LionGlobal Short Duration Bond Fund: Earn regular income with a resilient bond portfolio

ETFs

Powered by

By Gerald Wong, CFA • 09 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The LionGlobal Short Duration Bond Fund (Active ETF SGD Class) is Singapore's first active bond ETF and first listed share class of an existing fund.

This post was created in partnership with SGX. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

Interest rates have been coming down since the start of this year.

The yield on the 6-month Singapore T-bill has slipped to just 1.44% p.a. as of 28 August 2025, its lowest level in years.

For investors who have been relying on T-bills as a way to earn passive income, falling rates have raised an urgent question: how can I generate regular income without taking on excessive risk?

One possible alternative is to look at resilient bond funds or ETFs.

In particular, Singapore dollar denominated short term bond funds have been in focus as a way to generate steady income with fewer ups and downs and lower currency risks.

In this article, I’ll dive deeper into the LionGlobal Short Duration Bond Fund (Active ETF SGD Class), which is the ETF version of the LionGlobal Short Duration Bond Fund.

This is Singapore's first active bond ETF and first listed share class of an existing fund, giving you access to the same portfolio while providing you liquidity to trade the ETF units on SGX.

What is the LionGlobal Short Duration Bond Fund?

The LionGlobal Short Duration Bond Fund is the flagship bond fund of Lion Global Investors, one of Singapore’s leading asset managers.

Lion Global Investors benefits from the backing of OCBC, Singapore’s second-largest banking group, and Great Eastern, the country’s oldest and largest life insurer.

The fund is actively managed with the aim of delivering both capital growth and income over the medium to long term.

Some of the key features of the LionGlobal Short Duration Bond Fund include:

- Broader exposure: Includes both Singapore and global bonds

- Total return focused: Focus on generating total return of capital growth and income over the medium to long term

- Short duration: Reduces sensitivity to interest rate fluctuations

#1 – Broad exposure

The portfolio of LionGlobal Short Duration Bond Fund (Active ETF SGD Class) consists mainly of high-quality, short-duration bonds, exposure to Singapore issuers and global bonds.

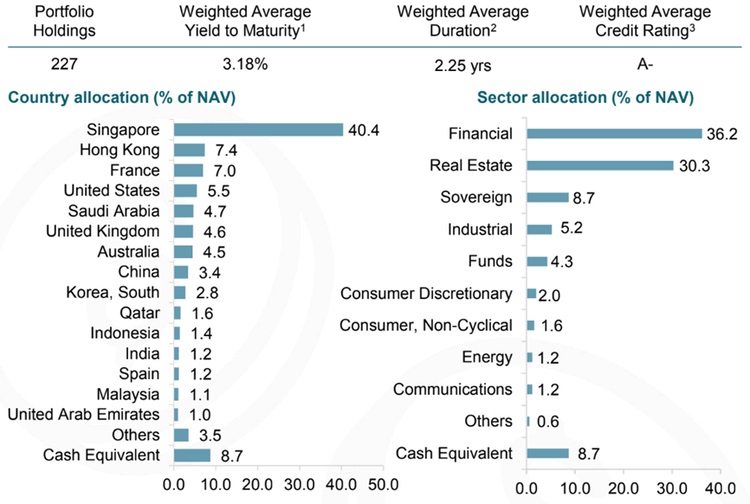

As of 31 July 2025, the fund has about 67% exposure to Financials and Real Estate, and almost 40% exposure to Singapore bonds.

Despite a high allocation to corporate bonds, particularly in the Financials and Real Estate sectors, which dominate Singapore’s bond market, the portfolio maintains a weighted average credit rating of A-, which is investment-grade.

As the fund is actively managed, it has flexibility to adjust exposures, including shifting more heavily into sovereign bonds during periods of credit market stress.

#2 – Total return focused

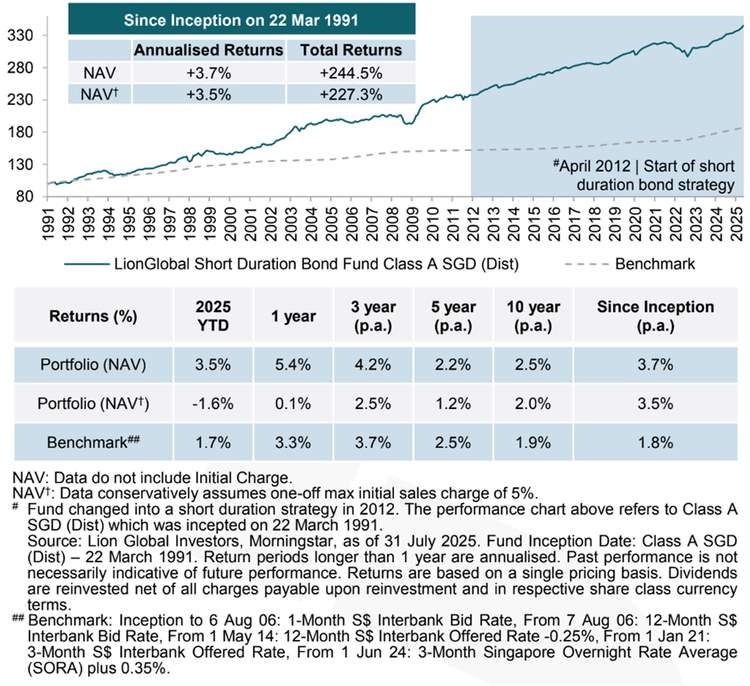

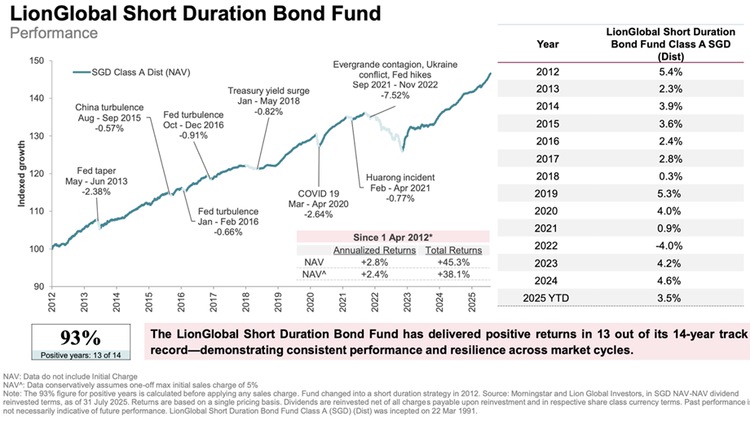

Incepted since 22 Mar 1991, the LionGlobal Short Duration Bond Fund has built a solid track record.

Since its inception, it has delivered 3.7% p.a., outperforming its benchmark, the 3-month Singapore Overnight Rate Average (SORA) + 0.35%, which returned 1.8% p.a. as of 31 July 2025.

While it did post a loss in 2022 like many other bond funds during the global interest rate spike, the fund recovered promptly and has otherwise produced positive calendar-year returns every year since 2012.

For income seekers, the manager of LionGlobal Short Duration Bond Fund (Active ETF SGD Class) intends to make a distribution at the end of every quarter, on or around 31 March, 30 June, 30 September and 31 December of every year.

The LionGlobal Short Duration Bond Fund has a weighted average yield-to-maturity (YTM) of 3.18% as of 31 July 2025, above the 6-month Singapore T-bill yield of 1.44% as of 28 August 2025.

The yield-to-maturity (YTM) is the expected annual rate of return earned by a bond assuming the bond is held until maturity.

It’s worth noting that distributions are not fixed and are adjusted periodically according to market conditions.

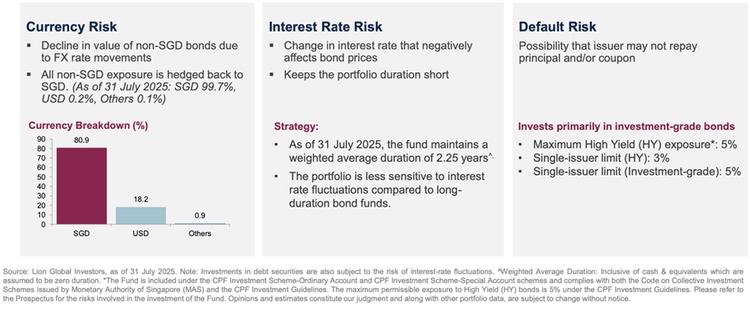

#3 – Active risk management

The fund adopts an active approach to risk management, with particular focus on currency, interest rate, and credit default risks.

Each of these is closely monitored, and the portfolio is adjusted promptly and prudently to keep risks under control.

The “short duration” mandate makes the fund less sensitive to interest rate movements, which can be particularly valuable in uncertain rate environments.

In simple terms, a shorter duration reduces the ups and downs caused by rate movements.

The fund caps its average duration at four years, and is currently at 2.25 years as of 31 July 2025.

Currency risk is actively managed as well.

All non-SGD positions are fully hedged back to SGD, ensuring that investors are not exposed to foreign exchange fluctuations. For Singapore-based investors, this means added convenience and peace of mind.

What are the risks of the LionGlobal Short Duration Bond Fund?

While the portfolio of the LionGlobal Short Duration Bond Fund offers resilience, I would remain mindful of risks, including credit risk and interest rate risk, amongst others.

#1 – Credit risk

The fund invests largely in corporate bonds, particularly in the Financials and Real Estate sectors that dominate Singapore’s bond market.

While most holdings are investment grade and the portfolio carries an average credit rating of A-, corporate bonds still carry the risk of credit downgrades or defaults. Periods of economic stress could increase this risk, even if the fund actively manages exposures.

#2 – Interest rate risk

Although the fund’s short-duration mandate reduces sensitivity to interest rate changes, it does not remove the risk entirely.

If interest rates rise sharply, bond prices in the portfolio may still fall.

Conversely, if rates decline further, the fund’s short duration profile may limit its potential gains compared to longer-duration bond funds.

What you need to know about active ETFs

Compared to the existing mutual fund share classes, the LionGlobal Short Duration Bond Fund (Active ETF SGD Class) comes with some notable differences:

- Liquidity: Allows intra-day trading and real time pricing

- Cost efficient: Lower cost than mutual funds’ retail share classes

- Less constrained: Does not track benchmark index, potentially giving more room to outperform the broader market

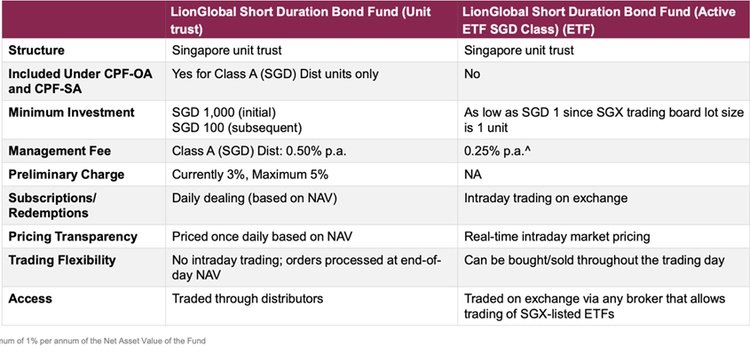

#1– Liquidity

The LionGlobal Short Duration Bond Fund (Active ETF SGD Class) will trade on the SGX like a stock, with prices moving intraday based on supply and demand.

Unlike single stocks, one cannot easily buy or sell corporate bonds on the secondary market due to a lack of secondary market liquidity. However, an ETF allows investors to buy and sell units that invest into a basket of bonds in real time, though prices may occasionally trade at a premium or discount to NAV.

Existing share classes are priced once daily based on net asset value (NAV) and can only be traded through authorised distributors.

#2 – Cost efficient

The LionGlobal Short Duration Bond Fund (Active ETF SGD Class) will have a management fee of 0.25% p.a., lower than the current management fee of 0.50% p.a. on the A share classes.

Importantly, ETFs do not carry subscription fees, unlike the A share class which may come with a preliminary sales charge on selected platforms.

As the ETFs can be traded via any broker that allows trading of SGX-listed ETFs, prevailing brokerage fees and commissions will apply.

Unlike unit trusts, ETF holdings on SGX typically come with zero annual platform fees or wrap fees.

#3 – Less constrained

Active ETFs are actively managed by a team of investment professionals.

These fund managers would make decisions about which stocks, bonds, or other assets to include in the fund, with the objective of outperforming the market or a specific benchmark index through their investment choices.

You can learn more about active ETFs here.

What would Beansprout do?

With T-bill and fixed deposit yields falling, it’s natural for investors to explore other ways to sustain regular income.

The LionGlobal Short Duration Bond Fund offers resilience with its long performance track record and active risk management.

However, investors should remember that bond funds are not risk-free.

As the ETF version of the LionGlobal Short Duration Bond Fund, the LionGlobal Short Duration Bond Fund (Active ETF SGD Class) offers intraday trading on the SGX as well as lower management fees compared to the unit trust.

The Initial Offering Period (IOP) runs from 8 to 23 September 2025, with trading to start on 29 September 2025.

Exclusive promotions

- FSMOne: Get S$10 for every S$10k invested (capped at S$200). Valid 8 Sep–31 Oct 2025. Only cash subscription is eligible during 8 Sep - 23 Sep 2025. Cash and SRS subscriptions are both eligible for promotion after 29 Sep 2025 listing. Cash reward credited 6 weeks after 31 October 2025.

- POEMS: S$10 for every S$5k invested (capped at S$500 per client). First 200 clients, valid 8–22 Sep 2025. Cash reward credited after 31 October 2025.

It is also available via the participating bank/dealers: OCBC ATM, Online and Mobile Banking, OCBC Securities, Phillip Securities, iFAST, DBS Vickers, and Maybank Securities.

After its listing on 29 Sep 2025, the LionGlobal Short Duration Bond Fund (Active ETF SGD Class) will be listed on SGX and available via brokers with SGX market access. Supplementary Retirement Scheme (SRS) can also be used to invest in the ETF after 29 Sep 2025.

- SGX tickers: SBO (SGD counter) and SBV (USD counter)

- Bloomberg tickers : SBO SP (SGD) and SBV SP (USD)

Join us for our upcoming webinar - "Attractive, Adaptable, Affordable: Triple A Magnetism of A Short Duration Bond ETF – Presented by Lion Global Investors"

You can find out more about the LionGlobal Short Duration Bond Fund (Active ETF SGD Class) by registering for a webinar, presented by Gerald Wong, Founder of Beansprout and Ong Xun Xiang, Head of ETFs at Lion Global Investors to receive greater insights on the ETF and how it fits into a resilient income portfolio for investors. The webinar will be held at 7pm on 16 September. Sign up here.

Learn more about the LionGlobal Short Duration Bond Fund here.

Find out more about Exchange Traded Funds (ETFs) in Singapore here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Disclaimer

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. It is for information only, and is not a recommendation, offer or solicitation to deal in any capital markets products or investments and does not have regard to your specific investment objectives, financial situation, tax position or particular needs.

The LionGlobal Short Duration Bond Fund (the “Fund”) is not like a typical unit trust offered to the public in Singapore. The Fund comprises both classes of units listed and traded on the Singapore Exchange (“SGX-ST”) and classes of units which are neither listed on the SGX-ST nor any other stock exchange.

You should read the prospectus and Product Highlights Sheet for the Fund, which is available and may be obtained from Lion Global Investors Limited (“LGI”) or any of the appointed Participating Dealers (“PDs”), agents or distributors (as the case may be) for further details including the risk factors and consider if the Fund is suitable for you and seek such advice from a financial adviser if necessary, before deciding whether to purchase units in the Fund. Applications for units in the listed or unlisted classes of the Fund must be made in the manner set out in the prospectus. Investments are subject to investment risks including the possible loss of the principal amount invested.

Investments in the Fund are not obligations of, deposits in, guaranteed or insured by LGI or any of its affiliates and are subject to investment risks including the possible loss of the principal amount invested. The performance of the Fund is not guaranteed and the value of units in the Fund and the income accruing to the units, if any, may rise or fall. Past performance, payout yields and payments as well as any predictions, projections, or forecasts are not necessarily indicative of the future or likely performance, payout yields and payments of the Fund. Any extraordinary performance may be due to exceptional circumstances which may not be sustainable. Any dividend distributions, which may be either out of income and/or capital, are not guaranteed and subject to LGI’s discretion. Any such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the Fund. Any references to specific securities are for illustration purposes and are not to be considered as recommendations to buy or sell the securities. It should not be assumed that investment in such specific securities will be profitable. There can be no assurance that any of the allocations or holdings presented will remain in the Fund at the time this information is presented. Any information (which includes opinions, estimates, graphs, charts, formulae or devices) is subject to change or correction at any time without notice and is not to be relied on as advice. You are advised to conduct your own independent assessment and investigation of the relevance, accuracy, adequacy and reliability of any information or contained herein and seek professional advice on them. No warranty is given and no liability is accepted for any loss arising directly or indirectly as a result of you acting on such information. The Fund may, where permitted by the prospectus, invest in financial derivative instruments for hedging purposes or for the purpose of efficient portfolio management. LGI, its related companies, their directors and/or employees may hold units of the Fund and be engaged in purchasing or selling units of the Fund for themselves or their clients.

The Fund is an actively managed fund. Please refer to the Prospectus for further details, including a discussion of certain factors to be considered in connection with an investment in the listed units of the Fund on the SGX-ST.

The listed units of the Fund are listed and traded on the Singapore Exchange (“SGX”), and may be traded at prices different from their net asset value, suspended from trading, or delisted. Such listing does not guarantee a liquid market for the units. You cannot purchase or redeem listed units in the Fund directly with the manager of the Fund, but you may, subject to specific conditions, do so on the SGX or through the PDs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments