DBS Multiplier Promo: Earn up to 2.5% p.a. and S$680 cash rewards

Savings

Powered by

By Nicole Ng • 02 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

New DBS Multiplier customers can earn up to 2.5% p.a. on your first S$100,000! Plus, get up to S$680 cash rewards by crediting your salary and signing up for a DBS yuu Card.

This post was created in partnership with DBS. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What’s the deal with the DBS New-to-Multiplier promo?

Lately, I have noticed more Singaporeans looking for ways to grow their savings.

DBS has launched a New-to-DBS Multiplier Account promotion, where new DBS Multiplier customers can earn more interest on their savings.

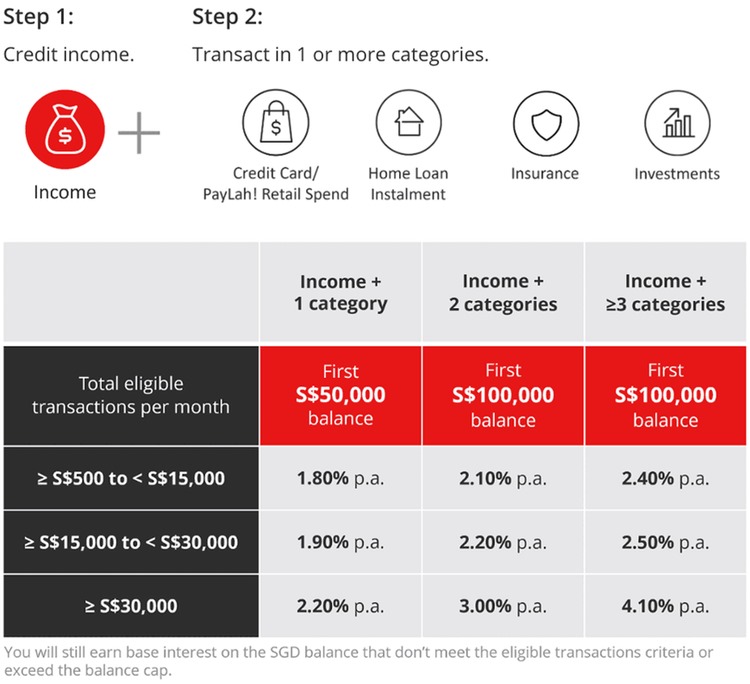

Here’s how it works:

- Earn up to 2.5% p.a. on your first S$100,000 when you credit your salary and transact in just one category, such as DBS/POSB Credit Card/PayLah! Retail Spend, Home Loan Instalment, Insurance or Investment.

- And get up to S$680 in cash rewards when you credit your salary and apply for the DBS yuu Card.

This promotion is only available to customers who:

- Open a new DBS Multiplier Account between 1 September and 31 December 2025, and

- Have not closed a Multiplier Account between 1 January and 31 August 2025

Let’s break down how this promotion works and how you can stack the benefits to make your money work harder.

How does the DBS New-to-Multiplier promotion work?

The DBS Multiplier lets you earn higher interest on your savings when you credit your salary and transact across more DBS/POSB product categories each month.

The more product categories you use, and the higher your total eligible monthly transactions, the higher the bonus interest rate you can earn.

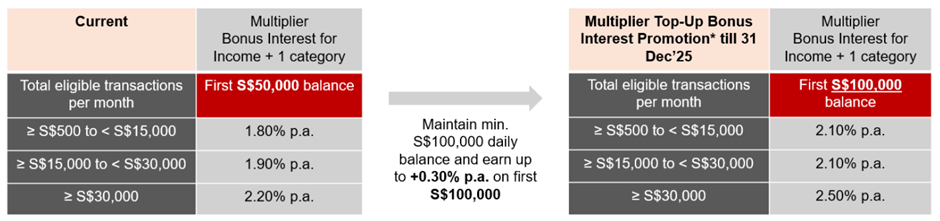

With the existing regular DBS Multiplier Account tiers, you would earn up to 2.20% p.a. on just the first S$50,000 of your balance if you are able to meet one category.

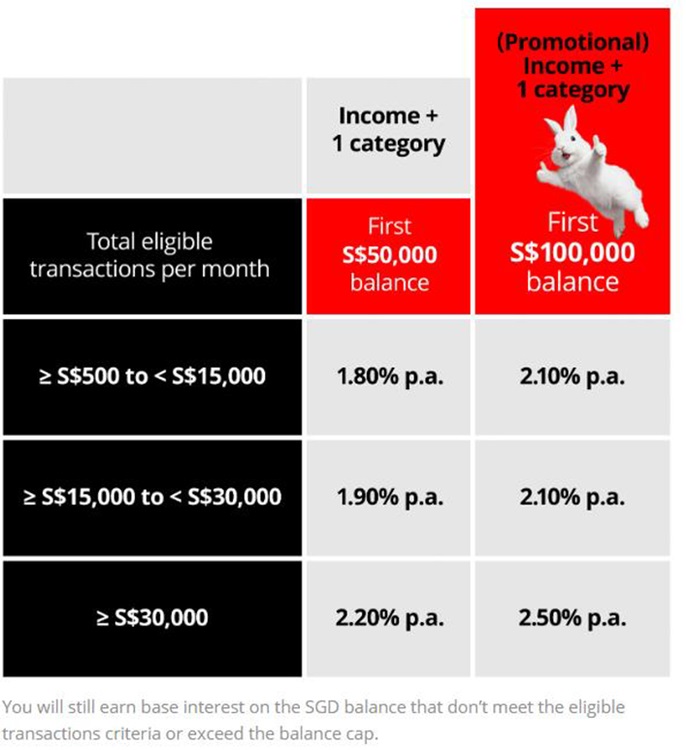

But with the DBS New-to-Multiplier promotion, you can now earn up to 2.50% p.a. on the first S$100,000 in your DBS Multiplier Account, while still transacting in just one eligible category each month, from 1 September to 31 December 2025.

This promotional rate gives you up to an additional 0.30% p.a. and doubles the balance eligible for higher interest from S$50,000 to S$100,000.

To qualify for the DBS New-to-Multiplier promotion, you’ll need to:

- Open a DBS Multiplier Account as a new customer

- Deposit fresh funds and maintain a daily balance of at least S$100,000 during the promotion period.

- Credit your salary via GIRO

- Make transactions in at least one eligible category such as DBS/POSB Credit Card/PayLah! Retail Spend, Insurance, Investments, or Home Loan Instalment.

Your total eligible monthly transactions will determine which promotional tier you fall under. The more you transact, the higher your interest rate.

You can find the full terms and conditions of the promotion here.

How the interest is paid out

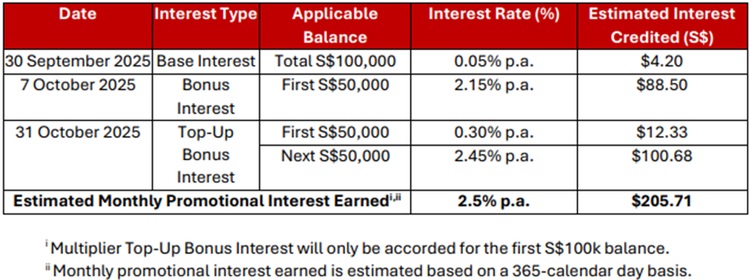

The interest from this promotion isn’t credited all at once. Instead, it’s spread out over the following month in three parts, once you’ve met the eligibility criteria.

Here’s an example based on a daily balance of S$100,000, with income credited, spending in one category, and S$30,000 of eligible transactions in September 2025:

- 30 September 2025 – You’ll first receive the base interest of 0.05% p.a. on the full S$100,000.

- 7 October 2025 – The first bonus interest of 2.15% p.a. is credited on the first S$50,000.

- By 31 October 2025 – The final bonus interest is credited: 0.30% p.a. on the first S$50,000 and 2.45% p.a. on the next S$50,000.

When added up, this gives you the full advertised rate of 2.50% p.a. on your savings.

Up to S$680 Cash Rewards for Salary Credit and New DBS yuu Card sign-ups for new and existing DBS Multiplier customers

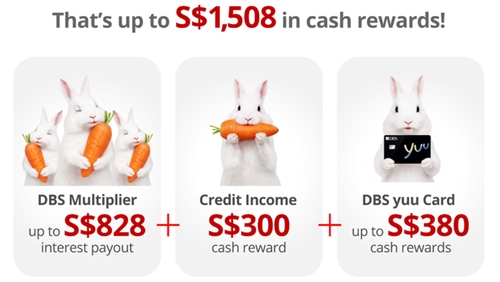

Apart from bonus interest, DBS is also giving out up to S$680 in cash rewards as part of this promotion.

Here’s how the cash reward works:

S$300 salary credit reward

You can first receive a S$300 cash reward simply by crediting your salary of at least S$1,600 per month into any DBS/POSB account for three consecutive months.

This offer is available if you haven’t credited your salary to a DBS or POSB account before, or if you haven’t done so between 1 January and 30 June 2025.

This salary credit promotion runs from 1 July to 31 December 2025.

You can find the full terms and conditions of the promotion here.

Up to S$380 cash rewards from the DBS yuu Card

Additionally, if you sign up for a DBS yuu Card with promo code ‘DBSYUU’, you can get cash rewards of up to S$380 cash rewards.

This offer is for New to DBS/POSB Credit Cardmembers, i.e. customers who don’t currently hold any Principal DBS/POSB Credit Card, and haven’t cancelled one in the last 12 months.

The DBS yuu Card also lets you earn up to 18% cash rebates on your daily spend at Cold Storage, Giant, foodpanda, SimplyGo and more.

This card promotion is valid from 1 October to 31 December 2025.

You can find the promotion details and full terms and conditions here.

Because these rewards are separate from the interest promotion, you can still earn them even if you are not able to set aside the full S$100,000 balance.

Put together, these offers add up to S$680 in guaranteed cash rewards, which you can stack on top of your interest earnings from the Multiplier Account.

How much can you earn as a New DBS Multiplier account holder?

By combining the boosted interest from the New-to-DBS Multiplier Account promotion with the additional cash rewards, you could increase the returns on your savings within just four months.

Here we’ll illustrate a few scenarios of how your benefits could stack up:

Scenario 1 — Earning 2.10% p.a. with S$100,000 balance

Let’s say you open a new DBS Multiplier account on 1 September 2025 and maintain S$100,000 in your Multiplier Account.

You credit a salary of S$3,500 and make S$500 of eligible transactions on your new DBS yuu Card.

With S$4,000 in total eligible transactions, you’ll earn the 2.10% p.a. promotional rate on your first S$100,000.

Over the four-month period from 1 September to 31 December 2025, this would give you about S$700 in interest.

In addition, you will receive a S$300 cash reward from crediting your salary for three months.

Plus, enjoy an extra S$380 cash rewards when you apply for a DBS yuu Card as a new to DBS/POSB Credit Cardmember.

All you have to do is meet the minimum spend and have a valid PayLah! account by the end of the qualifying spend period.

That totals up to about S$1,380 in interest payout and combined rewards over the four months from September to December 2025.

Scenario 2 — Maximising 2.50% p.a. with S$100,000 balance

Assuming you have opened a new DBS Multiplier account on 1 September 2025 and maintain a balance of S$100,000 in your Multiplier Account.

In this case, if you manage to credit your salary, make transactions in only one of the categories, and are able to reach the highest total eligible transaction tier of S$30,000 or more, you can unlock the promotional rate of 2.50% p.a. on your first S$100,000.

Over the four-month period from 1 September to 31 December 2025, you can earn an interest of about S$828.

Along with the additional S$680 cash reward, you would receive up to S$1,508 in interest payout and combined rewards over the four-month promotion period.

What would Beansprout do?

The DBS New-to-DBS Multiplier Account promotion could help you earn more on your savings over the next few months.

By crediting your salary and transacting in just one eligible category each month, you can earn up to 2.5% p.a. on the first S$100,000, a step up from the usual 2.2% p.a. on only the first S$50,000 under the regular tiers.

On top of this, you can also receive up to S$680 in cash rewards, including S$300 for salary crediting and up to S$380 when you apply for the DBS yuu Card.

Find out more about the DBS yuu Card here.

All in, this represents up to S$1,508 in interest payout and combined rewards over the four-month promotion period.

If you don’t have S$100,000 yet, you can still sign up and use the regular Multiplier tiers to earn up to 2.20% p.a. on the first S$50,000, plus you will still be eligible for cash rewards of up to S$680 when you meet the requirements.

Learn more about the DBS New-to Multiplier Limited Time Offer here .

Disclaimers

The information and opinions contained in this article has been obtained from sources believed to be reliable, but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose. • This article is meant for information only and should not be relied upon as financial advice.

T&Cs apply. SGD Deposits are insured up to S$100K by SDIC.

Earn up to 2.5% p.a. on your first S$100,000 plus get up to S$680 cash rewards

Learn moreRead also

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments