Hong Leong Asia - Net cash position powering medium-term growth

Stocks

By Ng Hui Min • 18 Dec 2025

Why trust Beansprout? We're licensed by the Monetary Authority of Singapore (MAS).

Hong Leong Asia is a diversified industrial group with core businesses spanning building materials, diesel engines, and consumer appliances, anchored by strong market positions across Singapore, Malaysia, and China.

Industrial arm of Hong Leong Group

Hong Leong Asia (HLA) is the industrial flagship of the Hong Leong Group Singapore, one of Southeast Asia’s largest and most diversified conglomerates with interests spanning property, finance, and manufacturing.

Listed on the Singapore Exchange (SGX) since 1998, HLA has evolved over six decades from a domestic building-materials producer into a pan-Asian industrial platform with operations spanning China, Singapore, and Malaysia, supported by a workforce of approximately 10,000 employees.

HLA’s business is organised under two main operating divisions:

Hong Leong Asia (HLA) holds a 48.7% stake in China Yuchai International (NYSE: CYD), which is the listed holding company for the group’s engine operations. CYD in turn owns 76.4% of Guangxi Yuchai Machinery Company Limited (GYMCL), one of China’s largest independent manufacturers of diesel, natural gas, and alternative-fuel engines.

Through this two-tier shareholding structure, HLA’s effective economic interest in GYMCL is approximately 37%, reflecting its partial ownership of CYD rather than direct control of the operating engine business.

Despite the minority stake, the Powertrain Solutions segment remains HLA’s largest earnings contributor and the key determinant of group performance.

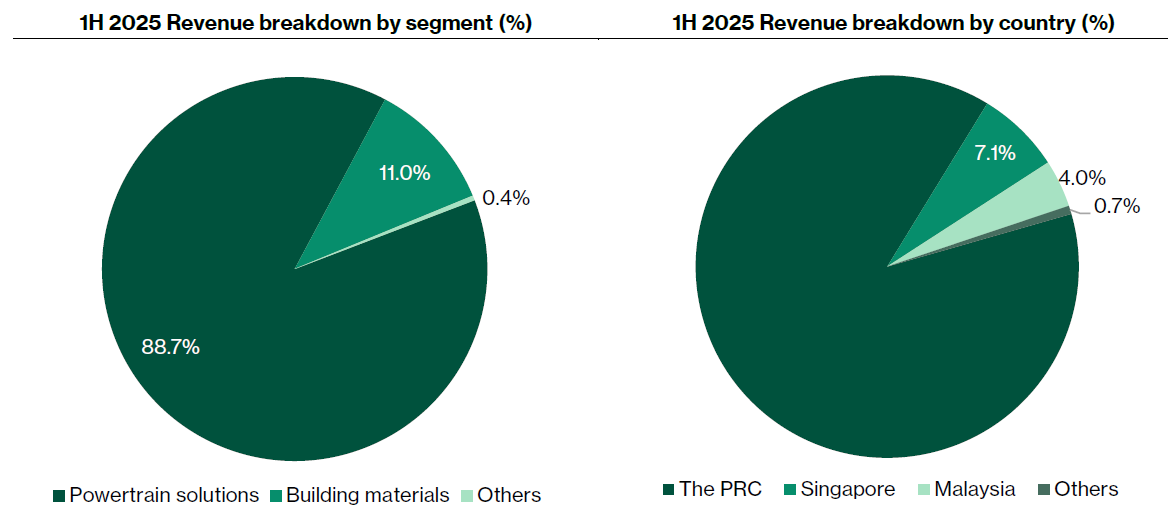

Building Materials – Accounting for about 11% of 1H2025 revenue, encompassing HL Building Materials, Island Concrete, HL Cement (Quarries & Aggregates) and Tasek Corporation Berhad (a major cement producer in Malaysia, 98.3%-owned).

This division supplies cement, ready-mix concrete, precast components and aggregates to Singapore’s and Malaysia’s construction and infrastructure sectors.

With vertically integrated operations and leading market share positions, it provides HLA with earnings stability and steady cash returns, offsetting the cyclicality of its China exposure.

Strong rebound in 1H25 earnings with the doubling of interim dividend

Group revenue rose 25.7% YoY to S$2.83 billion from S$2.25 billion, led by a 30.8% surge in Powertrain Solutions sales to S$2.51 billion. Building Materials saw a 3.5% YoY decline to S$310 million amid lower ready-mix volumes.

Group gross profit expanded 18.5% to S$427.5 million, though gross margin moderated to 15.1% (from 16.0%) due to product mix and RMB weakness.

Profit before tax jumped 31% YoY to S$121 million, driven by volume growth and operating efficiencies at Yuchai.

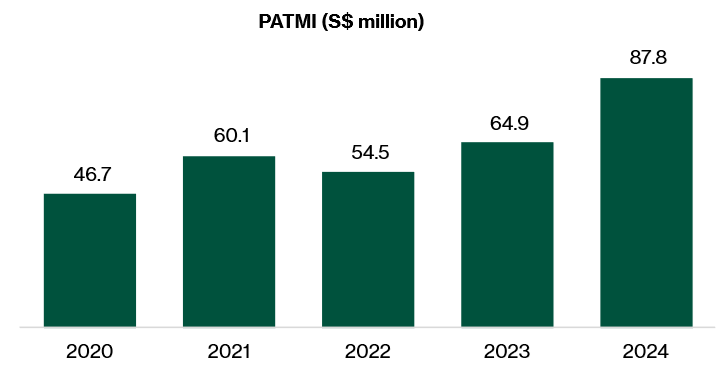

Net profit attributable to shareholders (PATMI) was S$56.0 million (+13.1% YoY). Excluding a one-off associate gain in 1H 2024, core PATMI rose 21.2% YoY.

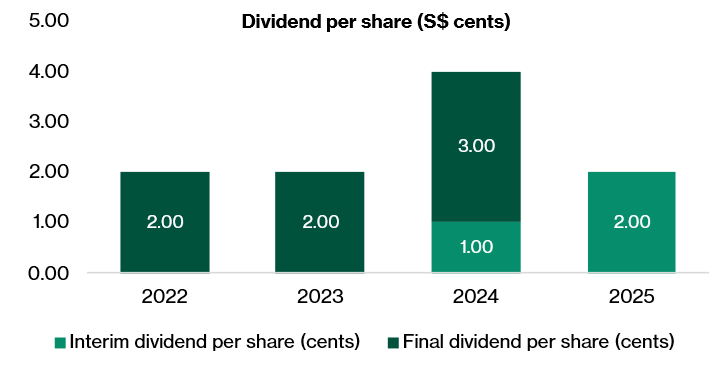

Earnings per share climbed to 7.49 Singapore cents, and the Board doubled the interim dividend to S$0.02/share.

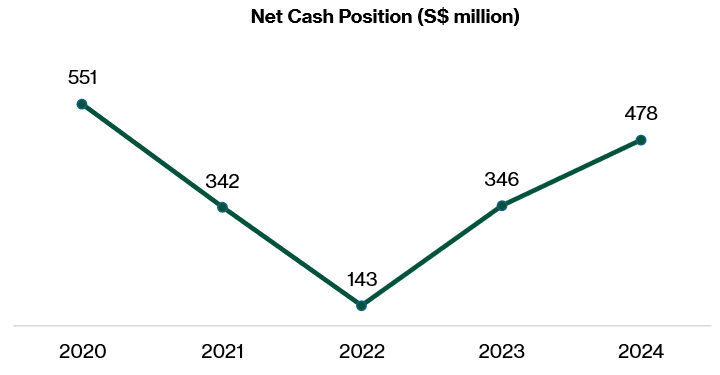

Operating cash flow soared to S$397 million (>8× YoY), lifting HLA’s net cash position to S$749 million (Dec 2024: S$478 million). Net-cash-to-equity improved to 0.79×, reflecting a strong balance sheet for expansion and dividend growth.

Powertrain solutions division remains core earnings driver

The Powertrain Solutions division remains the cornerstone of Hong Leong Asia’s earnings profile and long-term value creation, underpinned by its effective controlling stake in China Yuchai International (NYSE: CYD).

CYD, in turn, owns a majority interest in Guangxi Yuchai Machinery Company Limited (GYMCL), one of China’s largest independent engine manufacturers with a strong technological roadmap and extensive OEM relationships.

The business develops and produces an integrated suite of diesel, natural gas, hybrid, and emerging hydrogen-powertrain engines that are deployed across trucks, buses, marine vessels, construction machinery, industrial equipment, and power-generation applications.

Its long operating history, broad product portfolio, and expanding position in export and alternative-fuel markets give the Powertrain Solutions segment the scale, innovation capability, and recurring cash generation that anchor HLA’s industrial leadership and their transition toward cleaner, high-efficiency power systems.

Strong 1H25 performance with outperformance versus peers

Yuchai delivered a strong set of half-year results in 1H 2025, selling 250,396 engines (+29.9% YoY) and generating a 30.8% YoY increase in revenue to S$2.51 billion.

Profit after tax surged 56.4% YoY to S$96.8 million, supported by market share gains, margin expansion, and strong momentum in export markets.

Segment performance was broad-based, with truck and bus engine sales up 38%, marine and genset engines up 31.5%, and industrial engines rising 27%.

Importantly, this strength was achieved despite a 2.6% decline in China’s domestic commercial vehicle market, according to China Association of Automobile Manufacturers (CAAM). Growth was driven instead by OEM export demand, a shift toward higher-value heavy-duty and marine engine applications, and Yuchai’s disciplined pricing strategy.

Positive read-across from policy tailwinds

China’s policy backdrop remains highly supportive. Equipment renewal subsidies, the phased decommissioning of National IV heavy-duty trucks, and increased overseas infrastructure investment should lift demand for new HDT engines, heavy machinery, and logistics equipment. These policies directly benefit CYD’s core segments.

Global policy and structural trends also align in Yuchai’s favour, particularly rising requirements for multi-hour standby power in data centres and critical infrastructure.

These drivers support sustained margin and revenue visibility in high-horsepower engine applications.

Data-centre power – a high-margin growth pillar

A major medium-term catalyst for CYD is its growing exposure to data-centre backup power systems.

Diesel gensets remain the industry standard for Tier 3 and Tier 4 data centres given their reliability, rapid start-up capability, and cost-effectiveness.

The rapid development of AI, cloud, and hyperscale facilities—particularly those concentrated in Johor and wider Southeast Asia—positions Yuchai well.

While CYD sold just 1,000 units to data-centre customers in 1H25 (a small proportion of its >250,000 total units sold), the margin profile is significantly higher, and the multi-year growth runway remains compelling.

MTU Yuchai Power Co. Ltd, its joint venture with Rolls-Royce Power Systems, is expanding capacity to meet rising demand from hyperscale and high-availability facilities, reinforcing CYD’s positioning in this structurally expanding segment.

Strengthened international footprint and clean-technology transition

Yuchai continues to broaden its geographic and technological footprint.

The Thai subsidiary commenced production of the first K08 engine in 1H 2025, while a new strategic partnership with Vietnam’s FUTA Group enhances its distribution capabilities in ASEAN.

At the same time, the company is accelerating R&D into low-carbon and zero-emission technologies, including hybrid systems, integrated electric drive axles, hydrogen fuel cells, and clean natural gas engines—supporting its longer-term competitiveness as domestic and international emissions standards tighten.

CYD maintains a strong shareholder-return profile, paying a US$0.53/share cash dividend for FY2024, which continues to provide steady upstream cash flows to HLA.

Building Materials provides stable recurring cash flow

The Building Materials division is Hong Leong Asia’s second core earnings pillar, providing steady profitability and resilient cash generation through its integrated presence across Singapore and Malaysia.

The business spans HL Building Materials, Island Concrete, and Tasek Corporation Berhad (98.3% owned), giving HLA end-to-end capabilities across cement, aggregates, ready-mix concrete (RMC), and precast products.

As a key supplier to major infrastructure, industrial and housing projects, the division benefits from multi-year public and private sector demand in both markets.

Steady performance despite near-term volume softness

Building Materials revenue declined 3.5% YoY to S$310 million in 1H 2025, while profit after tax fell 10.7% YoY to S$37.4 million. In Singapore, precast demand improved alongside the ramp-up of public-housing projects, although RMC output was temporarily affected by capacity delays at certain batching plants.

Even so, order books continued to expand across both public and private sectors, in line with the Building and Construction Authority’s (BCA) forecast of S$47–53 billion in total construction demand for 2025.

In Malaysia, Tasek Corporation’s profitability was supported by operational efficiencies and higher contributions from associates, offsetting slower infrastructure rollout and a modest decline in cement volumes following the higher Sales & Services Tax.

Capex investments to lift efficiency and automate operations

The division is executing targeted capacity upgrades and productivity enhancements to support rising demand.

New batching plants at Punggol Timor and Jurong Port RMC Hub are underway, and the company plans to pilot its first autonomous front-wheel loader in 2H 2025.

These initiatives should improve plant utilisation, throughput consistency, and manpower efficiency.

The Jurong facility—operating on a long-term lease expiring in 2053/54—produces roughly 2,000 m³ per day and relies on semi-automated processes where utilisation is heavily determined by project scheduling and demand flow.

AI-driven operational improvements

Management has begun piloting an AI-powered scheduling and dispatch system designed to optimise plant utilisation and reduce manpower requirements—highly relevant given Singapore’s tightening foreign workforce rules.

Full rollout is expected in 2026, and early results suggest meaningful efficiency uplift and better coordination across the company’s multi-plant network.

Second Jurong plant: modern automation with attractive returns

HLA also secured a 25-year lease in August 2025 for its second Jurong plant, with construction slated to begin in 1Q 2026 and completion targeted for early 2027.

Equipped with two 6.0 m³ mixers and modern automation systems, the plant is designed for higher throughput efficiency.

Tailwinds from Singapore’s multi-year infrastructure and housing cycle

The outlook for construction activity in Singapore remains bright. Budget 2025 earmarked S$19.6 billion for infrastructure, with significant allocations to transport (Changi Airport Terminal 5, MRT line extensions, North–South Corridor), healthcare (Tengah Hospital), and industrial development (Woodlands North Coast).

Transport infrastructure alone received an incremental S$18 billion funding boost.

Beyond infrastructure, residential demand is strengthening.

HDB plans to launch ~55,000 BTO flats between 2025 and 2027—10% above earlier targets—to alleviate housing pressures.

The Government Land Sales programme will also release land for 9,755 private homes in 2025, ~50% above the 2021–23 average.

These trends point to sustained demand for RMC, precast components, cement, and aggregates over the coming years.

Positioned to benefit from long-term demand through 2029

The BCA projects annual construction demand of S$39–46 billion through 2029, underpinned by major developments such as Changi Terminal 5, the Marina Bay Sands and Resorts World Sentosa expansions, and renewed infrastructure activity in Malaysia.

With a diversified product suite, sustainability-aligned operations (including alternative fuels and Green Mark-certified facilities), and ongoing automation initiatives, the Building Materials division offers stable, high-visibility earnings that balance the more cyclical Powertrain Solutions segment.

It remains a key contributor to HLA’s overall resilience and cash-flow strength.

Clear medium-term strategic roadmap

Hong Leong Asia’s medium-term strategy is focused on driving sustainable growth and value creation across its industrial portfolio.

HLA focuses on advancing the green powertrain transition, with Yuchai at the forefront of developing next-generation engines powered by hybrid, hydrogen, and clean gas technologies.

Leveraging its deep R&D capabilities and joint ventures with global partners such as Rolls-Royce Power Systems, Yuchai aims to expand its low-emission product range and capture new opportunities arising from China’s clean-energy transition and global decarbonisation initiatives.

The second pillar centres on automation and digitalisation, as HLA invests in robotics, digital batching systems, and data-driven logistics to enhance operational efficiency within its Building Materials segment.

These initiatives are expected to improve margins, reduce labour dependency, and support sustainable scalability in Singapore’s and Malaysia’s construction ecosystems.

The third strategic thrust lies in regional expansion, broadening both product and geographic exposure.

Yuchai is actively growing its export footprint in Southeast Asia, particularly in Thailand, Vietnam, and Indonesia, while the Building Materials division seeks to extend its cement and aggregates distribution networks beyond Singapore and Malaysia.

These efforts position HLA to benefit from regional urbanisation trends and rising infrastructure demand.

Together, these strategic priorities reinforce Hong Leong Asia’s transformation into a future-ready, diversified industrial leader.

Initiate with Buy

We initiate coverage on Hong Leong Asia (HLA) with a BUY rating.

Our positive view is underpinned by a multi-year earnings recovery driven by the rebound in Yuchai’s Powertrain business, improving margins in the Building Materials segment, and a healthier balance sheet supported by strong cash generation.

Yuchai’s volume growth outlook has strengthened on rising demand for cleaner engines and export markets, while HLA’s Singapore Building Materials operations are positioned to benefit from a sustained pipeline of public and private construction projects.

The company maintains a solid balance sheet with a net cash position, supported by disciplined capital management and improving visibility on margin expansion across its key business segments.

Target price of S$2.75

We adopt a sum-of-the-parts (SOTP) framework to capture the distinct value drivers across Hong Leong Asia’s diversified portfolio.

HLA’s largest component is its 48.7% stake in China Yuchai International (CYD), which we value at market, implying a stake worth S$714m based on CYD’s share price of US$30.20, 37.65m shares outstanding, and an FX rate of 1.29.

For the Building Materials Unit (BMU), we apply a 10x P/E multiple to FY24 PAT of S$86.2m, reflecting its stable earnings profile and favourable construction outlook, deriving a valuation of S$862m.

We also mark to market HLA’s 20.15% stake in BRC Asia, valuing it at S$228m.

Adding group-level net cash of S$749m (as reported in 1H25 results) results in a gross SOTP value of S$2.55bn.

To account for conglomerate structure, partial ownership, and transparency discounts, we apply a 20% holding-company discount, arriving at an implied equity value of S$2.04bn, or S$2.75 per share.

At S$2.75, this would imply 19.8x 2026 P/E and 2% dividend yield.

Key Risks

Key risks include cyclical demand in truck and construction markets, evolving regulatory requirements for clean-energy powertrains, foreign-exchange volatility in China and Malaysia, execution risk in new-technology adoption, and potential governance and operational uncertainty linked to ongoing regulatory matters in China.

Download the full report here.

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in Hong Leong Asia.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments