Are Astrea 9 PE bonds worth buying?

Bonds

By Gerald Wong, CFA • 02 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

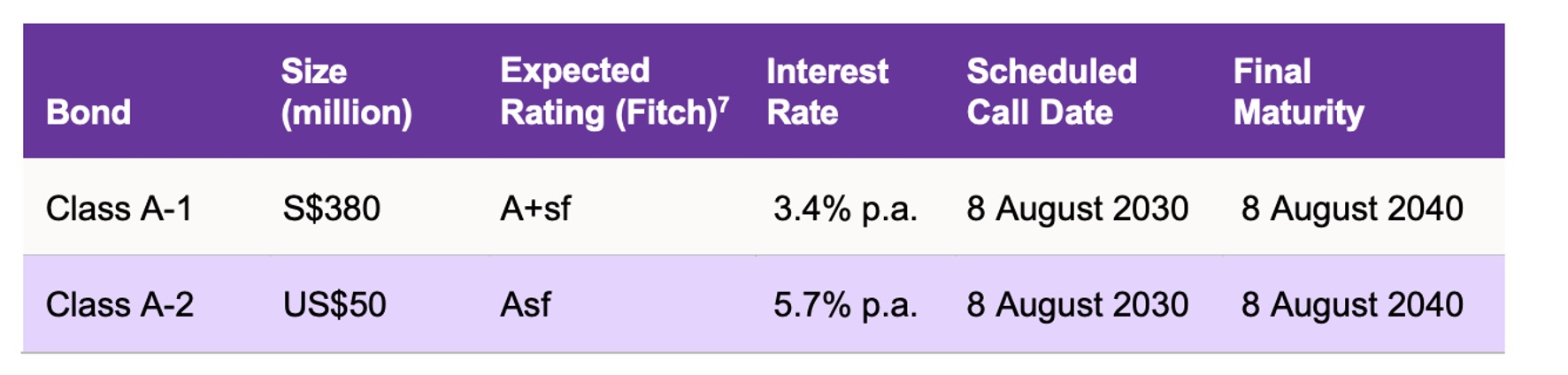

The Astrea 9 Class A-1 Bonds offer a fixed interest rate of 3.40% per annum, and the Class A-2 Bonds offer a fixed interest rate of 5.70% per annum.

Summary

Offer of Astrea 9 PE bonds: Astrea 9 has launched a public offer of S$380 million of Class A-1 Bonds at a fixed interest rate of 3.4% per annum, and US$50 million of Class A-2 bonds at a fixed interest rate of 5.7% per annum. Astrea 9 is backed by cash flows from a portfolio of 40 private equity funds that invested in 1,086 companies across diversified industries and geographies. The portfolio is valued at US$1,625 million as at end-2024. The manager of Astrea 9 Pte Ltd is Azalea, an indirect 100%-owned subsidiary of Temasek Holdings. The PE Bonds are not guaranteed by any party, including Temasek Holdings.

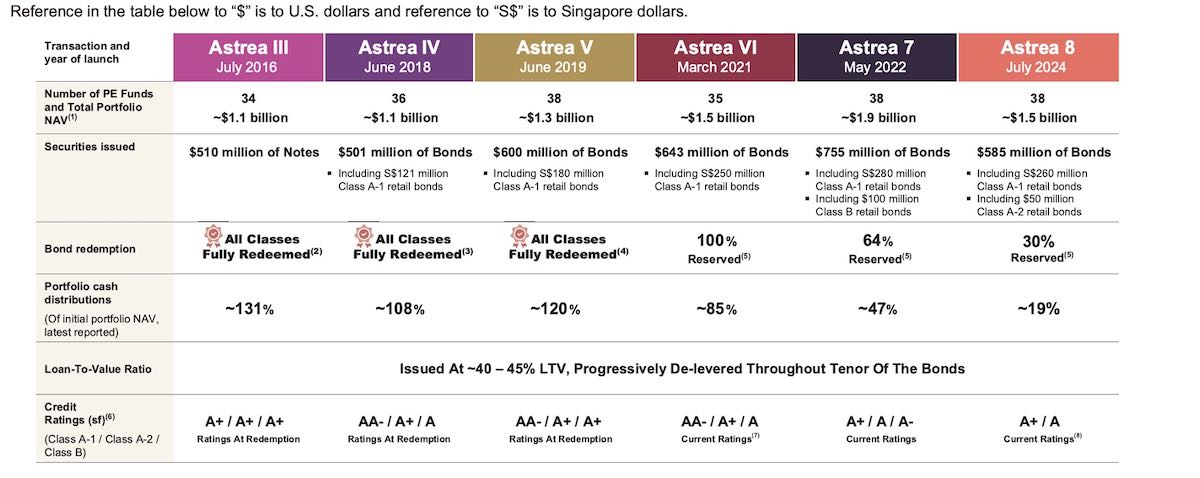

Proven issuer track record. The bonds will mature in 15 years in August 2040. The Class A-1 and Class A-2 bonds both have a mandatory call at the 5th year, subject to certain conditions. There will be a one-time interest step up of 1.0% per annum if these are not redeemed at the call date. We note that the Astrea III, IV and V bonds were all redeemed on their scheduled call dates before their maturity. While the bonds are not guaranteed by any party, there are structural safeguards such as the reserves accounts mechanism, maximum loan-to-value (LTV) ratio of 50%, and credit facility if cash flow shortfall occurs.

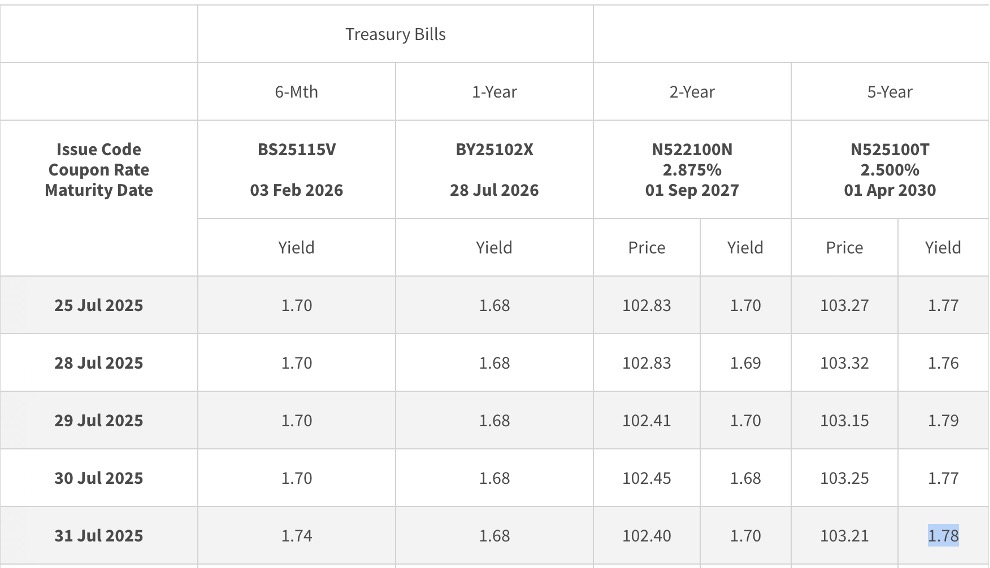

Higher yield compared to existing Astrea bond issues. The yield to call of the Class A-1 bonds of 3.4% is above the 2.79% for the existing Astrea 8 A-1 S$ issue, and the 5-year Singapore government bond yield of 1.78% as of 31 July 2025. Likewise, the yield to call of 5.7% for Class A-2 bonds is above the 4.48% for the existing US$-denominated Astrea 8 A-2 issue, as well as the 5-year US government bond yield of 3.96% as of 31 July 2025.

We believe Astrea 9 bonds may be attractive for investors seeking regular income for a longer duration, given the track record of past Astrea series and safeguards in place. We prefer Class A-1 bonds due to the attractive yield premium compared to existing Astrea S$ series, with no direct US Dollar currency risk. Key risks include liquidity risk, leverage risk, amongst others. Class A-2 bondholders whose investment currency base is not in US dollars may face exchange rate risks from the US dollar denominated bonds.

Offer of Astrea 9 PE Bonds

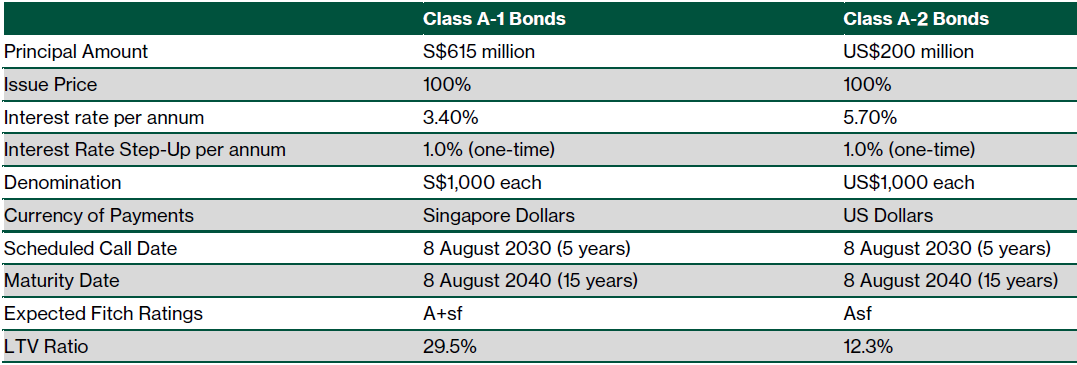

Astrea 9 offers two classes of bonds, Class A-1 and Class A-2.

Astrea 9 PE Bonds backed by cash flows from US$1,625 million portfolio of investments in 40 private equity (PE) funds across 1,086 Investee Companies.

The investments are diversified across regions, sectors, and vintages.

Compared to Astrea 8, a higher share of the Class A-1 bonds has been set aside for the public offer to retail investors in Singapore.

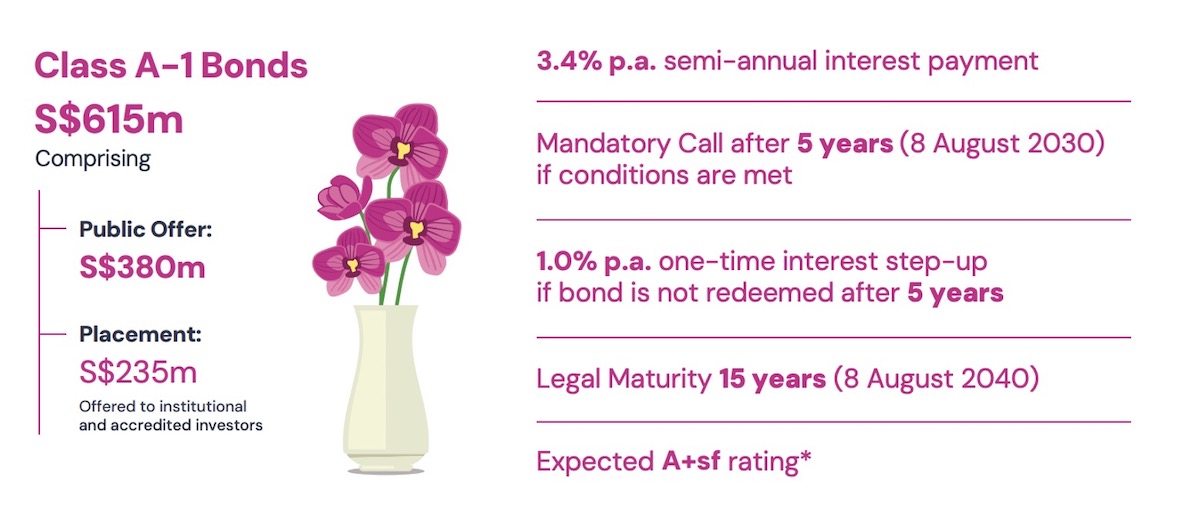

Class A-1 Bonds

The Issuer will offer S$615 million in aggregate principal amount of Class A-1 Bonds, consisting of:

- Class A-1 Public Offer: S$380 million to retail investors in Singapore.

- Class A-1 Placement: S$235 million to institutional and other investors in Singapore as well as elsewhere outside the U.S.

Class A-2 Bonds

The Issuer will offer US$200 million in aggregate principal amount of the Class A-2 Bonds, consisting of:

- Class A-2 Public Offer: US$50 million to retail investors in Singapore.

- Class A-2 Placement: US$150 million to institutional and other investors in Singapore as well as elsewhere outside the U.S.

The key features of each class are summarised in the following table:

Issuer has proven track record

The PE Bonds are issued by Astrea 9, an indirect wholly-owned subsidiary of Azalea.

Azalea is a wholly-owned subsidiary of Seviora Holdings and an indirect wholly-owned subsidiary of Temasek Holdings (Private) Limited.

The Astrea Platform develops a series of investment products based on diversified portfolios of PE Funds.

Azalea was established in 2015 with a mandate to broaden investor access to private equity. Since 2016, Azalea has launched six series of Astrea PE bonds.

Diversified portfolio of PE funds

Astrea 9 is backed by cash flows from a diversified portfolio of 40 private equity funds which invested in 1,086 companies across diverse industries and geographies.

Learn more about private equity (PE) here.

The net asset value of the portfolio was US$1,625 million as of 31 December 2024.

The portfolio has exposure to major investment regions, including North America, Europe and Asia.

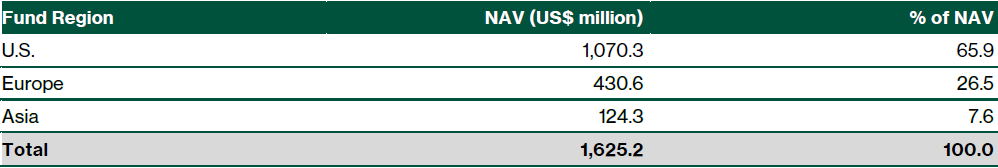

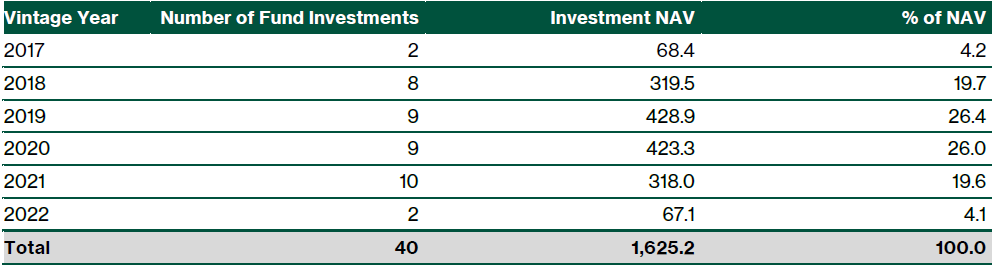

As of 31 December 2024, the portfolio breakdown is summarised in the following figure and table:

The fund investments were invested across diversified sectors, with information technology representing the largest exposure at 31% of the net asset value as of 31 December 2024.

This is followed by industrials (21%), healthcare (15%), and the financials sector (8%). None of the portfolio companies represent more than 0.9% of the entire net asset value of the portfolio.

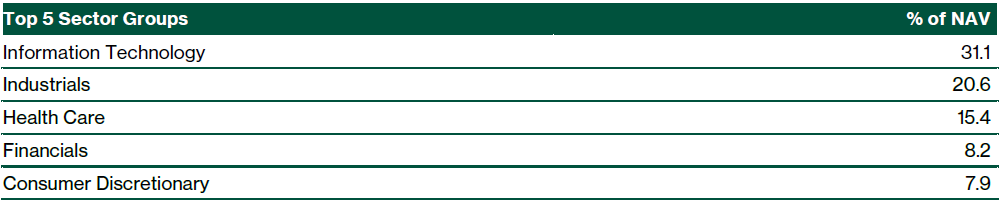

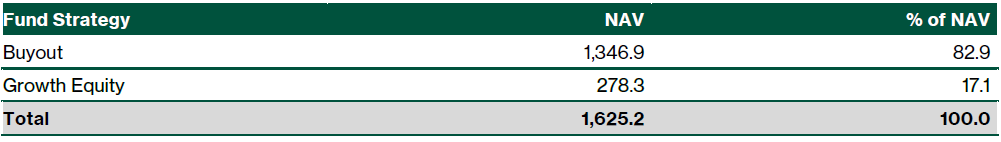

Key investment strategies employed by PE Funds are buyout and growth equity. The Buyout strategy has the strongest historical performance among PE strategies historically.

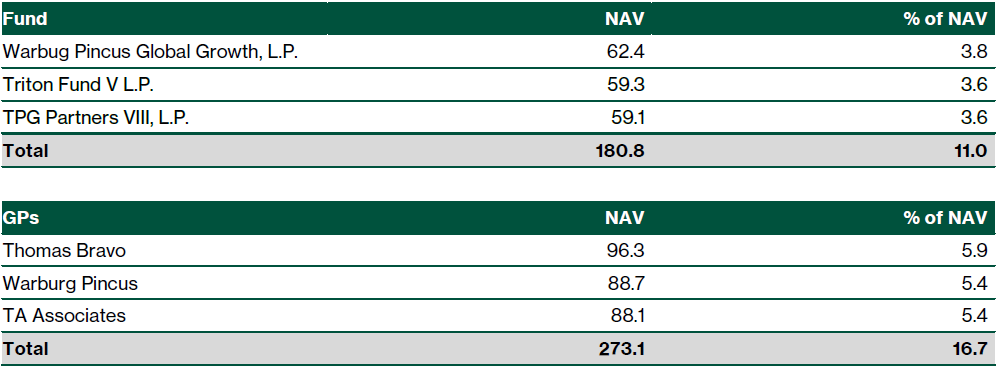

The top three PE fund managers (General Partners) for Astrea 9 are Thomas Bravo (5.9%), Warburg Pincus (5.4%), and TA Associates (5.4%).

The top three fund investments are Warburg Pincus Global Growth, L.P. (3.8%), Triton Fund V L.P. (3.6%) and TPG Partners VIII, L.P. (3.6%).

The weighted average fund age is 5.5 years.

Across vintage years, about 26% of the fund investments were made in each of 2019 and 2020, followed by 20% in each of 2018 and 2021.

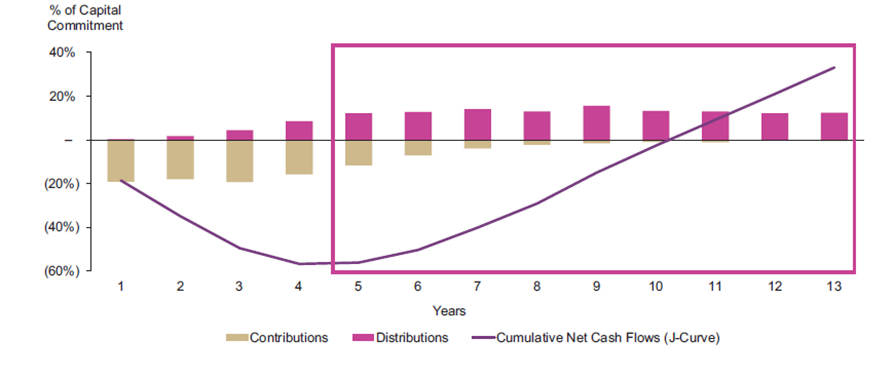

Because of the private equity J-Curve effect, net cash flows are expected to accelerate from year five onwards, with mature funds more likely to generate cash flow.

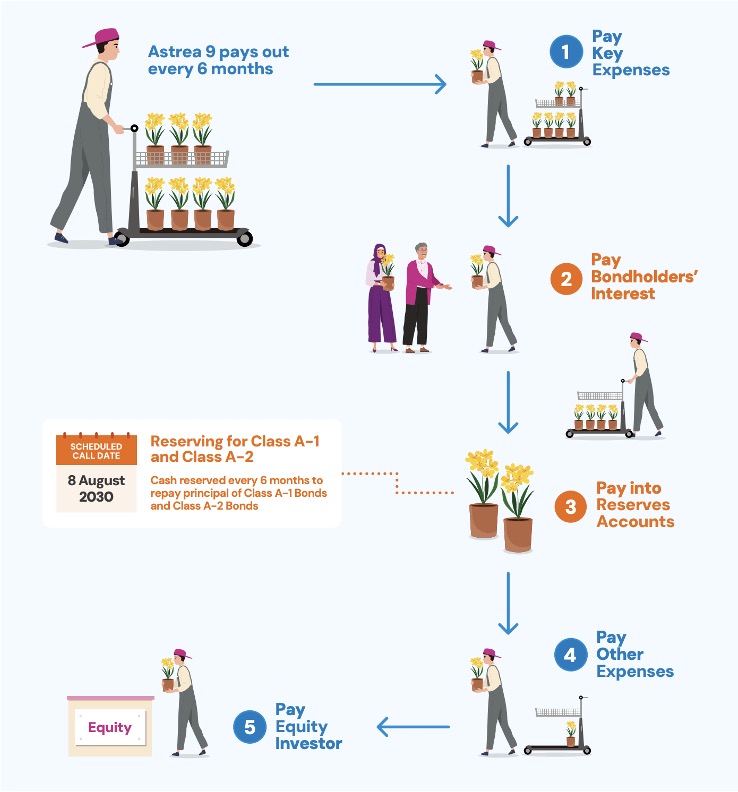

Priority of Payments

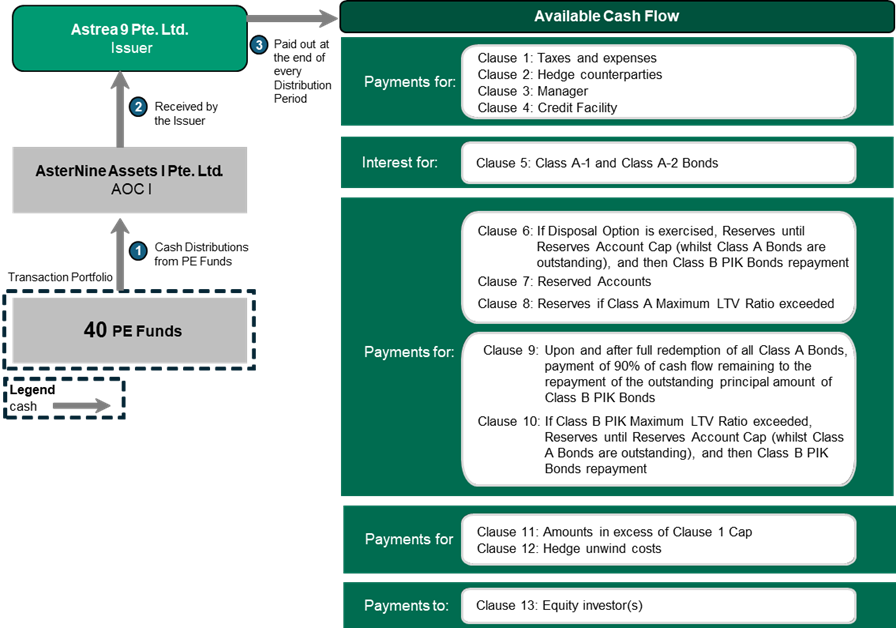

Astrea 9 will receive cash from the portfolio of PE fund investments when the underlying investments are sold.

At the end of every semi-annual distribution period, the available cash flow will first be used to pay for tax and expenses, hedge counterparties, manager, and credit facility.

Thereafter, they will be used to pay for the interest for the Class A-1 and Class A-2 bonds.

The Class A-1 Bonds and Class A-2 Bonds have the same seniority, without any preference or priority among themselves.

Structural safeguards in place

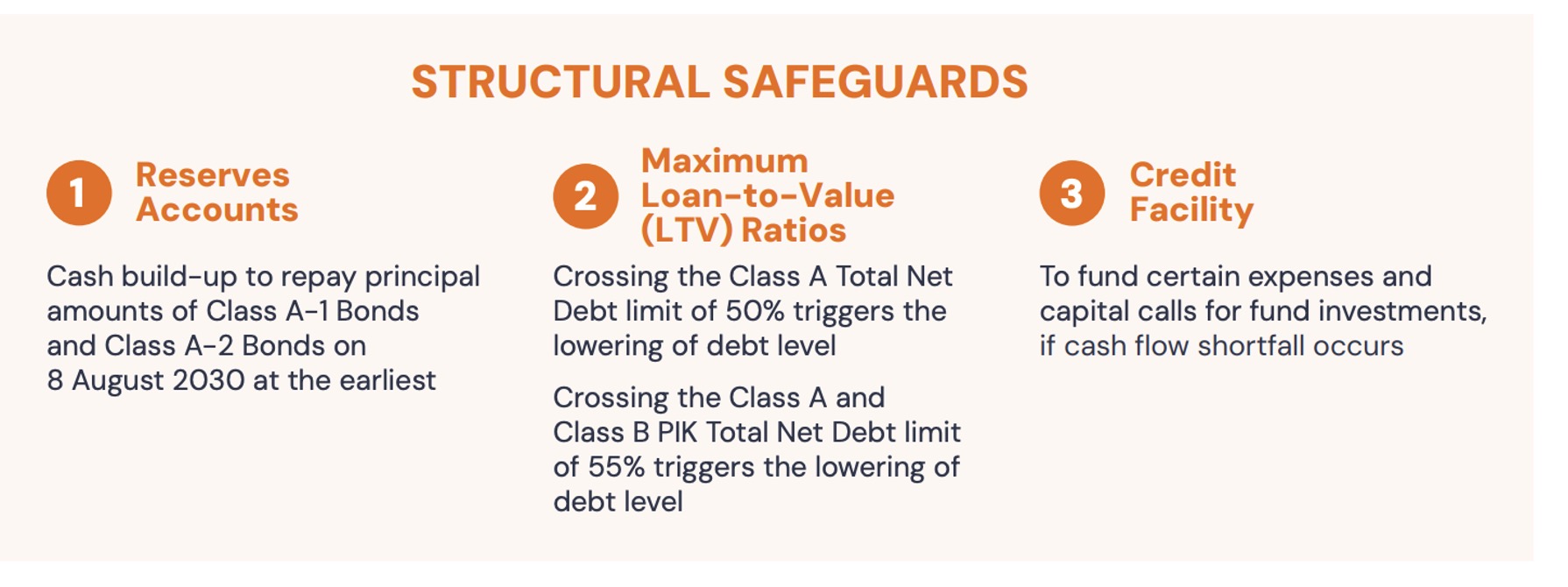

The Astrea PE bonds are designed with safeguards for bondholders, including the following:

- Reserves Accounts Mechanism: Cash build-up to repay principal amounts of bonds

- Maintain LTV ratio below 50%: Cross the debt level limit of 50% triggers the lowering of total net debt

- Credit facility: To fund certain expenses and capital calls for fund investments, if cash flow shortfall occurs.

Reserve Accounts Mechanism

The Reserves Accounts Mechanism allows cash build-up to repay the principal amounts of the Bonds.

While any of the Class A-1 and Class A-2 Bonds are outstanding, the cash will flow into the Reserves Accounts for the redemption of the Class A-1 and Class A-2 Bonds.

If the Class A maximum Loan-To-Value (LTV) ratio has been exceeded, 100% of the cash flows remaining after application of Clause 1 through Clause 7 of the priority of payments will be paid to the reserve accounts.

After the Class A-1 and Class A-2 Bonds have been fully redeemed, 90% of the cash remaining after application of Clause 1 through Clause 8 will flow to the repayment of the outstanding principal amount of Class B PIK Bonds.

Available cash may also flow into the Reserves Accounts earlier if either the Disposal Option is exercised, or the Maximum Loan-to-Value Ratio has been exceeded.

If the reserves are insufficient for the full redemption of the Class A-1 or the Class A-2 Bonds, there will be a one-time 1.0% per annum step-up in their respective interest rates at the call date.

Maximum Loan-to-Value (LTV) Ratio Below 50%

The Loan-to-Value (LTV) ratio is capped at 50%, which is higher than the 40% for the recently issued Astrea 8 bonds but in line with the 50% for earlier Astrea series.

If this is breached, additional distributions have to be deposited into the Reserves Account to lower the LTV to 50% before any distribution to equity investors.

The bond offering will raise US$780 million, or 48.0% of the portfolio value of US$1,625 million as at end-2024 (loan-to-value or LTV).

The LTV ratio at issuance may mitigate risk of loss, as the portfolio will need to lose 52.0% of its value before bondholders are impacted.

In addition, there is an alignment of interest with bondholders, as the sponsor Azalea which owns 100% of the equity will take first loss.

Credit Facility

In the event of cash flow shortfalls, the Issuer may draw on the facility provided to fund certain expenses and other amounts payable (including unpaid accrued interest on the Class A-1 and the Class A-2 Bonds) and Capital Calls.

However, the Credit Facility cannot be used to repay any principal amount on the Bonds.

Key risks of Astrea 9 PE Bond

There are various risks associated with investing in Astrea 9 PE Bonds, including investment risks, market risks, leverage risks, amongst others. In addition, Class A-2 bondholders whose investment currency base is not in US dollars may face exchange rate risks from the US dollar denominated bonds.

Investment Risks

As the Astrea 9 bonds are backed by cash flows from a portfolio of private equity funds, there are investment risks due to the nature of private equity fund investments. In particular, the amount and timing of distributions from the private equity funds are uncertain.

In addition, there is limited disclosure on the performance of the underlying investee companies. As such, it may be difficult to keep track of any decline in the returns or cash flows of the fund investments.

Market Risk

Any adverse change in macroeconomic conditions may result in declining private equity asset valuations and deal activities. This may result from events such as rising inflation and interest rates, rising geopolitical tensions, and global pandemics. Such market developments may also lead to less distributions from the private equity fund investments if exits on the investee companies happen during a period of declining asset valuations or deal activities.

Leverage Risk

The use of leverage by a private equity funds may increase the exposure of Investee companies to adverse financial or economic conditions, which in turn may impact their ability to finance operational and capital needs. This may then lead to less distributions received from the private equity fund investments.

Liquidity Risk

The trading market for the bonds may be limited, and there is no assurance that the bonds may be able to be sold at an attractive price. In addition, there is no certainty as to when the bonds would be fully redeemed before the Maturity Date.

Exchange Rate Risk

As the Class A-2 bonds are US dollar denominated, bondholders whose investment currency base is not in US dollars may be subject to exchange rate fluctuations. In particular, a sharp depreciation of the US dollar may lead to foreign exchange losses for Class A-2 bondholders whose investment currency base is not in US dollars.

Decent yield compared to existing Astrea issuances

We compare the bonds with existing outstanding Astrea series, which are also invested in PE funds managed by Azalea with similar features.

The Astrea 9 A-1 bond offers a yield of 3.4%.

Existing Astrea S$-denominated issues are priced at a yield to call (YTC) of 2.82% for the Astrea 8 A-1 bond and 2.64% for the Astrea 7 A-1 bond, as of 31 July 2025. Hence, the Astrea 9 A-1 bond offers a spread of 0.58% and 0.76% over the Astrea 8 Class A-1 bond and Astrea 7 Class A-1 bond, respectively.

The 5-year Singapore government bond offers a yield of 1.78% as of 31 July 2025. As such, the Class A-1 Bonds offer a yield spread of 1.62% over the Singapore government bond.

The Astrea bonds should offer a higher yield compared to Singapore Government Securities due to the higher inherent risks of the underlying private equity funds, in our view.

The Astrea 9 A-2 bond offers a yield of 5.7%.

The yield to call (YTC) of the Astrea 8 Class A-2 bonds is at 4.85%. Consequently, the Astrea 9 A-2 bond offers a spread of 0.85% over the Astrea 8 Class A-2 bond .

The 5-year US government bond offers a yield of 3.96% as of 31 July 2025. Hence, the Class A-2 Bonds offer a yield spread of 1.74% over the US government bond. The wider spread for Class A-2 bonds is likely due to wider range of investment options in the US dollar debt market, and concerns around the depreciation of the US Dollar.

Given the above, we believe Astrea 9 PE bonds offer a decent yield and would prefer Class A-1 bonds for the yield premium to existing Astrea S$ issues with no exposure to US Dollar risk.

What would Beansprout do?

We believe Astrea 9 PE bonds may be attractive for investors seeking regular income over a longer duration, given the track record of past Astrea series and safeguards in place.

We prefer Class A-1 bonds over Class A-2 bonds for the yield premium to existing Astrea S$ issues.

However, we would need to be aware of the various risks associated with investing in Astrea 9 PE Bonds, including investment risks, market risks, leverage risks, amongst others.

In addition, Class A-2 bondholders whose investment currency base is not in US dollars may face exchange rate risks from the US dollar denominated bonds.

Also, find out other ways that you can generate passive income in Singapore.

I have seen many questions in the Beansprout Telegram group about the Astrea 9 PE bonds, and I will try to also address some of them below.

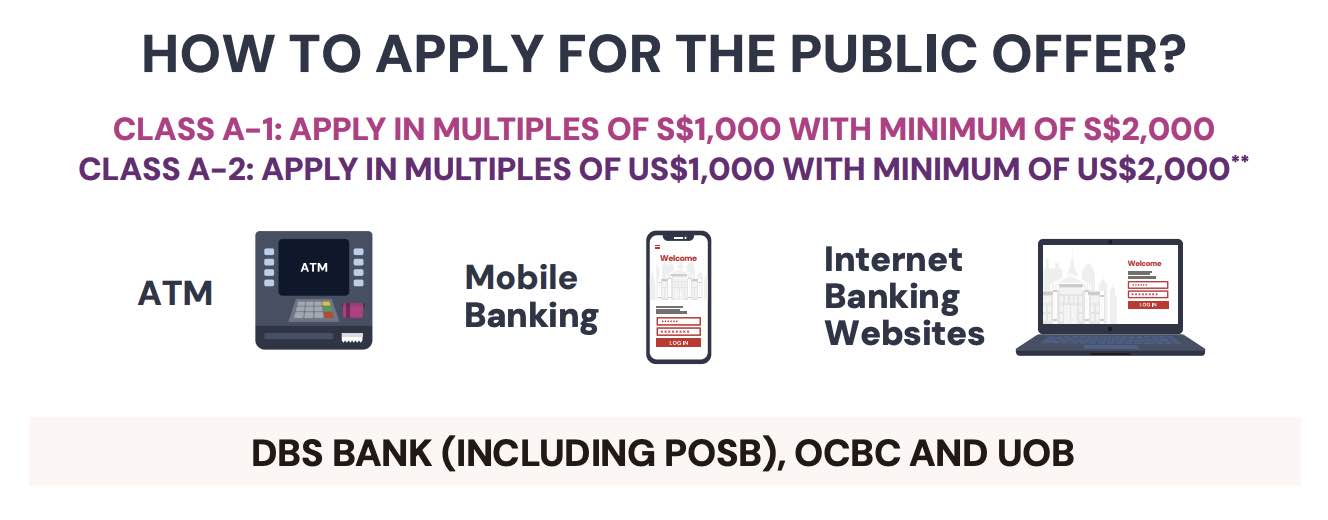

How to apply for Astrea 9 PE bonds?

You may apply for the Astrea 9 PE Bonds through ATM, internet banking and mobile banking via DBS, POSB, OCBC and UOB.

You will require a CDP account to apply for the Astrea 9 PE Bonds.

- The public offer for the Astrea 9 PE bonds open from 9am on 31 July 2025, and will close at 12 noon on 6 August 2025 (Wednesday).

- The Class A-1 Bonds and Class A-2 Bonds are expected to list and start trading on the Mainboard of the SGX on 11 August 2025 (Monday).

You may apply for both the Class A-1 bonds and Class A-2 bonds.

- The minimum application for the Singapore dollar denominated Class A-1 bonds is S$2,000 per application, and the bonds will be traded in denominations of S$1,000.

- The minimum application for the US dollar denominated Class A-2 bonds is US$2,000 per application, and the bonds will be traded in denominations of US$1,000.

You may only apply for the Astrea 9 PE Bonds using cash. Applications for the Astrea 9 PE bonds using CPF or SRS are NOT allowed.

You may apply using one of the following manners:

- ATMs of DBS (including POSB), OCBC and UOB

- Internet banking websites of DBS (including POSB), OCBC and UOB

- Mobile banking application of DBS (including POSB), OCBC and UOB

You can make an electronic application for the Class A-2 Bonds in the same way as Class A-1 Bonds.

While the Class A-2 Bonds are US$ denominated, applications for these Bonds will be made in S$ based on a predetermined exchange rate of US$1 to S$1.2852.

All refunds of unsuccessful or partially allocated applications will also be credited in S$ based on the same predetermined exchange rate of US$1 to S$1.2852 during application.

Are there any fees for applying for the Astrea 9 PE bond?

A non-refundable administrative fee of S$2 is paid by the applicant for each application.

Would I receive interest and principal payments for Class A-2 bonds in US$ or S$?

The Class A-2 Bonds are denominated in US$, and all interest and principal payments are made by the Issuer in US$.

If you hold the bonds through CDP and have activated the Direct Crediting Service, you will receive the payments in Singapore dollars (S$) by default. The US$ amounts will be converted to S$ at an exchange rate determined by CDP’s partner bank.

If you prefer to receive the payments in US$ instead of S$, you can opt out of the default conversion via CDP Internet. In this case, the US$ payments will remain in your CDP cash balance until you request a withdrawal. Please note that telegraphic transfer fees and receiving bank charges will apply for each withdrawal.

You can find out more here https://www.sgx.com/cdpfaqs.

How much allocation of the Astrea 9 PE bonds will I get?

Based on the balloting ratio of Astrea 8 PE bonds, all valid applicants who applied for less than S$50,000 of Class A-1 Bonds received allocations either in full or in part.

Investors who applied for S$9,000 and below of Class A-1 Bonds received full allocation.

Investors who applied for S$10,000 to S$29,000 of Class A-1 Bonds received S$9,000 allocation.

Investors who applied for S$30,000 to S$49,000 of Class A-1 Bonds received S$10,000 allocation.

Based on the balloting ratio of Astrea 8 PE bonds, all valid applicants who applied for less than US$50,000 of Class A-2 Bonds received allocations either in full or in part.

Investors who applied for US$4,000 and below of Class A-2 Bonds received full allocation.

Investors who applied for US$5,000 to US$9,000 of Class A-2 Bonds received S$4,000 allocation.

Investors who applied for US$10,000 to S$29,000 of Class A-2 Bonds received US$5,000 allocation.

You can find out the allotment result of the Astrea 8 PE bonds here.

However, do note that the actual allotment of the Astrea 9 PE bond may differ from the Astrea 8 PE bond, as it will eventually depend on the amount of applications for the bond.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Subscribe to our free newsletter to stay updated on the Astrea 9 PE bond and get the latest insights on Singapore T-bills, SSBs and other bonds.

Download the full report here.

Disclosure

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments