One app to grow your wealth: A look at DBS digiWealth

Robo Advisor

Powered by

By Nicole Ng • 06 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We explore how DBS digiWealth can help investors simplify their portfolios with curated CIO Insights Funds, insurance products, clearer insights, and digital tools.

This post was created in partnership with DBS. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What Happened?

In 2025, I set out to build better money habits.

After all, one of my financial goals is retirement safety, and I read that we need S$550,000 to retire well in Singapore.

But with a complex universe of investment and insurance products, as well as numerous platforms in the market, it’s easy to feel overwhelmed and unsure where to start or what to focus on.

I might buy funds on one platform, purchase insurance policies on another, check my assets and liabilities elsewhere, and track my investments and coverage on separate spreadsheets.

And when markets get choppy, I often find it even harder to stick to my financial plan and stay invested to meet my retirement goal.

DBS recently introduced digiWealth to solve exactly this problem.

Built directly into the DBS digibank app we already use every day, it brings your investments, wealth planning, and protection into one organised space.

In this article, I’ll walk you through how digiWealth works and how it can make investing and managing your wealth in totality feel a lot simpler.

Explore digiWealth directly in your DBS digibank app here.

What is DBS digiWealth?

DBS digiWealth is a holistic digital wealth platform, built directly into the DBS digibank app.

It brings together the convenience of digital tools and the reassurance of reliable guidance from a trusted source, especially in a more uncertain market environment.

Instead of toggling between multiple platforms, digiWealth lets you access investments, insurance options, advisory support, and market insights in a single ecosystem.

Here’s what that includes:

- A curated suite of products: digiWealth offers access to investment solutions through the DBS CIO Insights Funds and relevant insurance products across different needs, whether you're building a long-term portfolio, planning for retirement, or looking for passive income.

- Insights and research in one place: You can browse market updates, CIO commentary, fund insights, and educational content directly in the Invest tab. This makes it easier to stay informed without relying on multiple news sources.

- Advisory: Previously only accessible to high-net-worth clients, you can reach out to a Wealth Planning Manager directly through the app if you prefer human guidance for all your wealth management decisions.

With just a tap on the digiWealth tab, you get access to curated fund ideas, ready-made portfolios, and personalised insights.

Access digiWealth directly in your DBS digibank app here.

And you can start investing from as low as S$100, with zero fees on recurring top-ups.

Alongside that, you can even view your full financial picture in one place in the Plan, Insure, Net Worth, and Retire tabs.

Everything is available under one login and within one familiar app, allowing you to manage your wealth holistically.

This offers a simpler way to see where your money is, how it’s working, and how each decision fits into your bigger financial picture.

How DBS digiWealth helps make investing simpler and smarter

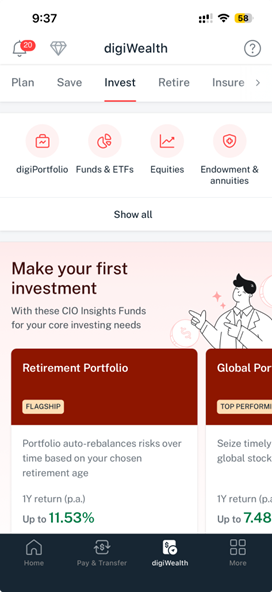

#1 – Access curated funds and DBS managed portfolios through CIO Insights Funds

A key feature within digiWealth is the CIO Insights Funds, a curated shortlist of high-conviction investment ideas selected by DBS’s Chief Investment Office and Fund Selection Team.

Rather than being faced with hundreds of options, you’re presented with a focused set of options across funds and managed portfolios shaped by the DBS CIO team that reflects DBS’s latest research and market views.

What makes this particularly valuable is DBS’s institutional backing behind the selection process.

With decades of experience managing wealth across different market cycles, the same research capability and investment discipline used to advise affluent and private banking clients is now made accessible through digiWealth.

These funds aren’t positioned as “hot picks” or short-term trades.

They’re structured as portfolio building blocks for long-term investing, each with clear explanations of the investment objective and the role the fund plays in a portfolio.

This gives investors a clearer foundation to work from, especially in a market where information overload can make it difficult to decide where to begin.

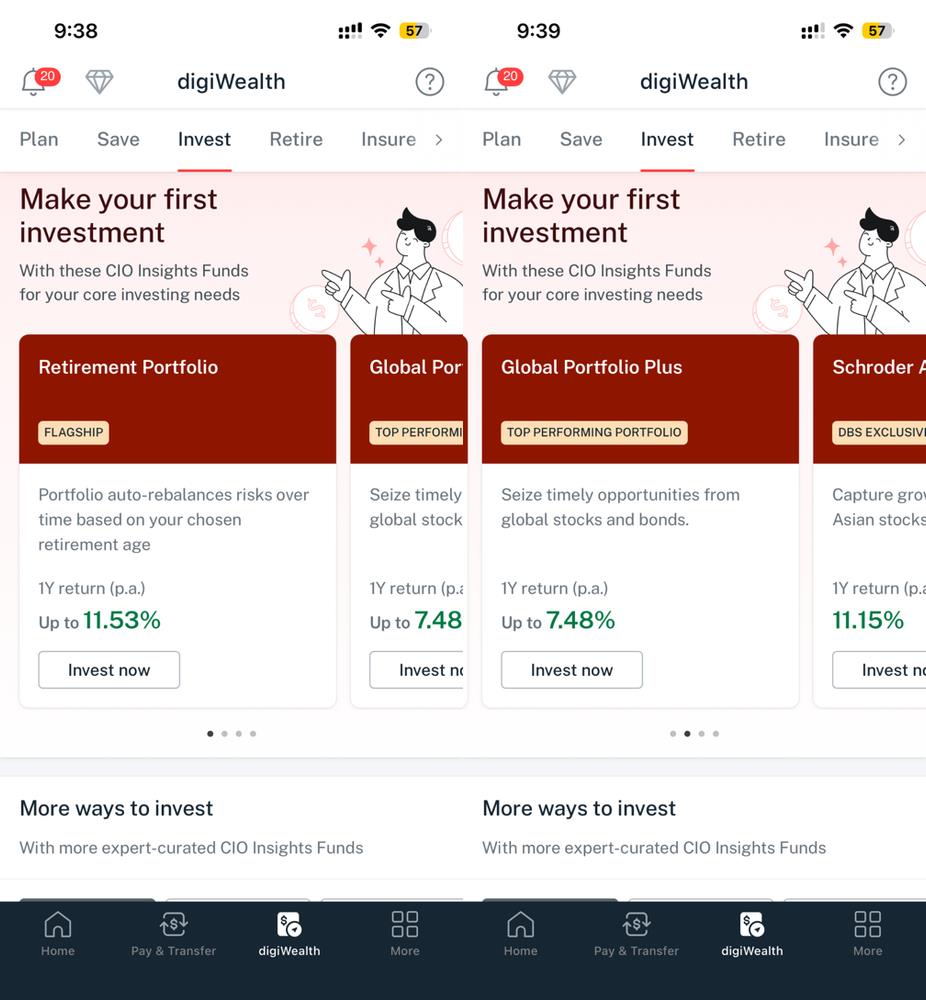

Among the personalised options, some DBS managed portfolios that caught my eye were the Retirement Portfolio, Asia Portfolio, and Global Portfolio Plus portfolios.

Each fund card provides a short description and recent performance, making it easy to interpret at a glance.

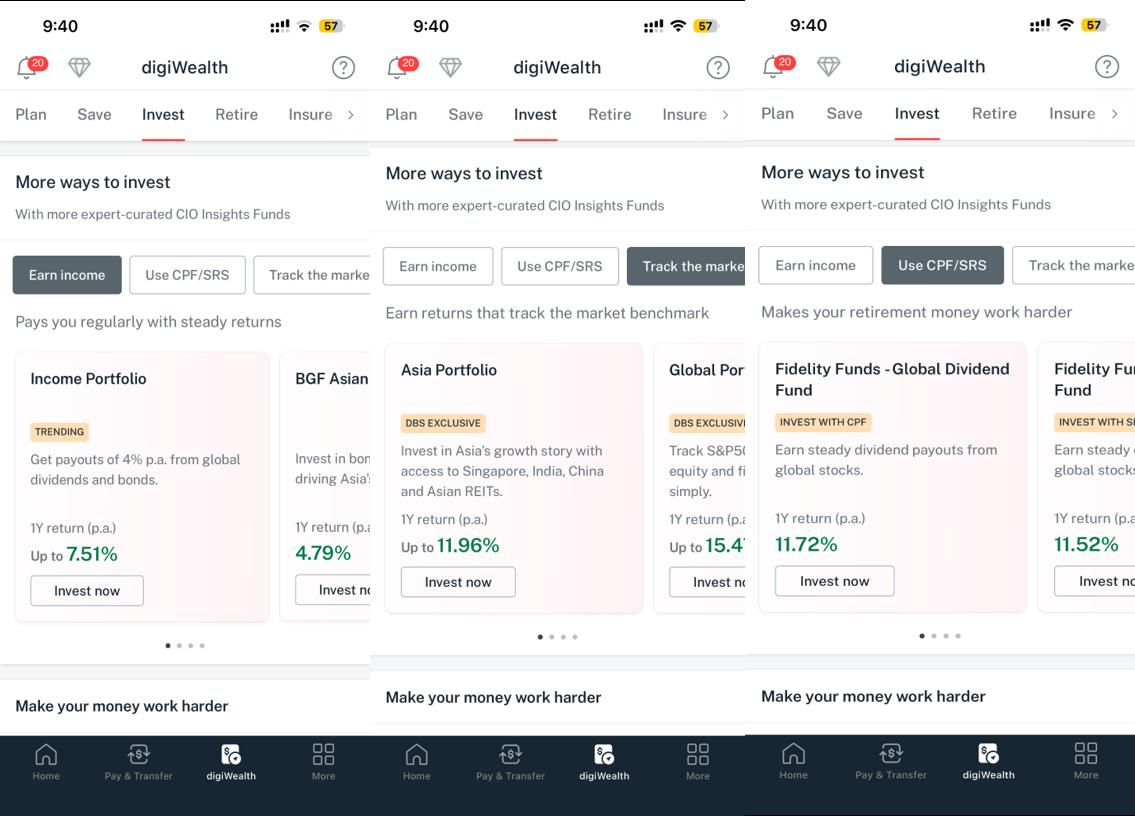

The “More ways to invest” section further suggests options based on your goals, whether you’re investing for long-term growth, after passive income, or using CPF/SRS.

This is supported by the depth of DBS’s internal research, allowing investors to benefit from both expert curation and easy digital access.

Learn more about the CIO Insights Funds here.

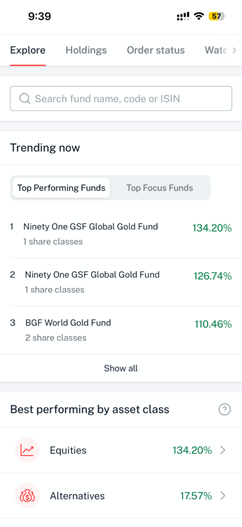

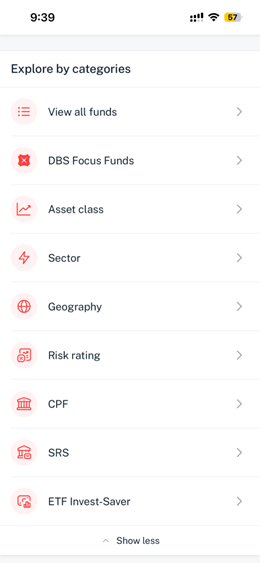

#2 – Explore and compare funds easily

If you’d like to explore beyond the highlighted ideas, you can also explore the entire CIO Insights Funds universe in digiWealth.

You can find funds by name, code, ISIN, or explore trending funds, funds by asset class.

In the Explore tab, you immediately see what’s trending.

Top-performing funds, top focus themes, and even a quick snapshot of which asset classes are doing well right now.

You can even explore funds by category across asset classes, sectors, geographies, CPF, and SRS.

What adds depth to this experience is that the CIO Insights Funds have been through a rigorous selection process by DBS’s Chief Investment Office and Fund Selection Team.

DBS’s research teams analyse fund managers, track records, portfolio construction, and market suitability, and only a small subset makes it into the curated list.

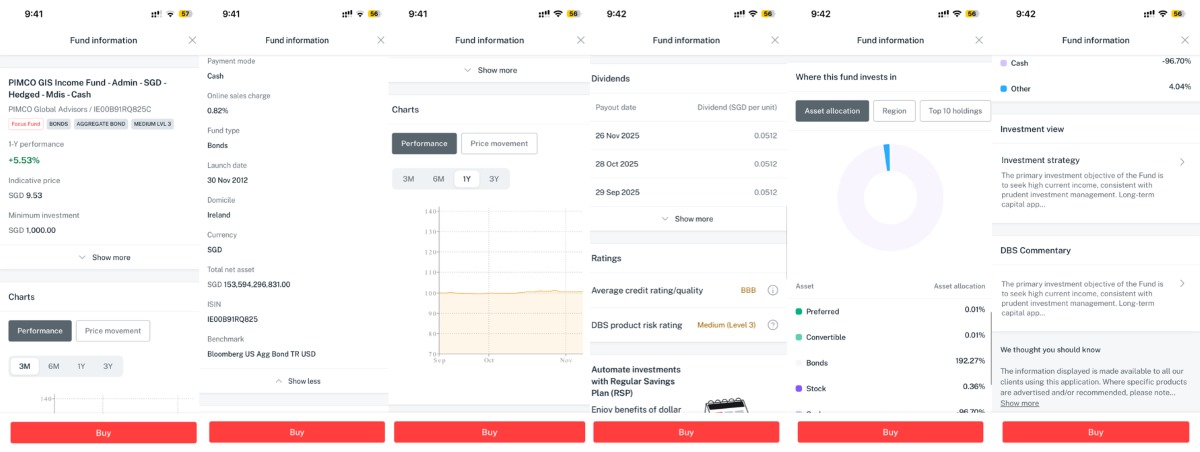

Tapping on a fund brings up a detailed fund page.

The fund detail page shows the fund’s historical performance, dividend payout history, risk ratings, fund documents, fund allocations or top holdings, fund objectives, DBS commentary, and other important information, all laid out clearly.

For DBS managed portfolios, such as the Asia Portfolio, you can even choose your desired risk level and get a projection of your potential returns based on a lump sum or recurring investment

There’s no digging for information, no jumping between different platforms or Googling fund factsheets. Everything loads instantly in a clean, visual format within digiWealth.

You view the exact ETFs inside a portfolio, see the allocations, and quickly understand how diversified the mix is. It makes comparing options feel a lot less overwhelming.

All of this comes together to help you make decisions with clarity.

Whether you’re exploring out of curiosity, researching your next investment, or reviewing your existing positions, digiWealth makes the process feel smoother and more transparent.

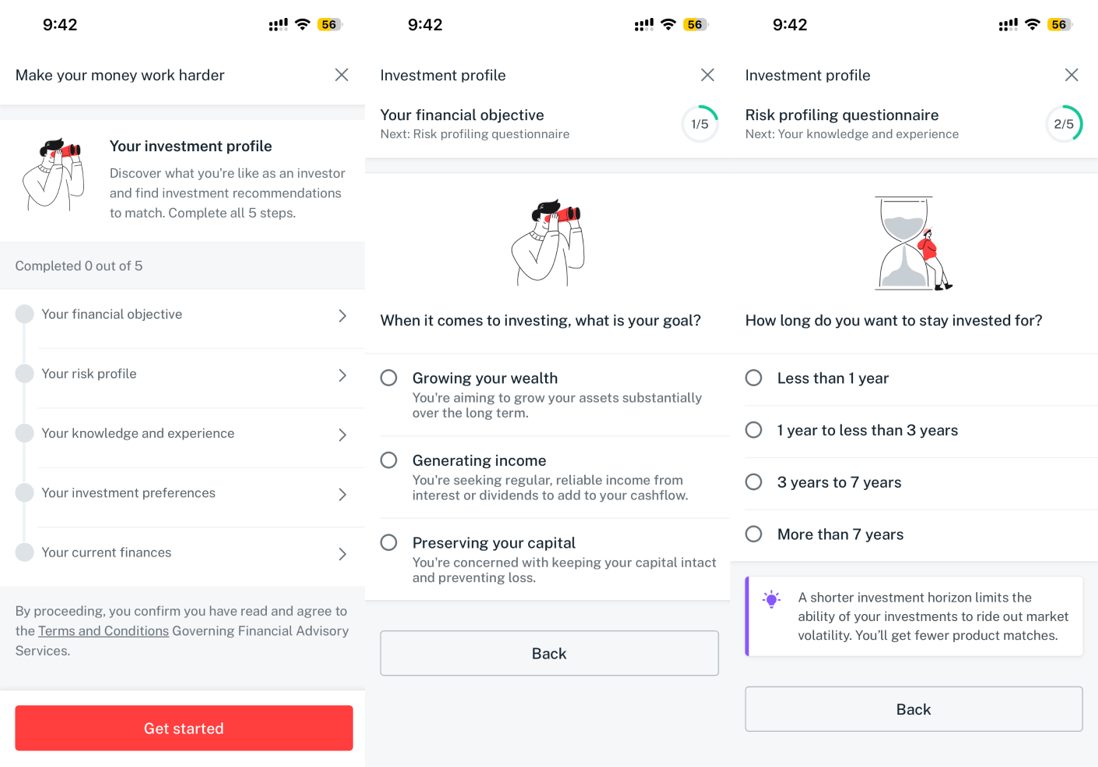

#3 – Personalised recommendations based on your investment profile

If you need more guidance, digiWealth can also tailor recommendations based on your investment profile.

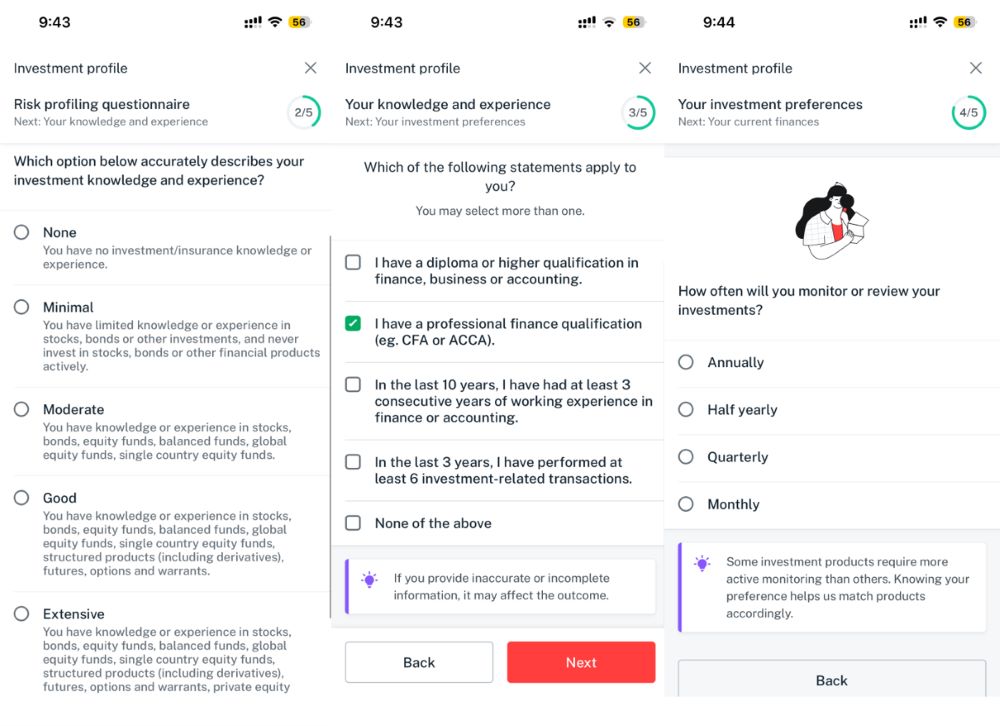

Instead of giving every investor the same list of options, digiWealth walks you through a simple five-step process to understand your objectives, risk tolerance, time horizon, experience, and financial situation, and then curates products that actually fit you.

The entire flow feels like a lightweight version of sitting down with a wealth advisor, but packaged into a clean, guided interface.

What I appreciated is how the app explains why each question matters.

For example, if you select a shorter investment horizon, it immediately reminds you how that may limit the type of products suitable for you.

Once you complete all five sections, digiWealth presents a neat summary page, showing your full profile at a glance.

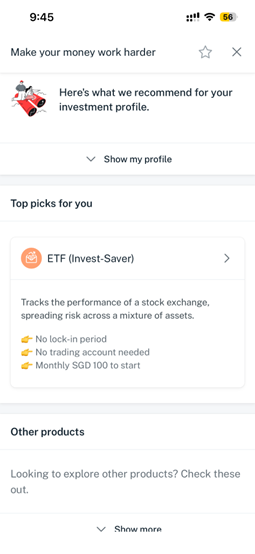

After profiling, the app automatically generates a set of “Top picks for you.”

For example, one of the recommendations was ETF (Invest-Saver), a low-barrier, steady approach for building a portfolio through monthly contributions.

You can always revisit or edit your answers as your financial situation evolves.

If you change your goals, say, you shift from income generation to long-term growth, you can update your profile and receive new product suggestions instantly.

Investors often struggle with the “what should I buy?” question because the market is flooded with too many options.

digiWealth bridges that gap by narrowing the universe into products that match your risk comfort, financial ability, and investment horizon.

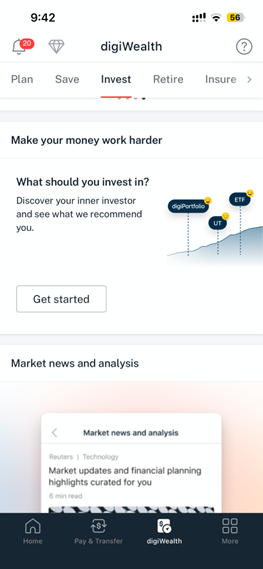

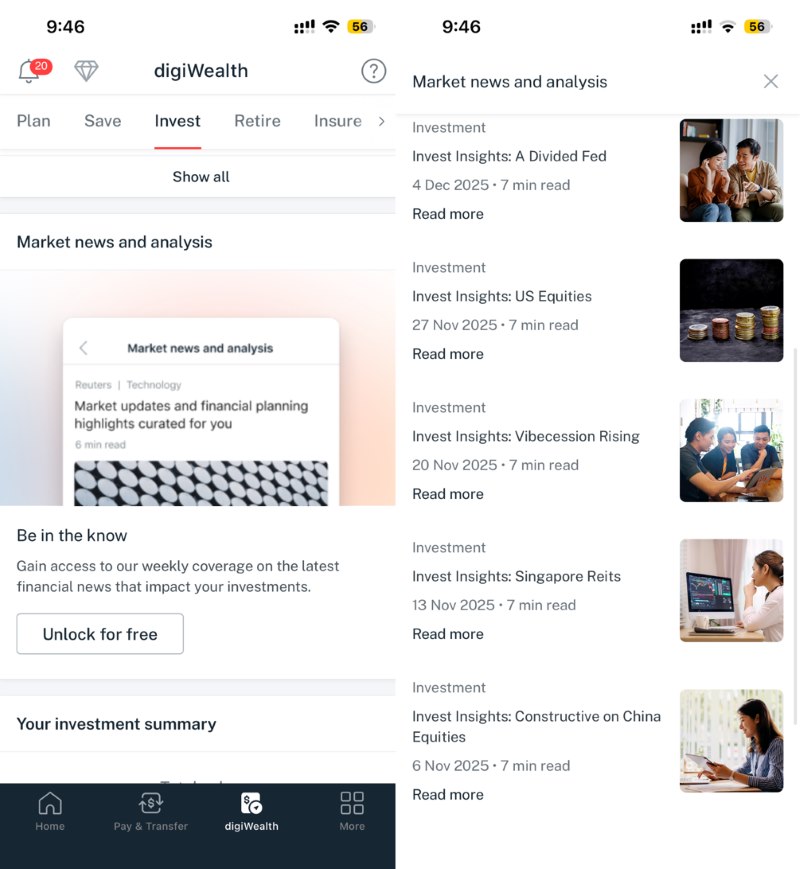

#4 – Insights and research at your fingertips

You can also access market research, expert commentary, and CIO insights within digiWealth.

This section functions like a curated research hub, bringing together articles and market summaries produced by DBS’s Chief Investment Office and research team.

These are the same teams that guide the bank’s broader investment strategy and shape the CIO Insights Funds selection.

For example, the Invest Insights breaks down issues like a divided Federal Reserve, shifts in US equities, and other themes relevant to portfolio construction.

I like to think of it as a mini news feed for investors.

Instead of scrolling through generic financial news, I get to see what DBS’s experts are saying.

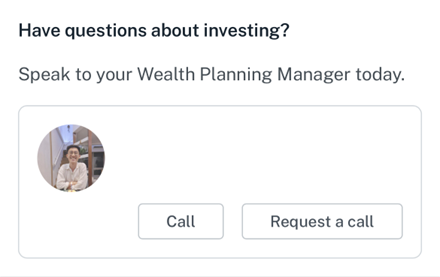

And if I want human guidance for deeper planning or have questions about my portfolio, digiWealth gives me immediate direct access to a Wealth Planning Manager (WPM).

In the past, advisory support was exclusively provided to private banking and high-net-worth customers.

But now, every DBS customer will have a representative that they can request a call with right from the app.

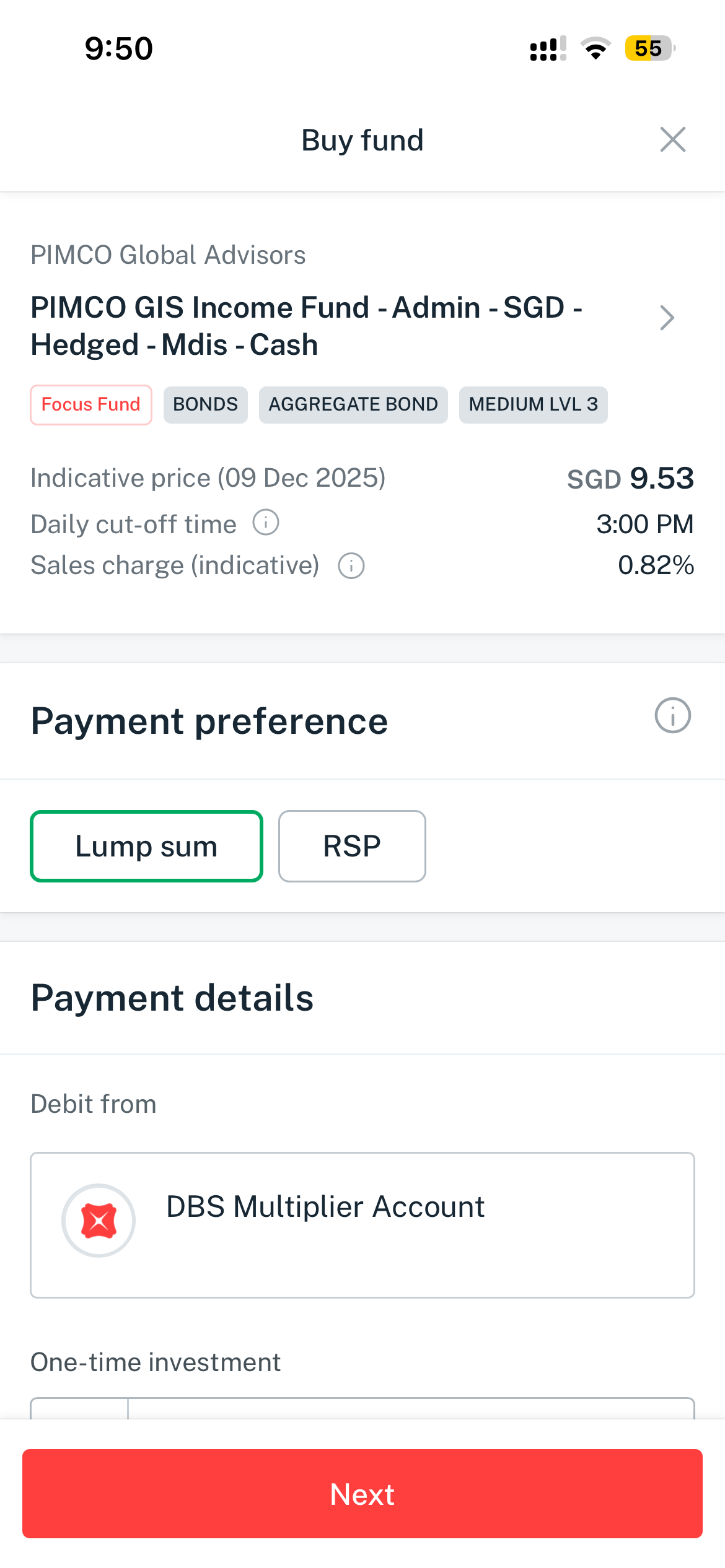

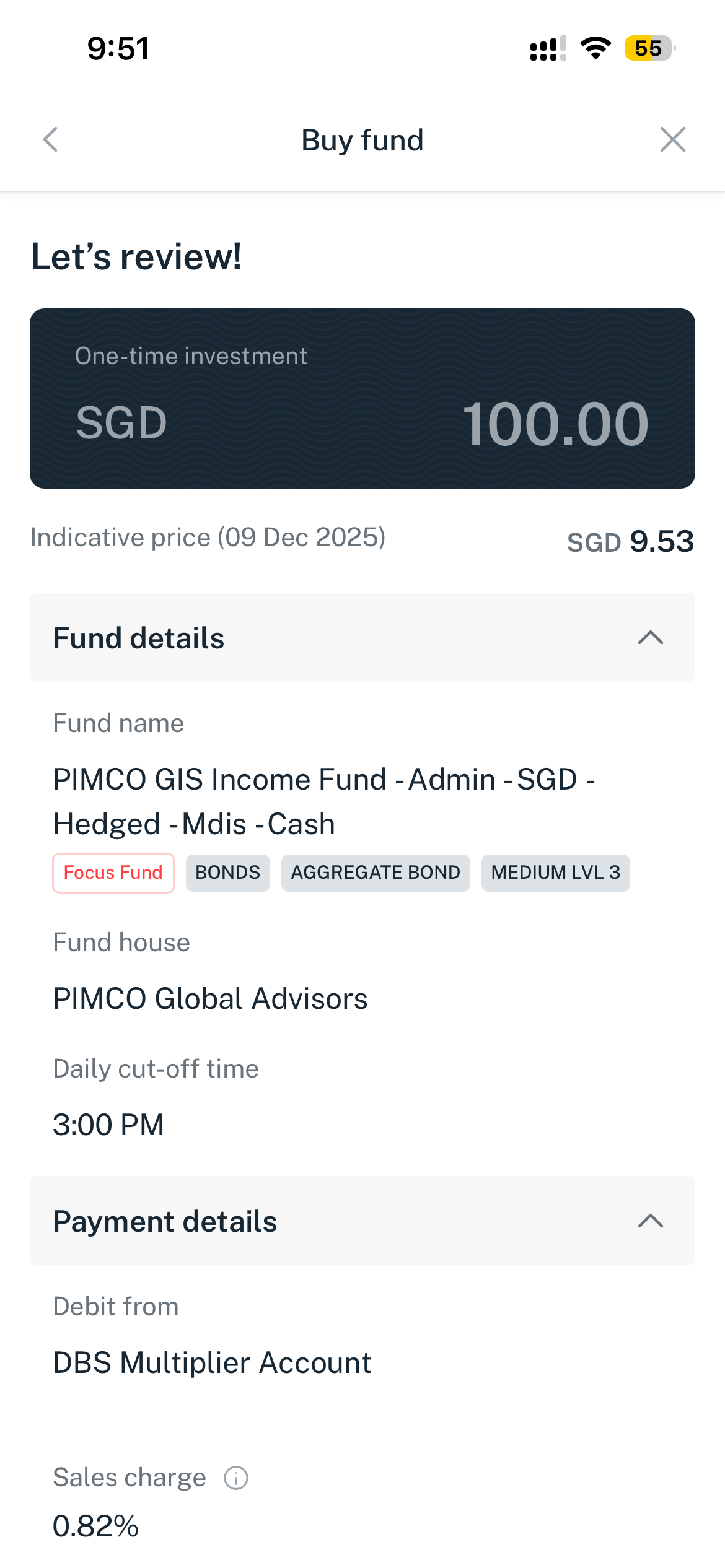

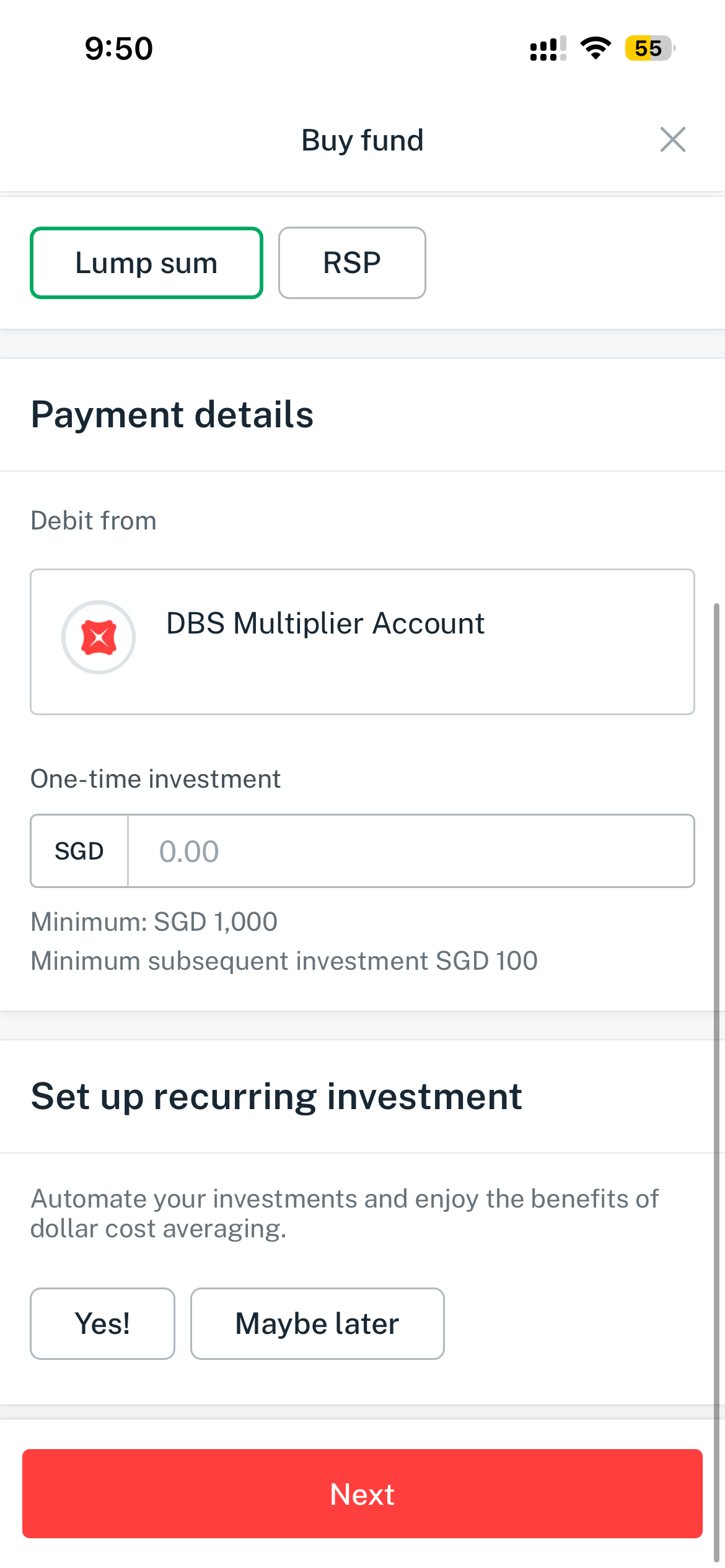

#5 – Easily invest from just S$100

One of the most convenient parts about investing through DBS digiWealth is how seamlessly it ties into your existing savings accounts in digibank.

When you decide to buy a fund, you can debit the investment directly from your DBS Multiplier Account, without needing any top-ups or transfers.

Pro tip: You also get to maximise your interest on your Multiplier account when you invest in funds through digiWealthdigiWealth

From the fund screen, just select “Lump sum” and enter your investment amount.

The minimum subsequent investment starts from just S$100, making it easy for beginners to get started.

Your linked savings account will be shown clearly, so you’ll always know exactly where the funds are coming from.

And if you'd like to build the habit of investing regularly, digiWealth also lets you set up a Recurring Investment Plan (RSP) with one tap.

For the entirety of 2026, you can enjoy $0 fees on RSPs set up for investments into any products from the CIO Insights Funds list.

Simply choose “Yes!” when prompted, and your investment will be automated every month.

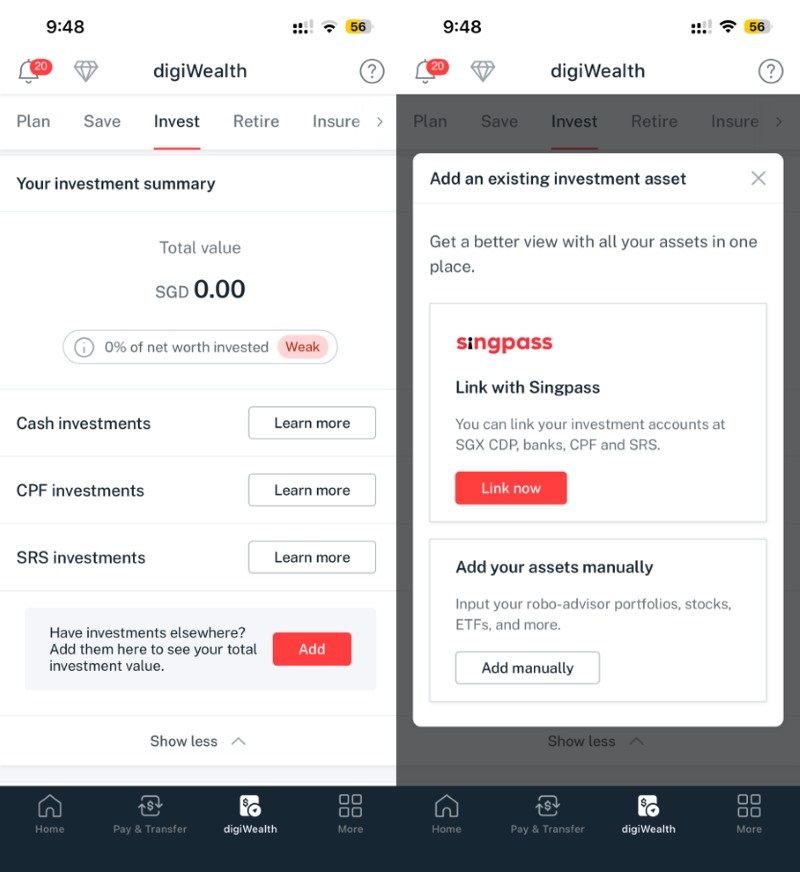

#6 – View all your investments in one place

Keeping track of your wealth often means juggling multiple accounts, CPF, SRS, CDP, insurance-linked portfolios, robo-advisors, and your bank accounts.

With digiWealth, you can see everything in one place.

From your investment summary dashboard, you’ll get an instant view of your total investable assets across cash, CPF and SRS.

And if you have investments held elsewhere, you can easily pull them in.

With just a tap, you can:

- Link your external investment accounts via Singpass, including SGX CDP, banks, CPF and SRS

- Add portfolios manually, such as robo-advisors, ETFs, insurance savings plans or overseas brokerage holdings

Having a consolidated view helps you understand how much of your net worth is actually invested, whether you're too concentrated in certain asset classes, and where there may be gaps in your long-term plan.

It becomes much easier to rebalance, track progress, and stay disciplined.

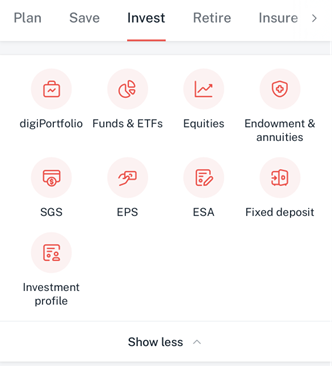

And if you want to invest in other products such as endowments and annuities, and SGS securities like T-bills, or stocks through DBS Vickers, you can easily access those instruments in the top menu on the Invest tab.

What would Beansprout do?

digiWealth can be a useful tool for people who want a more holistic and structured way to manage their wealth holistically across investments and insurance.

The CIO Insights Funds, curated through DBS’s institutional research and CIO team, offer a more focused set of ideas compared with browsing hundreds of choices on your own.

This can be especially helpful if you want options that have undergone a rigorous research and screening process and are backed by a trusted institution.

The ability to start investing from just S$100, track everything in one place, and contact your WPM directly and immediately for advisory support from the app also removes much of the friction that comes with complex financial decisions.

If you're building your first portfolio, you can choose from one of DBS’ managed portfolios or invest in one of the curated funds in the CIO Insights Funds universe, which is a straightforward starting point backed by DBS’s research team.

And if you are already investing, the ability to invest, consolidate, and monitor your holdings, including CPF and SRS, within digiWealth can help you stay more disciplined over time.

Grow your wealth with DBS. Alternatively, learn more here.

Important Information

The article herein is published by Beansprout and is for general information only and should not be relied upon as financial advice. This article may not be reproduced, reposted or communicated to any other person without the prior written permission from DBS Bank.

This information does not take into account the specific investment objectives, financial situation or needs of any particular person. Before entering into any transaction involving any product mentioned in this information, where applicable, you should seek advice from a financial adviser regarding its suitability for your own objectives and circumstances. If you choose not to do so, you should make an independent assessment and do your own due diligence on the product.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The information herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation.

DBS Bank, its related companies, their directors and/ or employees may have positions or other interests in, and may effect transactions in the product(s) mentioned in this article. DBS Bank may have alliances or other contractual agreements with the provider(s) of the product(s) to market or sell its product(s). Where DBS Bank’s related company is the product provider, such related company may be receiving fees from investors. In addition, DBS Bank, its related companies, their directors and/ or employees may also perform or seek to perform broking, investment banking and other banking or financial services for these product providers.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment.

Any past performance, prediction, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

0 questions