Simple and fuss-free investing: A look at GXS Invest

Cash Management

Powered by

By Nicole Ng • 02 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

GXS Invest lets you start investing from just S$1 directly on the GXS Bank app. We explore how it works, its features, and what it invests in.

This post was created in partnership with GXS Bank. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

Interest rates have been steadily declining in recent months.

The yield on the 6-month Singapore T-bill and the 1-year return on the Singapore Savings Bonds have both fallen to 1.44% and 1.93% respectively.

This shift is a reminder that we still need to make our money work harder, especially with inflation remaining a concern.

But not everyone is ready to dive into complex investment products or go through the hassle of opening a CDP account for T-bills.

GXS Bank has recently launched GXS Invest, a new product within its app.

Designed to be fuss-free and accessible, GXS Invest offers a straightforward way to overcome the inertia of investing.

It lets you invest, and enjoy a layer of protection without jumping through hoops.

In this article, I’ll take a closer look at what GXS Invest offers, what makes it stand out, and whether it could be a starting point for your investing journey.

🎁 Get S$5 cashback when you invest S$1,000 or more with GXS Invest. Find out how here.

What is GXS Invest?

GXS Invest is the latest retail product from GXS Bank, the digital bank backed by Grab and Singtel*. GXS Bank holds a banking license and is regulated by the Monetary Authority of Singapore.

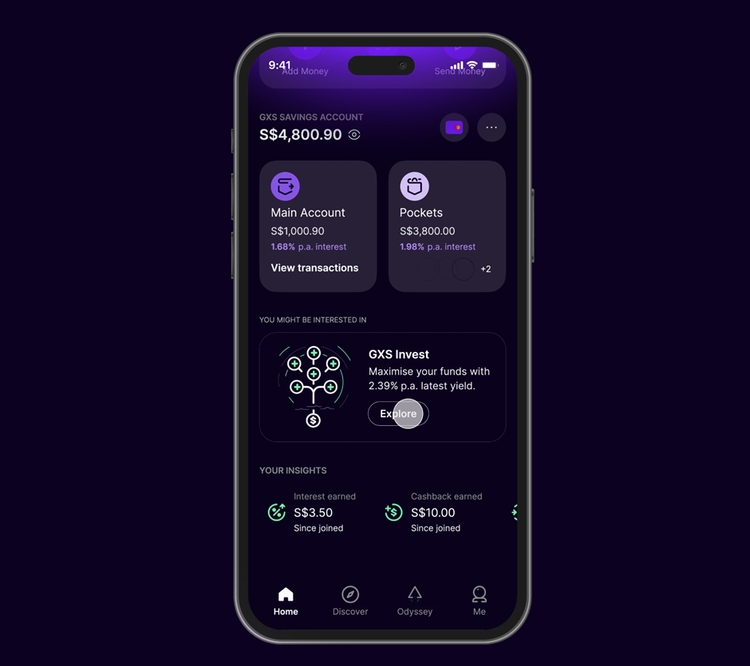

The bank has already gained traction with its existing GXS Savings Account, so when it rolled out this new product, it naturally caught my attention.

As I'm already using the GXS Bank app, I don't need to download anything new. GXS Invest is built right into the same app I'm already familiar with.

So how does it work?

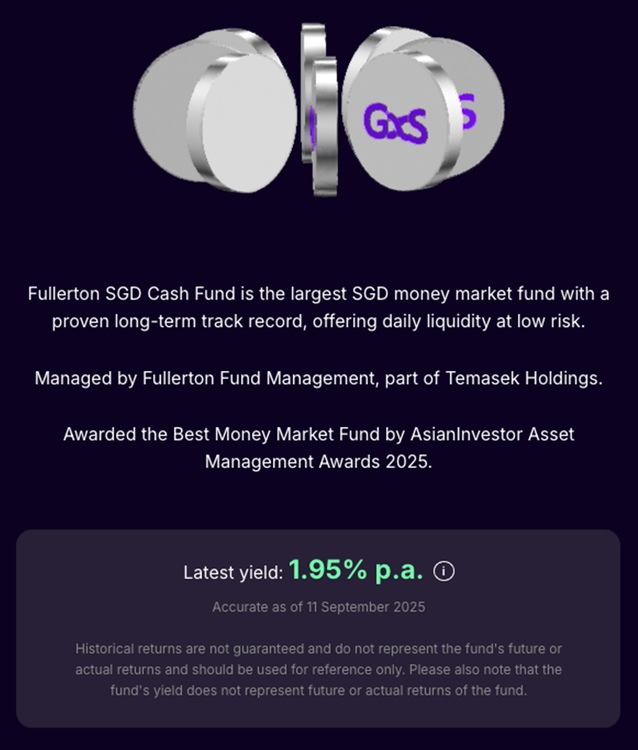

When I invest through GXS Invest, my funds are invested into the Fullerton SGD Cash Fund - Class G, the largest SGD money market fund (MMF), with assets of S$9.45bn as of end August 2025 (Source: Extracted from Fullerton’s latest factsheet).

The fund is managed by Fullerton Fund Management, part of Temasek Holdings, and has been around for over 15 years, with a proven track record of steady performance.

The fund’s objective is simple: provide returns that are potentially higher than a regular savings account, while still keeping money accessible whenever I need it.

To achieve this, the fund invests in low-risk , short-term instruments such as Singapore Government Treasury Bills and high-quality bank deposits.

Because these instruments are both short-term and low-risk, the fund’s value tends to remain stable.

It’s what some would call “investing that doesn’t keep you up at night”, which is steady, low-risk, and meant more for capital preservation, so I don’t need to worry about tracking the markets every day.

Bond funds can fluctuate when interest rates change, and stock funds swing with the broader market. A money market fund provides more stability and predictability.

As of 11 September 2025, the Fullerton SGD Cash Fund - Class G was yielding 1.95% p.a**.

The Class G share class is exclusive to GXS Invest, so you won’t find this exact version of the fund offered anywhere else, which makes it a tailored product for GXS Bank customers.

What you might like about GXS Invest

Here are some reasons why GXS Invest could be a handy addition to your financial toolkit.

#1 – Fuss-free investing from just S$1

The standout feature of GXS Invest is how incredibly easy it is to start.

With a minimum investment of just S$1, it lowers the barrier to entry so that anyone can begin.

If you’re a beginner, that means you can start small and experiment without feeling overwhelmed.

If you’re a more experienced investor, it’s just as simple to put in a larger amount of cash to grow steadily in the background.

GXS Invest is available to all eligible GXS Savings Account customers, which means you can open the GXS Invest account easily and invest directly from your GXS Bank app with just a few taps.

It’s a great option for those who want to make their idle funds work harder but don’t want to deal with the hassle of opening multiple accounts with different platforms or complex application processes.

#2 – No transaction fees, no lock-ins

Many platforms charge transaction fees, have hidden charges, or have early withdrawal penalties. With GXS Invest, there are none.

The only cost is the management fee of the underlying fund, which is already factored into the returns you see. The management fee is currently 0.25% p.a. as of 31 July 2025.

And if I need my cash back for an emergency, I can sell my investments anytime.

The money from the sale is credited into my GXS Savings Account by the next working day***, so it doesn’t feel like my money is “stuck” somewhere out of reach.

This flexibility means I could even park my emergency funds in GXS Invest to earn potentially more in returns than a regular savings account.

***Your redemption transaction must be placed successfully on a dealing day before the cut-off time of 3.30pm and is subject to prospectus and distributor requirements.

#3 – Bonus insurance coverage

When I invest through GXS Invest, I automatically receive complimentary Group Personal Accident Insurance worth up to 3 times my investment amount in the Fullerton SGD Cash Fund - Class G, as of the day of the accident capped at S$100,000.

According to GXS Bank, this is a first-of-its-kind feature in a money market fund product within Singapore’s investment space.

To put it in perspective: if the market value of my investment is S$10,000 as of the day of the accident, I get accident coverage of up to S$30,000 for accidental death or total permanent disability.

If the market value of my investment is at S$35,000 or more as of the day of the accident, I get coverage of up to S$100,000.

For customers aged 65 and above, the coverage is halved, but still meaningful at up to S$50,000.

The best part? This coverage happens automatically for eligible customers^ (Singapore Citizens, PRs, and EP/S Pass holders).

There are no forms to fill in, no medical check-ups to schedule, and no separate premiums to pay.

The policy is underwritten by Singlife (Singapore Life Ltd.) and simply activates once I start investing .

On top of that, there’s a GXS Bank promotion running where you can earn S$5 cashback with a S$1,000 investment. Learn more here.

How GXS Bank helps you build a strong financial foundation

At its core, personal finance rests on three fundamental pillars: saving, investing, and protecting yourself against the unexpected.

What makes GXS Bank interesting is how it brings all three together within a single, integrated platform.

Everything begins with a solid savings base. The GXS Savings Account, with features like Saving Pockets and Boost Pockets, helps you organise and grow your savings.

It provides a safe, accessible foundation to earn daily interest accrual, without having to jump through hoops like other savings accounts in the market, such as having to fulfil salary crediting or minimum spend criteria.

Once that base is in place, GXS Invest offers a natural next step.

It helps you earn a return for money you want to grow but still keep accessible, whether you’re setting aside funds for a home renovation, a wedding, or simply letting idle cash earn better potential returns while you consider longer-term investments.

Finally, the complimentary group personal accident insurance coverage acts as a built-in protection layer.

While it doesn’t replace a comprehensive insurance plan, it’s a valuable supplement that adds peace of mind, something many of us tend to overlook until it’s too late.

Having all three pillars—saving, investing, and protection—within a single banking app provides convenience.

But more importantly, it makes it easier to build and maintain good financial habits, as you can literally see your money flow seamlessly from saving to investing, all while knowing you have an extra layer of insurance coverage behind you.

What Would Beansprout Do?

With interest rates drifting lower, it’s tempting to leave cash sitting idle until “something better” comes along.

But inertia can be costly, especially when inflation is still eating into uninvested savings.

GXS Invest offers a fuss-free way to build and maintain an investing habit.

By combining easy access, no lock-ins, and bonus insurance coverage with the stability of the Fullerton SGD Cash Fund - Class G, it lowers the barriers for anyone who has been putting off investing.

For beginners, it’s a simple entry point: you can start with as little as S$1, build momentum, and get comfortable with the idea of investing, without worrying about market volatility.

For seasoned investors with larger savings, GXS Invest can play a different role.

Think of it as a convenient parking space for idle cash you may not be ready to commit to the markets yet, while still earning a better potential return than leaving it in a standard savings account.

GXS Invest can be a useful bridge between saving and investing, helping you make your money work harder while providing a little extra peace of mind.

GXS Invest Welcome Promo

To make it even easier to get started, GXS Bank is running a welcome campaign from 2 October to 17 October 2025 where you can earn a S$5 cashback when you start investing.

Here’s how it works in simple terms:

- Open a GXS Invest Account: You’ll need to be new to GXS Invest and have a GXS Savings Account.

- Invest at least S$1,000 in one go: Make a single investment of at least S$1,000 with GXS Invest during the campaign period. This has to be one transaction (not spread across multiple buys). This will be invested into the Fullerton SGD Cash Fund – Class G.

- Hold your investment until 30 November 2025 (inclusive)

- Receive your cashback: Successful customers will get S$5 credited to their GXS Savings Account by 31 December 2025.

A few things to note:

- The promotion is limited to the first 2,000 successful customers of the Campaign only.

- You can only get the cashback once, even if you invest more than S$1,000 or make multiple transactions during the Campaign.

Sign up with GXS today and try GXS Invest directly in the app here.

Just download the GXS Bank app, open a GXS Savings Account (if you’re new to GXS Bank), and apply for GXS Invest thereafter.

GXS Bank terms and conditions apply.

*GXS Bank is a separate entity and is not associated with the businesses of Grab, Singtel, Beansprout and their respective entities. GXS Invest is provided by GXS Bank. GXS Bank holds a banking license and is regulated by the Monetary Authority of Singapore.

**For more information on how the yield is derived, please refer to GXS Bank's FAQ page: https://help.gxs.com.sg/GXS_Invest

^Eligible customers must be between 19 and 75 years old (Age Next Birthday, inclusive), and be a Singapore citizen, Singapore Permanent Resident, or a holder of a valid Singapore Employment Pass (excluding Work Permit holders). Customers must also be residing in Singapore and must not be classified as a Prohibited Person. Insurance eligibility will be screened by GXS Bank and are subject to approval by Singlife.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

[For GXS Invest] Risk Disclosure Statement

- All investments come with risks, and you may lose all or part of your investment. Investments are not deposits and should not be treated as deposits.

- You acknowledge that prior to making an investment, you have received, read and understood the relevant prospectus or other offering document and, where applicable, the product highlights sheet or other materials or documents relating to the investment product which you are applying to invest into, and agree to be bound by the prospectus and offering and constitutive documents of the investment product.

- Past performance of an investment does not necessarily reflect its future performance. Any indicative return and/or distribution rate (where applicable) is for illustrative purposes only, and is not a prediction, projection or forecast of the future performance of the investment. There is no guarantee that the indicative return and/or distribution rate (where applicable) will be achieved. The value of investments and investment returns (including dividends, distributions, income or other returns) may rise or fall.

- Prior to making an investment, you represent and warrant that you are fully aware of the risks involved in the investment, including the risks set out in the Invest Account Terms, and you undertake all investments and investment transactions at your sole risk.

- You are responsible for your own investment decisions. We do not offer investment advice of any nature, and any information which we provide is not offered as investment advice or recommendations. Any such information which we provide is intended for general circulation and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. You shall place no reliance on us as giving you any advice or making any recommendations. You should seek your own independent financial, professional or other advice if necessary.

- Unless we inform you otherwise, we are acting as your agent in the investment transaction.

[For GXS Savings Account] Deposit Insurance Scheme:

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Terms and conditions: Invest Account Terms and Deposit Account Terms shall apply. For full terms and conditions, please visit www.gxs.com.sg/tnc.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments