Guide to investing in the living sector: A growing real estate asset class

Stocks

Powered by

By Gerald Wong, CFA • 05 Nov 2025

Why trust Beansprout? We're licensed by the Monetary Authority of Singapore (MAS).

Discover how to invest in the living sector, a fast-growing real estate asset class. Learn key trends, opportunities, and risks for investors.

What is the living sector?

The Living sector refers to professionally managed real estate assets that focus on rental housing for residential use.

Within this sector, two fast-growing segments stand out: Purpose-Built Student Accommodation (PBSA) and Co-Living Residences.

Both segments are gaining investor attention for their ability to generate stable rental demand and higher yields compared to traditional residential leases.

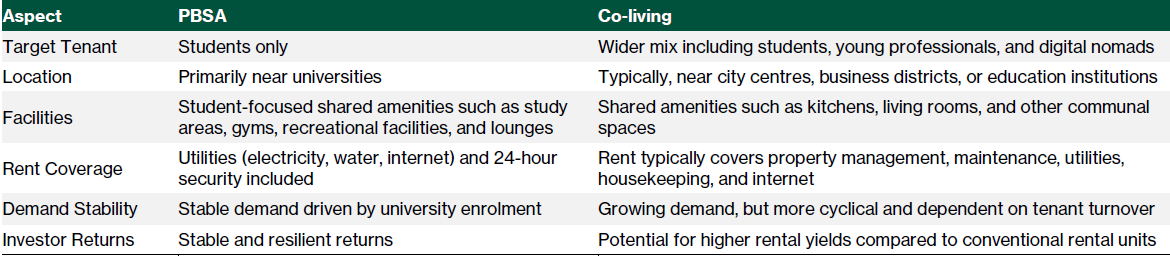

Globally, PBSA and Co-Living sectors are two dominant segments in the living sector.

Advantages of the Living Sector accommodation?

Property developers and asset managers have been allocating more capital into the living sector in recent years.

The appeal of this segment stems from several key advantages.

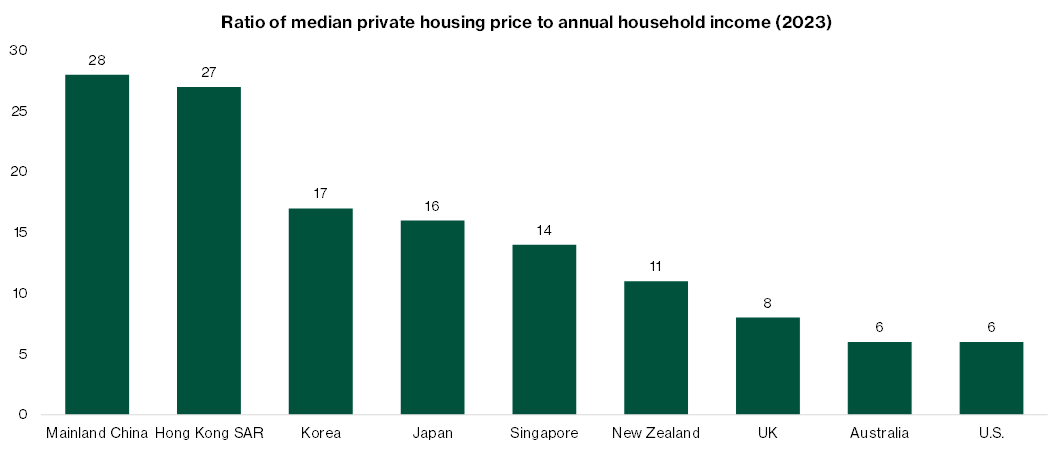

- Growing demand: Structural drivers such as persistent urbanisation and elevated housing costs are expected to sustain long-term rental demand.

- Diversification: For the investors, the living sector offers diversification benefits due to its relatively low correlation with other real estate classes such as office and retail, which are more cyclical in nature.

- Resilient returns: The living sector is defensive, with rental income that is less sensitive to broader economic cycles.

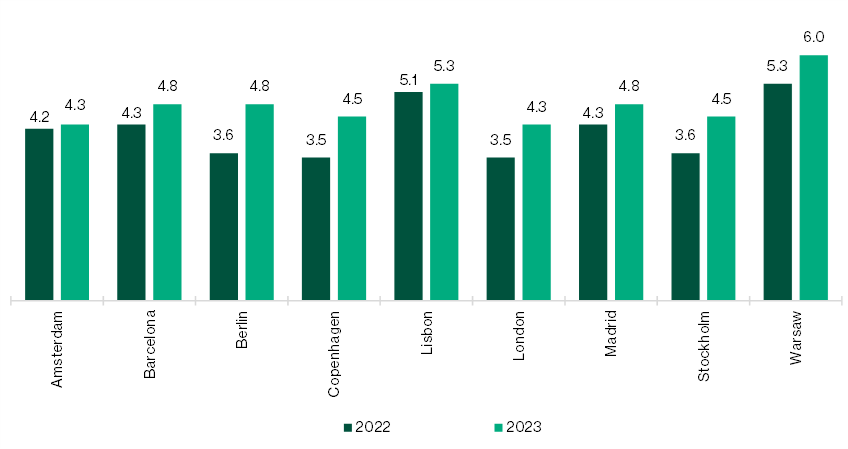

| Figure: PBSA investment yields (%) |

|

Who are the major players in the living sector?

The competitive landscape of the living sector has been relatively stable, with a handful of large players maintaining dominant market share.

Scale and operational expertise are key differentiators, particularly in the PBSA segment where global operators continue to consolidate portfolios.

Global Leaders in PBSA

- American Campus Communities (ACC): The largest PBSA owner, manager, and developer in the United States. Prior to being acquired by Blackstone in June 2022, ACC owned 166 student housing properties with approximately 111,900 beds.

- Unite Group plc: The leading PBSA operator in the UK and Europe. As of end-2024, Unite owned 66,132 beds across 153 properties in 23 cities in the UK. Listed on the London Stock Exchange with a market capitalisation of US$4.7 billion, Unite generated US$405.7 million in revenue in 2024.

- Global Student Accommodation (GSA): Owns more than 40,000 beds across 110 properties globally. Its portfolio includes 19,000 beds in the US, 20,800 beds in Europe, and 2,900 beds in Asia.

Singapore-Based Listed Players with PBSA Exposure

- Far East Orchard (SGX: O10): Entered the UK PBSA market in 2015. By end-2027, it is expected to own a portfolio of more than 4,700 beds across 16 properties. In 2024, it acquired a 49% stake in Homes for Students, a UK PBSA operator managing over 50,000 beds.

- Centurion Corporation (SGX: OU8): Expanded into PBSA with the acquisition of RMIT Village in Melbourne in 2014 and four UK assets in 2016. Centurion’s PBSA portfolio currently comprises 2,786 beds in the UK, 897 beds in Australia, and 663 beds in the US.

- Wee Hur Holdings (SGX: E3B): Entered the Australia PBSA market in 2016 and grew its portfolio to 5,662 beds across five cities. In April 2025, Wee Hur completed a partial divestment of its PBSA portfolio to Greystar for A$1.6 billion, retaining a 13% stake in the portfolio.

- Centurion Accommodation REIT (SGX: 8C8U): Listed on the Singapore Stock Exchange on 25 September 2025, Centurion Accommodation REIT is the first pure-play purpose-built living accommodation REIT. The initial portfolio injected by Centurion Corporation, the Sponsor, consists 26,879 beds with an appraised value of S$1.84 billion. The 14 properties are diversified – five PBWA assets in Singapore, eight PBSA assets in UK and 2 PBSA assets in Australia.

Singapore-Based Listed Players with Co-Living exposure

- Coliwoo, operated by LHN (SGX: 41O), is the largest player with 2,933 rooms at an occupancy rate of 97.2 percent. There are nine Coliwoo co-living locations around Singapore. The company plans to scale up to 10,000 rooms by 2030 and is preparing for a spinoff listing on the Singapore Exchange mainboard in 4Q 2025.

- The Assembly Place (TAP), founded in 2019 manages about 1,087 rooms in their 3 flagship shophouse locations – Jalan Besar, Owen Road, and Mill@32 Geylang. The properties are conveniently located across Singapore’s prime districts, including Orchard, River Valley, Bugis, Tanjong Pagar and East Coast.

- Lyf by The Ascott, owned by CapitaLand Ascott Trust (SGX: HMN), manages about 1,192 rooms across four properties in Singapore. Lyf Funan remains the largest single co-living space in Singapore with 329 rooms.

- Habyt (previously Hmlet), started in 2016, privately held by the Berlin-based startup after a merger in 2022. Habyt manages about 1,000 units in Singapore, including about 450 units in Hamiliton Road, Sarkies Road, and Balestier.

Industry growth trends in the living sector

The living sector continues to expand globally, supported by strong demand fundamentals and institutional investor participation. Both the PBSA and co-living markets are expected to deliver sustained growth in the coming years.

Purpose-Built Student Accommodation (PBSA)

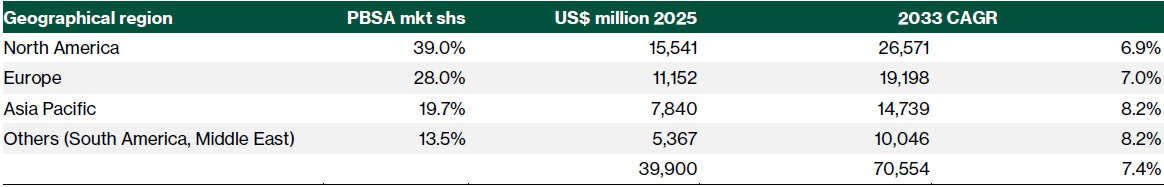

The global PBSA market is estimated at US$39.9 billion in 2025 and is projected to grow at a compound annual growth rate (CAGR) of 7.4 percent from 2025 to 2033, reaching US$70.5 billion.

Co-Living Residences

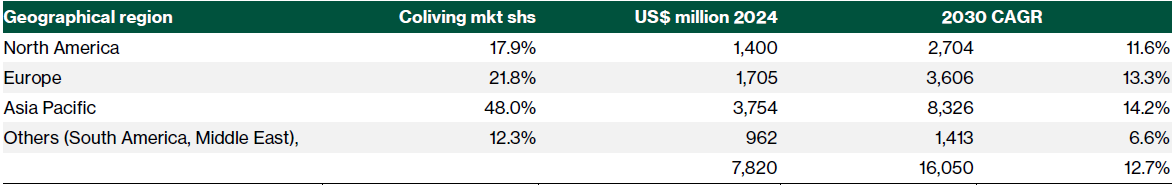

The global co-living market was valued at approximately US$7.8 billion in 2024 and is projected to more than double to US$16.0 billion by 2030, representing a compound annual growth rate (CAGR) of 12.7 percent between 2025 and 2030.

Asia Pacific is the largest market, accounting for 48.0 percent of revenue in 2024, and is also expected to be the fastest growing region with a projected CAGR of 14.2 percent.

Asia Pacific as the Growth Engine

Asia Pacific is stacking up to be the fastest growing region for the living sector. PBSA revenue in the region is expected to grow at a CAGR of 8.2 percent between 2025 and 2033, supported by a rising international student population, particularly in Australia.

- In August 2024, Far East Orchard Limited (SGX: O10) raised S$120 million for its FE UK Student Accommodation Development Fund to expand PBSA investments in the UK.

- In July 2025, Elite UK REIT (SGX: MXNU) secured approval to convert Lindsay House in Dundee, Scotland into a 168-bed PBSA facility, expected to complete in 2027. Average yields in Dundee PBSA are in the 5 to 7 percent range.

The co-living market in Asia Pacific is also expanding rapidly. While Japan’s multi-family housing market has long been the cornerstone of the sector, co-living is emerging as a new growth driver. Affordability pressures, shifting lifestyle preferences, and increased cross-border mobility among young professionals and students are spurring demand.

Singapore Spotlight

Singapore has become an important hub for both PBSA-linked investments and co-living operators.

- Foreign students have been a key driver of co-living demand, accounting for 25 to 40 percent of residents. The non-resident population grew at a steady CAGR of 1.1 percent between 2020 and 2024.

- Government support has been strong, with various state properties repurposed for co-living use. Hotels, offices, older condominiums, and hostels have all been converted into rental housing. For example, in August 2024, Ascott opened lyf Bugis in the former Hotel G property acquired earlier in the year.

Key risks of investing in the living sector

While the living sector offers attractive long-term growth prospects, investors should be mindful of several key risks.

These include macroeconomic conditions, regulatory changes, higher borrowing costs, and rising construction and operational expenses.

Macro risks: The demand for PBSA and co-living is closely linked to international student inflows and the mobility of foreign professionals. Weak economic conditions may reduce enrolments or dampen relocation demand.

Interest rate risks: Higher borrowing costs erode investment yields and can reduce investor appetite for the sector.

Construction risks: Rising construction costs and labour shortages present challenges to the timely delivery and profitability of new projects.

Operational risks: Operating expenses have been trending higher, particularly in mature PBSA markets

Key Metrics for Evaluating the Living Sector

For investors assessing PBSA and co-living assets, several operating metrics are critical in determining the attractiveness and performance of the properties.

These include occupancy rates, rental rates, rental growth, pre-bookings, and investment yields.

Occupancy rates provide a key measure of demand resilience. PBSA assets, in particular, have consistently demonstrated high occupancy due to structural undersupply. Rental growth is another important indicator of income potential.

The living sector provides attractive and stable investment yields across economic cycles. In the UK, PBSA investment yields expanded by around 65 basis points in 2023 despite macroeconomic uncertainty and geopolitical risks. This highlights the resilience of the sector as investors continue to allocate capital into student housing.

PBSA and co-living operators are typically valued using two key approaches: premium or discount to net tangible assets (NTA) and price-to-earnings (P/E) ratios.

Learn more about the living sector by downloading our guide for investors here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Beansprout was appointed by Singapore Exchange Limited via a third party platform provider and received monetary compensation from SGX via such third party platform provider to provide independent research. Beansprout is solely responsible for the contents of this document. Singapore Exchange Limited and/or its affiliates, including Singapore Exchange Regulation Pte. Ltd. (collectively, SGX Group Companies) assume no responsibility (whether under contract, tort (including negligence) or otherwise), directly or indirectly, for the contents of this document. The general disclaimers and jurisdiction specific disclaimers found on SGX’s website at http://www.sgx.com/terms-use are also incorporated into and applicable to this document.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments