How Mr & Mrs Sgfirecouple are building a life they don’t want to escape from: Money Diaries #9

Retirement

By Julian Wong • 16 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We speak to the couple about building a simple life focused on the things that truly matter.

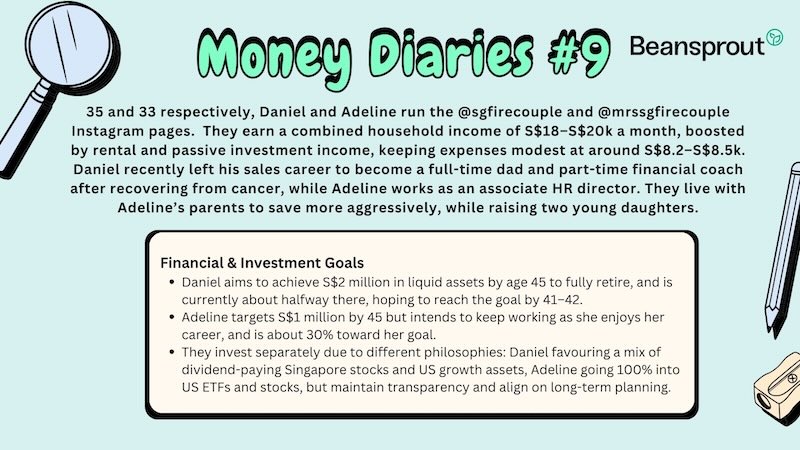

In this week’s Money Diaries, we speak to Daniel and Adeline, the folks behind the respective @sgfirecouple and @mrssgfirecouple Instagram accounts.

Daniel is 35, and worked as a former sales manager in advertising tech. Currently, he is a full-time dad and a part-time financial coach*. Adeline, on the other hand, is a Asst HR Director in a creative/media agency.

Their total household income is between S$20,000 to S$22,000/month, with Adeline drawing a fixed salary of S$10,000/month while Daniel’s fluctuates from month to month.

They also bring in rental income of S$4,300/month, and passive income from dividends and interests of around S$1,300 to S$1,500/month.

*Check out @sgfirecouple’s Instagram page to learn more about Daniel’s journey quitting corporate after battling cancer in 2024.

Money Diaries #9: How Mr & Mrs Sgfirecouple are building a life they don’t want to escape from

How would you describe the life stage you are in at the moment (as a couple)? What is your living situation?

We’re parents to two young girls (aged 6 and 3). We own a 4-room resale HDB flat in Jurong West, which is currently rented out. For now, we live with Adeline’s parents in their 5-room flat nearby, a temporary arrangement that allows us to save more aggressively while maintaining family support.

Breakdown of typical weekly household expenses:

We typically don’t spend much on weekdays as we mostly WFH. We are mostly frugal eating hawker or simple food at shopping mall so we could potentially spend less than $10 a day. On some days, we will spend more if we have certain cravings but still capped at $40-$50 per day.

On Weekends, we make a point to eat simple once, and eat slightly better food at restaurant once.

Potentially it could be Saturday spending $50 on food & free activities like playground. On Sunday, we could be spending $250 - $350 which includes better restaurant food like Genki Sushi, Crystal Jade etc.

Our Biggest expenses are our Car (Audi A3) – all in $1600 and my helper of coming to 6 years, $1,100 for her salary.

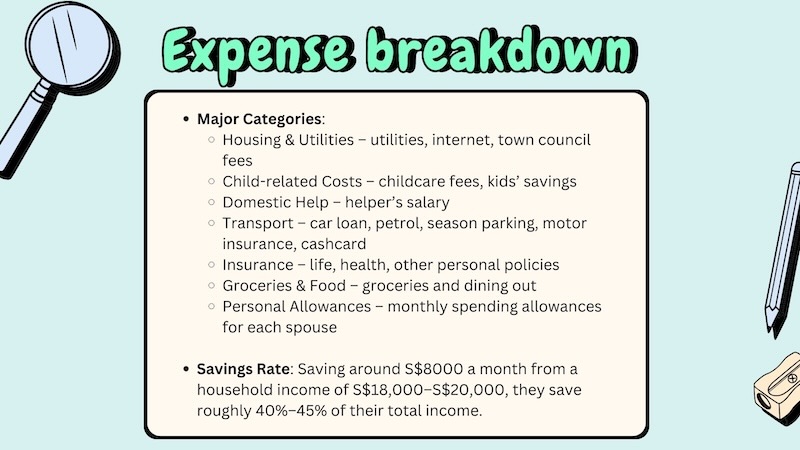

In total, our monthly expenses are around $8,200 to $8,500.

Here’s the full breakdown:

- $950 insurance

- $900 childcare

- $1,100 helper’s salary

- $1,100 car

- $100 petrol

- $100 cashcard

- $120 season parking

- $150 motor insurance

- $1,200 allowance for Mr

- $1,200 allowance for Mrs

- $600 savings for kids

- $500 utility bills, internet, town council

- $600 groceries

Estimate of how much you save every month as a household:

So, we typically save around $8000 a month, depending on how much our income is that month (currently, between $18,000 to $20,000).

What are your financial/investment goals as a family:

Daniel: My wife & I have different views towards Personal Finance.

For me, I have been dreaming of retirement so I’ve been wanting to leave corporate the day I started working. My Goal is $2m liquid assets by 45 years old.

Adeline on the other hand is very comfortable continuing working as she enjoys her work. Her liquid assets should reach around $1M by the time she reaches 45 – but likely she will continue working.

How close/far would you say you are from your financial goals?

Daniel: I’m currently around 50% to my goal — and with compounding on my side, I hope to hit it earlier, potentially by age 41–42.

Adeline is about 30% there, but with her consistent savings and disciplined investing, she’s likely to reach her goal around the same time.

Describe your investment approach as a couple / What steps have you taken or are taking towards achieving these shared goals?

We manage our investments separately. Why? Because we have very different philosophies:

- Adeline is more aggressive — 100% US market exposure, she believes in more aggressive growth in her 30s focusing towards ETFs and individual US stocks for higher growth

- I on the other hand, l believe in a mixture between Singapore stocks for modest, reliable dividends & US ETFs and individual stocks for growths.

Despite the differences, we operate with mutual respect and transparency. I’m often her “CIO” — she checks in with me before making any big moves.

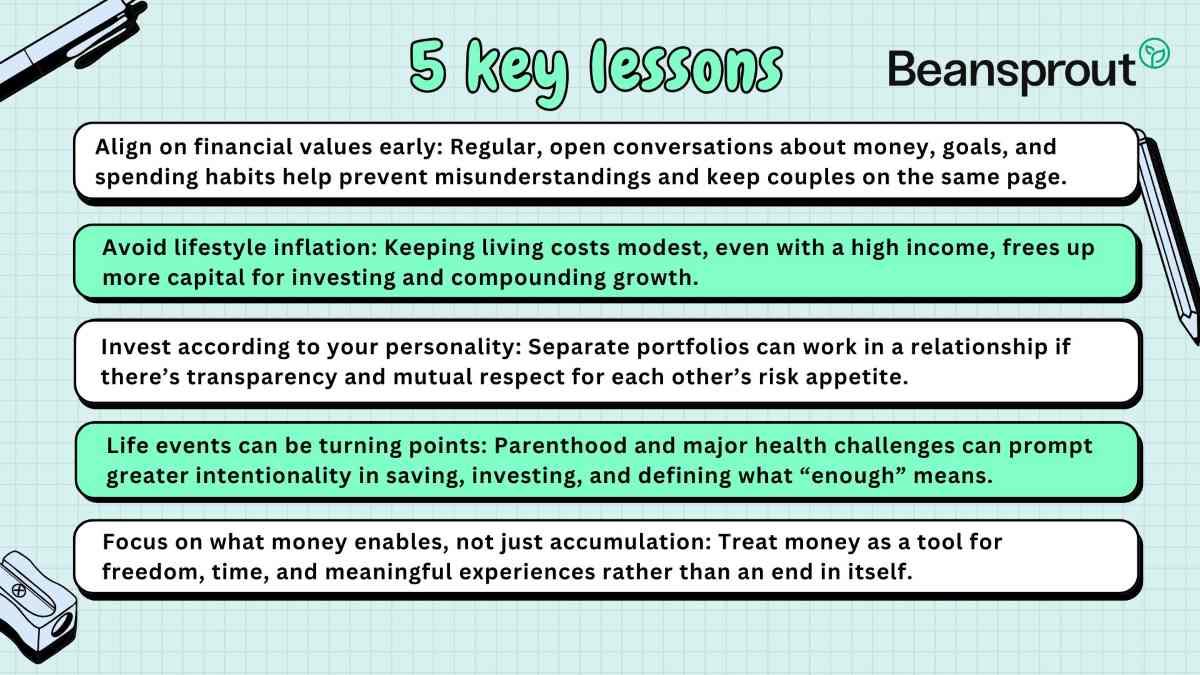

What we’ve done well as a couple is avoid lifestyle inflation. Despite our income, we’ve chosen to keep our living costs low — no condo upgrades, no flashy cars. That’s allowed us to allocate more towards investing and let compounding do its magic.

Related links:

What are some challenges you’ve faced in navigating finances and investing as a couple?

We’ve been lucky to experience a fairly smooth journey.

The biggest reason? Transparency.

We’re completely open with one another — income, savings, debts, and even spending habits. This honesty makes financial planning much easier.

We do keep our investment portfolios separate, which works for us due to differing strategies. But when it comes to planning, we always align.

How would you describe each of your mindsets with regards to money? (What are some beliefs you each have about money that others may not understand?)

Daniel: Money, to me, isn’t about getting rich. It’s about freedom, options, and peace of mind.

A lot of people assume I love money — but I don’t. I love what money enables: Time. Autonomy. The ability to choose how I live my life.

While others are trading time for money, I’m using money to buy back time.

Adeline: Money is important but only because it empowers you, but ONLY if you can draw clear lines between just money vs money-empowerments. I grew up with a family that uses money to establish love and affection compared rather than focusing on bonding, communication, affection and company. This is a kind of mentality I know for sure I will never want to have for me or my family and kids.

People need to start focusing investing in things money cannot replace, like time spent together, bonding, health, experiences etc.

What is an experience that has had the most impact on how you talk about money as a couple? How has it continued to influence your decisions?

Daniel: We became much more intentional with our finances when we found out we were expecting our first child in 2019.

That was the turning point — we doubled down on savings, career growth, and becoming better at managing money. That moment shaped not just our finances, but also our maturity as parents and professionals.

Adeline: The main turning point was our first born. I am not good with numbers and was unconvinced that we were ready to have a child in Singapore’s high Cost of Living at our mid 20s when our careers were still budding. But my husband did all the planning and convincing to show me that we were in a comfortable space to afford what we could, and we could have our own way of sustainably raising up a child, or 2 in our then financial abilities. Even till today, he continues to prove me time after that we are on track to achieve the goals we want.

What is one money habit you struggle with the most as a couple? (Alternatively: What is the expense you find hardest to cut down on?)

Daniel: I often joke that Adeline says I’m her retirement plan. 😅

She’s naturally more laid-back when it comes to investing. I used to push for more involvement, but over time I’ve learned to respect her pace — and she’s trusted me to lead.

In terms of expenses, the one thing we won’t cut is our helper. She’s been a blessing to our family, and we’re happy to pay her above market because she’s worth every cent.

Adeline: The 1st hurdle was to balance contributions. I am someone who always prefers splitting bills equally so that I don’t contribute less or owe other people more. But because we, as a couple, agreed that relationships are not supposed to feel so transactional, it didn’t feel right to keep going 50-50s like business shareholders. And no matter how much your partner can earn, one should never never assume it’s only right that he/she to contribute to whatever.

Over time, agreeing on a split based on our earnings and affordability was what we had to iron out and stick to.

One of the expenses hardest to cut down on now would be groceries because these are essentials. Of course, we could always go for the cheapest option available but at what cost?

Is there a shared financial decision you wish you could do over?

Daniel: Buying a car a little too early.

We didn’t fully assess our actual usage before committing. While it’s manageable given our income, we now recognize it as a sunk cost that could’ve been delayed or better optimized.

Adeline: I wish I could start saving and investing earlier 😊 I don’t have the financial acumen to do trading or short-term investments, but I wished I just knew where to put my money in earlier.

What are you most concerned about when it comes to your family's personal finances?

Daniel: After being diagnosed with cancer in 2024, I’ve had moments of “money dysmorphia” — where no amount ever feels like enough.

Even with a high net worth, the fear of not being able to provide if something goes wrong still lingers.

It’s something I’m working through, and it's made me more empathetic toward others with similar anxiety, even when they seem “financially okay” on paper.

Adeline: The biggest worries are definitely education and enrichment. I don’t want my kids to lose out in opportunities so I hope we can be able to afford whichever path of education/learning they choose.

The latter part is because not because there are so many new things that may be up and coming and we don’t have a rough guide to how much is necessary, things like enrichment programs, tuition, exchange programs, learning trips (more for tertiary etc). It’s the unknown that is concerning.

If you won S$1m in the lottery tomorrow, what would you do with the money and why? How would your family's spending/lifestyle change?

Daniel: I’d keep it simple:

- 10% to charity

- 10% on family wants or experiences

- 80% into investments — mainly dividend-paying assets and bonds to generate passive income

Would our lifestyle change? Not drastically. Maybe a few more nice dinners, but nothing major. We’re already living in a way that we’re content with.

Adeline: Save 5% for myself and pass the rest to my husband? 😊

I think we would use it to do something more sustainable and long-lasting in terms of money making and use that to sustain a better lifestyle with less work and more freedom.

What is one practical financial tip that has been useful in each of your personal financial journeys?

Daniel: When I was in NS, my mum in her own ways taught me about lifestyle inflation when I told her even though I was a cadet, I wasn’t saving money given that I had a 30% increment from when I was in BMT. She asked “Is it after becoming sergeant you will spend the same amount too? If that’s the case, next time you earn $3,000 you will spend everything?”

I became woke and started saving money BEFORE spending. And though there were a couple of years I grew tempted and derailed a little, I always go back to her teachings of not increasing my lifestyle tremendously.

Adeline: It’s not about how much you earn, it’s about how much you save.

What is a personal finance related lesson you’ve learned that you think other couples might benefit from?

Daniel: No matter how tough it is – TALK ABOUT FINANCES! Always. Not just how much you earn, but how you feel about it.

Discuss:

- Your relationship with spending

- Whether you have any debts

- What retirement looks like for each of you

- How you’ll split bills — 50/50 or by income ratio?

We’ve seen many couples fight about money, not because of the amount, but because they never aligned from the start.

Adeline: Aligning on your individual financial responsibilities in the relationship and agree on a financial goal as a couple is more important that you think.

Key Lessons

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

2 comments

- emuo emuo • 23 Aug 2025 12:23 PM

- Al • 24 Aug 2025 02:27 AM

- Melvin Teo • 21 Aug 2025 06:09 AM