How to buy gold in Singapore (2025)

alternative asset 101

By Gerald Wong, CFA • 17 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Discover the best ways to buy gold in Singapore in 2025 — from physical gold to ETFs — and learn why it’s popular, what drives prices, and the risks.

What happened?

Gold has once again captured investors’ attention after crossing another all-time high in October 2025, trading above US$4,300 per ounce.

The surge has sparked fresh discussions within the Beansprout community, with many wondering if it is time to add gold to their portfolios amid global uncertainties and expectations of further U.S. rate cuts.

As an investor in Singapore, you might also be thinking about whether gold deserves a place in your portfolio.

Before you put any of your hard-earned money into the precious metal, let’s explore the different ways to invest in gold and understand the key benefits and risks involved.

How to buy gold in Singapore?

There are several ways to gain exposure to gold, depending on how hands-on you want to be with your investment.

You can buy and store physical gold bars or coins, open a gold savings account with a bank, trade gold ETFs on the stock market, or take leveraged positions through gold CFDs.

Each method comes with different levels of risk, liquidity, and costs, so it is important to understand what you are getting into before making a purchase.

Investment option | Minimum investment amount | Liquidity | Fees | Ownership |

Physical gold | S$1,000 | Low | High | Direct |

Gold Savings Account | S$1,000 | High | Moderate | Indirect |

Gold stock/ETFs | From S$1 | High | Low | Indirect |

Gold CFDs | S$100 | High | Moderate | Indirect |

With that in mind, let’s take a closer look at each option and how they work.

Buy physical gold in Singapore

If you are a traditionalist and would like to have the assurance of owning your gold directly, you might want to consider physical gold.

This can come in the form of owning gold jewellery, gold bars, gold bullion coins, gold certificates and more.

But this method of buying gold has its own set of pros and cons.

Pros of owning physical gold:

- Direct ownership: Physical gold is a tangible physical asset that you actually own directly, offering reassurance to many investors.

- No counterparty risk: When you own physical gold, you're not dependent on any financial institution or third party.

Cons of owning physical gold:

- Storage and security: Storing physical gold at banks or other retailers will incur storage fees and insurance costs.

- Liquidity challenges: Selling physical gold can be more complicated than other investments, potentially resulting in delays or lower sale prices.

You can buy or sell physical gold at the daily rates offered by banks and authorised dealers.

Learn more about how to buy gold from UOB here.

Gold Savings Account in Singapore

Alternatively, a gold savings account lets you invest in gold without worrying about physical storage.

These accounts allow you to buy and sell gold at market prices through the bank, while the bank manages the storage and security on your behalf.

Pros of opening a gold savings account

- Convenience: You can effortlessly buy and sell gold without the concern of managing physical storage.

- Liquidity: It is generally easier to buy or sell gold compared to physical gold bars or coins

Cons of opening a gold savings account

- No physical ownership: You do not actually hold the gold, which may matter to investors who prefer tangible assets.

- Service fees: There could be fees linked to maintaining the account, which might reduce your overall returns.

For example, UOB charges a monthly service fee of 0.25% per year based on the highest gold balance each month, with a minimum charge of 0.12 grams of gold. The minimum transaction size is also 5 grams.

Learn more about how to buy gold from UOB here.

Gold stocks and ETF

Gold stocks and exchange-traded funds (ETFs) are among the easiest ways to invest in gold.

If you prefer a simple and low-cost way to invest in gold, exchange-traded funds (ETFs) are a popular choice.

Gold ETFs are funds that aim to track the price of gold and are listed on stock exchanges, meaning you can buy or sell them through your brokerage account just like any other stock.

Some ETFs, such as the SPDR Gold Trust (SGX: O87) or iShares Gold Trust (NYSE: IAU), hold physical gold in vaults to mirror gold prices closely.

Others, like the VanEck Gold Miners ETF (NYSE: GDX) and VanEck Junior Gold Miners ETF (NYSE: GDXJ), invest in gold mining companies, which can be more volatile but may offer higher potential returns if gold prices continue to rise.

Here are some popular gold ETFs investors can consider:

| ETF | Ticker | Exchange | Exposure | Expense ratio |

| SPDR Gold Trust | O87 | Singapore | Physical gold | 0.40% |

| iShares Gold Trust | IAU | US | Physical gold | 0.25% |

| VanEck Gold Miners ETF | GDX | US | Gold mining companies | 0.51% |

| VanEck Junior Gold Miners ETF | GDXJ | US | Small-cap gold mining companies | 0.51% |

| Source: ETF Manager’s websites, as of 16 October 2025 | ||||

Pros of investing in gold stocks or ETFs:

- Diversification: Gold stocks/ETFs offer the opportunity to invest in gold without requiring a significant amount of capital.

- Ease of trading: You can buy or sell ETFs and stocks anytime during trading hours, offering flexibility and liquidity.

Cons of investing in gold stocks or ETFs:

- Management fees: ETFs typically charge annual expense ratios that slightly reduce long-term returns.

- Market risk: The value of gold stock and ETFs can vary with market conditions, which may not always directly track the price of gold.

- Non-direct ownership: The gold is held in trust for you.

Read here to find out which is the best gold ETF in Singapore.

Gold CFDs to hedge

Lastly, we have gold Contracts for Difference (CFDs).

Gold CFDs allow investors to speculate on gold's price movements without actually owning the physical asset.

It can also be used as a strategy to hedge against price fluctuations.

Pros of gold CFDs:

- Trade both ways: you can position yourself from both rising and falling markets.

- Hedging tool: you may take a short position to protect your portfolio by hedging against potential price correction.

- Leverage: You can gain larger exposure with a smaller upfront investment.

Cons of gold CFDs:

- No ownership: You do not actually own any physical gold.

- Leverage risk: Using borrowed funds can amplify both gains and losses, so it requires careful risk management.

Discover the best CFD trading platform in Singapore here.

Why invest in gold?

Throughout the ages, humans have viewed gold as a valuable and special commodity.

Gold continues to be seen as a safe-haven asset that helps protect wealth during uncertain geopolitical and economic times as a universal store of value.

Unlike stocks or currencies, gold is a tangible asset that is not tied to the success of a particular company or nation's economy.

Many investors also turn to gold as a hedge against inflation, since its value often holds up when the cost of living rises.

Over the long term, gold has shown resilience and helped diversify portfolios and reduce overall volatility, as its price has a low correlation with other asset classes like stocks and bonds.

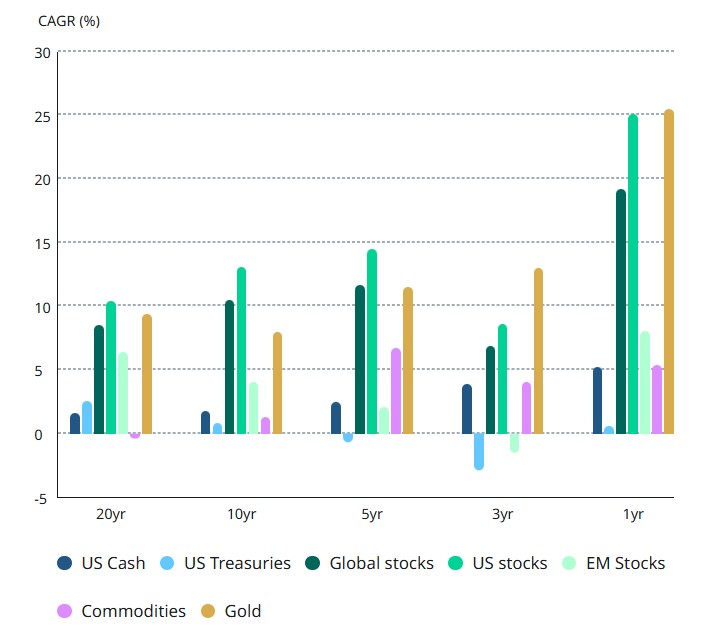

According to World Gold Council, its compounded annual growth rate (CAGR) over the past 20 years has been higher than US Treasuries, US Cash as well as commodities, and is comparable to equities.

Beyond investment demand, gold is also widely used in industries such as aerospace, electronics and dentistry, supporting steady global demand.

Its combination of stability, liquidity, low correlation with other assets and global recognition makes it a useful addition to a well-balanced portfolio.

Key factors affecting gold prices

Gold prices are influenced by a mix of global economic and political factors. Understanding what drives them can help you decide when and how to invest.

1. Strength of the US dollar

Since gold is primarily priced in US dollars, its value is directly correlated with the strength of the US dollar.

When the US dollar weakens, gold becomes cheaper for investors holding other currencies, which may drive demand for gold and push prices higher.

Conversely, a stronger dollar usually puts pressure on gold prices.

2. Interest rates

Gold does not pay interest or dividends. When interest rates go up, investors may prefer income-generating assets like bonds, reducing demand for gold.

On the other hand, when interest rates are expected to fall, gold prices often rise as investors look for assets that can hold their value.

3. Inflation

Another factor that affects the value of gold is inflation, which reduces the purchasing power of a currency.

When prices of goods and services increase and the value of money falls, investors may turn to gold to preserve their purchasing power and protect their wealth.

4. Geopolitical tensions and uncertainty

Events such as wars, political conflicts or economic slowdowns tend to push investors toward gold as a safe-haven asset.

In recent years, the escalation of geopolitical tensions has resulted in a rise in the purchasing of gold by central banks in emerging market nations.

5. Supply and demand

Finally, the price of gold is highly influenced by the balance between supply and demand.

Strong demand from investors, central banks or consumers in countries like China and India can push prices up, while an oversupply can lead to lower prices.

Overall, gold prices reflect how investors view global risk and the broader economic environment.

Risks of buying gold

While gold can help protect your wealth and diversify your portfolio, it is not without risks. Here are some key things to keep in mind before investing.

1. Price volatility

Gold prices can fluctuate significantly over short periods.

Although it is often seen as a safe-haven asset, it is not always stable.

There have been years when gold prices rose or fell by more than 30 percent.

2. No income generation

Unlike stocks or bonds, gold does not pay dividends or interest.

Any return you earn comes only from price movements, which means your gains depend entirely on price growth to generate returns.

3. Storage and insurance costs

If you buy physical gold, you will need to think about where to store it safely.

Keeping it in a bank or vault usually comes with storage and insurance fees, which can eat into your returns.

4. Liquidity and resale value

Selling physical gold can take time and may involve extra costs.

Prices offered by dealers can also differ from market prices, especially for smaller pieces like jewellery or coins.

5. Market and policy risks

Gold prices are affected by global economic conditions, geopolitical risks, central bank policies and investor sentiment.

Sudden changes, such as faster rate hikes or a stronger US dollar, can cause prices to fluctuate.

To sum up, you should carefully consider the risks associated with gold in relation to your personal financial goals and risk tolerance even though it can diversify a portfolio and act as a hedge against inflation.

What would Beansprout do?

If you are looking to diversify your investment portfolio, it might be worth considering gold investments.

You can then choose an investment strategy based on physical gold, gold savings accounts, gold ETFs, or CFDs, depending on your financial goals and risk tolerance.

That said, it is important to be aware of the potential downsides, such as price fluctuations and the fact that gold does not generate regular income like dividends or interest.

If you’re interested in opening a Gold Savings Account or owning physical gold directly, learn more about how to buy gold from UOB here.

To get broader and easier exposure to gold as an asset class, you can find out the best gold ETFs here.

If you're looking to open a brokerage account, check out our comparison of the best online brokerage & trading platform in Singapore here.

If you’re looking to hedge with gold CFDs, you can compare the best CFD trading platform in Singapore here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments