it into assets that can grow over time, while managing risk.

Unlike savings account, returns aren’t guaranteed, but taking some risk opens the door to higher growth — and that’s where the power of compounding comes in.

When investing, compounding is when your returns also start earning returns, like a snowball rolling downhill.

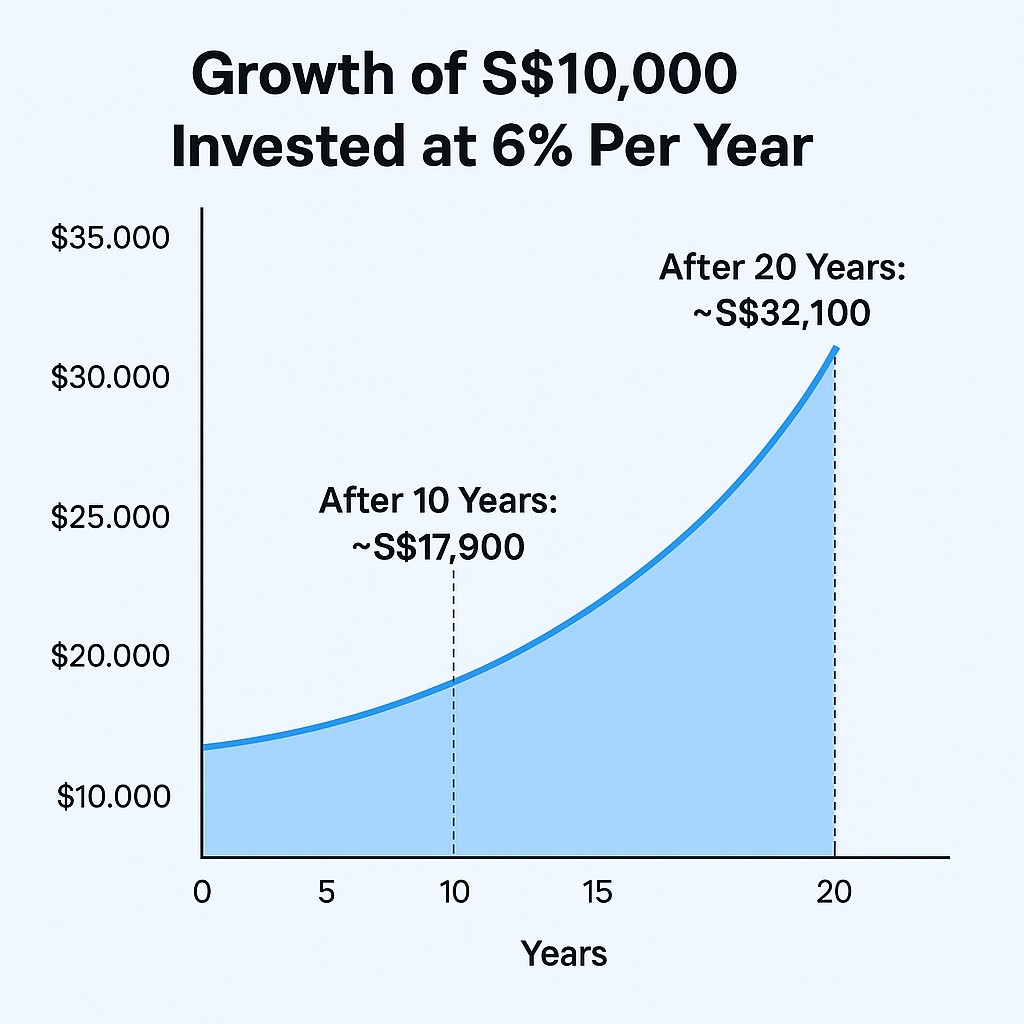

Let’s say you invest $10,000 and earn 6% a year, with the returns compounding annually. After 10 years, that money could grow to about $17,900.

Keep it invested for 20 years, and it grows even more to around $32,100. That’s the power of compounding working quietly in the background.

This shows you don’t need a big lump sum to begin. Starting early and staying consistent makes a huge difference.

And even if you begin later in life, it’s still not too late. Compounding works at any age and grows best over time.

What to do before you start investing

Before you start investing, it’s important to build a strong foundation.

Only invest money you won’t need in the short term, so you won’t feel pressured to sell during market dips.

Make sure you have an emergency fund in a savings account that pays decent interest, and basic insurance to cover unexpected events.

This safety net protects your savings and ensures you won’t be forced to cash out your investments too early.

Once that’s in place, you can move on to setting clear goals, deciding how long you want to stay invested, and understanding how much risk you’re comfortable with.

What to consider as you start investing in Singapore

With so many choices, it can be hard to know where to start.

Before looking at specific products, take time to understand your goals, risk appetite, time horizon, and liquidity needs. These factors will guide the investments that suit you best.

Factor | What it means | Why it matters |

| Potential expected returns | Average annual returns over time | Helps estimate how fast your money may grow |

| Volatility | How much the investment value moves up or down | Affects your emotional comfort during market swings |

| Liquidity | How quickly you can sell and get cash back | Useful if you need funds on short notice |

| Capital needed | How much you need to start | Ensures it fits your current budget |

Setting financial goals and knowing investment horizons

The first step is to think about your financial goals and how long you plan to invest.

Knowing why you’re investing makes a big difference, because everyone’s journey is unique.

Some might be saving for a BTO down payment in 5 years, others for a child’s education in 15 years, or retirement in 25 years.

Each goal comes with a different investment horizon, or the length of time your money can stay invested.

Understanding your goals helps shape your time horizon and the key considerations before you invest.

Example Goal | Investment Horizon | Key considerations |

| Wedding, vacation | Short (0–3 years) | Prioritise capital preservation and liquidity, as short-term market movements can have a larger impact when funds are needed soon. |

| Child’s education, BTO | Medium (3–10 years) | Balance between growth and stability, as there is moderate time to ride out market fluctuations before the funds are required. |

| Retirement | Long (10+ years) | Focus on long-term growth and compounding, as there is greater ability to withstand short-term volatility. |

Understanding your investment risk tolerance

Before picking an investment product, it’s important to know how much risk you’re comfortable with, also known as your risk tolerance.

This is about how you react to volatility and price swings.

If short-term market dips make you uneasy, lower-volatility products may give you greater peace of mind.

But if you’re comfortable riding through the ups and downs, you can look at higher-volatility assets that also offer the potential for stronger long-term returns.

Your risk tolerance is shaped by factors like age, income stability, financial commitments, and even your personality.

Risk profile | What it means | Common traits | Key considerations |

| Conservative | Focus on preserving capital, even if potential returns are lower | Prefer stability, dislike volatility, may need money soon | Emphasise safety and liquidity; potential returns may be modest. |

| Balanced | Comfortable with some ups and downs to potentially get higher returns | Medium- to long-term goals, regular payouts, some investing experience | Maintain a mix of assets to balance risk and return; review periodically as goals or market conditions change. |

| Aggressive | Willing to accept big fluctuations for higher potential returns | Long time horizon, can ride out market swings, higher income | Focus on long-term growth; be prepared for significant short-term volatility and ensure diversification. |

Common investment options in Singapore

When most people in Singapore think about investing, stocks and bonds usually come to mind.

But those are only part of the picture. There are many other ways to invest, each with different levels of risk and return.

Here are some of the most common investment options in Singapore.

#1 - Stocks

Buying individual company shares can give you the potential for higher returns and regular dividends, especially if the company performs well.

Unlike pooled products such as ETFs or unit trusts, owning stocks means you’re directly invested in a single business.

The trade-off is that stocks also come with higher risk and bigger price swings, so their value can move up or down sharply. Investing in stocks usually requires more research, patience, and confidence to manage actively.

In Singapore, well-known stocks include DBS and Singapore Airlines (SIA). Globally, popular names include Apple and Nvidia in the US, and Alibaba in China.

These examples show how stock investing lets you own a piece of companies you already know and use in your daily life.

You can check our Singapore High Dividend Stocks screener to find companies offering higher dividend yields.

#2 - REITs (Real Estate Investment Trusts)

If you want to invest in property without having to buy a building yourself, Real Estate Investment Trusts (REITs) make it possible. They pool money from investors to own and manage income-generating properties such as malls, offices, and data centres.

The appeal of REITs is that they pay out regular dividends from rental income, offering investors a steady stream of cash flow. At the same time, their value can rise or fall depending on property cycles and interest rate movements.

In Singapore, some well-known examples include CapitaLand Integrated Commercial Trust, which owns malls like Plaza Singapura and Bugis Junction, and Mapletree Pan Asia Commercial Trust, which owns iconic properties such as VivoCity. These familiar names make it easier to see how REITs connect to places we visit and enjoy every day.

You can go further by reading our beginner’s guide to Singaporean REITs to have a deeper understanding of how they are as an investment choice.

Get a complete overview of Singapore REITs here.

#3 - ETFs (Exchange-Traded Funds)

If you want diversification at low cost, exchange-traded funds (ETFs) are a simple way to get it.

Instead of buying individual stocks or bonds, an ETF lets you own a whole basket of them in one trade, making it easier to spread out your risk.

In Singapore, a popular example is the Straits Times Index (STI) ETF, which gives you exposure to the largest listed companies on the Singapore Exchange (SGX).

For those looking beyond Singapore, there are global ETFs such as the S&P 500 ETF, which tracks the biggest US companies, or the MSCI World ETF, which covers stocks across developed markets worldwide.

Learn more about the best STI ETFs, S&P 500 ETFs, gold ETFs, and bond ETFs in Singapore, or browse all our ETF guides and insights.

#4 - Unit Trusts / Mutual Funds

If you want professional management and easy diversification without having to pick individual stocks or bonds, mutual funds and unit trusts can be a good option.

They allow you to invest in a wide mix of assets, with a fund manager making the decisions on your behalf.

This convenience comes with some trade-offs, such as management fees that may eat into your returns, and the value of your investment will still go up or down depending on the market.

The good news is that you don’t need a large sum to begin. In Singapore, you can usually start with around S$100 through banks or online platforms.

Discover how unit trusts work in Singapore here.

#5 - Robo-Advisors

If you want a fuss-free way to start investing, robo-advisors can do the heavy lifting for you.

They automatically build and manage a diversified portfolio based on your goals and risk profile, so you don’t have to worry about picking individual investments.

They’re also highly accessible, with many platforms letting you start with as little as S$100, making them a popular choice for new investors.

You can learn more about robo-advisors investment platforms here.

#6 - Singapore Savings Bonds (SSBs)

Singapore Savings Bonds (SSBs) are government-backed investments that pay you regular interest and allow you to redeem your money when needed.

This makes them one of the safest and most flexible ways to grow your savings over time.

The only limitation is that withdrawals are processed according to the monthly payout cycle, so you may not get your money back immediately.

Learn how Singapore Savings Bonds (SSBs) work.

#7 - Treasury Bills (T-bills)

Treasury bills (T-bills) are short-term investments backed by the Singapore Government, making them a low-risk way to grow your money.

They mature in 6 or 12 months, so they can be a useful option if you want a safe place to park your cash for the short term while still earning a return.

Explore our beginner’s guide to Singapore T-bills to learn how they work and what to look out for before investing.

#8 - Cash Management Accounts

Cash management accounts are a simple way to make your spare cash work harder.

Offered by digital investment platforms, they put your money into a mix of relatively safe, short-term products like fixed deposits and money market funds.

The key appeal is that they often provide higher potential returns than a regular savings account, while still keeping your money relatively accessible.

Do note that returns aren’t guaranteed, as the value may move slightly up or down depending on market conditions.

Understand how cash management accounts here.

#9 - Gold and Silver

Gold has long been seen as a store of value that can help protect purchasing power over time and preserve wealth during periods of inflation or market uncertainty.

It doesn’t generate regular income like dividends or interests, but it can help diversify your portfolio and reduce overall volatility.

There are several ways to invest in gold in Singapore. You can buy physical gold bars and coins from banks such as UOB, or invest through gold savings accounts, gold ETFs, or unit trusts that track gold prices.

While gold prices can rise during times of economic stress, they can also fluctuate based on global demand, interest rates, and currency movements.

Hence, it’s best viewed as part of a diversified portfolio rather than a short-term investment.

Learn more about how to buy gold in Singapore here.

Alternatively, if you are interested in investing in silver, check out our guide to buy silver in Singapore here.

What would Beansprout do?

Start with knowing your investment objectives, risk appetite and need for liquidity.

Thereafter, choose the investment product that aligns with your goals and the level of risk you’re comfortable with.

If you would prefer the process of investing to be automated, it might be worthwhile starting with a robo-advisor platform.

If you would like to gain instant diversification, it might be worthwhile starting with ETFs, which allow you to start investing in a low-cost and simple way. Learn more about investing in ETFs here.

You may even choose to do a dollar cost average into a regular savings plan (RSP) to remove the emotions from investing.

If you feel like you are ready to invest in ETFs, stocks and REITs by yourself, explore the top online brokerage and stock trading platforms in Singapore to find one that fits your needs.

For those of us who are just beginning our investment journey, the key is to start small, build confidence gradually, and focus on long-term consistency rather than quick wins.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments