DBS reports 1% profit growth and maintains healthy dividend payout: Our Quick Take

Stocks

By Gerald Wong, CFA • 07 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

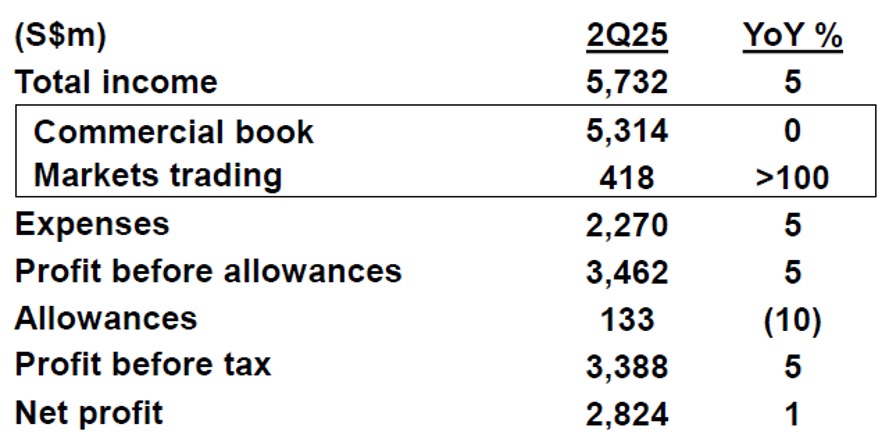

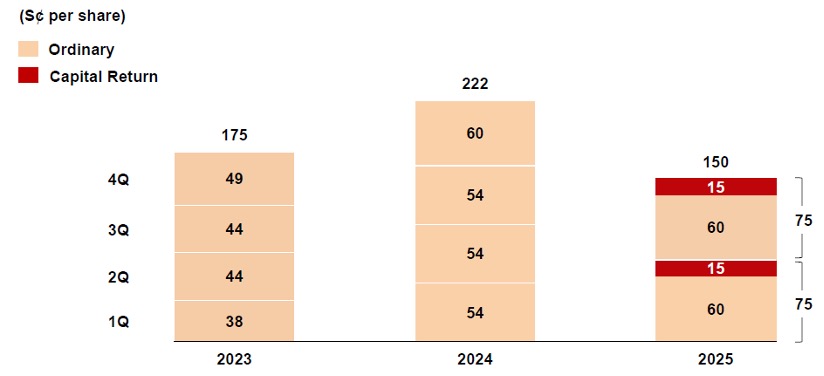

DBS reported net profit of S$2.82 billion in 2Q 2025, an increase of 1% year-on-year. The bank also announced an ordinary dividend of S$0.60 and a Capital Return dividend of 15 cents per share for 2Q 2025.

DBS 2Q25 earnings and dividend highlights

DBS has announced its earnings for second quarter of 2025. Key highlights include:

- Q2 2025 profit: SGD 2.82 billion (+1% year-over-year)

- First half 2025 profit: SGD 5.72 billion (-1% year-over-year)

- Interim dividend of 60 cents per share for 2Q 2025

- Capital Return dividend of 15 cents per share for 2Q 2025

DBS reported a 1% year-over-year increase in net profit for the second quarter, totaling SGD 2.82 billion.

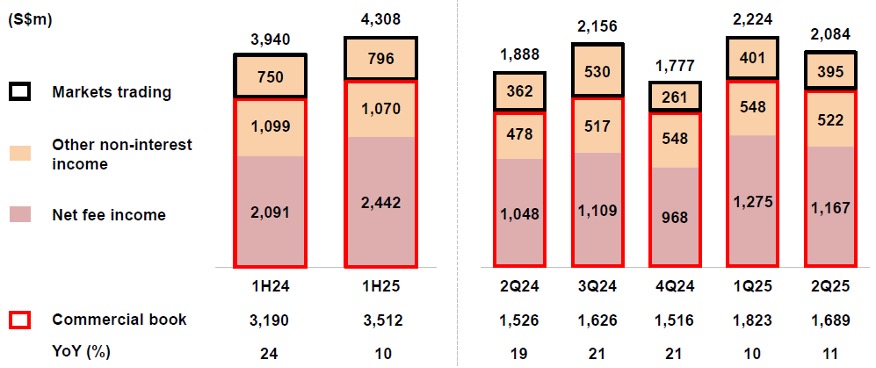

This growth was driven by strong deposit growth and proactive balance sheet hedging. Fee income and treasury customer sales rose while performance of markets trading division strengthened.

The annualised return on equity stood at a commendable 17.0%, matching the previous year's record.

Total income rose 5% year-over-year to SGD 5.73 billion, due to balance sheet growth, higher fee income, treasury customer sales, and stronger markets trading income.

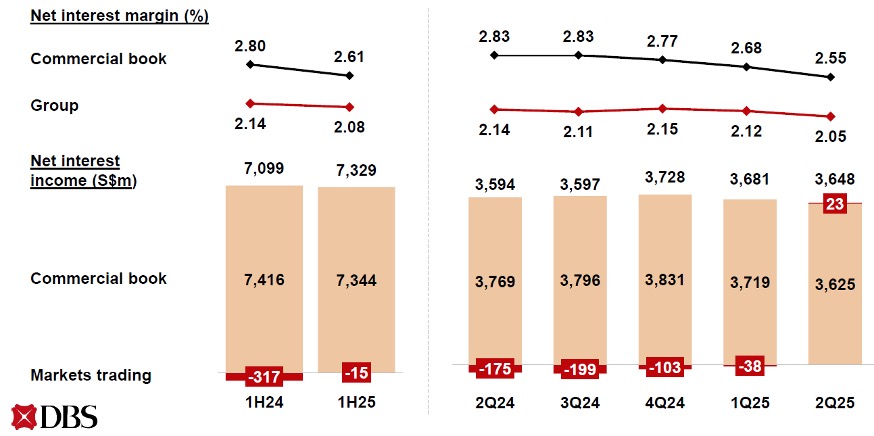

The bank's core lending activities saw a 3% decline in net interest income to SGD 3.65 billion in Q2, driven by decline in net interest margin which fell by 13 basis points to 2.55%.

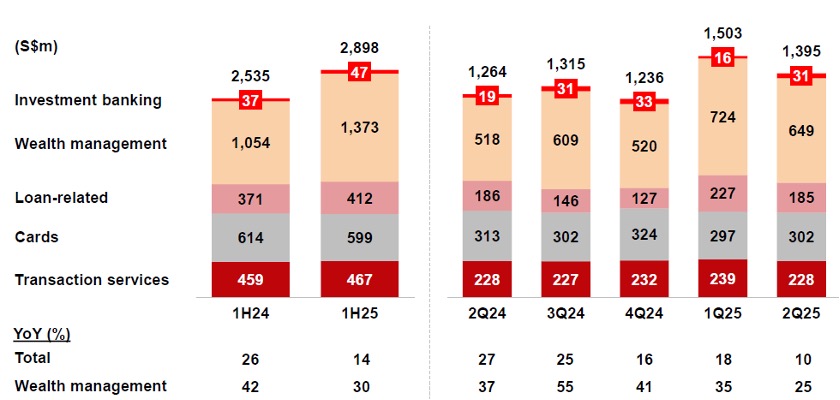

Fee income rose 11%, due to higher wealth management fees and investment banking fees from increased debt and equity capital market activity.

Wealth management fees rose by 25% to SGD 649 million, from broad-based growth in investment products and bancassurance.

The bank benefited from a 9% increase in other non-interest income, primarily due to strong treasury customer sales to both wealth management and corporate customers.

The bank's asset quality remains resilient, with the non-performing loan (NPL) ratio improved to 1.0%, from 1.1% in the previous quarter. New non-performing asset formation stayed low and was more than offset by higher repayments and write-offs.

The board proposed an ordinary of SGD 60 cents per share and a Capital Return dividend of SGD 15 cents per share for 2Q 2025, translating to a total 1H 2025 dividend of S$1.50 per share, a 39% increase over the previous year.

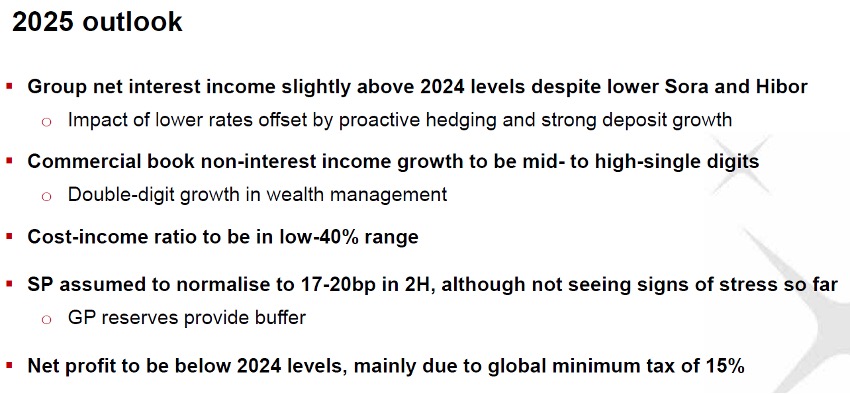

DBS maintained its expectation for group net interest income in 2025 to be slightly above 2024 levels, as proactive hedging and strong deposit growth offset impact of lower rates.

However, DBS maintained its net profit for 2025 to be lower than 2024 due to a global minimum tax of 15%.

Beansprout’s Quick Take on DBS earnings

The strong earnings and dividend hike reported are likely to be taken positively by investors.

Notably, the strong growth in wealth management fee income should help to allay concerns about the potential impact of interest rate cuts putting pressure on DBS’ net interest margin and profit.

Based on the total ordinary dividend per share of S$1.20 in 1H 2025, DBS currently offers an annualised dividend yield of 4.9% based on its closing price of S$48.85 on 7 Aug.

Adding the capital return dividend of S$0.15 per quarter for FY2025 to annualised full year dividend of S$2.40 would imply a potential total dividend per share of S$3.00. This would imply a potential dividend yield of 6.1%.

This would be above DBS’ historical average dividend yield and UOB’s dividend yield, and OCBC’s dividend yield.

DBS currently trades at a price-to-book valuation of 2.0x, above its historical average of 1.2x.

Related links:

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in DBS.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

1 comments

- John Smith • 10 Aug 2025 03:08 AM