Best gold ETF in Singapore as gold prices hit record highs

ETFs

By Beansprout • 18 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Gold price reached a record high of above US$4,300 per ounce. We find out which is the best Gold ETF for investors in Singapore.

What Happened?

Gold prices climbed to a new record high of US$4,300 per ounce on 16 October 2025, extending their strong uptrend this year.

This now surpasses the highs seen during the Covid-19 pandemic, the Ukraine conflict, and the 2025 global market sell-off sparked by sweeping U.S. tariffs and rising geopolitical tensions.

The sharp increase in gold price was driven by a flight to safety following escalating tensions between the U.S. and China, renewed tariff threats, and export controls.

In addition, the weaker US dollar and expectations of more potential interest rate cuts by the Federal Reserve have also led to a higher gold price.

With the bounce in gold price, many in the Beansprout community are wondering what are ways to gain exposure to gold.

One easy and accessible way is through a gold ETF.

Let's take a look at whether Singapore gold ETFs are a good way to gain exposure to gold, and if they might be a better option compared to physical gold.

What are Singapore gold ETFs?

A gold ETF tracks the value of physical gold and can be purchased and sold on stock exchanges, allowing you to participate in the gold market without the need to physically own gold.

The underlying asset of a Singapore gold ETF is the gold bullion. This means that investing in gold ETFs in Singapore can provide similar benefits to investing in physical gold.

Overall, investing in gold ETFs in Singapore is much more accessible, with lower barriers to entry, compared to physical gold investment, while still providing the advantages of investing in gold.

What are the advantages of Gold ETFs?

#1- Smaller investment size

Investing in physical gold may require a significant capital investment, especially with gold priced above US$4,300 per ounce (oz) as of 17 October 2025.

Singapore gold ETFs provide a way to gain exposure to the gold market without having to commit a large amount of capital.

The SPDR Gold Shares in Singapore is trading at US$398.90 per unit as of 17 October 2025. With a minimum purchase size of 1 lot, you can gain access to gold with about S$515 of capital.

#2 - Gold ETFs may offer more convenience

Investing in physical gold requires secure storage, which can be potentially expensive. You would also probably not want to be leaving the gold under your pillow!

Some may choose to purchase insurance policies to have a greater peace of mind, but this would potentially raise your investment costs.

On the other hand, Singapore Gold ETFs are traded on the SGX and can be bought and sold like stocks. As a result, you will be able to gain exposure to gold with greater convenience.

What are the disadvantages of Gold ETFs?

#1 - Gold ETFs may not track the price of gold perfectly

There are expenses relating to managing the gold ETF, which may erode the returns generated from investing in the fund over the long term.

The price of the Gold ETF may also not track the price of gold perfectly, depending on the liquidity of the gold ETF and market conditions.

#2 - Risks relating to ETFs

An ETF may be shut down in the event of financial difficulties faced by its sponsor. Hence, we need to check that the Gold ETFs are adequately funded and have a proven track record.

Also, not all Gold ETFs only track the price of gold. Some may include shares in gold-related companies, like gold mining firms. This presents a different set of risks compared to just owning physical gold.

Are Gold ETFs a good volatility hedge?

Gold has been considered a good hedge against volatility historically. However, its effectiveness may vary depending on the market environment.

Historically, gold has often been seen as a safe-haven asset that investors can turn to during times of increased volatility, such as during economic uncertainty or geopolitical crises.

This is because gold is a physical asset that is not tied to the performance of any specific company or economy. This makes it valuable as a tool for diversification.

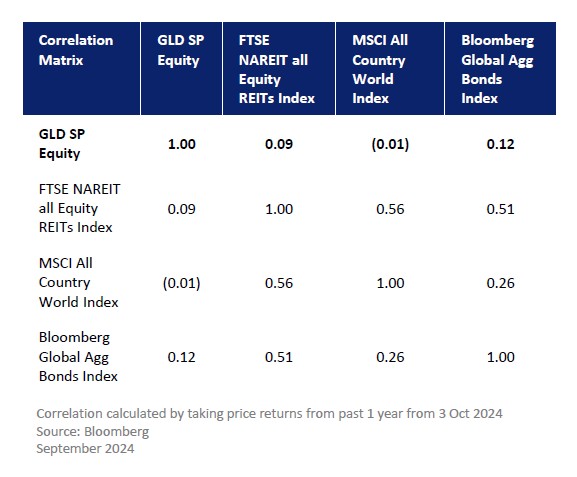

For example, the SPDR Gold Shares (GLD) in the table below shows low correlation with major asset classes such as equities, REITs, and bonds. This means adding gold to a portfolio may help diversify risk and reduce overall volatility.

It might be important to note that all investments carry risks, and gold ETFs may not be a perfect hedge for volatility.

This is because its performance may be affected by various factors such as foreign currency rates, as well as changes in demand and supply.

What is the SPDR Gold Shares ETF?

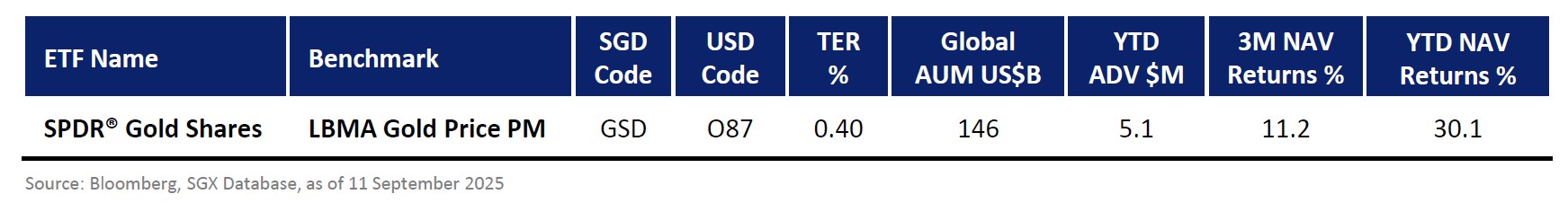

Currently, there is only one Singapore gold ETF, which is SPDR Gold Shares. The SPDR Gold Shares can be easily bought and sold on the Singapore Stock Exchange (SGX) just like stocks.

It seeks to track the performance of the LBMA Gold Price PM, a widely recognised global benchmark for the price of gold.

The SPDR Gold Shares offers the flexibility of both Singapore dollar (GSD.SI) and US Dollar (O87.SI) trading options.

SPDR Gold Shares has an annual total expense ratio of only 0.40%, making it a cost-effective solution for those looking to gain exposure in the gold market.

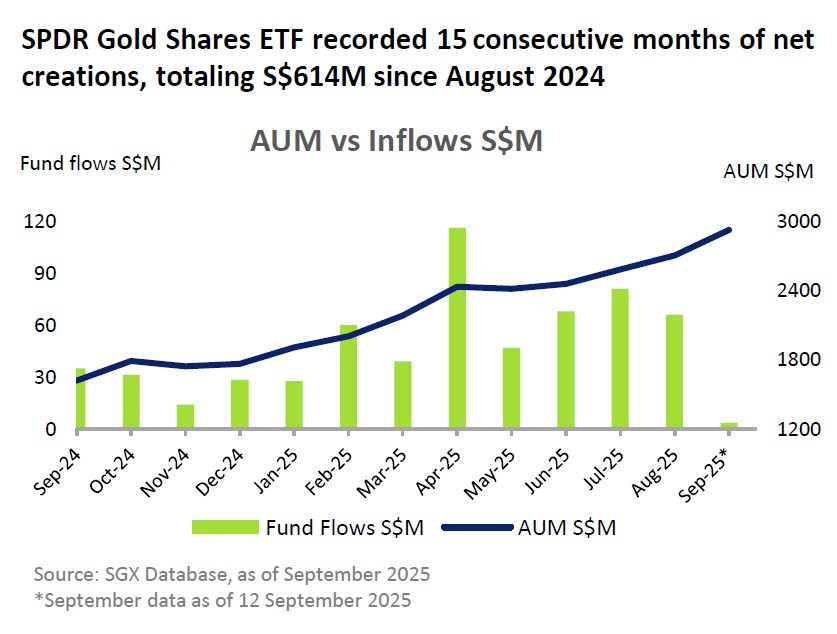

As of 12 September 2025, the SPDR Gold Shares extended its lead as the largest ETF on SGX with AUM growing to S$2.93 billion, driven by robust inflows.

You can find out more about SPDR Gold Shares here.

What are the Gold ETFs listed outside of Singapore?

If you are looking at Gold ETFs looking outside of Singapore, there are a few additional options to consider.

The iShares Gold Trust (IAU) is backed by physical gold held in a secure vault, is listed in the US, and has an expense ratio of just 0.25%.

The VanEck Gold Miners ETF (GDX) provides investors with exposure to gold mining companies, and is listed in the US.

The VanEck Junior Gold Miners ETF (GDXJ) provides investors with exposure to small cap companies involved in gold mining.

What is the difference between the SPDR Gold Shares and other Gold ETFs?

Both the SPDR Gold Shares (SGX: O87) and iShares Gold Trust (NYSE: IAU) are backed by physical gold, which may provide investors with a greater peace of mind.

The SPDR Gold Shares is the only gold ETF that is listed in Singapore. It is also an investment option that is included under the CPF Investment Scheme, subject to investment limits.

Amongst the four gold ETFs listed below, the iShares Gold Trust (IAU) has the lowest expense ratio at just 0.25%.

The VanEck Gold Miners ETF (GDX) and VanEck Junior Gold Miners ETF (GDXJ) offer exposure to gold mining companies rather than physical gold, and the value of these companies may be more volatile and fluctuate according to equity market conditions.

VanEck Junior Gold Miners ETF (GDXJ) may offer investors higher potential returns than larger, more established gold mining companies, but also come with higher risks.

The VanEck Gold Miners ETF (GDX) and VanEck Junior Gold Miners ETF (GDXJ) have a slightly higher expense ratio compared to the SPDR Gold Shares and iShares Gold Trust (IAU).

| Ticker | Exchange | Exposure | Expense ratio | |

| SPDR Gold Trust | O87 / GSD | Singapore | Physical gold | 0.40% |

| iShares Gold Trust | IAU | US | Physical gold | 0.25% |

| VanEck Gold Miners ETF | GDX | US | Gold mining companies | 0.51% |

| VanEck Junior Gold Miners ETF | GDXJ | US | Small-cap gold mining companies | 0.51% |

Which is the best performing Gold ETF?

As of 30 September 2025, the SPDR Gold Trust ETF gained about 46.1% year-to-date, compared to the year-to-date return of 46.6% for its its benchmark, the LBMA Gold Price PM (%).

Reflecting the strong rally in gold prices, this would also make the SPDR Gold Trust the best performing ETF in Singapore year-to-date.

This would quite similar to the total return of 46.25% year-to-date return for the iShares Gold Trust.

Reflecting the bullish sentiment towards gold prices and gold miners, the VanEck Gold Miners ETF and and VanEck Junior Gold Miners ETF (NYSE: GDXJ) generated even higher year-to-date returns compared to the SPDR Gold Trust ETF.

| ETF | Year-to-date performance |

| SPDR Gold Trust (SGX: O87) | +46.1% |

| iShares Gold Trust (NYSE: IAU) | +46.25% |

| VanEck Gold Miners ETF (NYSE: GDX) | +125.1% |

| VanEck Junior Gold Miners ETF (NYSE: GDXJ) | +131.1% |

| Source: Fund fact sheet as of 30 September 2025 | |

How to buy Gold ETFs in Singapore?

The SPDR Gold Shares is traded on the SGX, and can be purchased through a brokerage account just like trading in stocks.

You can purchase SPDR Gold Shares through the CPF Investment Scheme (CPFIS), as well as using your Supplementary Retirement Scheme (SRS) funds too.

To purchase a US-listed ETF, you will need a brokerage account that allows you to trade US stocks.

Check out our comparison of the best brokerage account to trade US and Singapore ETFs.

What would Beansprout do?

Gold has continued to attract attention as prices surge to record highs amid heightened geopolitical tensions and expectations of lower interest rates.

While gold has historically served as a hedge during uncertain periods, it’s important to note that its price movements can also be influenced by shifts in market sentiment, currency strength, and investor demand.

For those looking to gain exposure, gold ETFs such as the SPDR Gold Shares provide a convenient way to participate in the gold market without the need for physical storage. Check out our comparison of the best brokerage account to trade US and Singapore ETFs.

Alternatively, you can find out other methods to buy gold in Singapore here.

However, given that gold does not generate income and prices can fluctuate, investors may wish to view it as part of a diversified approach rather than a short-term trade.

What other ETFs to consider?

If you prefer to invest in a familiar market like Singapore, you can read our guide to STI ETF here and guide to Singapore REIT ETFs here.

If you prefer to invest in the US market, find out more about the best S&P 500 ETFs for Singapore investors here.

Find out more about Exchange Traded Funds (ETFs) in Singapore here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments