HSBC Everyday Global Account (EGA): Earn up to 3.08% p.a. promotional interest on fresh funds

Savings Account

By Gerald Wong, CFA • 03 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The HSBC Everyday Global Account (EGA) is offering a promotional interest rate up to 3.08% p.a. on fresh funds. We dive into how the HSBC EGA works and evaluate if the savings account is worth it.

What happened?

As some of you may know, HSBC has been running limited-time promotions on fresh fund deposits with its Everyday Global Account (EGA) for some time now.

This time, the bank has adjusted its promotional interest rate, offering interest rate up to 2.03% p.a. for SGD fresh funds, on top of the prevailing interest rate of 0.05% p.a. for February 2026, and an additional 1% p.a. bonus interest under the HSBC Everyday+ Rewards Programme, bringing the total potential interest rate earned up to 3.08% p.a..

Unlike the January campaign, this February 2026 promotion pays bonus interest over a four-month period from February to May 2026, with the bonus rate stepping down over time depending on your customer segment and balances.

That’s led to plenty of discussion in the Beansprout community about whether HSBC EGA is still worth parking your savings in.

So what exactly has changed, what do you need to do to qualify for this rate, how much can you realistically earn, and are there any hidden catches?

Let’s break it down simply, so you can decide if the HSBC EGA is still worth considering for your savings today.

What is HSBC Everyday Global Account (EGA)?

The HSBC Everyday Global Account (EGA) is a multi-currency savings account that lets you hold, spend, and transfer in up to 11 different currencies.

HSBC EGA also offers bonus interest on fresh SGD and USD deposits. Below, we take a look at how the bonus interest works.

What is the interest rate on the HSBC EGA?

The HSBC Everyday Global Account (EGA) offers a prevailing interest rate of 0.05% p.a..

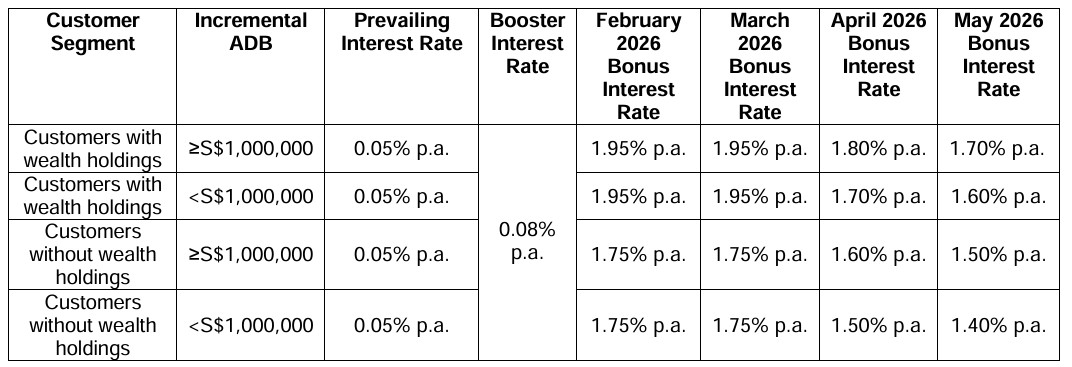

You will earn a bonus interest rate when you top up fresh funds into your account in February 2026. However, the bonus interest step down later on each month.

In other words, you’ll earn the highest bonus interest in February 2026 and March 2026, and slightly less in April 2026 and May 2026.

If you're a customer with wealth holdings and has an incremental ADB of ≥S$1,000,000, you'll enjoy a bonus interest of 1.95% p.a. in February 2026 and March 2026, 1.80% p.a. in April 2026, and 1.70% p.a. in May 2026.

If you're a customer with wealth holdings and has an incremental ADB of lower than S$1,000,000, you'll also enjoy a bonus interest of 1.95% p.a. in February 2026 and March 2026, but lower rates at 1.70% p.a. in April 2026, and 1.60% p.a. in May 2026.

Eligible wealth products are Unit Trusts, Equities, Bonds, Structured Products, Regular Premium insurance policies and Single Premium insurance policies, with the exclusion of Foreign Exchange (FX) and Dual Currency Plus. Insurance policies exclude those that are not sold by HSBC.

If you do not have a wealth product, you can still qualify for bonus interest of 1.75% p.a. in February 2026 and March 2026, 1.60% p.a. in April 2026, and 1.50% p.a. in May 2026 as a transactionally engaged customer with an incremental ADB ≥S$1,000,000.

If your incremental ADB is lower than S$1,000,000, you will qualify for bonus interest of 1.75% p.a. in February 2026 and March 2026, 1.50% p.a. in April 2026, and 1.40% p.a. in May 2026 as a transactionally engaged customer.

To qualify as a transactionally engaged customer, you’ll need to make at least seven eligible card transactions each month — these can be posted transactions made in SGD on either your HSBC personal credit card or your Everyday Global Debit Card.

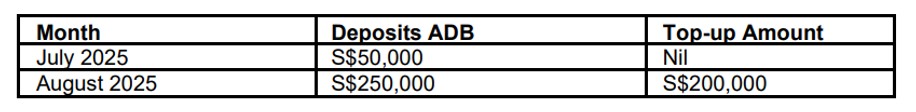

On top of the bonus interest, HSBC EGA also offers a small Booster Interest Rate of 0.08% p.a. if you maintain your incremental balances over the promotion period.

To qualify for the 0.08% p.a. Booster Interest Rate, your incremental average daily balance (ADB) in March, April and May 2026 must be at least equal to your incremental ADB in February 2026.

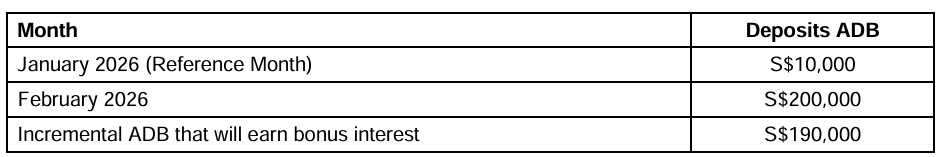

To qualify, HSBC looks at how much your average daily balance (ADB) grows compared to your January 2026 balance using fresh funds. Bonus interest is paid on the incremental portion only, up to a cap of S$5 million.

For example, if you have an average daily balance (ADB) of S$200,000 in February 2026 and ADB of S$10,000 in January 2026, the top-up amount will be S$190,000.

The bonus interest is calculated separately, on a simple (non-compounded) basis, and will only be credited into your account by 31 July 2026, after HSBC has verified that you’ve met the requirements for the entire promotion period.

It’s worth keeping in mind that if you registered for HSBC’s January 2026 promotion, you will not be eligible to sign up for this February 2026 promotion, and you must have an existing EGA account on or before 31 October 2025 to sign up for this promo.

Read the full T&C here.

How to earn an 'additional 1% p.a. bonus interest rate’ on the HSBC EGA Account

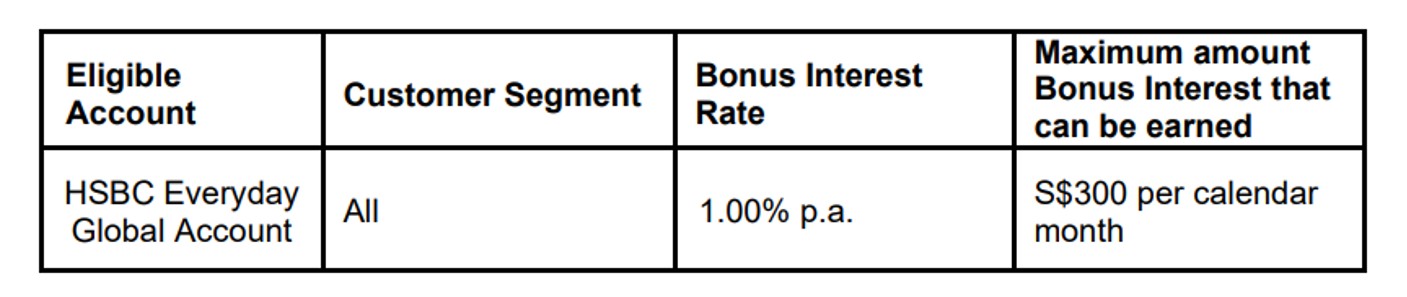

Apart from the promotional rate on fresh funds, HSBC also runs the Everyday+ Rewards Programme, which allows you to earn an 'additional 1% p.a. bonus interest' on your EGA savings.

This is separate from the promotional bonus, and the two can stack together.

To unlock this additional 1% p.a., you’ll need to meet two conditions in a calendar month:

- Deposit fresh funds via salary crediting or inward transfers from a non-HSBC account.

- For Personal Banking customers, the minimum is S$2,000.

- For Premier customers, the minimum is S$5,000.

- Make at least 5 eligible transactions in the same month. These include:

- Spending with an HSBC credit card,

- Using your Everyday Global Debit Card,

- Making GIRO bill payments, or

- Transferring funds from your EGA to a non-HSBC account.

(Note: transfers between your own HSBC accounts don’t count.)

It’s important to note that the additional 1% p.a. bonus interest rate is only applied to the incremental SGD average daily balance.

This means you’ll earn the extra 1% p.a. on the fresh funds you add compared to the previous month’s balance, as long as you also meet the Everyday+ Rewards criteria.

In practice, this means that if you want to keep enjoying the additional 1% each month, you’ll need to top up new fresh funds month by month.

For clarity, “fresh funds” refers to money coming in from outside HSBC. Transfers from your existing HSBC accounts, HSBC cheques, cashier’s orders or demand drafts will not qualify.

There is a max cap of S$300 to be earned per calendar month for this ‘additional 1% bonus interest’.

How much interest can I earn with the HSBC EGA and the 'additional 1% bonus interest'?

Assuming you meet the criteria set out in the HSBC Everyday+ Reward Programme, your fresh fund top up in February will also qualify for the additional 1% bonus interest in February only.

If you qualify under the wealth holdings category with a incremental ADB of less than S$1,000,000, here’s how much total bonus interest you would earn each month:

| Month | Prevailing Interest Rate (p.a) | Booster Interest Rate (p.a.) | Bonus Interest Rate (p.a.) | Additional 1% bonus interest | Total Interest Rate (p.a.) |

| February | 0.05% | 0.08% | 1.95% | 1% | 3.08% |

| March | 0.05% | 0.08% | 1.95% | NIL | 2.08% |

| April | 0.05% | 0.08% | 1.70% | NIL | 1.83% |

| May | 0.05% | 0.08% | 1.60% | NIL | 1.73% |

If you are a transactionally engaged customer instead with a incremental ADB of less than S$1,000,000, your total bonus interest would be:

| Month | Prevailing Interest Rate (p.a.) | Booster Interest Rate (p.a.) | Bonus Interest Rate (p.a.) | Additional 1% bonus interest | Total Interest Rate (p.a.) |

| February | 0.05% | 0.08% | 1.75% | 1% | 2.88% |

| March | 0.05% | 0.08% | 1.75% | NIL | 1.88% |

| April | 0.05% | 0.08% | 1.50% | NIL | 1.63% |

| May | 0.05% | 0.08% | 1.40% | NIL | 1.53% |

Earn cashback through the HSBC Everyday+ Rewards Programme

You can earn a cashback of 1% on eligible card spend on HSBC Everyday Global Debit Card.

Do note that there are exclusions to the above e.g. your usual insurance, utilities, educational institutions payments. You can refer to the T&C link for the full list.

Here, I want to point out that there is also a cap on the cashback you are getting.

It is S$300 per calendar month for HSBC Personal Banking customers and S$500 for Premier customers.

Welcome promotions for new HSBC customers

New to HSBC Everyday Global Account (EGA)

If you are opening a new HSBC Everyday Global Account (EGA) in February 2026, you may qualify for the HSBC Welcome Rewards Promotion.

This offers tiered rewards depending on your banking relationship and how much fresh funds you bring in. Customers can choose to receive their rewards either as a cash credit or as an investment in HSBC Singapore Dollar Liquidity Fund:

- Premier customers: Cash credit rewards from S$680 up to S$880 or HSBC Singapore Dollar Liquidity Fund worth SGD 1,360 up to SGD 1,860 for deposits of S$300,000 to S$600,000. Rewards also include welcome interest rates of up to 1.68% p.a. on SGD and 3.98% p.a. on USD deposits for the first three months, capped at S$3,000,000.

- Premier Elite / Accredited Investor customers: Higher tiers are available, with rewards from S$2,880 up to S$5,860 cash credit rewards or HSBC Singapore Dollar Liquidity Fund worth SGD 1,860 up to SGD 5,860 for very large deposits of S$600,000 to S$1.2 million. These tiers also come with the same attractive welcome interest rates of up to 1.68% p.a. on SGD and 3.98% p.a. on USD deposits for three months.

Fresh Funds must be maintained for the required period to qualify.

The Welcome Rewards cannot be combined with other HSBC sign-up offers and is a separate promo from the February 2026 bonus interest promo on the HSBC EGA. But you can stack the Welcome Rewards with the Everyday+ Rewards Programme.

Check out the Welcome Rewards T&C here.

New to Everyday+ Rewards Programme

If you are new to the HSBC Everyday+ Rewards Programme, there is also a one-time bonus cash reward on top of the ongoing cashback and bonus interest benefits:

- S$150 for Personal Banking customers (maintain at least S$100,000 for six consecutive months),

- S$300 for Premier customers (maintain at least S$200,000 for six consecutive months).

These rewards are credited in the 7th month, once the balance requirements are met.

In addition, HSBC offers smaller rewards of S$50 cash credit each for completing simple onboarding actions.

These include registering PayNow and linking it to your EGA, activating your debit card and making seven purchases, using Global Money Transfer, or subscribing to HSBC SG Chat.

On top of that, customers who take up wealth products with HSBC may also qualify for additional cash credits of S$100 to S$300 for every S$50,000 invested, subject to caps depending on the product type.

What else do I need to do to be eligible for the HSBC Everyday Global Account (EGA) promotion?

To be eligible for the HSBC EGA promotion, both new and existing HSBC customers must successfully register by sending an SMS with the relevant info in the following format to 74722 within the promotional period:

EGA <space> First 9-digit of their Everyday Global Account number (e.g. EGA 123456789)

Alternatively, you can register via the HSBC Singapore app.

Final verdict on the HSBC Everyday Global Account (EGA)

The HSBC Everyday Global Account (EGA) can be attractive if you’re looking to boost returns on your savings with promotional bonus interest and are willing to meet the conditions.

February's and March's rate can go up to 2.08% p.a. for customers with wealth holdings but there are some catches to keep in mind.

The bonus rates step down each month from February 2026 and March 2026 to May 2025, and you’ll need to wait until 31 July 2026 to actually receive the credited bonus interest.

On top of that, the additional 1% bonus from the Everyday+ Rewards Programme requires monthly fresh funds top-ups and meeting transactional criteria.

Without a wealth product and less than S$1,000,000 of ADB, the interest rate of up to 1.88% p.a. in February and March is comparable to the interest rate for most other savings accounts currently and requires you to make at least seven eligible transactions to qualify.

As there are numerous conditions that come with each of the bonus rewards, it is recommended that you go through the terms and conditions here and here carefully.

In short, the HSBC EGA may work best as a supplementary savings account if you’re prepared to park fresh funds for a few months and meet the activity requirements.

But if you’re after fuss-free, long-term rates, you may want to compare it with other high-interest savings accounts available.

To find out which savings account allows your money to work harder, check out our guide to the best savings account with highest interest rates in Singapore.

To find out other ways to make your savings work hard, check out our guide to best ways to earn a passive income in Singapore.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Find out which savings account allows you to earn the highest interest rate on your savings.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

1 questions

- Geri • 15 Jul 2025 06:06 AM