Futures in investing: Can they strengthen your portfolio?

Trading

By Nicole Ng • 11 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Explore how futures work and how to use them to hedge risks, diversify your portfolio, and capture opportunities in volatile markets.

What happened?

If you’re already investing in stocks or ETFs, you’ve likely felt the impact of today’s volatile market conditions.

Inflation, shifting interest rates, and ongoing geopolitical tensions have created a lot of uncertainty in the market, which may impact your portfolio.

That’s what led me to explore futures, which are contracts to buy or sell a specific underlying asset at a future date.

In an environment like this, I wanted more tools to help manage risk, protect my portfolio, and potentially benefit from short-term market trends.

Make no mistake, futures come with risks. But for investors looking to take a more active approach, futures offer flexibility, leverage, and the ability to hedge or capitalise on price movements.

The key is knowing how to use them, and use them right.

In this article, I’ll share how futures work and how they may fit your existing investment strategy.

Use cases: How futures can fit into a portfolio strategy

Futures aren’t just for traders chasing short-term gains, they can play a valuable role in a diversified portfolio.

Depending on how they’re used, futures can help protect your investments, express a market view, or potentially enhance returns.

Here’s a look at three common use cases, starting with one that many long-term investors can relate to:

Use case #1 – Protect against market drops

Let’s say I’ve built a US$100,000 stock portfolio with SPY, which tracks the S&P 500.

I’m happy with my gains, but headlines about market downturns and geopolitical risks make me uneasy.

Instead of just hoping for the best, I could use futures to “insure” my portfolio, a strategy known as hedging.

According to Isaac Lim, Chief Market Strategist, Moomoo Singapore, “futures have emerged as a powerful tool for investors looking to mitigate downside risks and manage volatility with greater precision, given their unique combination of liquidity, accessibility, and flexibility.”

Let’s find out how this works using an example.

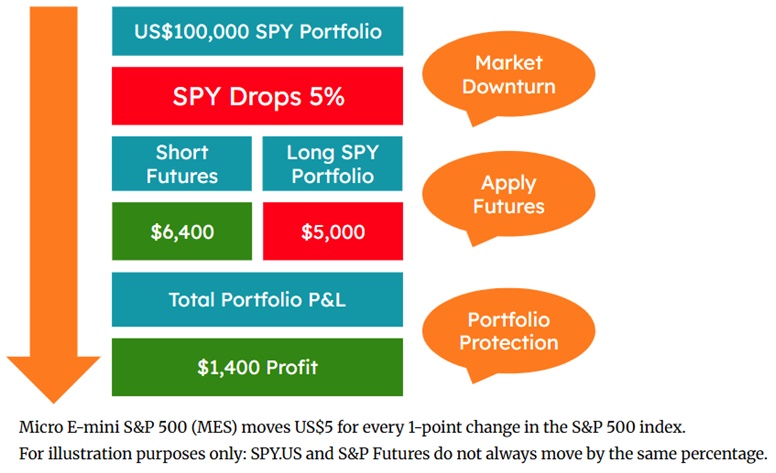

Example: Hedging with Micro E-mini S&P 500 Futures

Let’s say I own 157.5 shares of SPY.US at US$635 each, worth about US$100,000.

For example, the S&P 500 index touched 6,400 intraday on 31 July 2025, and I want protection without selling my shares.

A Micro E-mini S&P 500 futures contract (MES) tracks the S&P 500 index but is smaller than standard futures, making it more accessible for individual investors.

Each contract moves US$5 for every 1-point move in the index.

Since the index is at 6,400, one MES contract has a notional value of 6,400 points x $5 = US$32,000

To hedge my US$100,000 position, I can short about 3–4 MES contracts.

My SPY position is long, so I sell futures to offset potential losses.

| ETF Holding | Long SPY 157.5 shares @ US$635 = US$100,000 |

| S&P Index Level | 6400 |

| Micro E-mini S&P 500 (MES) Futures Contract Notional Value | 6,400 x $5 = US$32,000 |

| Contracts needed to fully hedge my portfolio | Short (sell) 3 to 4 MES Contracts 6,400 x $5 x 4 = US$128,000 |

If the S&P 500 drops 5% (from 6,400 to 6,080), that’s a 320-point fall. My SPY portfolio may be down around US$5,000.

But since I sold 4 MES contracts at 6,400, I’d gain: $5 x 4 x 320 points = US$6,400.

That gain from the short MES position cushions the loss from SPY holding, yielding a net profit of US$1,400.

According to Isaac Lim, Chief Market Strategist, Moomoo Singapore, one popular strategy during volatile periods is constructing market-neutral or low-beta portfolios using Micro E-mini S&P 500 futures (MES).

Investors looking to preserve income-generating positions in blue-chip dividend stocks could hedge out broader market exposure using MES contracts.

This approach can help to buffer portfolios from broader selloffs while maintaining upside participation in stable, high-quality equities.

Learn more about how futures can be used for hedging here.

Use case #2 – Expressing my views on market move

Futures can also be used to make tactical, short-term trades when markets move quickly.

Futures, whether on crude oil, gold, or an index like the S&P 500, allow me to take positions on market movements without owning the underlying asset.

While some contracts permit physical delivery, traders may choose to close or roll their positions before expiry, avoiding delivery altogether.

This flexibility really comes in handy during periods of heightened volatility.

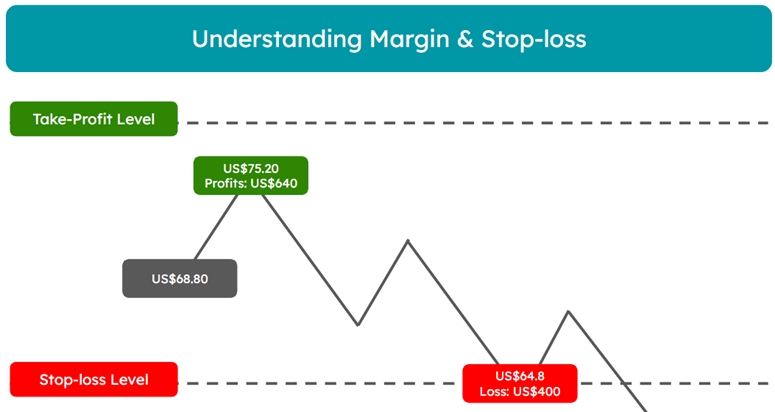

Example: Using margin for a short-term crude oil trade

Let’s say I think crude oil prices are about to spike due to a sudden supply disruption.

Instead of buying physical oil or oil-related stocks, I can use the Micro Crude Oil Futures (MCL) contract to take a direct long position.

| Contract Size | 1 unit Each 1-point move in crude oil = US$100 gain or loss |

| Total Contract Value | Current crude oil price: US$68.80 per barrel x US$100 = US$6,880 |

| Margin required to open a trade | US$964.08 (just a fraction of the total value) |

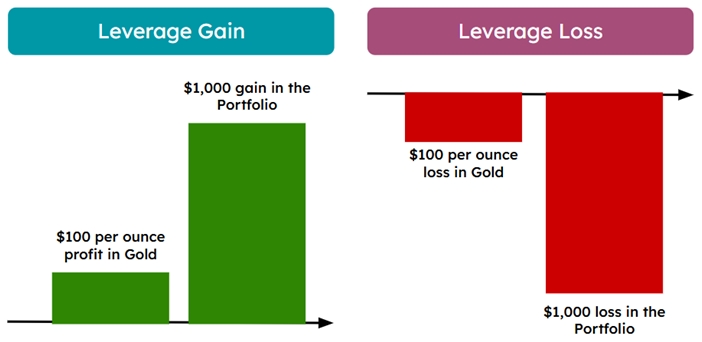

Using margin provides leverage, which can magnify both profits and losses. That’s why it’s essential to plan trades carefully, with defined take-profit and stop-loss levels.

Use case #3 – Expand and diversify across markets

Futures don’t just stop at stocks or oil—they also let me access interest rates, foreign exchange, and agricultural commodities,

This opens the door to diversification.

I’m no longer reliant on how just one asset class, like equities, is performing.

Instead, I can balance my portfolio by gaining exposure to different asset classes that may move differently across market cycles.

For example, if the CME FedWatch Tool, which tracks market expectations for upcoming Federal Reserve interest rate decisions, shows higher odds of a rate cut as of 4 September 2025, asset classes such as gold may respond positively.

I’ve been keeping an eye on gold.

With all the global uncertainty lately, it’s been surging, and many investors see it as a safe haven asset.

Futures give me a more flexible way to take a position in gold without having to buy and store physical bullion, or limit myself to traditional ETFs.

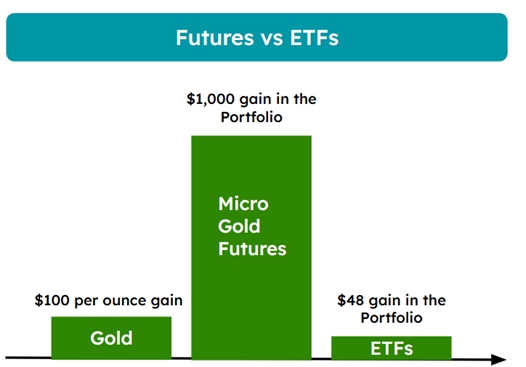

Example: Diversifying with Gold futures

Let’s say I want to express a long-term bullish view on gold with Micro Gold Futures (MGC).

| Micro Gold Futures (MGC) current price | US$3,355 per troy ounce |

| Contract Size | 10 ounce per contract |

| Contract Value | 10 ounce x US$3,355 = US$33,550 |

| Margin required to open a trade* | ~S$2,131.25 |

| *As of 24 August 2025, margin requirement subject to change | |

For comparison, SPDR Gold Trust (GLD.US), a gold ETF, is priced at US$306.25 per share

Now here’s the difference:

With SG$2,131, I can either buy a handful of GLD ETF shares, or open a gold futures trade that controls a much larger position.

If gold rises just 3%, the futures position would return roughly US$1,000. That same 3% rise in the ETF would only earn me around US$48.

Learn how to use gold futures to hedge risk here.

Futures give you greater exposure with less capital upfront, which can be especially useful when you want to diversify into assets like gold, oil, or currencies but still seek meaningful returns.

Of course, higher potential returns come with higher risk. So as always, it’s important to know your limits and use proper risk management.

What are the risks involved and how to mitigate them?

#1 – Market volatility

Futures can be very sensitive to rapid price movements.

One sharp swing can mean a big win or a steep loss in just minutes, as I explained using the gold example from earlier.

A 3% move could give me potential gains of over 50%, but it could just as easily empty my account.

That’s why it’s important to be strict with risk management, including setting stop losses.

Practicing with a demo account helps me understand how futures really move before I put real money on the line.

#2 – Margin calls

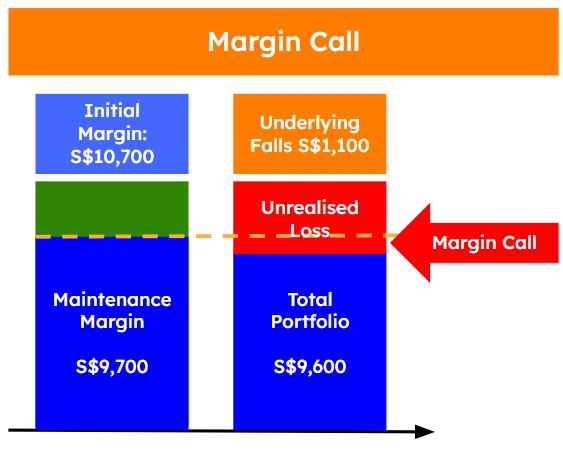

Futures are traded on margin, which means I only need to deposit a fraction of the total contract value to open a position.

For example, SG$10,700 in the gold futures trade.

If my position starts losing value and my account drops below the minimum maintenance margin required, things can get stressful fast.

When this happens, my broker will ask me to top up my account—this is called a margin call.

The best way to avoid it? Always keep extra cash in my account as a buffer, and avoid putting all my funds into a single trade.

It’s a simple step to save you from unnecessary stress.

It is also important to know of other risks such as curve risk, amongst others. You can learn more about the risks of trading futures here.

What would Beansprout do?

Whether you’re hedging your portfolio, making tactical short-term moves, or diversifying beyond stocks, futures can be a powerful tool when used with care.

They offer flexibility, leverage, and access to a wide range of markets, from indices and commodities to currencies.

If your focus is portfolio protection, you can refer to our guide on hedging with CME futures to understand contract choice and position sizing.

If you are looking at equities specifically, our US index futures article covers the main contracts across the S&P 500, Nasdaq 100, Russell 2000, and the Dow, and explains how Micro contracts can help you scale exposure more precisely.

If diversification is the goal, our gold futures guide explains how gold futures work and the key risks to watch.

If you are comparing instruments for downside protection, we explain here on how to use futures and options to protect profits with the S&P 500 as a case study.

But to use them effectively, it’s important to understand how different strategies work, and to practise before putting real money on the line.

You can start with a demo account with a MAS-regulated broker like Moomoo Singapore, which offers access to CME Group’s regulated futures products.

If you’re already trading stocks or ETFs, it may be worth understanding how futures can become one of the most versatile tools in your portfolio. You can learn more about futures here.

Disclaimer

Any information provided in this article is meant purely for informational and investor education purposes and should not be relied upon as financial or investment advice, or advice on corporate finance.

This article is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to purchase any financial product or subscribe or enter any transaction. This article also does not take into account your personal circumstances, e.g. investment objectives, financial situation or particular needs and shall not constitute financial advice. You should consult your own independent financial, accounting, tax, legal or other competent professional advisors.

The information provided in this article are on an “as is” and “as available” basis without warranty of any kind, whether express or implied. Beansprout does not recommend any particular course of action in relation to any investment product or class of investment products. No information is presented with the intention to induce any person to buy, sell, or hold a particular investment product or class of investment products.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments