CATL HK SDR - Global leader in electric vehicle batteries

Singapore Depository Receipts

By Gerald Wong, CFA • 06 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Contemporary Amperex Technology Co., Limited (CATL) is the world’s largest electric vehicle battery manufacturer.

Global Leader in EV and Energy Storage Batteries

Contemporary Amperex Technology Co., Limited (CATL) is currently the world’s largest manufacturer of electric vehicle (EV) and energy storage system (ESS) batteries.

The company is widely recognised as a global leader in innovative energy solutions. Previously listed solely on the Shenzhen Stock Exchange, CATL completed a secondary listing on the Hong Kong Stock Exchange in May 2025.

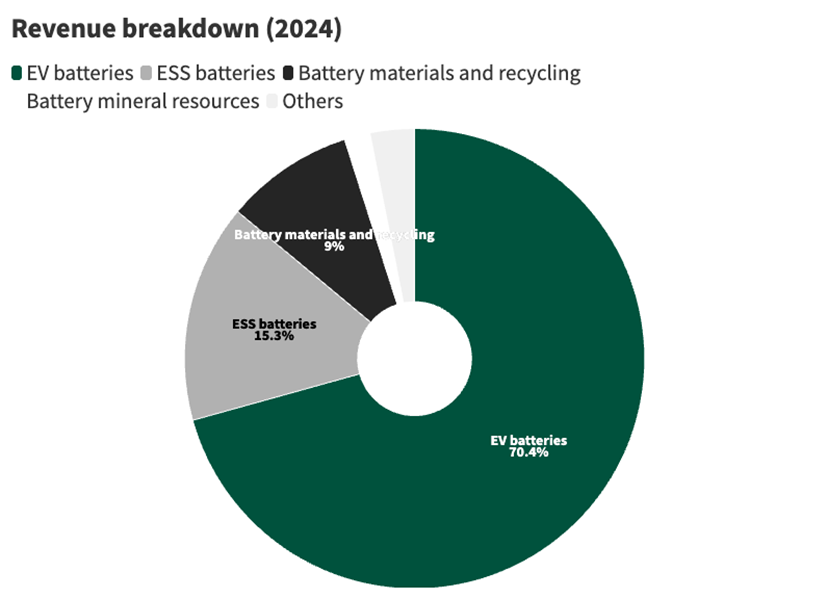

According to CATL’s Hong Kong listing prospectus, approximately 70% of the company’s total revenue in 2025 is expected to be derived from the EV battery segment, where it supplies batteries to both domestic and global electric vehicle makers. An additional 15% of revenue comes from its ESS battery business.

CATL has benefited from strong momentum in EV adoption, particularly in China, where EV penetration reached 53% of total new vehicle sales as of June 2025. The company has also accelerated its international expansion, especially in Europe, through partnerships with key OEMs such as BMW.

In the ESS segment, CATL’s battery systems are used to support renewable energy generation from sources such as wind and solar. The rise of artificial intelligence has driven demand for energy-intensive data centres globally, fuelling further growth in grid-level ESS demand as part of broader energy infrastructure development.

Leading market share

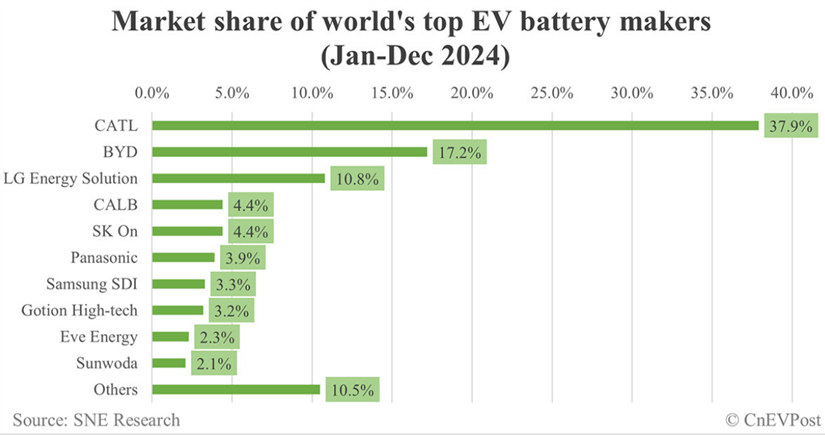

CATL began as a domestic battery supplier to Chinese electric vehicle (EV) manufacturers but has since grown to become the global leader in both EV and energy storage system (ESS) batteries. As of 2025, CATL holds a dominant position with an estimated 38% global market share in the EV battery segment, reflecting its strong scale, technological edge, and broad customer base.

In the ESS battery segment, CATL also leads globally with a 36.5% market share, supported by rising demand for grid-level storage solutions amid the global transition toward renewable energy.

BYD, which primarily uses its batteries in-house for its own EV models, ranks second in global EV battery market share. Meanwhile, Korean players such as LG Energy Solution (LGES), SK On, and Samsung SDI follow, with each holding market shares ranging between 3% and 11%.

Battery Chemistry a Key Differentiator: CATL vs Korean Competitors

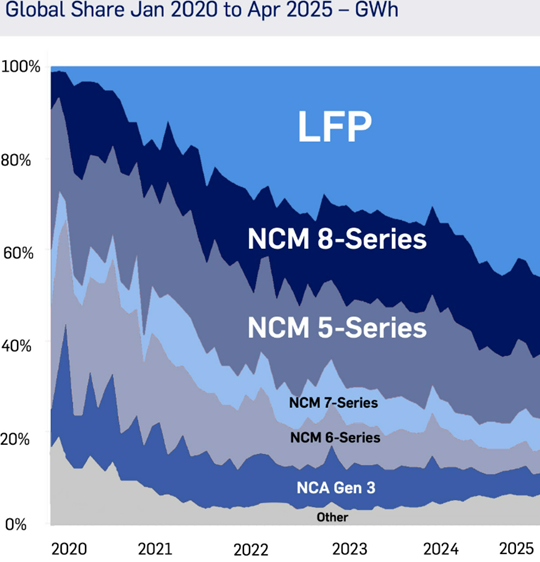

The competitive dynamics in the global EV battery market are increasingly shaped by the choice of battery chemistry. Currently, lithium-ion (Li-ion) batteries are dominated by two key types of cathode materials—Nickel Manganese Cobalt (NMC) and Lithium Iron Phosphate (LFP).

Korean battery manufacturers, including LG Energy Solution, SK On, and Samsung SDI, have primarily focused on NMC battery technology. In contrast, CATL has been a leading proponent of LFP batteries, investing significantly in research, development, and production capacity for this chemistry.

LFP batteries offer several advantages over NMC:

- Thermal stability: LFP cells exhibit higher resistance to heat and are less prone to thermal runaway, enhancing safety.

- Longer lifespan: LFP batteries support between 2,500 to 9,000 charge-discharge cycles, translating into longer operational life versus NMC batteries, which typically range from 1,000 to 2,000 cycles.

- Lower cost: The average LFP cell price stood at approximately US$60/kWh in 2024, significantly below the US$120–150/kWh range for NMC.

However, the trade-off is lower energy density. LFP batteries typically store 120 Wh/kg, while NMC batteries can achieve up to 220 Wh/kg—meaning LFP-powered EVs may require more frequent charging or carry larger battery packs to match range.

Despite this, LFP adoption has surged, rising to approximately 46% of EV battery installations globally over the past five years, largely at the expense of NMC. CATL has played a central role in this shift, leveraging its cost leadership, manufacturing scale, and technology capabilities to accelerate global acceptance of LFP technology.

CATL Pushing Technological Boundaries in LFP Battery Innovation

While LFP batteries have traditionally been associated with lower energy density compared to NMC batteries, CATL has been making significant strides in addressing this limitation through continuous innovation.

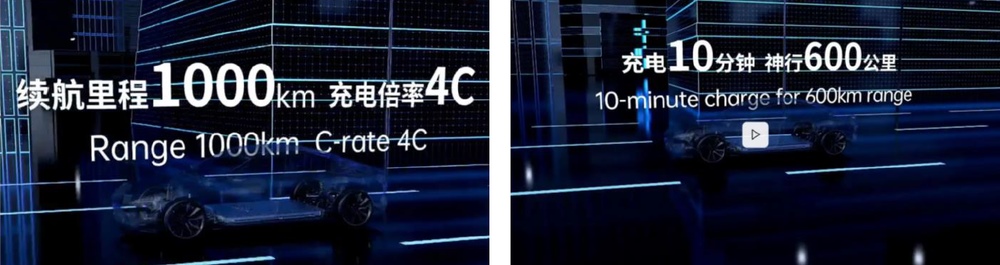

In April 2025, CATL unveiled its latest LFP battery advancement—the Shenxing Plus battery. This new iteration delivers a driving range of up to 1,000 km on a full charge, representing a major leap from the first-generation Shenxing battery introduced in 2024, which offered a 700 km range.

By enhancing both the cathode material and the internal cell structure, CATL has successfully increased the energy density to 205 Wh/kg, bringing LFP performance closer to that of higher-end NMC batteries. In addition to improved energy density, the Shenxing Plus battery supports ultra-fast charging—capable of delivering up to 600 km of range with just 10 minutes of charging. This is a significant improvement from the earlier version, which could deliver 400 km of range from the same charging duration.

CATL’s ongoing advancements in LFP technology reflect its strategic focus on bridging the performance gap with NMC batteries, while retaining LFP’s inherent advantages of safety, longer lifespan, and cost efficiency. This positions CATL to maintain its leadership in the global EV battery space, particularly as cost competitiveness and charging convenience become increasingly important factors for mass-market EV adoption.

CATL Remains the Most Profitable Battery Manufacturer Globally

CATL continues to demonstrate clear competitive advantages in the EV and ESS battery industry, cementing its position as the most profitable battery company worldwide. In 2024, CATL reported an operating profit margin (OPM) of 17.8%, significantly outperforming both its domestic and international peers. Among its closest competitors, LG Energy Solution recorded a lower OPM of 10%, while others in the industry either operated at break-even or reported losses.

Notably, CATL is estimated to contribute to approximately 90% of the entire battery industry’s profit, highlighting the scale of its dominance in both profitability and market influence.

Q2 2025 Performance: Profitability Surges on Margin Expansion

CATL delivered strong second-quarter results in 2025, with revenue rising 8.3% year-on-year to RMB 94.2 billion, and net profit surging 33.7% year-on-year to RMB 16.5 billion.

Despite headwinds from lower average battery selling prices—driven by declining raw material costs and increased competition—battery shipment volume grew 36.4% year-on-year to 150 GWh, reflecting robust demand.

More importantly, gross margin expanded by 4.8 percentage points year-on-year to 25.6%, supported by a higher mix of premium battery products and enhanced operating leverage. High plant utilisation, which remained above 90%, also contributed to scale efficiencies and margin gains.

CATL’s ability to grow earnings faster than revenue, even in a deflationary pricing environment, reinforces its operational strength and leadership in battery technology and cost management.

Key Risks

While CATL benefits from strong structural tailwinds in the transition to electric vehicles (EVs) and energy storage systems (ESS), it operates in a highly competitive and capital-intensive industry. The company and its peers have been expanding manufacturing capacity aggressively to capture expected long-term demand growth.

However, if the pace of EV adoption slows, whether due to policy changes, consumer sentiment shifts, or macroeconomic headwinds, or if other verticals such as ESS or industrial storage grow more slowly than anticipated, CATL could face underutilised capacity. This may lead to downward pressure on battery selling prices and lower margins.

In such a scenario, CATL’s profitability could be negatively impacted, especially given its high fixed cost base and large-scale capital investments tied to long-term demand assumptions. Investors should closely monitor industry supply-demand dynamics and policy developments that could influence end-market growth.

Trading at 22x P/E

Since its H-share listing in May 2025, CATL’s share price has risen by 36%, reflecting investor interest in its position as a global leader in EV and energy storage batteries.

Based on current estimates, CATL trades at a forward price-to-earnings (P/E) ratio of 21.7 times.

You can now trade CATL through Hong Kong Singapore Depository Receipts (SDRs). These HK SDRs offer investors a more accessible way to invest in Hong Kong-listed companies.

Apart from CATL (HCCD), Pop Mart (HPPD) would also be accessible through Hong Kong SDRs for investors from 6 August 2025.

The introduction of Singapore Depository Receipts allows investors to purchase CATL shares with a lower minimum investment outlay compared to buying Hong Kong-listed shares directly.

Additionally, SDR holdings will be custodised within investors’ Central Depository (CDP) accounts, providing seamless integration with their existing Singapore-based portfolios.

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in CATL HK SDR 30to1.

Download the full report here.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments