DBS profit falls 10% but dividend higher in 4Q25: Our Quick Take

Stocks

By Gerald Wong, CFA • 09 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

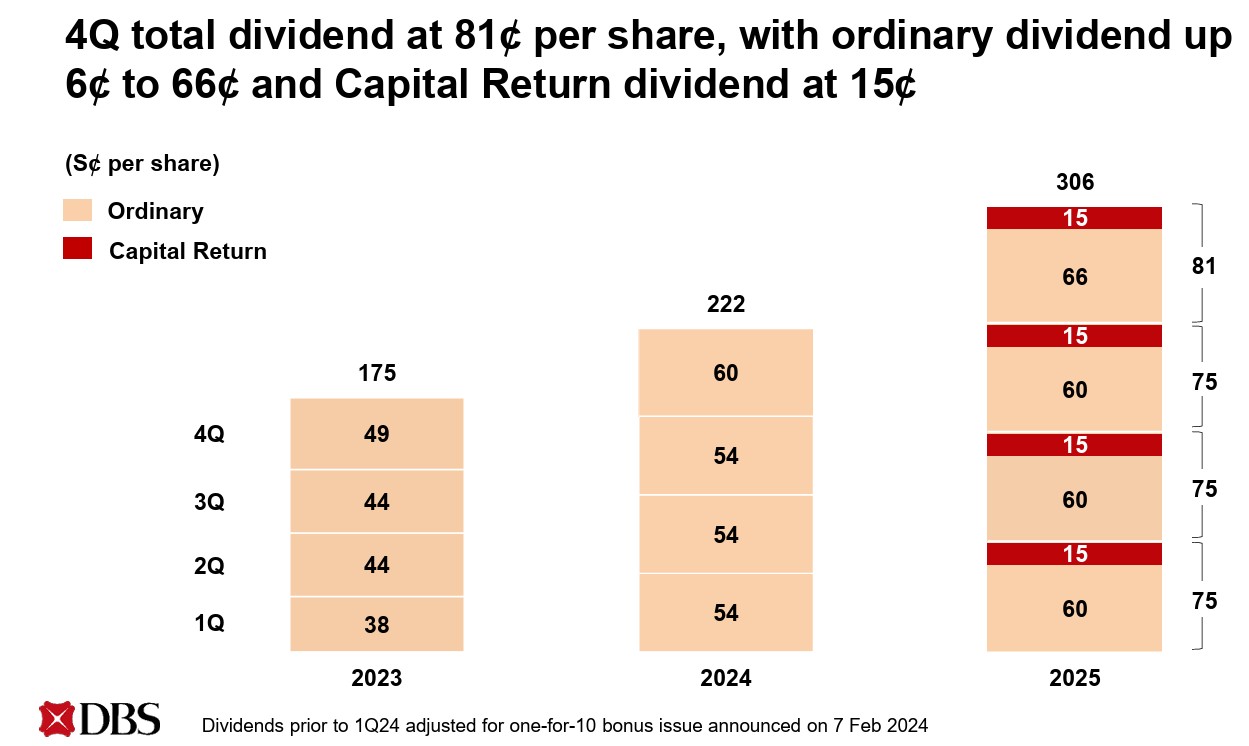

DBS reported a 10% drop in profit but raised its 4Q25 ordinary dividend by 10% to S$0.66, alongside a S$0.15 capital return, bringing total dividends to S$0.81.

DBS 4Q25 earnings and dividend highlights

DBS has announced its earnings for fourth quarter of 2025. Key highlights include:

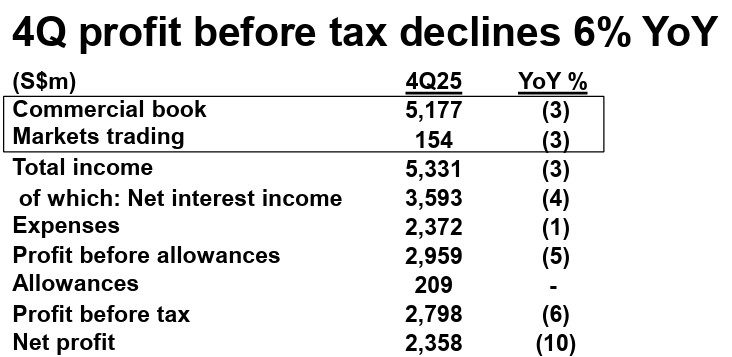

- Q4 2025 pre-tax profit: SGD 2.80 billion (-6% year-over-year)

- Q4 2025 net profit: SGD 2.36 billion (-10% year-over-year)

- FY2025 profit: SGD 11.0 billion (-3% year-over-year)

- Final dividend of 66 cents per share for 4Q 2025

- Capital Return dividend of 15 cents per share for 4Q 2025

What we learnt from DBS 4Q25 earnings

#1 - Net interest income declined

4Q25 net profit declined 10% year-on-year to $2.36 billion, as rate headwinds, higher tax expenses and the absence of non-recurring gains booked a year ago more than offset stronger fee income and treasury customer sales.

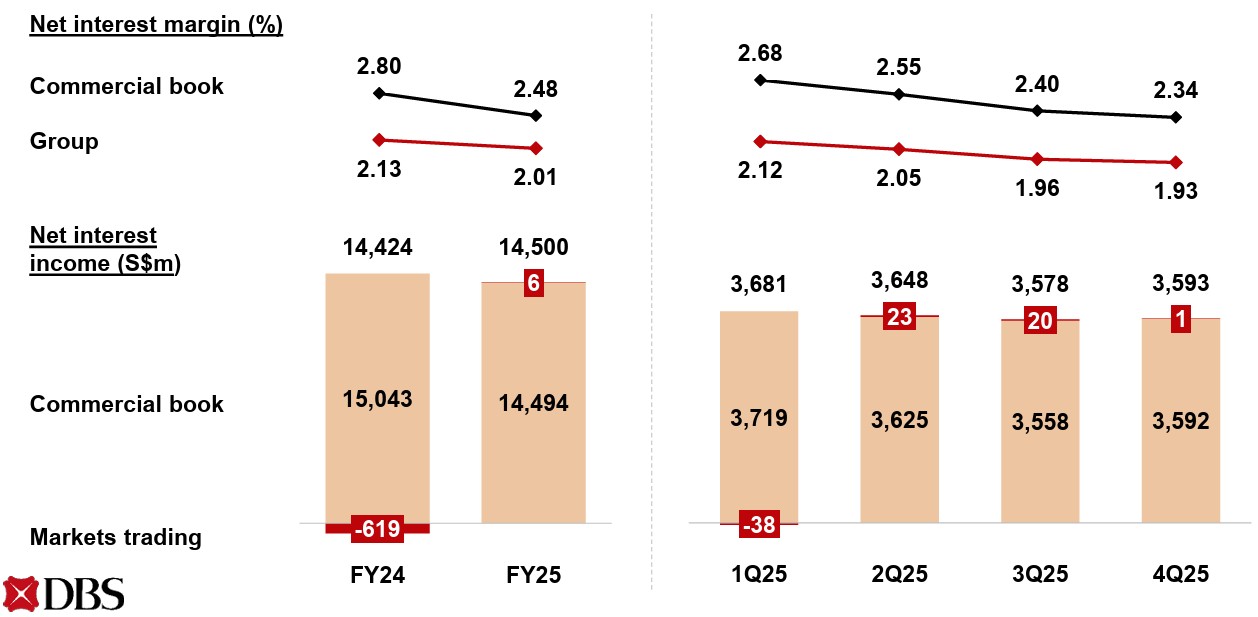

Group net interest income fell 4% YoY to S$3.59bn in 4Q25, driven by a 0.22% net interest margin (NIM) compression to 1.93% amid lower interest rates and a stronger Singapore dollar. Within the commercial book, net interest income (NII) declined 6% on the same NIM-driven pressure.

Loans grew S$24 billion (+6% YoY) in constant-currency terms to S$451 billion, driven by broad-based growth in corporate and wealth management loans.

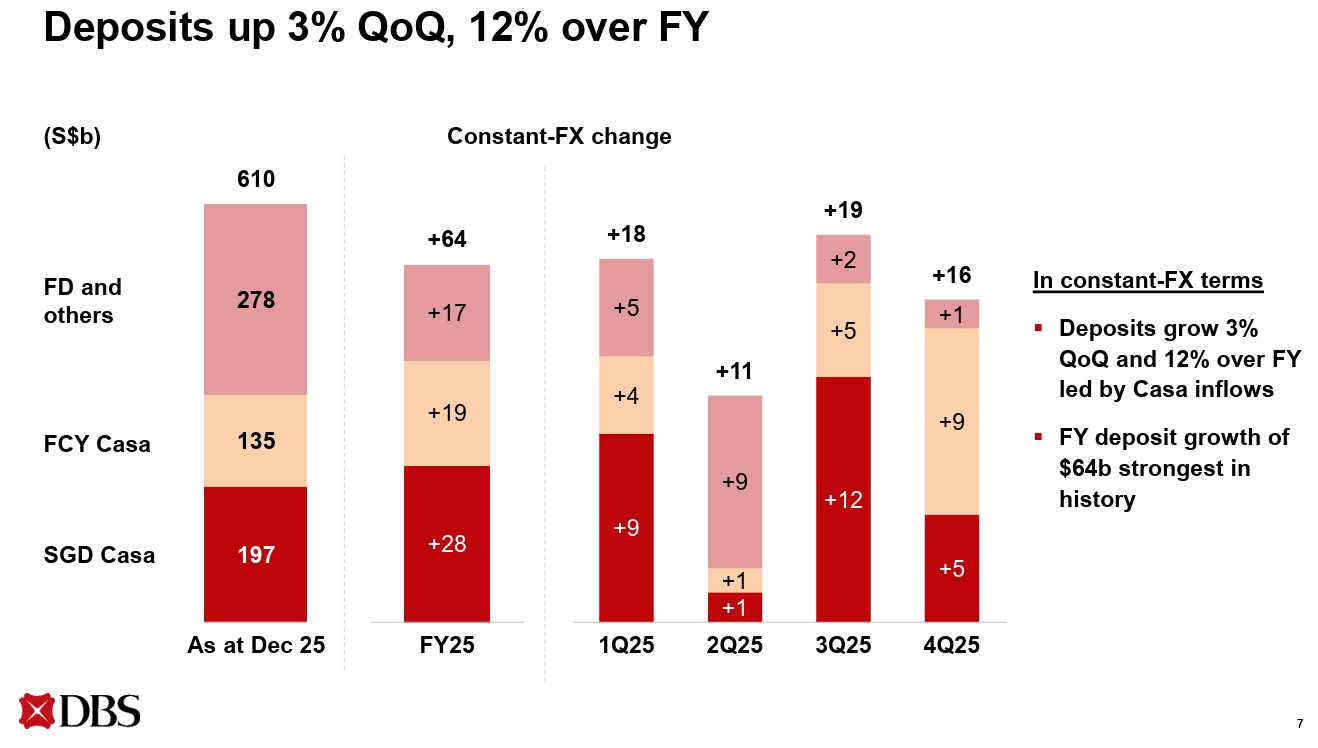

Deposits rose S$64 billion (+12% YoY) to S$610 billion, the largest absolute increase in the bank’s history, driven predominantly by CASA, which accounted for over two-thirds of the growth.

The surplus liquidity was channelled into liquid assets, which lifted overall net interest income and return on equity, though it modestly compressed net interest margin.

#2 - Fee income growth supported by strength in wealth management

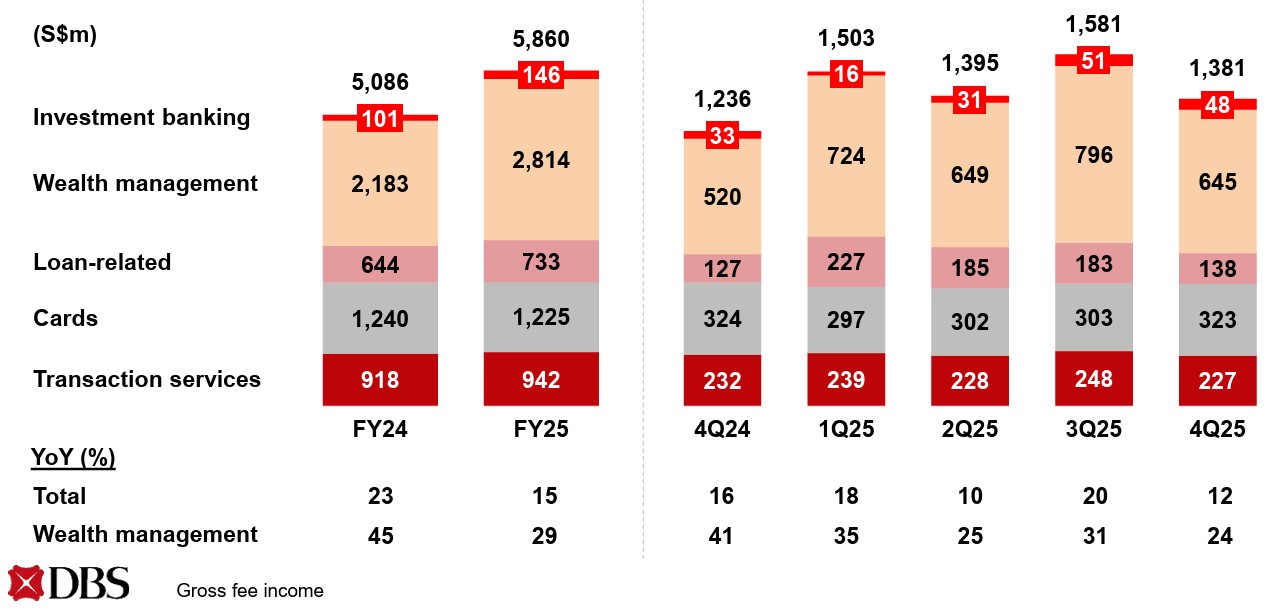

Offsetting the weakness in net interest income, DBS' commercial book net fee income rose 14% to S$1.10bn in 4Q25, led by stronger wealth management, with investment banking and loan-related fees also higher.

Wealth management fees led the growth, up 24% to S$645 million from growth in investment products and bancassurance solutions.

Investment banking fees also jumped 45% YoY, while loan-related fees was up 9% YoY.

#3 - Non-performing loan ratio stable, but specific allowances rose

DBS' non-performing loan (NPL) ratio remained stable at 1.0%.

However, specific allowances rose to S$415m in 4Q, driven largely by real estate-related exposures.

General allowances of S$206m were written back, including the release of provisions that had previously been set aside for those exposures.

#4 - Ordinary dividend raised

The board proposed an ordinary of SGD 66 cents per share and a Capital Return dividend of SGD 15 cents per share for 4Q 2025, translating to a total FY 2025 dividend of S$3.06 per share, a 38% increase over the previous year.

Management reaffirmed that the capital return dividend of 15 cents per quarter will be maintained through 2026 and 2027.

#5 - FY2026 total income to to be broadly in line with 2025

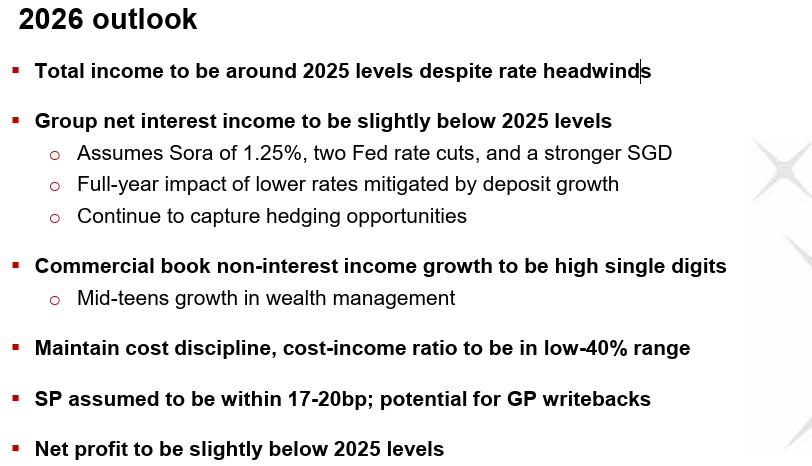

DBS expects FY2026 total income to to be broadly in line with 2025 despite continued rate headwinds, while group net interest income is likely to come in slightly below prior-year levels.

This outlook assumes SORA at around 1.25%, two Fed rate cuts and a stronger Singapore dollar, with the full-year impact of lower rates partially mitigated by deposit growth and ongoing hedging activities.

Commercial book non-interest income is expected to grow at high single-digit rates, underpinned by mid-teens growth in wealth management.

The group intends to maintain cost discipline, keeping the cost-income ratio in the low-40% range. Specific provisions are assumed at 17–20bp, with potential for general provision write-backs, while net profit is expected to be slightly below 2025 levels.

Beansprout’s Quick Take on DBS earnings

DBS' share price declined about 1% after reporting a decline of 10% in 4Q25 net profit as higher specific allowances and lower net interest income was offset by stronger fee income.

Looking ahead, management expects DBS expects FY2026 total income to to be broadly in line with 2025 despite continued rate headwinds, with group net interest income likely to come in slightly below 2025 levels.

DBS declared a 4Q total dividend of 81 cents, which brings annualised total dividend per share going forward to $3.24, implying a dividend yield of 5.5% based on the closing price of S$59.30 (as of 6 Feb 2026).

The dividend yield of 5.5% may help to cushion downside, even as its total income is expected to stay broadly flat in 2026 compared to 2025.

DBS currently trades at a price-to-book valuation of 2.5x, above its historical average of 1.2x.

Related links:

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in DBS.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments