4 reasons to invest in Singapore now

Mutual Funds

Powered by

By Ng Hui Min • 07 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Singapore’s market hit new highs amid major economic transformation. Explore the growth drivers, income potential, and why investors are paying attention now.

This post was created in partnership with Fullerton Fund Management. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

Singapore’s market has maintained strong momentum this year, and has climbed to new highs.

But beyond the strong performance, what has really caught investors’ attention is something much bigger: Singapore is undergoing one of its most significant economic transformations in years.

With global markets feeling uncertain and variable, Singapore has continued along its path of enhancing its growth engines.

And this transformation is reshaping earnings potential, capital inflows, and investment opportunities across the market.

At the same time, Singapore still retains the fundamentals that investors seeking income and long-term growth look for: stability, a strong currency, and solid dividends.

Here, we take a closer look at the economic transformation that could continue to make Singapore an attractive option for investors.

How Singapore’s economic transformation could support its growth

The most exciting part of Singapore’s investment story today is its ongoing economic transformation.

Progression remains backed by clear government targets, national strategies, and structural investments that will shape growth over the next decade.

Recently, Deputy Prime Minister Gan shared that Singapore is aiming for 3–4% GDP growth in the coming years.

This target is achievable only if the country continues to build up higher-value industries such as advanced manufacturing, precision medicine, artificial intelligence, and the green economy.

We are already seeing progress.

#1 – A rising digital economy

The digital economy is one of Singapore’s fastest-growing engines and now accounts for 18.6% of GDP in 2024, up from 14.9% five years ago, according to IMDA.

This reflects stronger demand for cloud computing, cybersecurity, and AI.

To support the next phase of expansion, Singapore’s Green Data Centre Roadmap has approved at least 300 megawatts of new data-centre capacity, with a strong focus on energy-efficient and green designs.

This is important as AI computing drives higher energy use.

#2 – Advanced manufacturing as a growth engine

Advanced manufacturing is another pillar.

Under the Economy 2030 vision, Singapore aims to expand its manufacturing value-added by 50% by 2030, focusing on areas such as semiconductors, biomedical science, and precision engineering.

Global technology firms continue to increase their presence here because of Singapore’s stability, skilled workforce, and strong protections for intellectual property.

These investments help lift productivity and wages, and they strengthen the long-term earnings potential of companies linked to these sectors.

#3 – Sustainability to reshape capital flows

Singapore is also stepping up its efforts in sustainability.

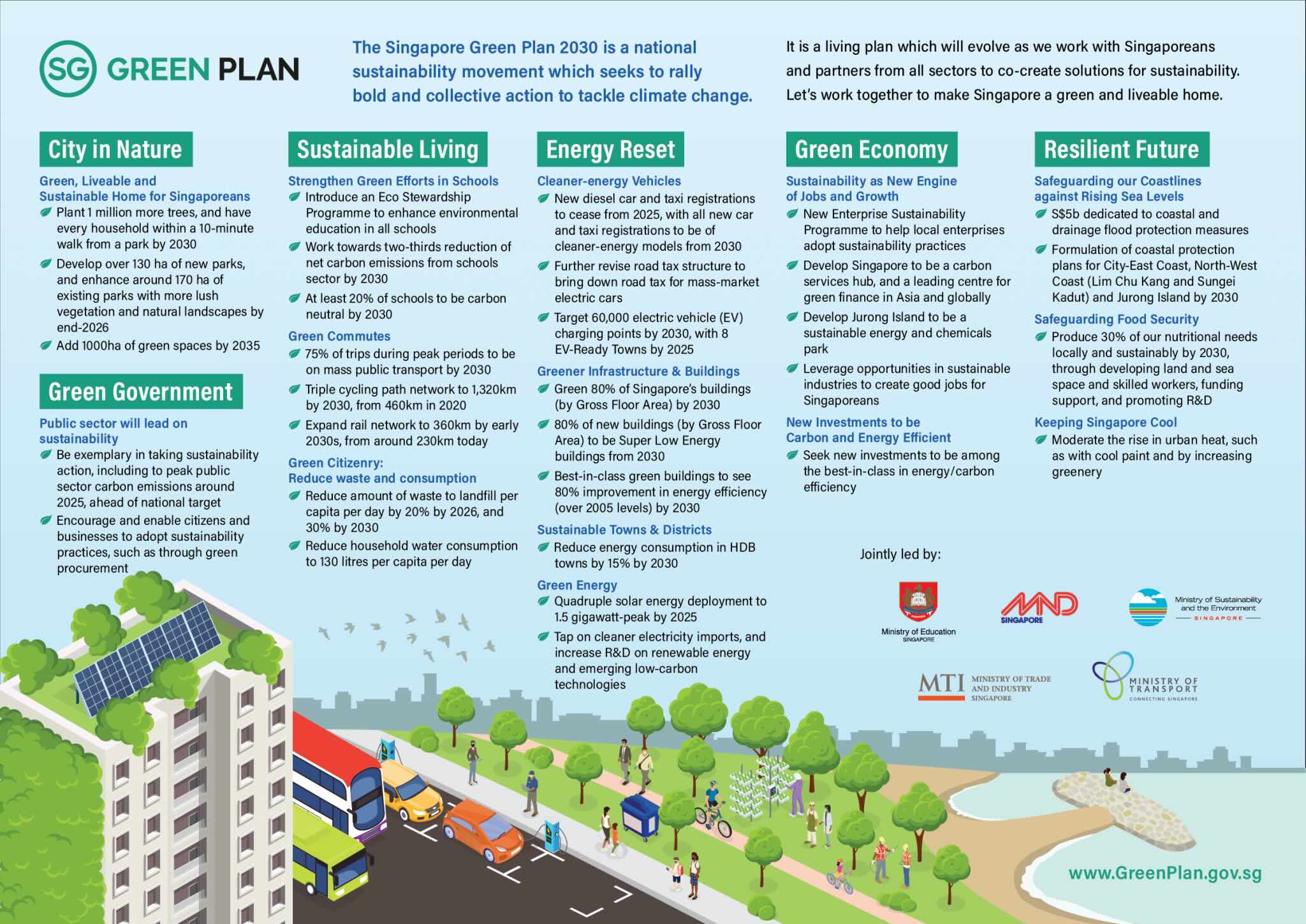

Under the Singapore Green Plan 2030, the country targets 2 gigawatt-peak of solar energy, 80% green buildings, and cleaner-energy vehicles for all new car and taxi registrations from 2030.

These targets are reshaping capital flows in energy, real estate, and transport.

Figure 1: Singapore Green Plan 2030

Companies are already adjusting their business models and investment plans to align with these national goals.

#4 – Efforts to boost capital markets

At the same time, Singapore is also revitalising its capital markets to support this next phase of growth.

In the Government’s 2025 Budget (February 2025), significant tax concessions were announced for firms that list on the Singapore stock exchange or issue more shares.

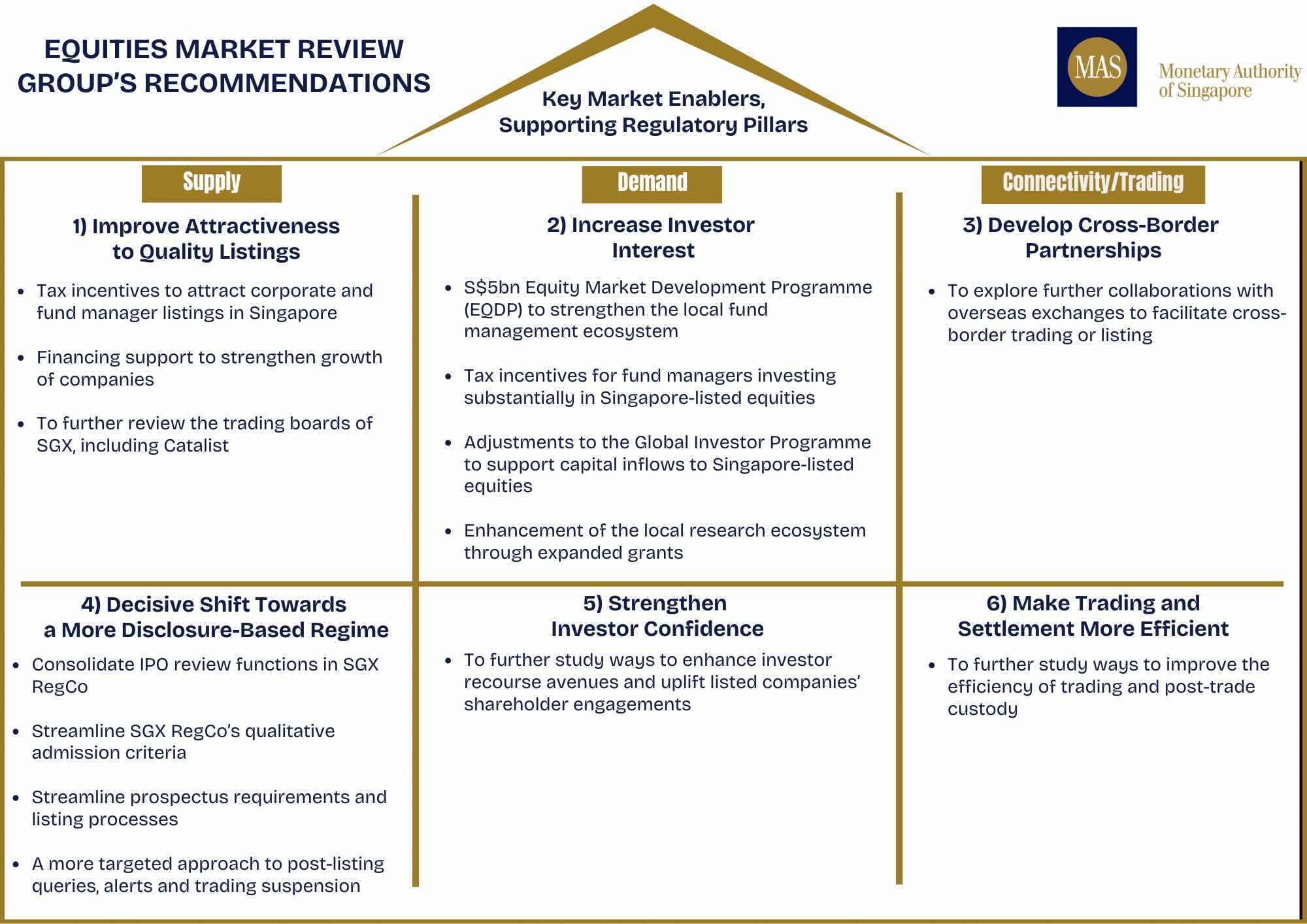

In addition, the Monetary Authority of Singapore’s Equities Market Review also recommended a full set of reforms designed to improve liquidity and strengthen investor participation.

These measures include the S$5 billion Equity Market Development Programme (EQDP), streamlined listing requirements, and new cross-border trading collaborations.

Such initiatives aim to make Singapore’s equity market more vibrant and competitive – especially with enhanced research coverage. As it is, we are already seeing more activity and renewed interest from institutional investors.

According to global fund flow data, analysts have highlighted that global fund managers increased exposure to Singapore for stability, yield, and currency strength.

Figure 2: MAS Equity Market Review Recommendations

At the company level, many Singapore firms are restructuring to unlock value.

Some are selling non-core assets, improving capital efficiency, and focusing on dividend sustainability.

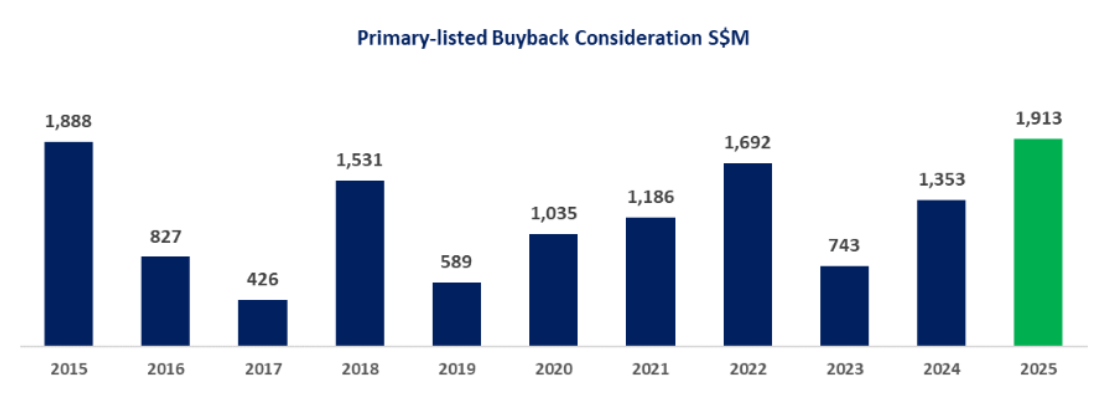

Share buybacks have also risen sharply, reaching S$1.9 billion in 2025, the highest in more than ten years, even with data only up to October.

Figure 3: Shares buyback trend (2015 to 2025)

This reflects stronger balance sheets and growing confidence among management teams.

Together, economic transformation, capital-market reform and corporate restructurings are creating opportunities that did not exist even as recent as just a few years ago.

Others are expanding into regional markets for new growth.

These changes can create opportunities for investors who can identify companies benefiting from these shifts.

A resilient foundation with income, value, and steady earnings

Even as Singapore undergoes major economic transformation, it hasn’t lost the qualities that long made it a defensive favourite.

#1 – Singapore is stable and still delivering steady returns

For years, the US market dominated headlines. In contrast, Singapore is often seen as a “defensive” market, stable but supposedly lacking excitement.

Yet that stability has proven to be one of its biggest advantages.

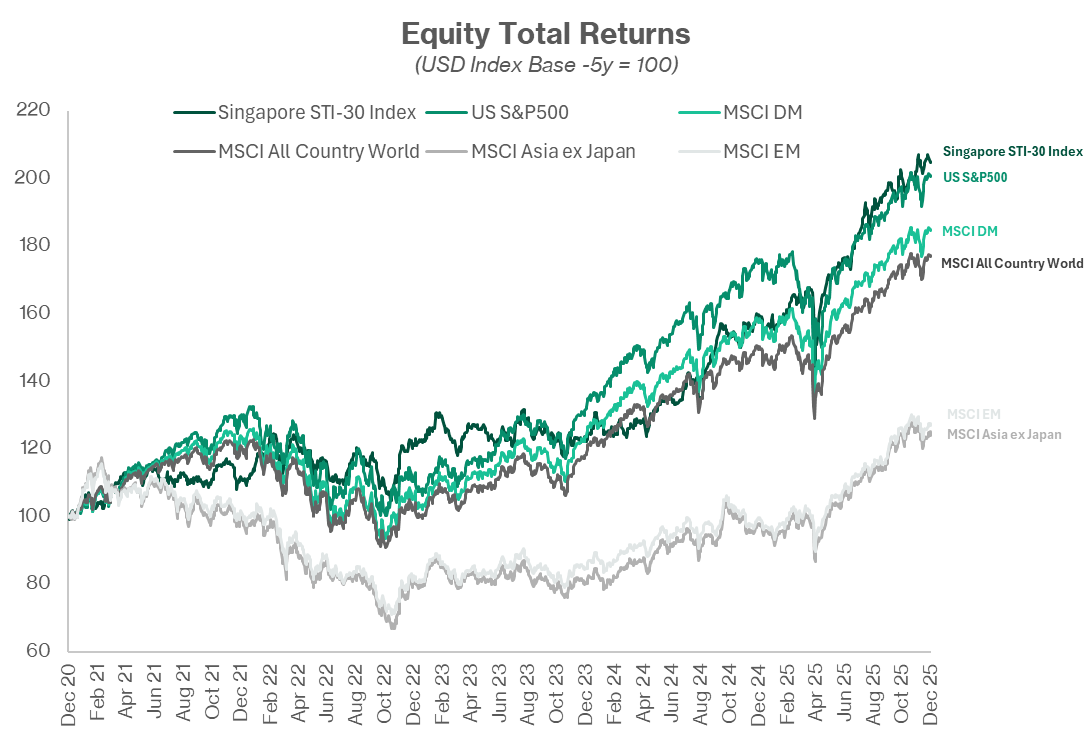

The Singapore market has delivered decent returns and with lower volatility compared to key global markets over the last five years, on average in USD terms, according to FTSE Russell and MSCI (see Figure 4). As of 30 November 2025, the STI-30 Index returned 15.8%p.a (5-year return), higher than MSCI All-Country (AC) World (12.5% p.a.), MSCI (World) Developed Markets (13.4% p.a.), MSCI Asia ex-Japan (5% p.a.), and on par with the S&P 500 (15.3% p.a. over the same period - all calculations in total return, USD terms).

More recently, Singapore’s returns have been exceptional. Looking back (as at 30 November 2025), the STI-30 Index returned 29.5% p.a. (USD terms) over the past 2 years, higher than MSCI All-Country (AC) World (22.6% p.a.), MSCI (World) Developed Markets (22.8% p.a.), MSCI Asia ex-Japan (22.8% p.a.), the S&P 500 (24.1% p.a.), and MSCI EM (21.0% p.a.) over the same 2-year period (all calculations in total return, USD terms).

Figure 4: Annualised returns and volatility across key markets

| Previous years (annualised returns) | STI-30 Singapore total returns %p.a. (USD) | MSCI All Country World total returns %p.a. (USD) | MSCI DM (World) total returns %p.a. (USD) | MSCI Asia ex Japan total returns %p.a. (USD) | US S&P 500 total return %p.a. (USD) | MSCI EM total returns %p.a. (USD) |

| 10y | 10.1 | 12.0 | 12.5 | 8.6 | 14.6 | 8.3 |

| 5y | 15.8 | 12.5 | 13.4 | 5.0 | 15.3 | 5.5 |

| 2y | 29.5 | 22.6 | 22.8 | 22.8 | 24.1 | 21.0 |

| Previous years (Annualised volatility) | STI-30 Singapore total returns %p.a. (USD) | MSCI All Country World total returns %p.a. (USD) | MSCI DM (World) total returns %p.a. (USD) | MSCI Asia ex Japan total returns %p.a. (USD) | US S&P 500 total return %p.a. (USD) | MSCI EM total returns %p.a. (USD) |

| 10y | 16.2 | 14.5 | 14.8 | 16.7 | 15.2 | 16.5 |

| 5y | 12.3 | 14.1 | 14.5 | 16.9 | 15.1 | 15.6 |

| 2y | 9.3 | 9.1 | 9.5 | 12.0 | 10.7 | 11.1 |

| Source: LSEG DataStream, as of 30 November 2025 | ||||||

Figure 5: Selected equity indices total returns - USD, total returns (Dec 2020 to Dec 2025)

Investors in Singapore have enjoyed competitive long-term returns, but with fewer sharp swings, offering both growth and stability historically (see Figure 5).

That resilience is supported by strong fundamentals.

The country holds a AAA credit rating, has a disciplined fiscal policy, large reserves, and a robust currency, even during bouts of greater global uncertainties.

Singapore’s economy is driven by finance, logistics, innovation, and tourism, which contributes to stable earnings growth and attracts capital inflows from global investors.

MAS data confirms these robust capital inflows, rising non-resident deposits, and increased foreign participation in Singapore Government Securities, which collectively contributes to more vibrant capital markets.

#2 – Valuations are fair and dividend income remains attractive

At the same time, strengths like reasonable valuations, a strong dividend culture, and healthy earnings growth remain intact.

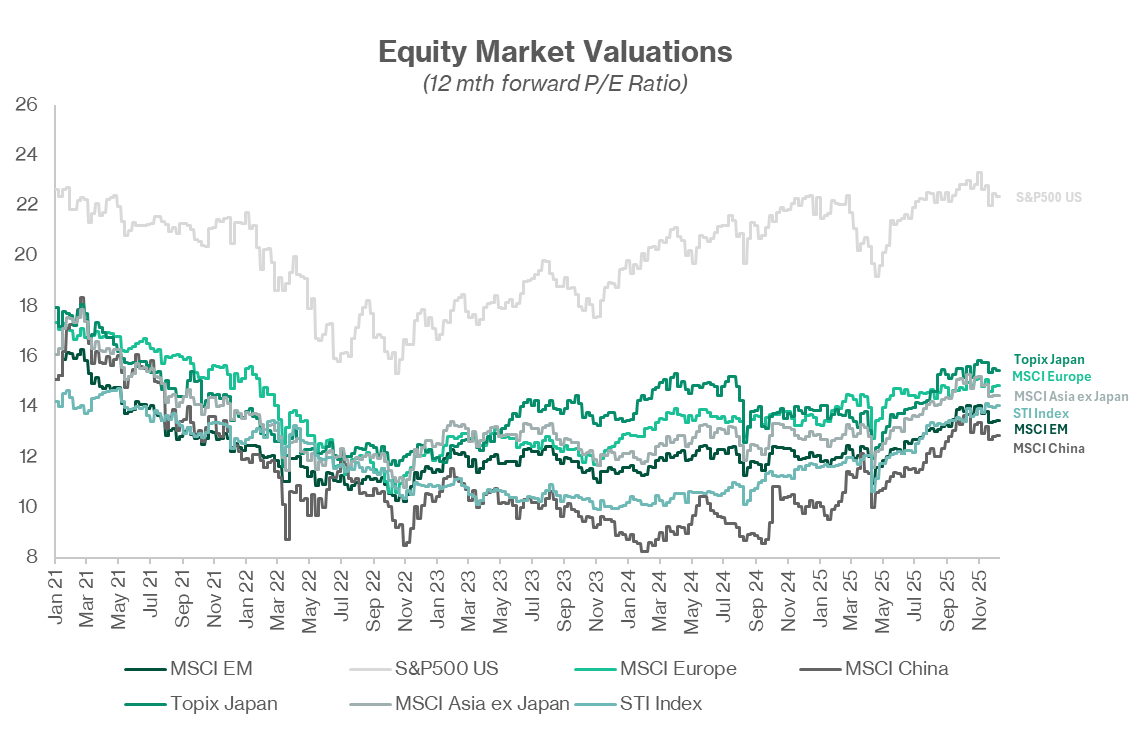

Singapore’s forward P/E ratio is about 14 times, lower than many regional and developed markets, according to LSEG as of 15 December 2025.

Figure 6: Selected equity indices – market valuations

Income-seeking investors also benefit from Singapore’s strong dividend culture.

The market’s dividend yield is around 4.2%, according to FTSE Russell as of 15 December 2025.

Even as Singapore’s dividend yield normalises back toward its historic average it may remain attractive to investors, supported by key sectors like REITs and banks.

With interest rates likely to remain subdued in 2026, stable dividend income becomes even more valuable.

Going forward, analysts are forecasting continued earnings growth over the next 12 months, particularly from sectors such as financials, industrials and technology-linked companies.

These are areas that benefit from demand for digital infrastructure and continued economic growth.

Key risks and considerations

Singapore is an open and trade-driven economy. A global slowdown or drop in external demand could affect earnings.

Banks, which make up a large part of the STI, may face margin pressure if loan growth proves much weaker than anticipated.

The market can also be affected by falls in global risk sentiment and geopolitical tensions, even if local fundamentals remain strong.

What would Beansprout do?

Singapore’s transformation story continues with growth engines becoming stronger across digital infrastructure, advanced manufacturing, and sustainability.

This is supported by capital market reforms and corporate restructuring.

More listed companies are streamlining their businesses by selling non-core assets, consolidating overlapping entities, and simplifying their structures to improve transparency, reduce costs, and free up capital for higher-return opportunities.

These efforts have strengthened balance sheets and supported more sustainable dividends.

In the process, firms are becoming more shareholder-friendly by introducing clearer dividend policies, offering special dividends after major divestments, and ramping up share buyback programmes, reflecting stronger management confidence and a wider push to improve liquidity and capital efficiency

This can create bottom-up opportunities for investors who are able to identify companies poised to benefit from these trends. At the same time, Singapore offers the rare mix of stability, reasonable valuations, and steady income.

For investors looking to participate, a balanced approach may be considered, especially as we may still be in the early stages of different growth catalysts playing out.

This might mean keeping exposure to stable dividend-paying names for income, while identifying companies that stand to benefit from Singapore’s well-established longer-term trends.

Together, these give investors both resilience and the potential to capture new sources of growth.

Investors who want diversified exposure to these themes may find it useful to explore funds in the market that focus on companies improving their business models, unlocking value through restructuring, and tapping into Singapore's structural growth themes.

These can serve as ways to gain broad exposure without needing to pick individual stocks.

Ultimately, the right approach depends on your goals and risk appetite.

Nonetheless, with strong fundamentals and a clear long-term roadmap, Singapore remains a compelling market to watch as it enters its next chapter.

About Fullerton Fund Management

Fullerton Fund Management is a home-grown investment specialist with over 20 years of investing experience in financial markets.

Fullerton helps clients, including government entities, sovereign wealth funds, pension plans, insurance companies, private wealth and retail, from the region and beyond, to achieve their investment objectives through our suite of solutions.

Important Information

No offer or invitation is considered to be made if such offer is not authorised or permitted. This is not the basis for any contract to deal in any security or instrument, or for Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) or its affiliates to enter into or arrange any type of transaction. Any investments made are not obligations of, deposits in, or guaranteed by Fullerton. The contents herein may be amended without notice. Fullerton, its affiliates and their directors and employees, do not accept any liability from the use of this publication. The information contained herein has been obtained from sources believed to be reliable but has not been independently verified, although Fullerton Fund Management Company Ltd. (UEN: 200312672W) (“Fullerton”) believes it to be fair and not misleading. Such information is solely indicative and may be subject to modification from time to time.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

1 comments

- chan ah meng • 09 Jan 2026 04:37 PM

- Beansprout • 26 Jan 2026 05:54 AM