A simple way you can stay on track when markets get volatile

Robo Advisor

Powered by

By Nicole Ng • 28 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Learn how AutoWealth helps investors stay on track during market volatility with globally diversified, low-cost portfolios.

This post was created in partnership with AutoWealth. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

Markets have started 2026 on a stronger footing.

US equities hit new highs on 12 January 2026, and investor sentiment seemed to have improved.

But rising markets don’t mean volatility has disappeared. When markets sell off, as they did in April 2025 due to US trade tensions, conditions can shift quickly.

For some investors, a key challenge was having too much exposure to a single stock or asset class.

When that exposure declined sharply, it affected their overall portfolio.

It’s a reminder that diversification plays an important role in managing risk.

Whether you’re investing for growth or passive income, by spreading your investments across different asset classes and markets, you reduce the impact of any single event on your portfolio.

That’s one reason I’ve started looking for ways to diversify my own portfolio.

For beginner investors or those who prefer a hands-off approach, robo-advisors like AutoWealth offer a simple way to invest across multiple markets and asset types.

In this article, I’ll take a closer look at AutoWealth’s Starter Portfolio, what it’s made of, how it works, and how it helps investors achieve diversification with ease.

What is AutoWealth Starter?

AutoWealth Starter is a globally diversified investment portfolio offered by AutoWealth that invests in f equity and bond funds to help investors achieve their financial goals.

For those seeking a simple and accessible way to invest with a minimum investment amount of S$3,000, AutoWealth is a straightforward option.

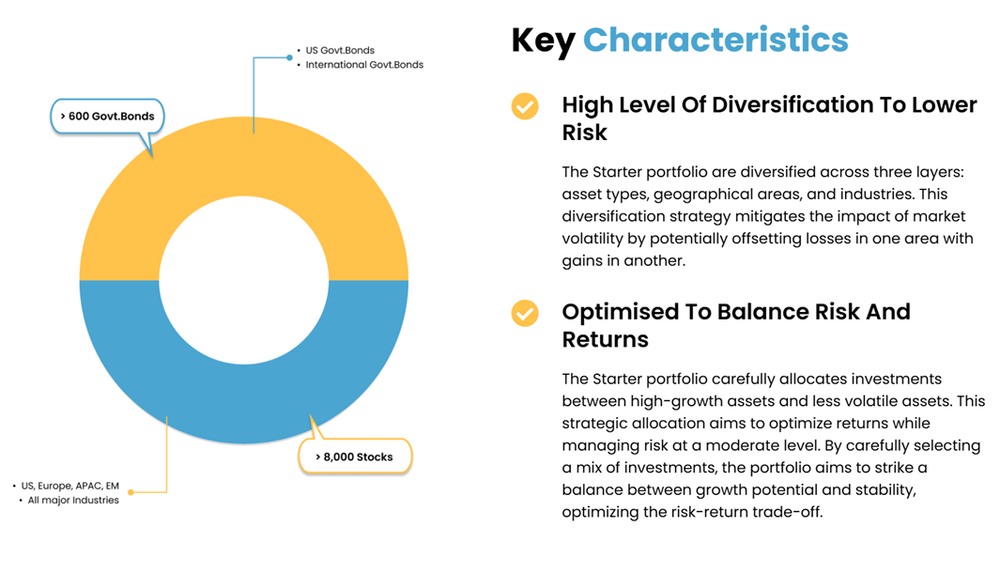

The portfolio has exposure to over 8,000 stocks and 600 government bonds worldwide, as of 30 June 2025.

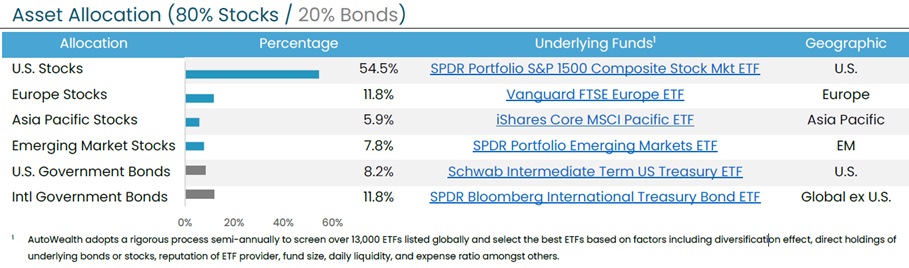

Here are some of the underlying funds that make up the Starter portfolio:

- SPDR® Portfolio S&P 1500® Composite Stock Market (U.S.)

- Vanguard FTSE Europe (Europe)

- Asia Pacific via iShares Core MSCI Pacific ETF (Asia Pacific)

- Schwab Intermediate Term US Treasury ETF (U.S. Bonds)

- SPDR Bloomberg International Treasury Bond ETF (International Bonds).

This diversification means that when certain markets struggle, others may remain stable or even grow, cushioning your portfolio from extreme fluctuations.

In volatile times, it’s easy to panic.

We may overreact to losses and underestimate our own ability to stomach risk, sometimes pulling out of long-term strategies at the worst possible moment.

But when your portfolio is broadly diversified, the ups and downs feel less extreme.

That cushion may help you stay invested and stay the course.

What investors should know about AutoWealth Starter

#1 – Optimised risk-return balance

AutoWealth’s approach is built on the traditional equity–bond portfolio framework, allocating funds between growth-oriented equities and more stabilising bond exposures based on an investor’s selected risk level.

Instead of relying on market timing or individual stock selection, this approach focuses on maintaining a consistent asset mix that aligns with long-term objectives and risk tolerance.

The balance between equities and bonds is adjusted according to the chosen risk profile.

For example, a moderate-risk Starter Portfolio would typically include a mix of equities and bonds intended to capture potential long-term growth while helping to moderate short-term fluctuations.

This structure reflects a portfolio construction method used widely in wealth management.

#2 – Portfolios tailored to risk appetite

AutoWealth lets me select a risk level from 1 (very cautious) to 5 (aggressive).

Once selected, the portfolio invests in a specific allocation of equities and bonds within these risk parameters.

AutoWealth offers five distinct risk levels for investors:

| Risk Level | Allocation | Objective |

| Risk Level 1 (Very Conservative) | 20% equities and 80% bonds | Prioritises capital preservation with minimal volatility |

| Risk Level 2 (Conservative) | 40% equities and 60% bonds | Offering slightly more growth potential while maintaining strong stability. |

| Risk Level 3 (Moderate) | 60% equities and 40% bonds | Providing a middle ground between growth and stability |

| Risk Level 4 (Growth-Oriented) | 80% equities and 20% bonds | Long-term growth with acceptance of moderate volatility |

| Risk Level 5 (Aggressive Growth) | Up to 100% equities with minimal or no bonds | Maximising growth potential while accepting higher short-term fluctuations |

| Source: AutoWealth Singapore | ||

These allocations ensure that investors across the risk spectrum can find a portfolio that aligns with their comfort level and financial goals.

The clear delineation between risk levels makes it easy to understand exactly what I'm investing in and how my portfolio is expected to behave in different market conditions.

#3 – Auto rebalancing

As markets fluctuate, a portfolio's asset mix can drift from the target allocation.

For example, if stocks rally significantly, I could end up with a higher proportion of equities than planned, inadvertently increasing my portfolio's risk level.

AutoWealth monitors the portfolio daily and rebalances whenever my allocation deviates by more than 3% from the target.

This means the robo-advisor sells high-performing assets and buys underperforming ones to restore the intended balance.

This accomplishes two crucial objectives:

- Maintains consistent risk levels: I don't suddenly become a higher-risk investor just because certain sectors performed exceptionally well. Rebalancing prevents over-concentration and keeps my risk profile steady.

- Removes emotion from investing: Rebalancing automatically enforces the classic "buy low, sell high" discipline that many investors struggle to implement independently. During volatile periods, this mechanism ensures my portfolio takes profits on overperforming assets and acquires undervalued ones, without requiring my intervention.

Importantly, AutoWealth covers all rebalancing costs, so I'm not penalised when these adjustments occur.

The result is a portfolio that more consistently aligns with my long-term strategy without requiring micromanagement or causing stress over market movements.

#4 – Low fees

AutoWealth charges a management fee of 0.5% a year, plus a flat US$18 annual platform fee:

There are no hidden charges or sales commissions.

For a S$10,000 Starter portfolio, fees would amount to roughly S$74 per year (about $6 monthly).

While fees are only one consideration, lower costs can help more of an investor’s capital remain invested over time.

How has AutoWealth Starter performed?

AutoWealth publishes historical returns for its Starter portfolios, so you can find out how these portfolios have performed in the past.

As of 30 June 2025, the Aggressive Growth portfolio (100% equities) achieved a 10-year annualised return (net of fees and charges) of 12.22% in SGD terms, while the Preservation portfolio (20% equities) returned 1.46% p.a in SGD terms over the same period.

Long Term Growth, Balanced, and Conservative portfolios returned 9.34% p.a., 6.17% p.a., and 3.87% p.a. over 10 years, respectively.

Past returns are not indicative of future performance, but the historical returns provide context for how a globally diversified approach has behaved over different market cycles.

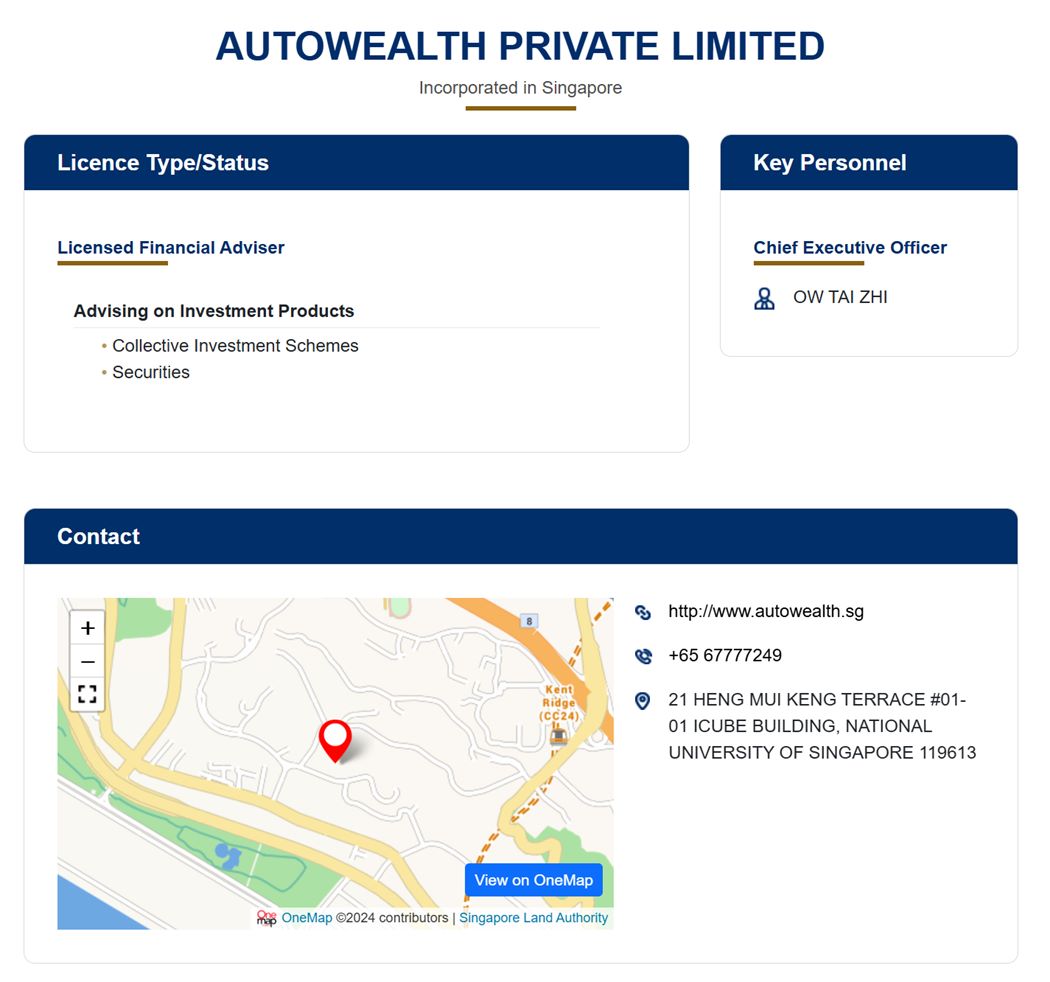

Is AutoWealth safe and legit?

AutoWealth is a licensed financial adviser regulated by the Monetary Authority of Singapore (MAS) under the Financial Advisers Act (Chapter 110) with Licence No. FA100064-1:

Additionally, client assets are held in personal, segregated custody accounts with MAS-licensed custodians, offering an added layer of protection and ensuring that clients' investments are safeguarded independently of the company's own assets.

Other features AutoWealth offers

Beyond its Starter Portfolio, AutoWealth offers a range of features that support different investing needs and life stages.

#1 – CPF and SRS eligible

If you’re contributing to Singapore’s Supplementary Retirement Scheme (SRS), AutoWealth allows you to invest those funds through its SRS Core Portfolios.

The SRS Core Portfolios come with the same five risk levels and a diversified strategy, helping your SRS funds grow instead of sitting idle at low interest in your SRS account.

In addition, AutoWealth recently announced that it will support investments under the CPF Investment Scheme (CPFIS), giving existing AutoWealth users another digital option to invest their CPF funds, subject to CPFIS rules and limits.

#2 – Cash management solutions

For cash you’re setting aside temporarily, Flexi Cash offers cash management accounts:

- Flexi Cash SGD (for SRS funds) invests in short-term money market funds

- Flexi Cash USD (for regular savings) taps into ultra-short-term U.S. Treasuries

These options let you keep your money working without leaving the platform.

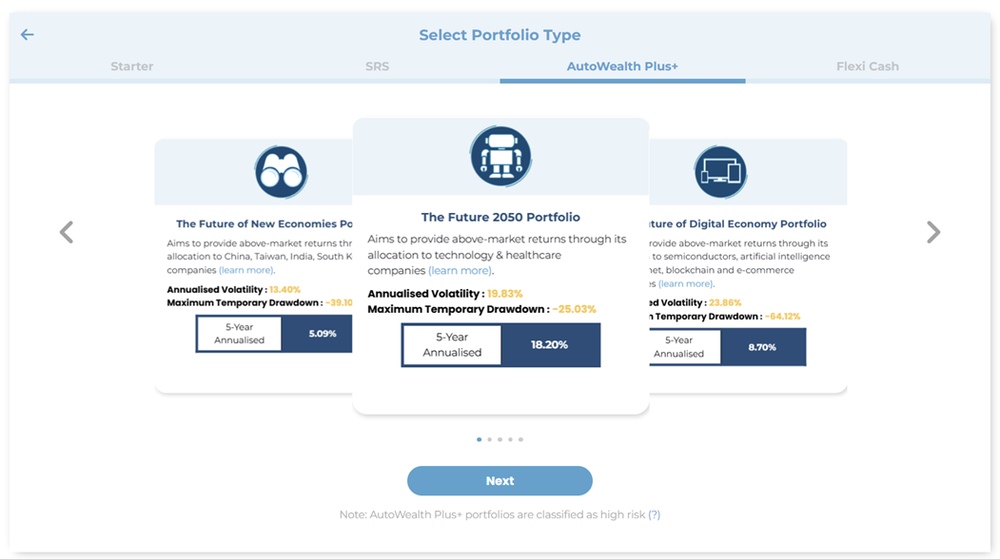

#3 – Invest in thematic portfolios with AutoWealth Plus+

And for those with a higher risk appetite, AutoWealth’s Plus+ thematic portfolios focus on long-term trends like future healthcare and tech innovation.

These equity-only portfolios offer a growth-oriented option for investors looking to ride structural shifts shaping the world over the next few decades.

Take the Future 2050 Portfolio, for example. It’s a thematic portfolio built around transformative macro trends, such as technological disruption and the rising demand for healthcare driven by ageing populations.

For instance, as of 30 June 2025, the Future 2050 portfolio has a 5-year annualised return of 18.20% in USD terms.

Plus, fees are charged based on a performance fee model of 8% of profits in each calendar year. If there are no profits for the year, no performance fee is charged.

This fee structure aligns the interests of the portfolio manager with those of the investors.

What are the risks and considerations of investing with Autowealth Starter?

#1 – Market risk

AutoWealth portfolios invest in equities and bonds, which remain subject to market fluctuations.

During periods of volatility or market downturns, the value of the portfolio can decline, even if it is diversified across regions and asset classes.

Diversification helps manage, but does not eliminate, market risk.

#2 – Foreign currency risk

Because AutoWealth portfolios include global ETFs, part of the investment is exposed to foreign currencies.

Shifts in exchange rates may affect overall returns, resulting in currency gains or losses regardless of the underlying asset performance.

#3 – Selecting an appropriate risk level

AutoWealth offers five risk levels, each with a different mix of equities and bonds.

Choosing a level that does not align with your risk tolerance, investment horizon, or financial goals may lead to discomfort during market swings or may affect the ability to meet long-term objectives.

Investors should assess their ability to tolerate fluctuations before selecting a portfolio.

What would Beansprout do?

If market turbulence has taught us anything, it's that overexposure to a single stock or asset can be risky.

For long-term investors looking to grow their wealth, the key to weathering volatility is less about predicting the next big move and more about having a diversified, disciplined investment strategy that works in different market conditions.

Solutions like AutoWealth Starter provide beginner investors and investors who want a hands-off, goal-aligned approach with a globally diversified portfolio tailored to your risk appetite, that is automatically rebalanced and is managed with low fees.

Sign up for AutoWealth here if you’re looking for a simple, low-cost, and diversified approach to growing your wealth.

Disclaimers and Important Information

Investments always involve risks and the possibility of losses. Any reference to past performance is not necessarily indicative of and is no guarantee to the future or likely performance of your investments. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

0 questions