NTT DC REIT - 5 key takeaways from SIAS Corporate Connect Webinar

REITs

By Gerald Wong, CFA • 20 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We share five key takeaways from the SIAS Corporate Connect webinar with NTT DC REIT, including portfolio stability, growth strategy and data centre market trends.

What happened?

NTT DC REIT is one of the largest REIT IPOs in Singapore in more than a decade.

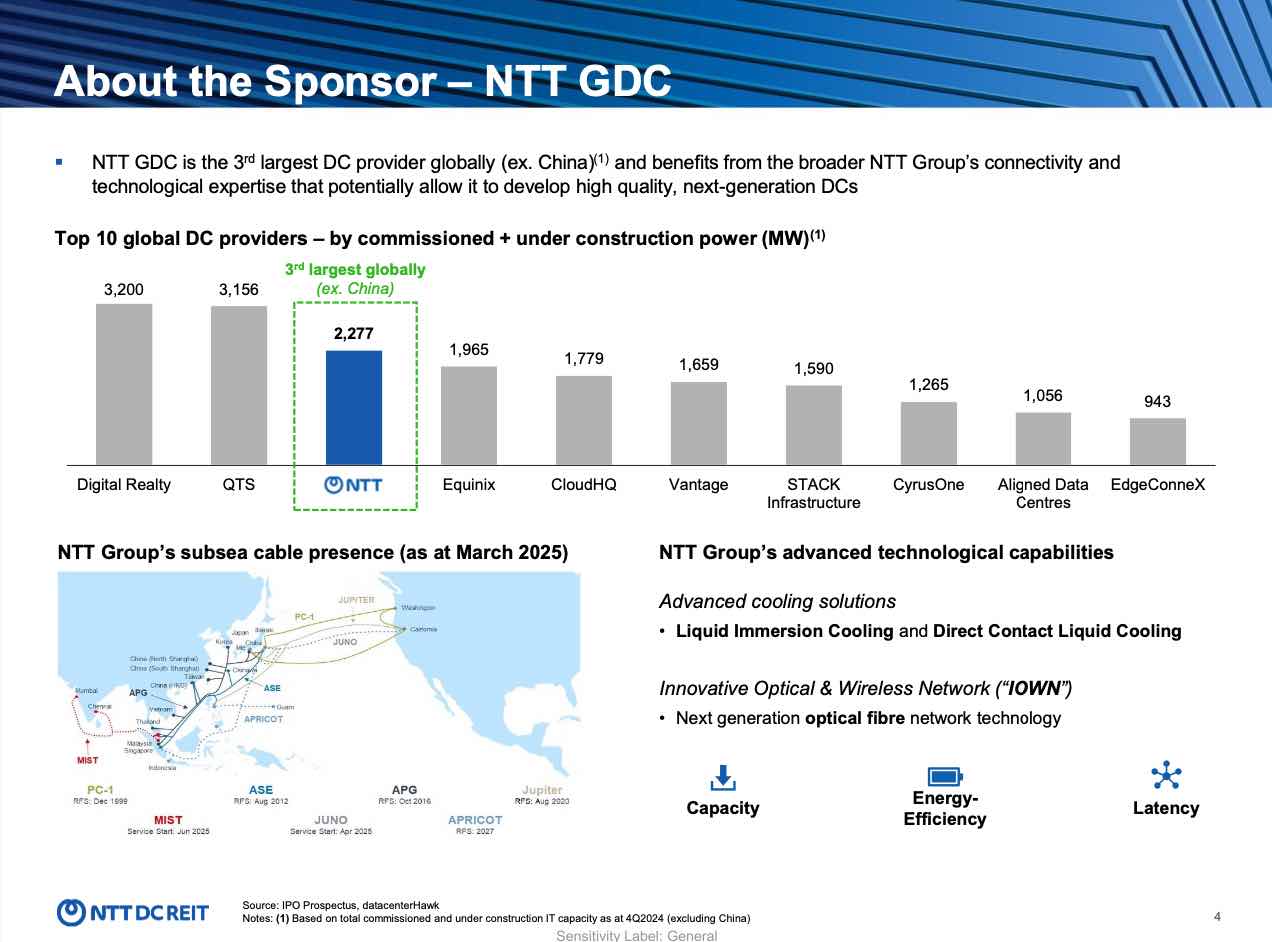

The REIT owns a global portfolio of income-producing data centres across the US, Europe and Singapore, and is backed by sponsor NTT Global Data Centers, one of the world’s largest data centre operators.

NTT DC REIT recently joined a Corporate Connect webinar organised by SIAS and supported by SGX Group to share updates on its portfolio and strategy.

The session gave investors a closer look at market trends, the outlook for data centre REITs, and NTT DC REIT’s plans for long term growth.

During the discussion, we spoke with Masayuki Ozaki, Chief Financial Officer of NTT DC REIT, to understand how these developments could shape the REIT’s prospects and future distributions.

Watch the video to learn more about NTT DC REIT.

Key Takeaways from Corporate Connect Webinar with NTT DC REIT

Here are our five key takeaways from the discussion:

- Stable income profile supported by long leases and built in rental escalations

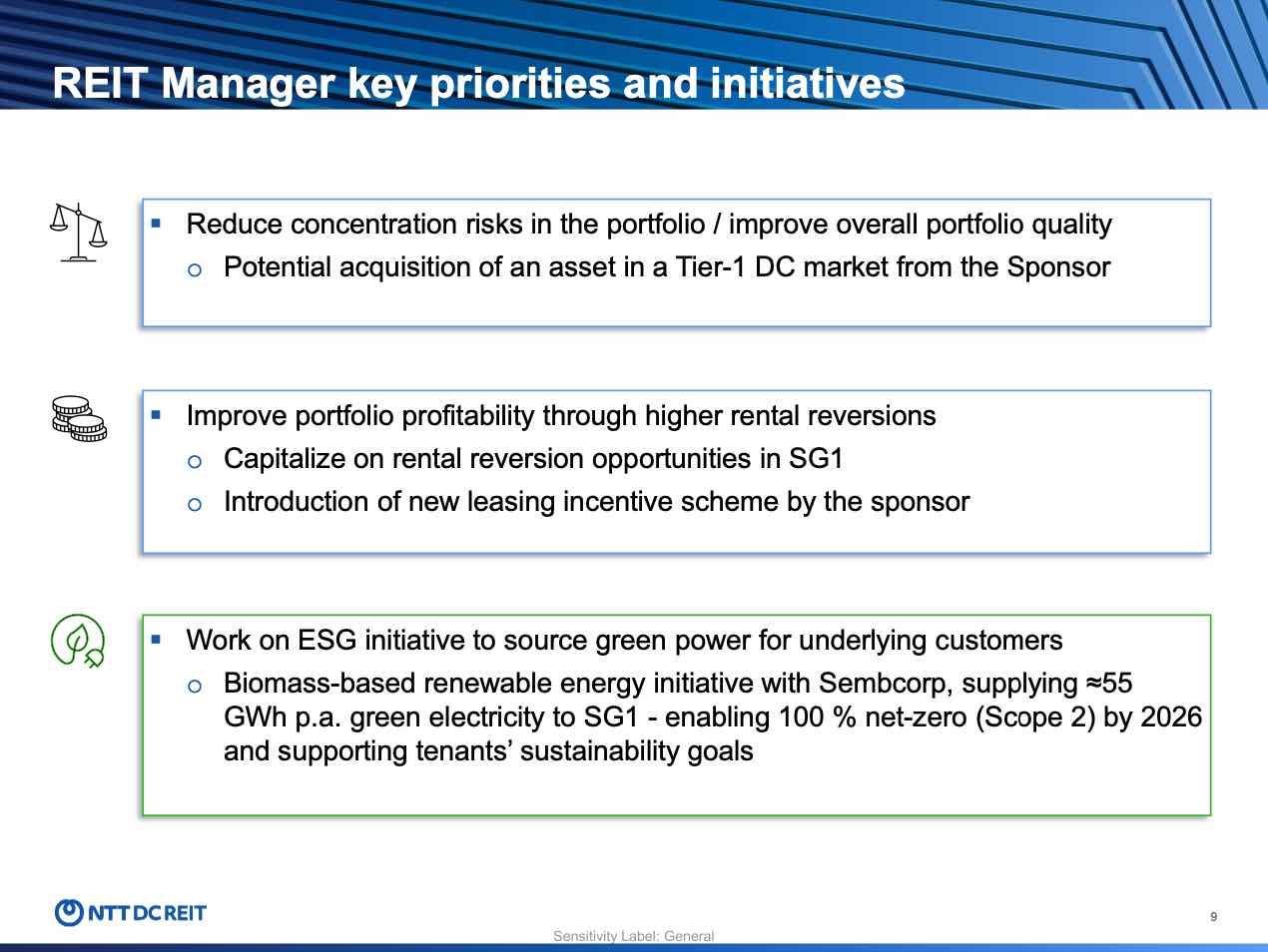

- Tenant concentration exists and is being managed through portfolio diversification

- Identified acquisition pipeline offers potential for portfolio growth

- Data centre demand underpinned by ongoing digitalisation and cloud trends

- Strategy focused on steady distributions and measured growth

#1 - Stable income profile supported by long leases and built in rental escalations

One of the clearest messages from the webinar was the stability of NTT DC REIT’s income profile.

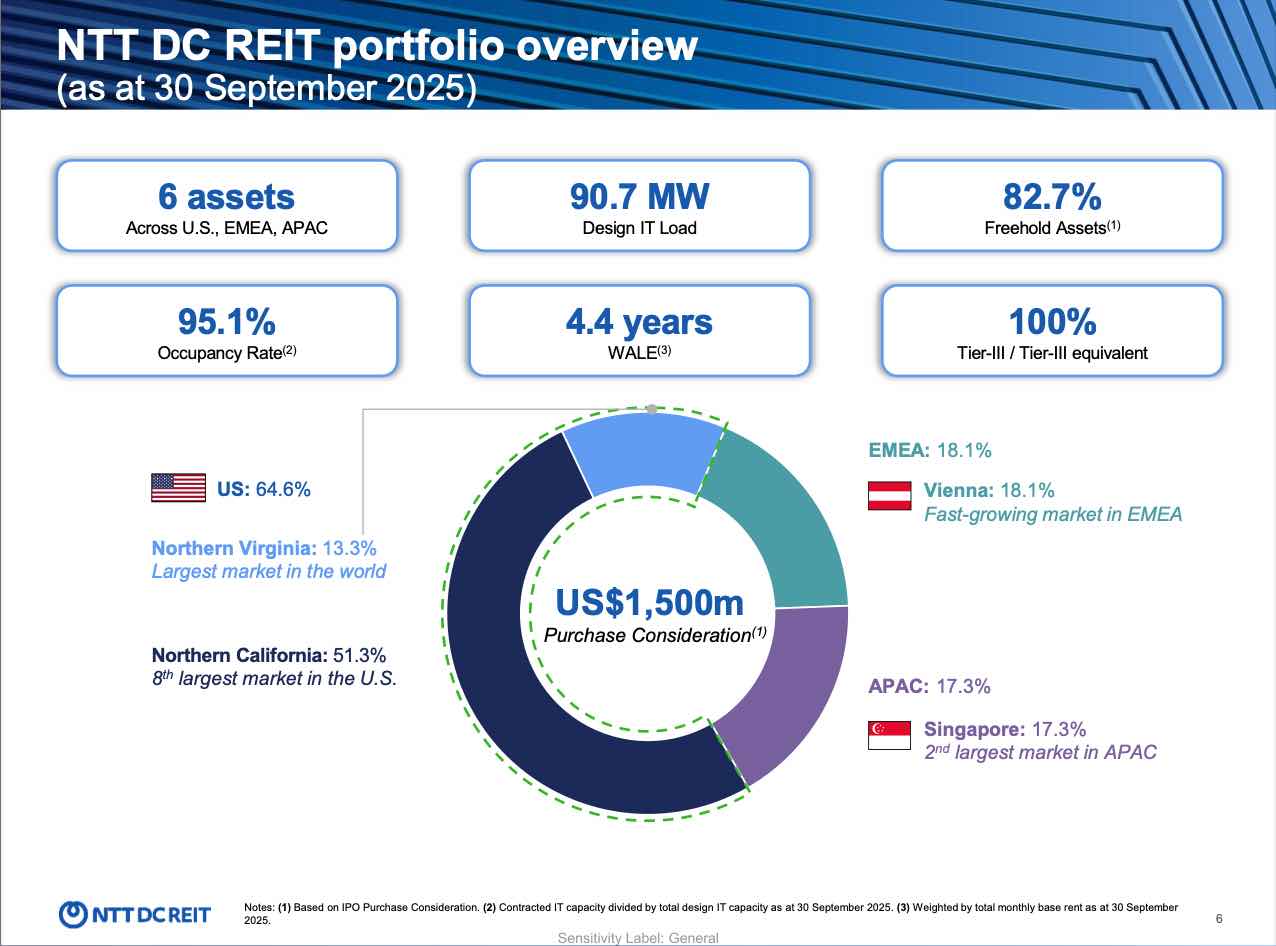

Management highlighted that the portfolio currently enjoys an occupancy rate of around 95 percent, supported by a long weighted average lease expiry of 4.4 years. This means that a large portion of the REIT’s rental income is already secured well into the future.

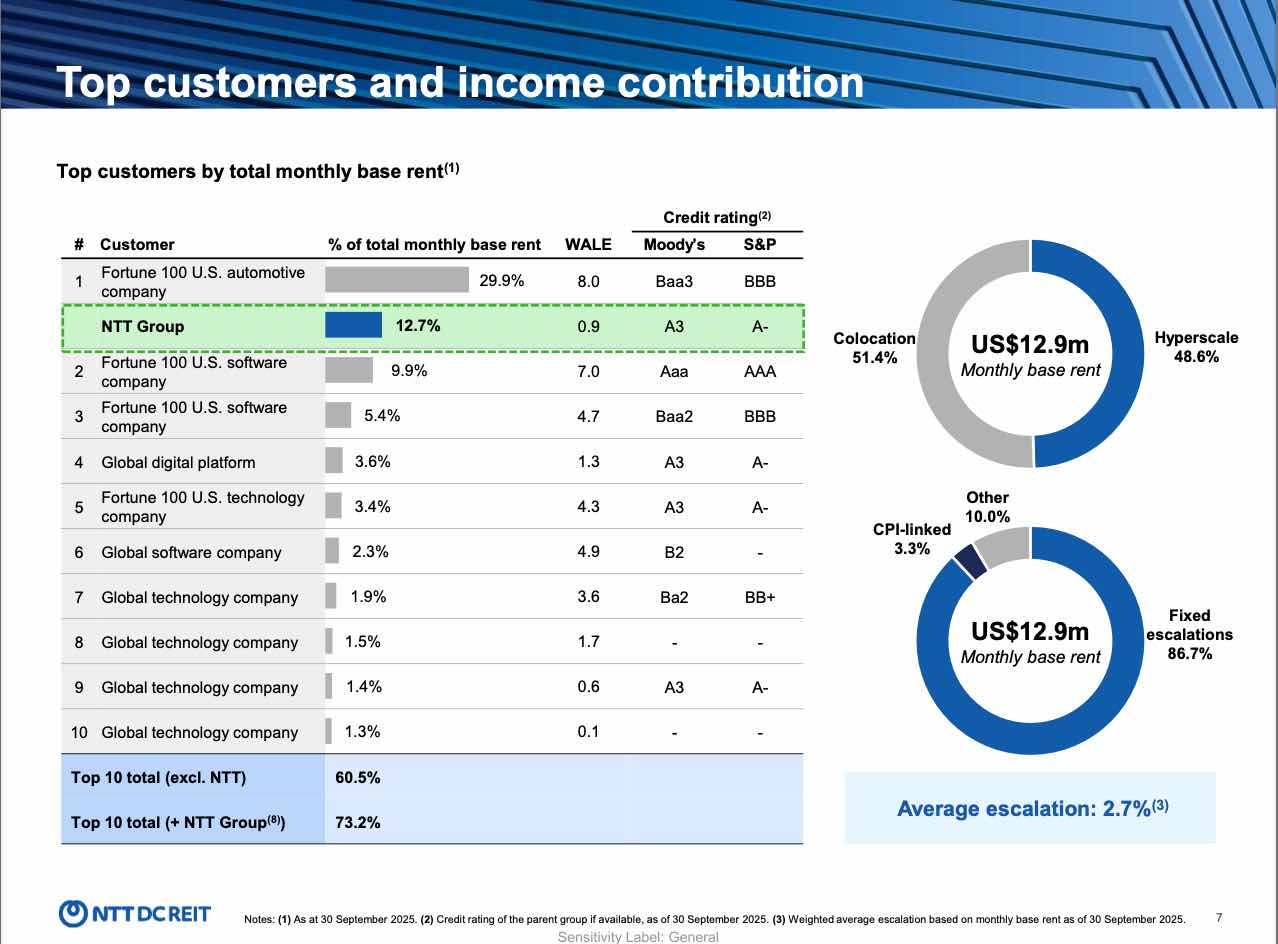

A key strength of the lease structure is that almost 90 percent of the portfolio benefits from built-in annual rental escalations. On average, rents increase by about 2.7 percent each year. This contractual escalation provides organic income growth without requiring the REIT to depend on market re-leasing.

The quality of tenants was another important point raised.

Most of the top tenants are large institutional grade companies with investment grade credit ratings. According to management, this gives them a high level of confidence in the sustainability of cash flows.

#2 - Tenant concentration exists and is being managed through portfolio diversification

Another major topic of discussion was tenant concentration.

Currently, around 30 percent of NTT DC REIT’s revenue comes from a single major tenant located within the Sacramento data centre campus. This tenant is an electric vehicle company that uses the facilities to support its autonomous driving operations.

Management addressed this issue directly and acknowledged that this is a risk area that needs to be managed carefully.

At the same time, they provided useful context. The tenant has consistently expressed interest in expanding its presence at the campus and has asked to be shown any additional capacity that becomes available. This suggests that the data centre remains strategically important to the tenant’s operations.

The CFO also pointed out that this tenant exposure is geographically concentrated only in Sacramento. As a result, any future acquisitions outside this market would naturally dilute the reliance on this single customer.

Management made it clear that diversification is a key priority. The main way to reduce this concentration risk will be through portfolio growth. By acquiring additional assets with different tenants in different locations, the REIT can gradually lower the proportion of revenue coming from any one customer.

This balanced explanation helped investors understand both the current risk and the practical steps being taken to address it.

#3 - Identified acquisition pipeline offers potential for portfolio growth

Growth through acquisitions was one of the most important themes of the webinar.

NTT DC REIT benefits from a strong relationship with its sponsor, NTT Global Data Centers. The REIT was created as a vehicle to acquire stabilised assets from the sponsor, allowing NTT to recycle capital back into new data centre developments.

At the time of listing, the sponsor had already identified a near-term acquisition pipeline of about 130 megawatts of data centre capacity. To put this into perspective, the IPO portfolio size was only 91 megawatts. This means the REIT has the potential to more than double in size over the medium term if these assets are successfully acquired.

Management shared that roughly half of this identified pipeline is located in Europe, with the remainder split between the US and parts of Asia. As a result, Europe is likely to be an initial focus area for acquisitions.

Japan was also discussed as a longer-term opportunity. Although there are currently no Japanese assets in the REIT portfolio, the sponsor is developing new data centres there. These facilities could eventually become part of the acquisition pipeline once they are completed and stabilised.

In terms of funding, the CFO explained that acquisitions would likely be financed through a combination of debt and equity, similar to how most Singapore REITs pursue external growth.

Importantly, management emphasised that they intend to remain disciplined and measured in their approach, focusing on accretive deals that support long-term value creation.

#4 - Structural trends in the data centre market

Beyond the company-specific updates, the webinar also provided useful insights into the broader data centre industry.

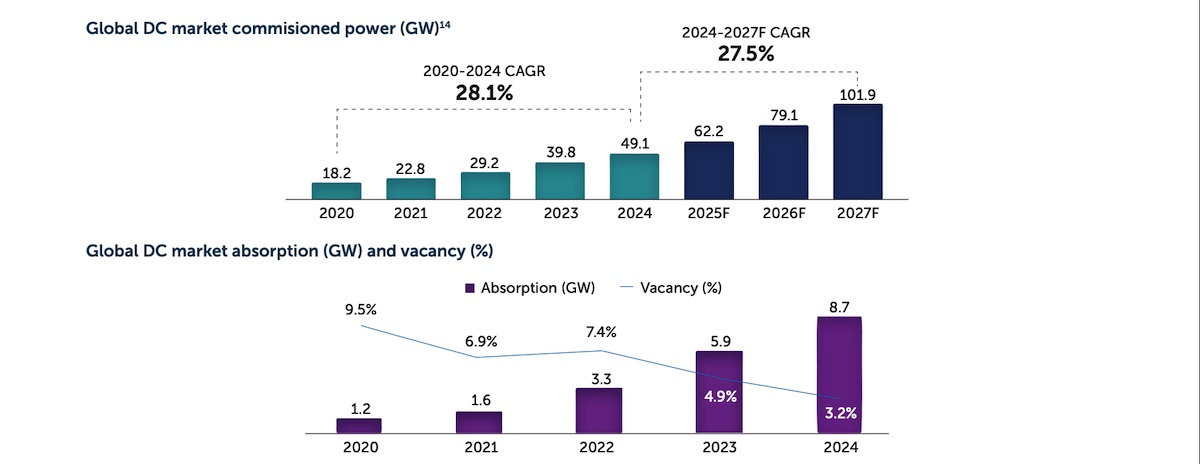

Management reiterated that demand for data centres continues to be supported by strong structural trends. Growth in cloud computing, digital transformation and higher data consumption are all driving the need for more computing infrastructure.

While artificial intelligence has attracted significant attention recently, the CFO highlighted that not all data centre demand is linked to AI. Traditional cloud demand remains a major driver and is expected to continue growing at mid-double-digit rates in the coming years.

This means that even existing data centre assets should continue to see healthy leasing demand, provided they remain well maintained and properly managed.

One common concern among investors is the impact of rising electricity costs. On this point, management explained that around 80 percent of the portfolio’s leases are structured on a power pass-through basis. This means that higher utility costs can be passed directly to tenants, limiting the financial impact on the REIT.

For the remaining bundled leases, rents are typically higher and lease tenures shorter, allowing the REIT to adjust pricing over time if energy costs increase.

#5 - How the REIT intends to drive growth for unitholders

The final key takeaway was how NTT DC REIT plans to create value for unitholders over time.

Management described a strategy focused on delivering a combination of stable recurring income and measured growth.

The core drivers include:

- Contractual annual rental escalations across most of the portfolio

- Maintaining high occupancy levels

- Acquiring new assets from the sponsor pipeline

- Active asset management to enhance portfolio profitability

- Prudent balance sheet management

With the current dividend yield at around 7.5 percent and built-in rental growth of close to 3 percent annually, management believes the REIT is well positioned to deliver attractive returns even before considering acquisitions.

Any successful portfolio expansion would act as an additional growth kicker on top of this base.

The CFO summed up the vision clearly, describing NTT DC REIT as a vehicle designed to provide reliable income supported by long leases and quality tenants, with structural demand for digital infrastructure underpinning long-term prospects.

Distributions will be paid twice a year, with the first payout expected after the fiscal year ending March.

Hear directly from management of NTT DC REIT

Watch the full Corporate Connect webinar with NTT DC REIT on SIAS’s YouTube channel to catch the complete discussion and hear the insights straight from the company.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments