A super realistic look at what it takes to succeed as an influencer in Singapore: Money Diaries #8

Retirement

By Julian Wong • 02 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We speak to a social media content creator on the deep-seated money habits that she is learning to heal.

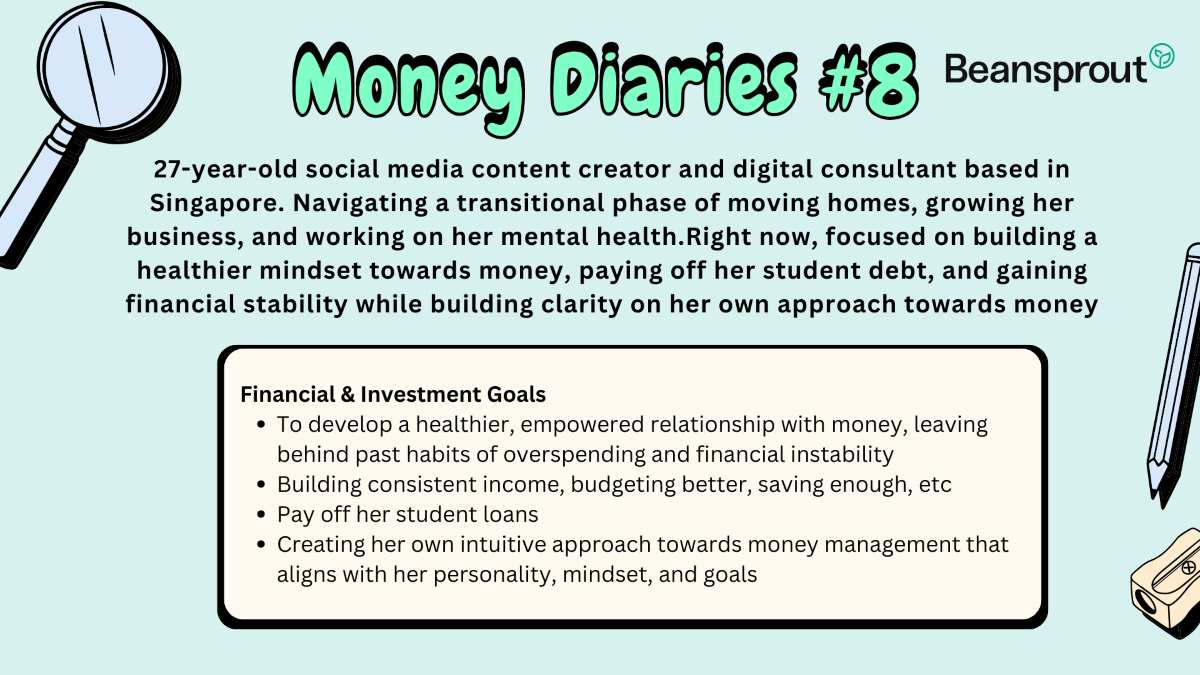

In this week’s Money Diaries, we speak to 27-year-old Daisy Anne Mitchell. Daisy is best known for being a social media content creator, and currently works in digital media and consulting.

While delivering a raw and unfiltered insider’s look at what it takes to make it as an influencer, she also unpacks the beliefs and childhood experiences that shaped how she approaches money.

Currently, her salary fluctuates from month to month, and can be anywhere between S$5-11k monthly.

Money Diaries #8: A super realistic look at what it takes to succeed as an influencer in Singapore

How would you describe the life stage you are in at the moment?

A transitional phase for sure! Over the past 18 months I've

- Quit the full time grind to start my own business in content consulting and creation

- Taken charge of my mental health (which can rack up $$$)

- Made changes in my living arrangements to better support my career and lifestyle (currently in the process of moving in with a friend)

- Started making more money than I ever have, which is kinda daunting, because I spend above my means to make up for experiences lost when I was on strict budgets.

Living situation: are you renting, staying with your parents, or do you own a home, etc?

I'm currently renting with family, but will be moving in with a friend in August, home ownership won't be in the cards for me in Singapore.

I have been paying rent to my family for a few years, ever since I turned 22 - which I know is a big culture shock to some, however, I was living with friends when I was fresh out of uni and on a really low teachers salary. It was difficult, so I moved back to save money.

Breakdown of typical weekly expenses: (each day, weekly total, biggest expense)

Due to the nature of being self employed, I don't have a set, repeatable routine. Where I am and what I'm doing is different each day, which is exciting, but can also be hard to track financially.

An ideal, manageable day looks like:

- Morning @ Tim Hortons, -$6.50 on their breakfast set.

- Afternoon @ events or shoots for my own content, or others'. Normally, I will take taxis to and from the events, which can easily surpass -$50 in a day (I live in Pasir Ris currently).

- Evening @ dinner media tastings - the meal is free / or taking my coaching calls at home +$150

A more accurate, unfiltered day looks like:

- Morning @ Tim Hortons, -$6.50 on their breakfast set.

- Afternoon @ another cafe in town for a change of scenery -$15-$25

- Distracted by shopping and makes impulse purchases -$50-$100

- Travelling by taxi my client's businesses to film content for them -$20

- Travelling by taxi to a media dinner -$25

- Going out for drinks after the media dinner -$100

- Taking a taxi home because it's late and I'm tired -$45

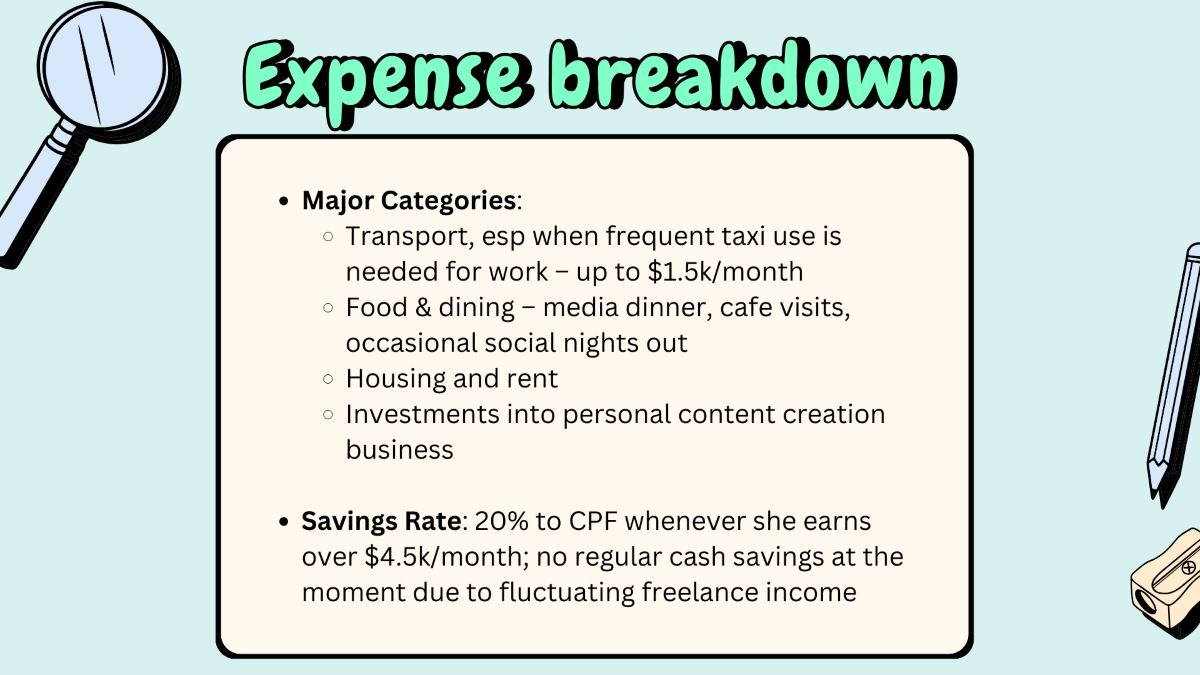

My monthly biggest expenses fluctuate between food and transport. My highest outgoing being $1500 on transport (this was a month where I was travelling overseas)

Estimate of how much you save every month:

I contribute 20% to my CPF if I make more than $4500 that month. In terms of cash savings, I have none. With freelancing, your income and expenditure can look different month to month, so until I have a more stable or healthy stream of income, I am reinvesting and profits back into my company and my brand.

What are your financial/investment goals:

Honestly, right now, it's to develop a healthy mental relationship with money. So, once that is achieved, the next goal is to pay off my student loan debt which is sitting at 60k.

How close/far would you say you are from your financial goals?

I have invested in courses on platforms, subscriptions like Female Invest, books and resources that have helped me shift from a 'money controls me' mindset to 'i control my money' mindset.

I've looked into hiring a money manifestation coach - I know that may sound woozy doozy, however the masculine approach to finance does not work for me. I'm an intuitive, emotional person, and I need to factor that into my financial journey.

So, I'd say I'm closer to having a healthy mindset around money now than I was last year. However I feel like I'll only achieve this goal once I'm able to properly budget, allocate funds, spend within my means, and have a cushion of cash savings for at least a year before moving onto the next goal.

How would you describe your mindset with regards to money? (What are some beliefs you have about money that others may not understand?)

I grew up with the belief that money was bad. It was not uncommon to go to the movies as a family and have it being pointed out how much it cost. Whenever we ate out as a family, I would always pick the cheapest item on the menu. As soon as the paycheck came in, our fridge was full and we were doing lot's of fun things. By the end of the month, we were having leftover bits for dinner. There was slight financial abuse too, which I only uncovered recently in therapy. There were times we would get money for Christmas or our birthdays and our parents would 'put it in the bank for us'. Take a guess if we ever saw that money?

I was never taught how to manage finances, was never shown how to make your finances work for you, my parents never owned property, I didn't even know what investing was, I never considered that I didn't actually have to spend all of my paycheck in the first week.

I always spent above my means, and was not given an accurate and sustainable allowance by my family to help me learn these skills. I borrowed from friends, and then my next allowance went into paying them back. Repeat repeat repeat.

That has taken many years to unlearn. It's hard not to put blame on my parents, they only knew what they were taught. However, living in Singapore as a PR is significantly more expensive than living in the UK as a citizen.

My mindset today is that it's OKAY to spend money, and spending SMART is SEXY. I am in charge, I am learning, I am allowed to make mistakes, I am allowed to do things differently, I am allowed to say no, I am allowed to say yes.

Is there an experience(s) that has shaped your relationship with money? How has it influenced your decisions

Watching finance content by women. Whether it's them talking about their income, their business, how they budget, how they manage their paychecks etc - just hearing different takes and experiences when it comes to personal finance and getting used to listening to and talking about money has already made such a difference.

What is one money habit you struggle with the most?

Travel. I am a capitalist's favourite consumer. I pay for convenience. Taking taxis at the inconvenience of it taking an hour and a half to get home, digs major holes in my pockets. This is why I am currently moving somewhere more central. It actually saves me money, and time, to pay higher rent in a more central location, than to pay cheaper rent in the east.

Travel time, the time I'll get back from not needed to spend over an hour commuting etc, is a better financial plan for me to curb this habit.

Is there a financial decision you wish you could do over?

Moving out of my family home the way I did.

In 2021, I was a fresh grad, had just landed my first full time job, and was just out of circuit breaker. I wanted to have my independence and at the time, was seriously mentally ill due to the nature of COVID and my industry at the time (performing arts).

I thought moving out would solve everything. I'd be my own person, my own provider, I'd be happier, I'd do what I want. But turns out, I just swapped out the stress of living with family, to the stress of having NO money left after paying rent. My first job completely exploited me, for months, on a probation pay that is laughable given the hours I was working.

I ended up spending 80% of my paycheck on rent, and getting into credit card debt just to be able to afford necessities. At one point, I was asking men on Tinder for money to be able to cover my rent (and it worked). Not my proudest moment, and I'll never put myself in that position again.

If I were to do that time over, I'd:

- Not take the master room in the apartment (it cost more $$$)

- Negotiate my probation salary to be higher / to have the probation period end earlier

- Educate myself on budgeting, and be really strict with where I could save costs

- Say no to a performance opportunity. This was my professional debut, so I jumped at the chance without considering the finance position I was in. The rehearsal process alone put me into thousands of dollars in debt due to having to take taxis to rehearsals. I was going from my full time job, to 5 hour rehearsals in the night, back home again, only to wake up at 6am the next day for work. repeat x 3 months. What's more. CB 2.0 happened on night 4 of our performance, so I never received my full payment for the performance.

I don't regret moving out, but I do regret not being better prepared for it.

What are you most concerned about when it comes to personal finances?

The lack of support from educational institutions from day 0. We interact with money on a daily basis, so why are we not taught about it?

If you won S$1m in the lottery tomorrow, what would you do with the money and why? How would your spending/lifestyle change?

Not tell anyone, hire a wealth manager or financial advisor to help me decide what to do with the money. I'd continue to live my life as if I didn't win the lottery, but I'd have the comfort of knowing I have something growing, somewhere. I'd anonymously send $100k to my mum - it's up to her what she does with it but I would hope she reinvests it into her passion project and side business, and invest the rest.

What is one practical financial tip that has been useful in your own financial journey?

Literally stop comparing your journey to others.

What is a personal finance related lesson you’ve learned that you think others might benefit from?

The 50/30/20 rule - your CPF is that 20%, not necessarily cash.

Key Lessons

Want to share your financial journey? Reach out to us to be featured in our Money Diaries series!

Join our Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments