How I’m growing and safeguarding my wealth amid market volatility

Private Wealth

Powered by

By Gerald Wong, CFA • 29 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Interest rates are falling, markets are volatile, so what’s next for investors? Explore how DBS Treasures can help you and your investments stay the course during this period.

This post was created in partnership with DBS Treasures. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

Navigating today's markets isn't easy.

With all the economic uncertainty and rising geopolitical tensions, it feels like markets react to every headline.

Even safe-haven options like T-bills and fixed deposits now yield less as interest rates fall.

Against this backdrop over the past few years, I’ve been thinking more about the importance of growing and protecting my wealth for myself and the legacy I want to build.

That journey has been supported by DBS Treasures, my trusted wealth partner since 2022.

Their expert guidance and personalised solutions have helped me cut through the noise and stay on course, even in volatile times.

In this article, I’ll share how DBS Treasures has helped me make clearer, more confident decisions about my finances in these unpredictable markets.

How I stay calm when markets get choppy

I’ve been asked quite a few times – what really helps me stay confident when markets get volatile?

For me, it boils down to having the right support and tools to make good decisions, especially when the headlines get noisy.

Here’s what’s helped:

#1 - Personalised guidance from a team of experts

It makes a huge difference to have someone I can speak with — not just anyone, but a trusted wealth manager who understands my financial goals and is backed by a team that knows the market inside out. They help me decide when (and when not) to tweak my portfolio.

Through a recent portfolio review, I gained valuable insights that helped me make sure my investments are aligned with my objectives and risk appetite, especially as market conditions shift.

For example, with interest rates coming down in Singapore this year, I’ve been able to consider how to re-balance my portfolio to stay on track with the income I’m targeting — and just as importantly, when not to make changes.

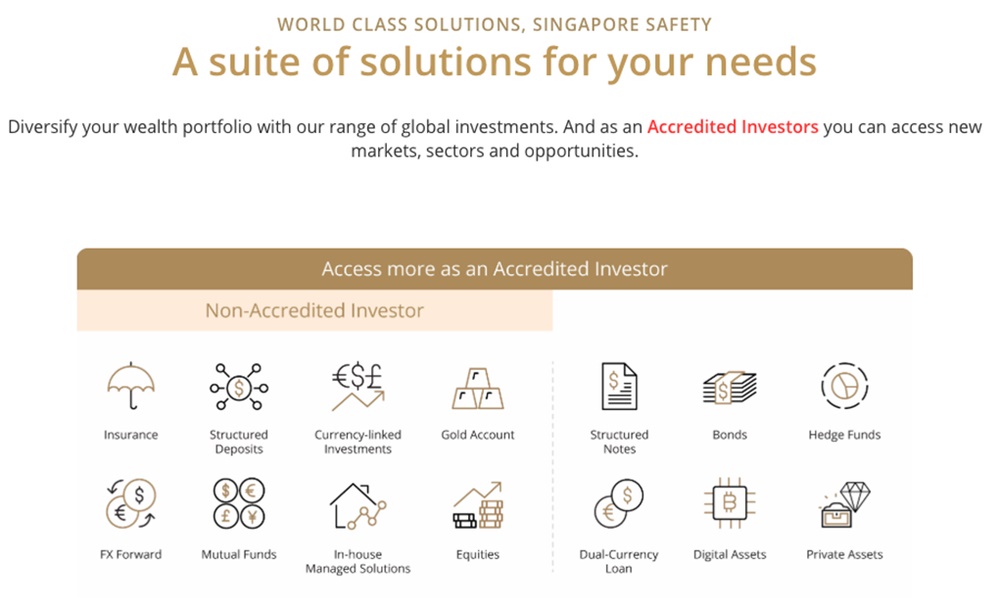

#2 – A wide range of investment solutions

Being able to go beyond the usual stocks and bonds has helped me diversify my investments.

Whether it's traditional assets focused on certain trends, or a robust suite of alternative investment for growth and cushioning against market drops, having more choices lets me build a more balanced portfolio.

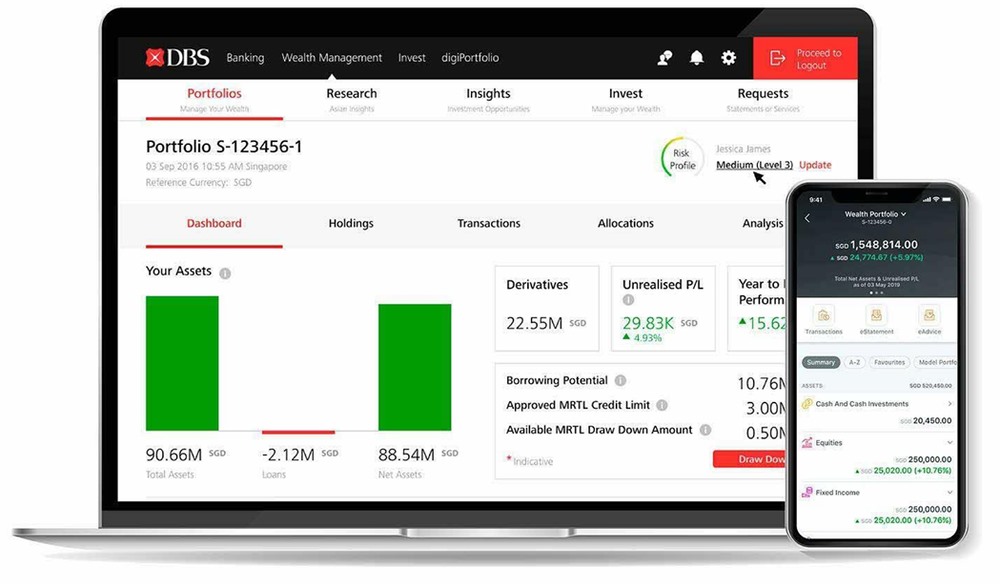

#3 - Tools for wealth and investment management

I like to take a more hands-on approach, and having a single view of my portfolio enables me to track and manage my investments easily, giving me more control and clarity over where I’m headed.

All of this has been possible through DBS Treasures in the last few years, which has played a key role in my investing journey as I work towards growing and protecting my wealth.

What is DBS Treasures?

DBS Treasures is a wealth management partner for clients with a minimum of S$350,000 in investible assets seeking a more personalised approach for their portfolio.

Here’s how DBS Treasures has been able to help me through a combination of expert guidance and tailored strategies.

#1 – Personalised guidance from a team of experts

What sets DBS Treasures apart is the team behind it.

I was paired with a dedicated Relationship Manager (RM), who is supported by Investment Counsellors and Bancassurance Specialists.

This team-based approach allows for more holistic financial planning, taking into consideration my financial goals, investment preferences, and lifestyle priorities.

For instance, I wanted to keep a portion of my funds liquid in case of emergency, while still growing the rest for mid-to-long-term goals.

Working with my Relationship Manager, we came to a plan to balance liquidity needs with growth, using quality short-term bond funds and longer-term investments tied to market cycles.

Beyond the support from my Relationship Manager, I have also been invited to exclusive events and webinars, including the DBS Treasures Wealth Symposium.

It’s where I get to hear directly from experts, explore the latest market outlook, and learn about investment strategies and opportunities curated by the DBS Chief Investment Office.

In an environment where timing and asset mix matter, this level of support helps investors who prefer to consult with experienced professionals before making portfolio decisions.

#2 – A wide range of investment solutions

One of the things I appreciate in my DBS Treasures journey was the breadth of investment options available to me.

Beyond the usual stocks and ETFs I had been investing and managing on my own, I was introduced to a more diverse set of solutions as an Accredited Investor.

Explore exclusive investment opportunities available for Accredited Investors with DBS Treasures

This included selected investment grade bonds that allowed me to earn a stable interest income to weather volatility in the global stock market as well as alternative investments such as Hedge Funds, Private Credit and Private Equity to diversify my portfolio.

I was also introduced to DBS in-house funds, which provided access to structural themes like innovation and disruption. As I was looking for ways to complement my income-generating portfolio, these funds helped to provide me with exposure to high-growth sectors for long-term capital appreciation.

Importantly, these funds are curated and managed by DBS’ team of experts and are aligned with the Chief Investment Office’s (CIO) latest views.

#3 – Tools for wealth and investment management

Beyond advisory services, DBS Treasures clients have access to an enhanced suite of digital tools via the Wealth Management Account in the DBS digibank app.

I liked that I could view curated insights from DBS CIO, along with tailored investment ideas and real-time performance updates on my portfolio.

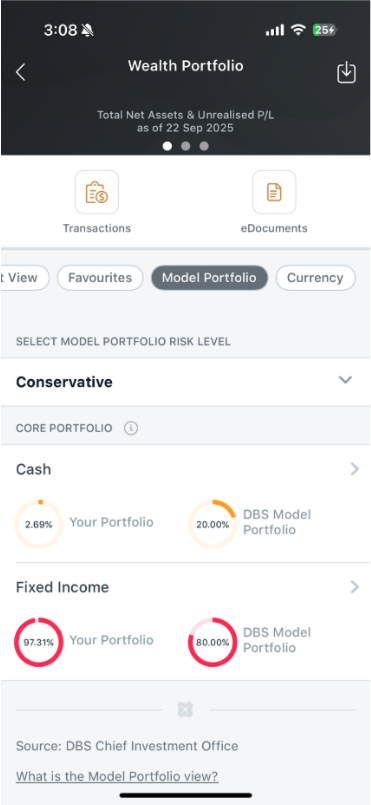

One feature I found particularly helpful was the model portfolio comparison tool. It let me see how my current holdings stacked up against DBS CIO’s recommended allocation.

As someone who values expert views and real-time insights, this gave me added confidence that my portfolio was well-positioned to ride through market volatility.

I could also use the customisable portfolio views based on gains/losses, market value, or currency.

For example, with the recent volatility in the US Dollar (USD), I could at one glance know the amount of exposure I have to USD investments and make decisions about whether there to adjust my exposure to USD-denominated assets.

What’s more, I could act on insights instantly. If I saw a research piece I liked, I could look further into the suggested product right from the app. This benefits me as a busy individual, as I don’t have the time to follow the markets throughout the day.

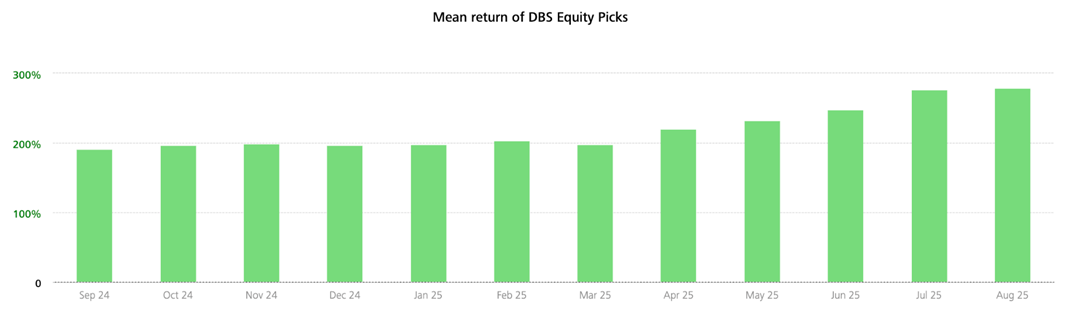

Getting timely updates from the app means I can react quickly to changes, manage risks more effectively, and seize opportunities when they arise, even when I’m on the go. With DBS’ equity picks, I get an overview of key companies in various markets and simply add them to my watchlist to receive timely alerts on them. In recent months, I’ve been particularly interested in Singapore Equities.

In today’s fast-moving and often volatile markets, these smart and prompt insights makes all the difference.

Learn how DBS Treasures’ smart digital tools and real-time market insights works.

How to qualify for DBS Treasures

To become a DBS Treasures client, you’ll need to maintain at least S$350,000 in bank deposits and investments with DBS. This can include:

- Bank deposits: include cash holdings in DBS/POSB Saving and current accounts, Wealth Management Account and Fixed Deposits (Trust, minor, and CPF accounts are excluded)

- Investments: refer to holdings in Unit Trust, digiPortfolio and eligible transfer-in assets into Wealth Management Account (eg. bonds, equities)

If you qualify as an Accredited Investor (AI), you can unlock exclusive access to structured instruments, early access to exclusive investment opportunities, and advanced wealth planning tools.

However, you are not required to be an AI to be a DBS Treasures customer.

Learn more about being an Accredited Investor with DBS Treasures.

What would Beansprout do?

If you’re someone with significant assets and serious wealth goals, DBS Treasures is one way you can access a more structured and personalised approach to wealth-building.

With a wide range of investment options beyond retail offerings, expert advice from a dedicated team backed by rigorous research and smart digital wealth management tools, DBS Treasures clients can benefit from a more informed investment experience.

After all, in today’s unpredictable markets, having a partner who understands both the bigger picture and your personal priorities can be an added advantage.

Visit DBS Treasures and discover how they can help you grow and protect your wealth.

Disclaimer: The investment products mentioned may carry risks such as investment strategy, concentration, currency, and issuer-specific risks, and are only available to Accredited Investors under Singapore regulations. Prospective investors should consult the relevant product documentation and seek independent financial advice before investing.

Disclaimers and Important Notice

The information and opinions contained in this article has been obtained from sources believed to be reliable, but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose.

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

It is provided in Singapore by DBS Bank Ltd (Company Registration. No.: 196800306E), an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments