DBS Multiplier Review: Is it a competitive savings account?

Savings, Savings Account

By Beansprout • 02 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The DBS Multiplier account has been made simpler to allow you to earn a bonus interest rate with a lower monthly transaction amount from August 2023.

What happened?

We’ve continued receiving questions about how interest is calculated on the DBS Multiplier account, and since the changes introduced on 1 August 2023, things have become much simpler.

Even in 2026, you can still earn up to 4.1% p.a. interest on your savings. The key updates made back in 2023 remain in effect today and have made the account more accessible to a wider range of users.

Here’s a quick refresher on what changed:

- Eligible transaction amount lowered from S$2,000 to S$500

- More ways to meet the 'Income' category

- More ways to meet the 'Spend' category

- Streamlined interest rate tiers (earn more, with less effort)

- Higher bonus interest even without income (for those 29 and below)

These updates continue to benefit university students, NSFs, first jobbers, gig workers, and even retirees.

You can also get up to S$588 in combined rewards when you credit your salary, pay your taxes via GIRO, open and contribute to a Supplementary Retirement Scheme (SRS) account, and sign up for the DBS yuu Card.

Read on to find out how you can still make the most of the DBS Multiplier account in 2026!

How does DBS Multiplier work?

To earn a higher interest on DBS Multiplier, you will need to credit your salary or dividends.

You will also earn a bonus interest when you take up more product categories with DBS/POSB.

The more product categories you transact with, the higher bonus interest you can potentially earn with the DBS Multiplier account.

These product categories would include:

- Spending on eligible credit cards or PayLah retail spend

- Purchase of eligible insurance product

- Purchase of eligible investment product

- Taking a home loan

What is the current interest rate of DBS Multiplier?

The interest rate you will earn for the DBS Multiplier account is based on total eligible transactions per month.

The higher value of your transactions, the higher the interest rate you will earn.

Let's take a look at how the interest is calculated for Option 1, where your eligible transactions add up to more than S$500 monthly.

For example, if you credit your salary, hit one category and have a monthly eligible transaction value of S$500 to S$15,000 you will earn an interest rate of 1.8% per annum on your first S$50,000.

If you credit your salary, hit two categories and have a monthly eligible transaction value of S$500 to S$15,000, you will earn an interest rate of 2.1% per annum on your first $100,000.

If you are able to transact in 2 categories and have a monthly transaction value of S$30,000 or more, you would be able to earn an interest rate of 3.0% per annum on your first S$100,000.

If you credit your salary, hit three categories and have a monthly eligible transaction value of above $30,000, you can unlock the highest bonus interest rate tier of 4.1% per annum on your first $100,000.

What are the latest DBS Multiplier promotions?

DBS is currently running a salary‑crediting promotion that allows customers to earn extra cash rewards on top of the standard Multiplier account interest rates.

The promotion is only open to those who did not have a salary‑crediting arrangement linked to a POSB/DBS account in 2025.

To qualify, you need to register for the promotion and credit a minimum of S$1,600 of your salary each month (or S$500 for full-time National Servicemen) into a DBS/POSB account for four consecutive months. Successfully doing so will earn you a cash reward of S$250, provided your first salary credit is made by 31 October 2026.

There are also ways to boost your rewards further.

You can earn up to an additional S$50 by paying your taxes via GIRO or by opening and contributing to a Supplementary Retirement Scheme (SRS) account.

You can read up on the T&C here.

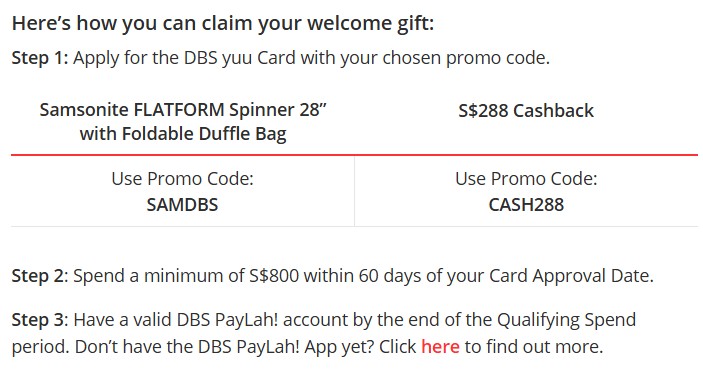

On top of the salary‑crediting promotion, DBS is offering a separate campaign for new DBS yuu Card applicants.

If you apply for a DBS yuu Card by 12 May 2026, you can choose between:

- Samsonite 28” luggage set (Samsonite FLATFORM Spinner 28” + Foldable Duffle Bag, worth S$740), using the promo code SAMDBS, or

- Up to S$288 cashback, using the use promo code CASH288.

This offer is for new to DBS/POSB credit card customers, meaning those who do not currently hold any principal DBS/POSB credit card and have not cancelled one in the past 12 months.

To receive the cashback, you need to spend at least S$800 within 60 days of card approval and have a valid DBS PayLah! account by the end of the qualifying spend period.

Beyond the sign-up rewards, the DBS yuu Card also lets you earn up to 18% cashback on everyday spending at Cold Storage, Giant, foodpanda, SimplyGo, and more.

You can find the promotion details and full terms and conditions here.

What is the advantage of DBS Multiplier?

The good thing about the DBS multiplier account is that you may find it easy to hit 2 out of 4 categories if you bank with them - you can spend using their credit card and have a home loan instalment plan with them.

Also, there is no minimum amount needed across all the transaction categories to unlock the bonus interest rate.

This means that you will still be able to hit the credit card category even if you only have a low spending on your credit card. You can make it up for the minimum total transaction value of $500 monthly through other categories, such as home loan.

With the changes effective from 1 August 2023, there are now more ways to meet 'Income' category, including:

- Salary credited via GIRO, FAST, or PayNow (Was limited to GIRO previously)

- Dividends credited via GIRO, FAST or PayNow

- Annuities from CPF or SRS are also recognised

What is the disadvantage of DBS Multiplier?

To earn the highest tier of interest rate on the DBS Multiplier Account, you will need to hit 3 or more categories.

The two categories that are harder to meet are insurance and investments, and the financial products you buy will only qualify for 12 months of bonus interest.

However, the silver lining is that there is no minimum purchase amount for each financial product.

For me, I do not invest using DBS Vickers nor do I purchase insurance for them. At best, my transaction value will fall between the $500 to $15,000 category and the interest rate I can earn on the first $100,000 is 2.1% per annum.

What are the requirements of the DBS Multiplier account?

To qualify for a DBS Multiplier account, you must fulfill the following requirements.

- You must be at least 18 years of age.

- No initial deposit required.

- Service charge of S$5 per month applies if your average daily balance falls below S$3,000. This service charge will be waived if you are 29 years old or below, or DBS Multiplier is your first DBS/POSB account (online applications only).

You can read the full terms and conditions here.

What is the interest rate I would earn on the DBS Multiplier account if I am not able to credit my salary?

If you are 29 years and below, you can still earn an interest rate of 1.50% per annum on your first S$50,000 with any credit card or PayLah! Retail spend.

Example #1 - University student who does not credit her salary

Using the example of Andrea, who is a 21 years old full time student who spends S$100 through PayLah.

This means that Andrea is able to earn an interest rate of 1.50% per annum on her first S$50,000 of deposits. When she credits her income through internship of $500 or more a month, she would be able to earn a higher interest rate of 1.80% per annum.

Example #2 - Retiree with no salary

Using the example of Philip, a retiree who receives his CPF LIFE monthly payouts through DBS and transacts using DBS PayLah!, he is still able to earn an interest rate of 1.80% per annum on his first S$50,000 in the DBS Multiplier account.

DBS Multiplier vs UOB One vs OCBC 360 – Which is the best savings account in Singapore?

Many are revisiting their savings strategies recently, especially as interest rates have started to trend lower and banks have made tweaks to their flagship accounts.

Since the DBS Multiplier account was simplified back in August 2023, it’s become a strong contender for those who want to earn bonus interest with less effort. But how does it compare today against the UOB One and OCBC 360 accounts?

To help you figure that out, we’ve done the math—based on the following assumptions:

- You credit your monthly salary into the account

- You save and spend at least S$500 per month

- You meet the credit card spending requirements

- You do not purchase insurance or investment products from the bank

Based on these criteria, we’ve compared the potential interest rates across different savings balances to see which account offers the best rates.

| Account monthly average balance | Maximum effective interest rate (per annum) | Winner |

| First $75,000 |

| OCBC 360 |

More than S$75,000 Less than $100,000 |

| OCBC 360 |

More than $100,000 Less than $150,000 |

| UOB One |

More than $150,000 Less than $250,000 |

| UOB One |

| $250,000 and above |

| OCBC 360 |

| Source: Various bank websites, Beansprout Compare Savings Accounts tool, as of 2 January 2026 | ||

The table above applies to existing DBS Multiplier customers.

What would Beansprout do?

The DBS Multiplier account offers a bonus interest rate when you carry out multiple transactions with the bank.

If you already have an existing account with DBS, you may find it easy to hit 2 out of 4 categories through your DBS/POSB credit card and have a home loan with them.

However, if you do not invest or insure with DBS, then you might find it difficult to unlock the highest tier of interest rates.

The good thing is that there is no minimum amount needed across all the transaction categories to unlock the bonus interest rate.

We are also pleased to see that the eligible transaction amount has been lowered from $2,000 to $500, and that there are more ways to meet 'Income' category.

To find out how DBS Multiplier account compares to other savings account in Singapore, check out our guide to the best savings accounts in Singapore.

To find out other ways to make your savings work hard, check out our guide to best ways to earn a passive income in Singapore.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Find out which savings account allows you to earn the highest interest rate on your savings.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

3 questions

- Thomas Chua • 29 Nov 2025 08:29 AM

- Terry • 12 Jul 2025 05:06 AM

- gen • 07 Nov 2024 03:49 AM

- JD • 05 Dec 2024 09:03 AM