Infinity Development Holdings - Established Asian footwear adhesives leader

Stocks

By Ng Hui Min • 28 Dec 2025

Why trust Beansprout? We're licensed by the Monetary Authority of Singapore (MAS).

Infinity Development is ranked among the top four footwear adhesive manufacturers in Asia.

Established Asian footwear adhesives leader (SGX: ZBA) - Not Rated

Infinity Development is principally engaged in the manufacture and sale of adhesives, primers, hardeners and other adhesive-related products used in footwear manufacturing.

According to an industry survey conducted by Converging Knowledge Pte. Ltd., the Group is ranked among the top four footwear adhesive manufacturers in Asia, reflecting its established presence and scale within the regional footwear supply chain.

Infinity Development markets its products under proprietary brands “Zhong Bu” and “Centresin”, which are manufactured and/or sold primarily in Vietnam, Indonesia, Bangladesh and the People’s Republic of China.

Over time, these brands have become well recognised among footwear manufacturers, supported by consistent product quality, technical reliability and long-standing customer relationships.

Infinity Development also produced and supplied certain adhesive and primer products on an OEM basis, complementing its branded offerings.

Adhesives, primers and hardeners are important inputs in footwear production.

Adhesives are used to bond key footwear components such as outsoles, insoles and uppers, while primers are applied during the pretreatment stage to prepare surfaces prior to bonding.

Hardeners act as curing agents when mixed with adhesives, facilitating or controlling the curing process to achieve the required bonding strength.

These products are applied at different stages of the footwear manufacturing process, and their performance can have a direct and material impact on the durability, quality and consistency of the finished footwear.

The Group’s core product portfolio comprises adhesives and primers under the “Zhong Bu” brand, with formulations designed to meet varying material requirements, production conditions and customer specifications.

While products generally fall within similar functional categories, Infinity Development continuously refines and improves formulations to enhance performance.

For example, in its water-based adhesive range, product development efforts have focused on achieving stronger initial tack and improved bonding strength.

These ongoing enhancements support product differentiation and align with industry trends towards environmentally friendly and sustainable materials, as footwear manufacturers increasingly adopt stricter environmental and compliance standards.

Overall, Infinity Development’s business model combines technical formulation expertise, branded product recognition and regional manufacturing presence, positioning the Group as an established supplier of essential adhesive solutions within the Asian footwear manufacturing ecosystem.

Business model and product offering

Infinity Development’s core product portfolio comprises adhesives, primers and auxiliary chemical products used in footwear manufacturing.

These include polyurethane (PU) adhesives, chloroprene rubber (CR) adhesives, water-based adhesives, and a wide range of primers designed to improve bonding performance on materials such as EVA, rubber, PVC, synthetic leather and textiles.

Infinity Development operates a solutions-driven model, working closely with customers to tailor chemical formulations to specific production requirements, materials and environmental standards.

In addition to standardised formulations, the Group develops customised and application-specific products, including low-VOC and toluene-free solutions, aligning with tightening environmental regulations and evolving customer sustainability requirements.

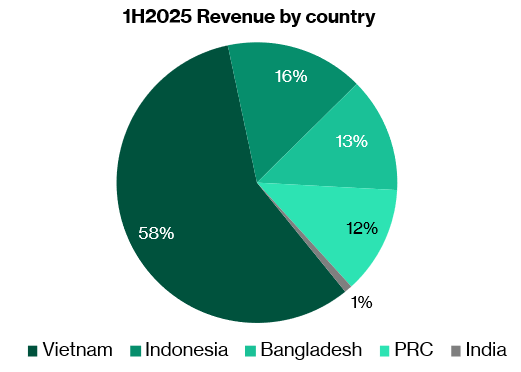

Diversified geographic exposure anchored in footwear manufacturing hubs

Infinity Development has established a diversified operational footprint across key footwear manufacturing regions.

Production facilities are strategically located close to customer clusters to reduce logistics costs, improve responsiveness and support technical servicing.

Sales operations span Macau, Mainland China, Vietnam, Indonesia, India, Taiwan and Southeast Asia, reflecting the geographic migration of global footwear manufacturing over time.

Manufacturing footprint and utilisation

Infinity Development operates a regionally diversified manufacturing footprint across key footwear production hubs in Asia, supporting its role as a supplier of mission-critical adhesive products to footwear manufacturers.

It operates three production facilities located in Vietnam, the People’s Republic of China and Indonesia, producing adhesives, primers and hardeners under both proprietary brands and OEM arrangements.

Existing production facilities and utilisation

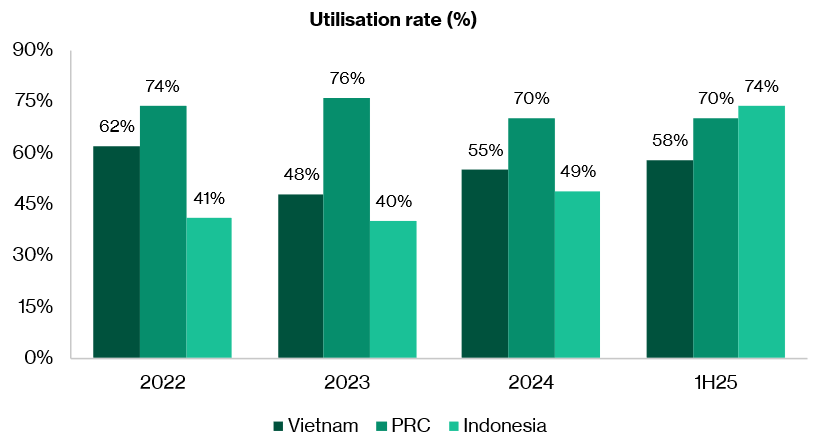

Infinity Development’s largest manufacturing base is located in Vietnam, where it operates 20 production lines with an annual productive capacity of approximately 41,000 tonnes.

Over FY2022 to FY2024, utilisation rates at the Vietnam facility ranged between 48% and 62%, reflecting a combination of stable customer demand and deliberate capacity headroom to accommodate fluctuations in order volumes and product mix.

In 6M2025, utilisation increased to 58%, indicating improving operating leverage while retaining flexibility for incremental growth.

In the PRC, Infinity Development operates a facility with 25 production lines and an annual productive capacity of approximately 28,000 tonnes.

This facility has historically operated at higher utilisation levels compared to Vietnam, with utilisation ranging between 70% and 76% over FY2022 to FY2024, before stabilising at around 70% in 6M2025.

The PRC plant primarily supports established customer relationships and demand in North Asia, contributing meaningfully to overall production output.

Their existing Indonesia plant operates four production lines with an annual capacity of approximately 6,000 tonnes, focusing on adhesives and primers.

Utilisation at this facility was lower in earlier years, averaging around 40–49% from FY2022 to FY2024, but rose sharply to 73.7% in 6M2025.

Across all facilities, maximum productive capacity estimates assume operations of 11.5 months per year, 30 days per month, with two 8-hour shifts per day, excluding maintenance downtime.

Note: Maximum production capacity for the above three plants is estimated based on maximum output for 11.5 months per year, 30 days per month, operating two shifts per day, with each shift of 8 hours.

New Indonesia plant to support capacity expansion

To address rising demand and strengthen its cost competitiveness, Infinity Development is in the process of constructing a new production facility in Indonesia, following the acquisition of industrial land in April 2022.

The construction of the New Indonesia Plant is intended to better serve customers by improving cost competitiveness and freight time advantages, and to further strengthen its core business.

The total estimated investment for the acquisition of property, plant and equipment, and construction works for the new Indonesia plant is approximately HK$90.4 million, of which HK$55.6 million had been incurred as at 31 March 2025.

This includes approximately US$4.25 million spent on machinery and production equipment acquired from an independent third party in November 2024, as well as associated pipeline, instrumentation and electrical works.

The project is funded entirely through internally generated funds, underscoring the Group’s strong cash flow position.

Upon completion, the new Indonesia plant is expected to add approximately 14,000 tonnes of annual production capacity, supported by 13 production lines, producing adhesives, primers and hardeners.

Trial production is targeted for the last quarter of 2025, with the existing Indonesia plant expected to be gradually phased out where appropriate.

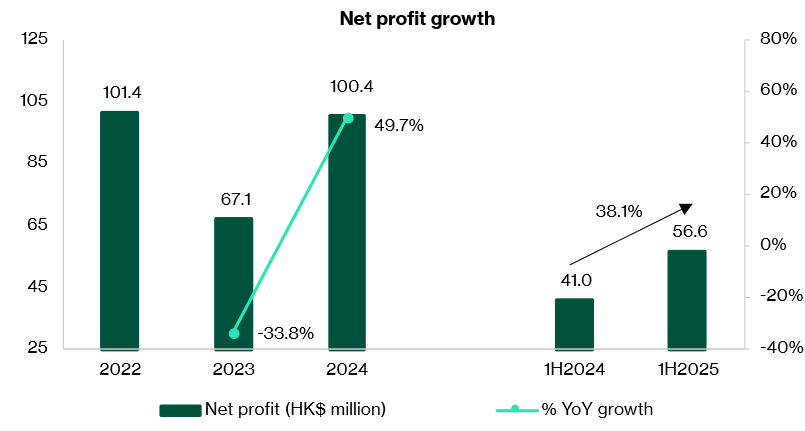

Financial performance

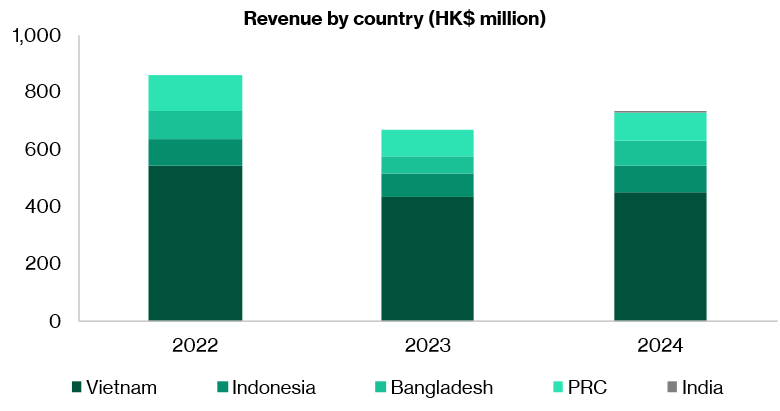

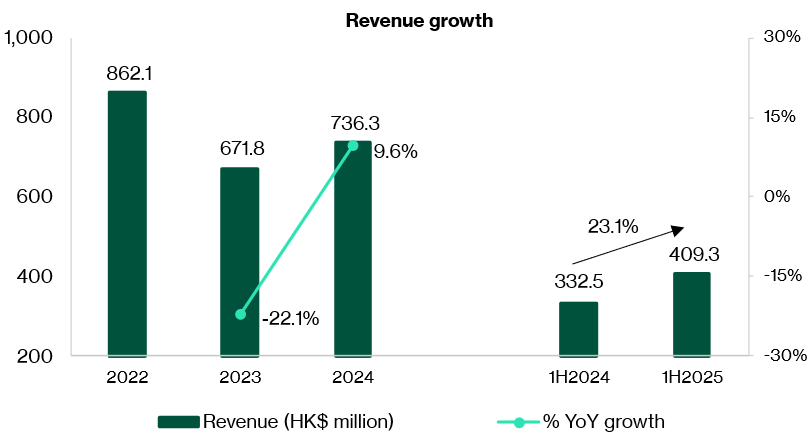

Revenue declined from HK$862.1 million in FY2022 to HK$671.8 million in FY2023 following a cyclical slowdown in FY2023 linked to post-pandemic inventory destocking across the global footwear industry.

This was followed by a recovery in FY2024, with revenue increasing by 9.6% year-on-year to HK$736.3 million, driven by improved order flows across all geographical regions as consumer demand for footwear normalised in the Asia-Pacific region.

Momentum continued into the most recent interim period, with 6M2025 revenue rising 23.1% year-on-year to HK$409.3 million, compared with HK$332.5 million in 6M2024.

Management attributes this growth to sustained demand recovery across Asia and increased production volumes by footwear manufacturers, underscoring Infinity Development’s leverage to downstream manufacturing activity.

Profitability growth has outpaced revenue growth, reflecting both operating leverage and disciplined cost management.

Gross profit declined modestly in FY2023 in line with lower sales, but gross margin expanded from 25.9% in FY2022 to 31.1% in FY2023, supported by lower material costs and proactive cost controls.

In FY2024, gross profit increased sharply to HK$277.4 million, with gross margin further expanding to 37.7%, driven by higher volumes and improved cost efficiency.

Gross margin remained stable at approximately 37.5%–37.6% in 6M2025, indicating that margin gains achieved in FY2024 have been sustained despite rising operating activity.

The earnings rebound accelerated in the most recent interim period, with 6M2025 PBT increasing 37.6% year-on-year to HK$69.7 million, and profit attributable to shareholders rising to HK$56.6 million.

Excluding one-off listing expenses of HK$3.0 million, adjusted interim profit attributable to shareholders would have been HK$59.6 million, reflecting both higher gross profit and favourable foreign exchange movements during the period.

From a balance sheet perspective, Infinity Development remains well capitalised, with total equity increasing from HK$487.3 million as at end-FY2022 to HK$583.6 million as at end-FY2024, and further to HK$591.2 million as at 31 March 2025. Net asset value per share increased steadily over the period.

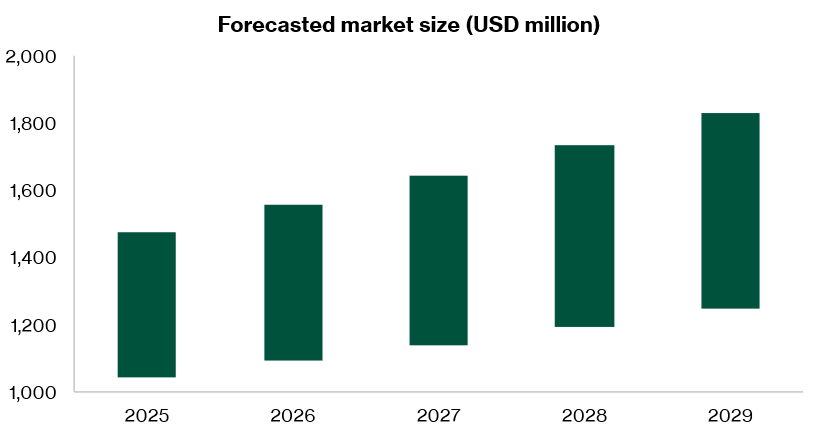

Industry outlook

Asia to remain the core growth engine for footwear adhesives

According to Converging Knowledge, Asia is expected to maintain its position as the global centre of footwear manufacturing, underpinned by its scale, established supply chains and cost competitiveness.

As a result, demand for footwear adhesives and related bonding solutions is projected to grow steadily over the medium term.

Based on industry research prepared by Converging Knowledge, the market size of the footwear adhesives industry in Asia is forecast to expand at a compound annual growth rate (CAGR) of approximately 4.5% to 5.5% between 2025 and 2029, increasing from around USD 1.2 billion to approximately USD 1.8 billion over the period.

This growth is supported by rising footwear production volumes, continued diversification of footwear categories and increasing technical requirements in bonding applications.

Structural demand driven by footwear consumption and product diversification

Footwear demand in Asia continues to be supported by both domestic consumption and export-oriented manufacturing.

While near-term macroeconomic conditions are expected to remain mixed, the region benefits from relatively resilient consumer demand for footwear across casual, athletic and functional categories.

In particular, footwear designed for running, outdoor activities and casual wear has gained traction in key markets such as the PRC, Vietnam and Indonesia.

These categories often require higher-performance adhesives to meet durability, comfort and quality standards, which supports demand for more specialised bonding solutions.

At the same time, growth in private-label and contract manufacturing for global footwear brands continues to drive demand for consistent, scalable and technically reliable adhesive products.

As footwear manufacturers seek to improve production efficiency and reduce defect rates, the role of adhesives, primers and hardeners as mission-critical inputs becomes increasingly important.

Increasing adoption of automation and advanced bonding technologies

The footwear manufacturing industry is undergoing a gradual shift towards greater automation, driven by labour constraints, rising wage costs and the need for more consistent production outcomes.

Automated cutting, bonding and assembly processes require adhesives with tighter performance tolerances, faster curing times and compatibility with automated equipment.

This trend is creating incremental demand for higher-value, application-specific adhesive formulations, particularly in markets such as Vietnam and the PRC, where manufacturers are upgrading production lines to remain competitive.

For adhesive manufacturers, this shift presents opportunities to work more closely with customers on customised formulations and technical support, while also raising barriers to entry for less sophisticated suppliers.

Sustainability and regulatory trends shaping product development

Sustainability considerations are becoming an increasingly important factor in footwear manufacturing, driven by both regulatory developments and brand-owner requirements.

Governments in key manufacturing hubs such as Vietnam, Indonesia and the PRC have introduced policy roadmaps and industry initiatives aimed at promoting sustainable manufacturing practices, including lower emissions, reduced volatile organic compound (VOC) content and improved material traceability.

As a result, demand is gradually shifting towards water-based and environmentally friendly adhesives, which offer lower VOC emissions compared to traditional solvent-based products.

Adhesive manufacturers that are able to develop compliant, high-performance alternatives are better positioned to benefit from this transition.

Localisation of supply chains and raw material sourcing

The footwear industry’s reliance on imported raw materials has highlighted supply chain vulnerabilities, particularly during periods of global disruption.

In response, several Asian countries are actively seeking to improve local sourcing capabilities for key inputs used in footwear manufacturing. Vietnam has announced plans to develop raw material hubs, while Indonesia continues to attract foreign suppliers across the footwear value chain.

These developments are expected to support more integrated local ecosystems, benefiting suppliers of ancillary products such as adhesives.

At the same time, adhesive manufacturers remain exposed to raw material price volatility, which may affect margins if cost increases cannot be fully passed through.

Industry participants are therefore expected to focus on supply chain optimisation, formulation efficiency and customer collaboration to manage cost pressures.

Competitive strengths

Established position as a leading regional footwear adhesives supplier

Infinity Development has built an established position within the Asian footwear adhesives market, supported by its scale, operating history and regional footprint.

According to an industry survey conducted by Converging Knowledge Pte. Ltd., Infinity Development is ranked among the top four footwear adhesive manufacturers in Asia.

This positioning reflects long-standing customer relationships, consistent product quality and their ability to support large footwear manufacturers across multiple production locations.

Their presence in key footwear manufacturing hubs, including Vietnam, the PRC and Indonesia, enables it to serve customers with regional supply requirements and reduces reliance on a single market or production base.

This geographic diversification enhances supply reliability and supports customer retention, particularly for multinational footwear manufacturers.

Mission-critical products embedded in customers’ production processes

Adhesives, primers and hardeners are essential inputs in footwear manufacturing, directly affecting bonding strength, durability and overall product quality.

Once qualified and approved by customers, these products are typically embedded within manufacturing processes and are not easily substituted without operational risk..

Infinity Development’s products are used across multiple stages of footwear production, including outsole, insole and upper bonding, as well as surface pretreatment and curing.

Proprietary brands with recognised market acceptance

Infinity Development markets its products primarily under the “Zhong Bu” and “Centresin” brands, which management believes are well recognised among footwear manufacturers in its core markets.

In addition, Infinity Development’s experience in OEM production provides flexibility to serve customers with varying branding and formulation requirements.

In-house formulation expertise and continuous product improvement

Infinity Development maintains in-house formulation capabilities that enable continuous refinement and enhancement of its adhesive products. While products generally fall within established categories, Infinity Development regularly improves formulations to enhance bonding strength, curing efficiency and compatibility with different materials and production processes.

Scalable manufacturing platform with expansion optionality

Infinity Development’s existing manufacturing facilities provide meaningful production scale, while recent investments in the new Indonesia plant add further capacity and cost advantages.

The expansion in Indonesia is expected to enhance proximity to customers, improve freight efficiency and support higher utilisation levels across Infinity Development’s manufacturing network.

Experienced management team with deep industry knowledge

Infinity Development is led by a management team with extensive experience in the footwear adhesives and specialty chemicals industry.

Senior management has deep operational knowledge across formulation, production, sales and customer technical support, enabling effective execution across multiple markets.

Management’s long operating history and established customer and supplier relationships provide continuity and execution discipline, which are important in an industry characterised by technical requirements, regulatory oversight and cost sensitivity.

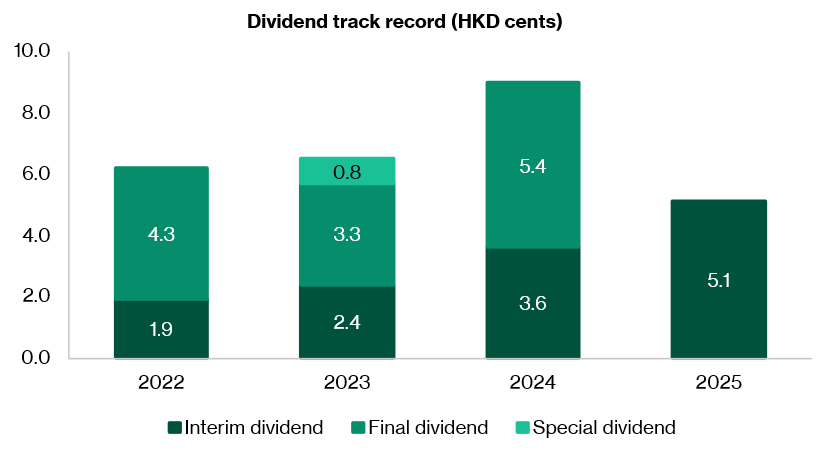

Dividend policy

Infinity Development has demonstrated a consistent history of dividend distributions over the past three financial years and the most recent interim period.

Dual listing and use of proceeds

Infinity Development’s IPO on SGX Catalist completed with the issuance of 35.1 million placement shares at S$0.39 each, raising approximately S$13.7 million in gross proceeds and resulting in a post-placement market capitalisation of about S$123.5 million.

The IPO was fully subscribed and attracted institutional participation.

Net proceeds from the placement are targeted at supporting regional expansion, with the majority (around S$6.2 million) earmarked to help grow Infinity Development’s overseas presence, particularly in markets with expanding footwear manufacturing bases.

A further S$2.4 million is intended for growth through acquisitions, joint ventures or strategic alliances, while the balance of approximately S$2.4 million will support general working capital needs.

Key Risks

Key risks include exposure to cyclical footwear demand, raw material price volatility, competitive pricing pressure, execution risks related to capacity expansion, regulatory and environmental compliance requirements, foreign exchange fluctuations and potential share price volatility following the Catalist listing.

Valuation

Infinity Development is currently trading at 5.7x trailing P/E and 1.3x P/B based on closing price on 19 December 2025 of S$0.39.

Check out Beansprout guide to the best stock trading platforms in Singapore with the latest promotions to Infinity Development Holdings.

Download the full report here.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments