Leong Guan - From noodle manufacturer to integrated food supplier

Stocks

By Ng Hui Min • 28 Dec 2025

Why trust Beansprout? We're licensed by the Monetary Authority of Singapore (MAS).

Leong Guan Holdings Limited is a Singapore-based food manufacturing and distribution company with over 22 years of operating history.

From noodle manufacturer to integrated food supplier (SGX: LGH) - Not Rated

Leong Guan Holdings Limited is a Singapore-based food manufacturing and distribution group with over 22 years of operating history, supplying staple food products that form part of everyday consumption across the domestic foodservice and institutional landscape.

Leong Guan produces fresh noodles and soy-based beancurd products, while also distributes a broad range of complementary food items to commercial and retail customers in Singapore and selected export markets.

Leong Guan’s portfolio is anchored in essential, affordable food categories that tend to exhibit relatively stable demand across economic cycle due to their affordability and alignment with local culinary preferences.

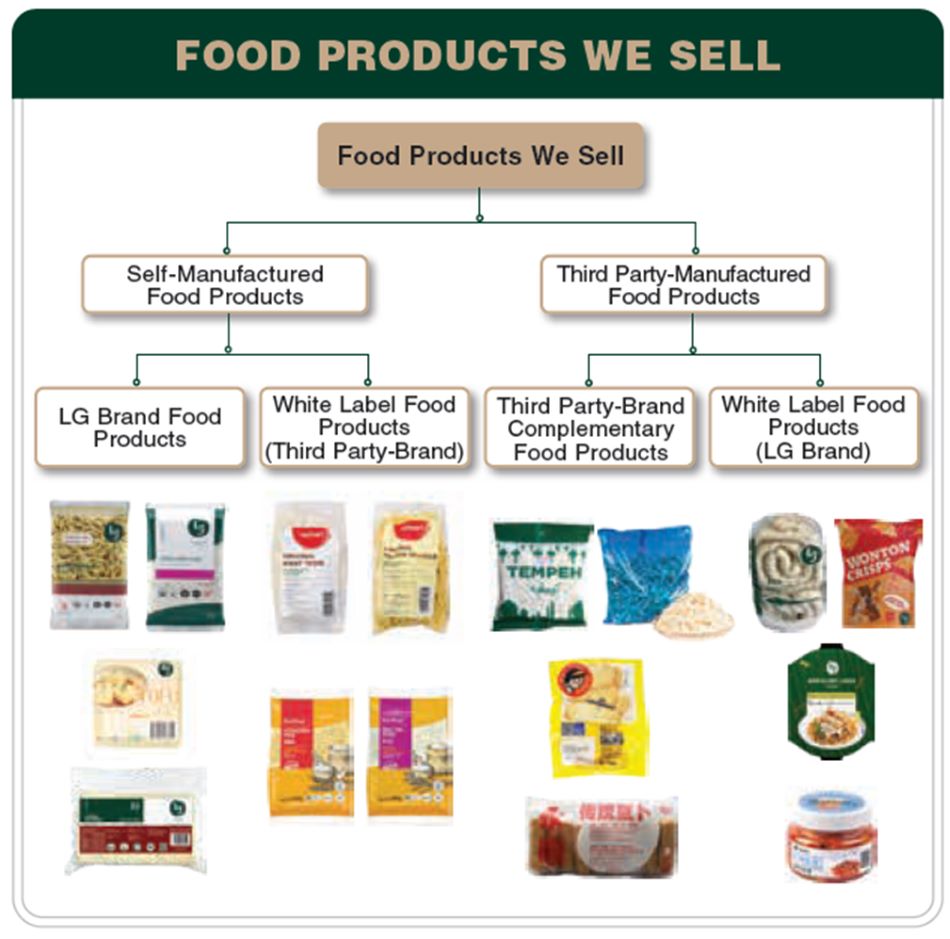

Over time, Leong Guan has evolved from a single-category noodle producer into an integrated, one-stop food sourcing partner.

It manufactures core products under its proprietary LG brand while offering trading and OEM (white-label) solutions that broaden its product range and enhance customer convenience.

Operationally, Leong Guan serves more than 2,000 customer accounts locally and internationally, spanning hotels, restaurants, caterers, food courts, hawkers, schools and hospitals.

It supports approximately 1,300 daily customer touchpoints through a direct doorstep delivery network across Singapore, enabled by an in-house fleet of more than 35 commercial vehicles.

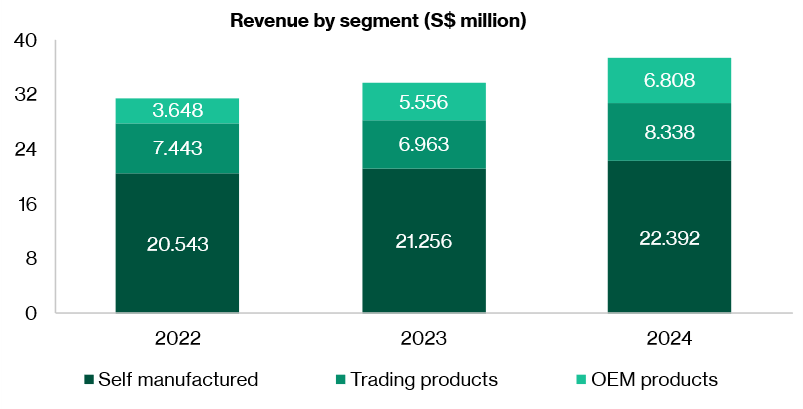

Diversified revenue streams anchored by self-manufactured products

Leong Guan operates across three business segments: self-manufactured products, trading products and OEM products.

Self-manufactured products are produced at Leong Guan’s manufacturing facilities and delivered to customers primarily under the group’s own LG Brand, and principally comprise noodle products, soy bean-based beancurd products and wanton skins.

Trading products are manufactured by third-party manufacturers and are marketed and sold to customers under third-party brands; they typically complement the group’s self-manufactured products and primarily comprise surimi, frozen foods and beansprouts.

OEM products are white-label products manufactured by third-party manufacturers and are marketed and sold to customers under the group’s own LG Brand; they comprise noodle products and soy bean-based beancurd products that the group does not manufacture, and they complement the group’s self-manufactured products.

Manufacturing footprint and utilisation

Leong Guan operates a dual-site manufacturing and warehousing footprint in Singapore, supporting production of fresh noodles and soy bean-based beancurd products, as well as storage and distribution of third-party food items.

On an average daily basis, Leong Guan manufactures approximately 30 tonnes of fresh noodle products at its Woodlands premises and approximately 6 tonnes of soy bean-based beancurd products at its Aljunied facility, reflecting the scale of its core staple categories.

Leong Guan currently operates two integrated manufacturing and warehouse facilities.

The primary site at 7 Woodlands Link has an aggregate floor area of approximately 3,056 sqm and serves as the main production hub for fresh noodles, alongside warehousing and logistics.

The Aljunied Factory, with an aggregate area of approximately 232 sqm, focuses on soy bean-based beancurd products, including tofu and tau kwa.

Perishable ingredients and products are stored in cold storage facilities to maintain freshness and comply with food safety requirements, with monthly stock-take exercises supporting inventory control.

As part of its medium-term operational roadmap, Leong Guan is relocating its beancurd manufacturing activities from Aljunied to a new facility at 24 Woodlands Terrace (new Woodlands factory).

The new facility, with an aggregate area of approximately 1,525 sqm, is expected to be completed by 1H2026.

From a capacity standpoint, the Woodlands facility has annual production capacity of approximately 19,400 tonnes (based on 22 hours per day, six days per week), while the Aljunied Factory has annual capacity of approximately 3,100 tonnes (based on 24 hours per day, seven days per week), excluding maintenance downtime.

Over FY2022–FY2024, utilisation at Woodlands remained stable in the mid-50% range.

In contrast, Aljunied utilisation increased from 58.9% (FY2022) to 70.1% (FY2023) and 77.7% (FY2024).

In 3M2025, utilisation moderated to 62.2%, which management attributes to a seasonal slowdown ahead of the Hari Raya Puasa fasting period.

Operationally, Leong Guan maintains preventive maintenance schedules (quarterly or semi-annually depending on equipment), supported by an in-house maintenance team, with more complex work outsourced when required.

Leong Guan also maintains spare parts inventory to minimise downtime, and has disclosed no major operational disruptions from equipment failure during the period under review.

Consistent revenue growth with improving profitability

Financially, Leong Guan has demonstrated steady top-line growth alongside a more pronounced improvement in profitability.

Revenue increased by approximately 11.1% y-o-y in FY2024, reflecting higher sales volumes and stable demand across core product categories.

More notably, profit before tax rose 42.7% and profit after tax increased 49.4% y-o-y, underscoring operating leverage as scale increased and efficiency measures took effect.

Industry outlook supported by structural demand for staple foods and gradual product-mix upgrading

Leong Guan operates in a segment supported by structural demand drivers rather than cyclical consumption trends.

According to Reuters, Singapore remained the most expensive city to live in 2024, and Leong Guan thinks this may lead more residents to choose economical dining options such as hawker centres and coffee shops.

As a supplier to food service operators in Singapore—particularly hawkers and coffee shops—Leong Guan continues to benefit from the resilience of this segment.

It manufactures and supplies staple foods, namely fresh noodles and soy bean-based beancurd products, which generally exhibit stable demand due to their affordability and alignment with local culinary preferences, regardless of economic conditions.

At the same time, consumer preferences continue to shift towards fresher, less processed and more health-oriented food options.

Leong Guan is also in the process of launching newly developed low-GI noodle products and expects to begin sales in 2026.

Competitive strengths in technology, R&D, distribution reach and compliance

Leong Guan’s competitive strengths are anchored in technology-driven operations and an integrated supply chain designed to enhance productivity, quality control and cost efficiency.

Leong Guan has invested in automation such as automated weighing and portioning systems, reducing manual intervention while improving accuracy, speed and hygiene standards.

Enterprise systems support streamlined order capture, inventory tracking, equipment monitoring and regulatory compliance, while cold-chain infrastructure supports reliable handling of perishable products.

Leong Guan’s in-house R&D team, established in 2012, supports product innovation and customer responsiveness through new formulations and customised solutions for commercial clients.

Over the years, Leong Guan has introduced differentiated offerings such as wholegrain noodles and ready-to-eat meals, while also developing bespoke noodle types and flavour profiles on a pre-order basis—reinforcing customer stickiness.

Leong Guan also benefits from a one-stop sourcing proposition supported by broad product breadth and extensive delivery capabilities.

Its fleet of more than 35 commercial vehicles enables daily doorstep delivery across Singapore, strengthening reliability for Horeca customers.

Growth strategy focused on capacity expansion, value-added products and measured overseas penetration

Looking ahead, Leong Guan plans to expand its market reach by growing its overseas customer base through export sales to distributors and brand owners.

In support of this, it intends to obtain the necessary food import certifications and work towards higher food safety standards, and is seeking internationally recognised certifications such as FSSC 22000, including engaging consultants and carrying out preparation works for the accreditation process.

It also has plans to broaden and diversify its product range, including a vertical expansion into value-added products tailored to customers’ preferences and lifestyles.

Its current plan includes expanding ready-to-eat meals beyond current offerings, collaborating with nutritionists/chefs and other professionals to develop products such as low-GI food products and reduced-carbohydrate ramen, developing snack foods, and developing functional foods designed to meet gerontological or paediatric needs or certain health requirements (for example, fortified noodles and soy products).

On capacity, the expansion of the New Woodlands Factory would allow it to produce a higher volume of goods to meet growing demand from customers.

It may expand its capabilities and business through acquisitions, joint ventures and strategic partnerships.

Experienced management team

Leong Guan is led by a management team with deep industry experience and long operating tenure.

Key executives and directors collectively bring more than two decades of experience in food manufacturing, distribution and operations, supported by established supplier and customer relationships.

Post-listing, LGH will operate under a board structure comprising executive and independent directors, aligned with Catalist governance requirements.

Incentive alignment is reinforced through the introduction of employee share option and performance share plans, which are intended to support talent retention and align management decision-making with long-term shareholder value creation.

As a newly listed company, ongoing execution on disclosure quality, governance discipline and capital allocation will be important areas for investor monitoring.

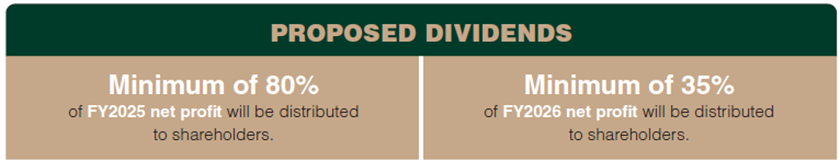

Dividend policy

Leong Guan intends to distribute a minimum of 80% of its FY2025 net profit, followed by a minimum payout ratio of 35% of its FY2026 net profit.

There is no fixed dividend policy and any dividend will be at the Board’s discretion.

IPO structure and use of proceeds

Leong Guan Holdings Limited did a placement on SGX Catalist comprising a combination of new shares issued by the Company and vendor shares offered by existing shareholders.

The total gross proceeds from the placement are expected to be approximately S$4.75 million, of which S$3.75 million will be raised from the issuance of new shares by the Company, with the remaining proceeds attributable to the sale of vendor Shares accruing entirely to the selling shareholder.

The Company will not receive any proceeds from the sale of vendor shares.

After deducting estimated listing-related expenses of approximately S$1.60 million, the net proceeds to be raised by the Company are expected to be approximately S$2.15 million.

Intended use of IPO proceeds

Management has outlined a clear framework for the intended use of net proceeds, with allocations designed to support both near-term operational strengthening and longer-term growth optionality.

Approximately S$700,000, representing the largest single allocation, is earmarked for the enhancement of manufacturing facilities, underscoring Leong Guan’s focus on capacity expansion, productivity improvements and operational resilience.

These investments are intended to support higher output volumes, improve cost efficiency and accommodate future demand growth.

A further S$600,000 has been allocated towards potential acquisitions, joint ventures and strategic alliances.

While no specific acquisition targets have been identified as at the latest practicable date, this allocation provides Leong Guan with financial flexibility to pursue inorganic growth opportunities that are complementary to its existing food manufacturing and distribution operations.

In addition, approximately S$300,000 is intended for the expansion of export markets and product range, reflecting management’s intention to gradually diversify revenue sources beyond the domestic market and to broaden its portfolio of value-added and convenience-oriented food products.

The remaining S$549,000 of net proceeds will be used for general working capital, supporting day-to-day operational requirements, inventory management and trade receivables as the business scales.

Key Risks

Key risks include raw material price volatility, labour cost inflation, reliance on Singapore domestic demand, competitive pricing pressure, food safety and regulatory compliance, and execution risk associated with capacity expansion.

As a Catalist-listed company, liquidity and share price volatility may also be higher than Mainboard peers.

Management’s focus on automation, quality control and disciplined capital deployment partially mitigates these risks, though they remain inherent to the food manufacturing and distribution sector.

Valuation

Leong Guan is trading at 13.9x trailing P/E based on 19 December 2025 closing price of S$0.22. Its price-to-book ratio of 3.5x is highest among its peers.

Download the full report here.

Check out Beansprout guide to the best stock trading platforms in Singapore with the latest promotions to Leong Guan Holdings.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments