Pan-United - Market leader with multi-year dividend growth

Stocks

By Ng Hui Min • 17 Dec 2025

Why trust Beansprout? We're licensed by the Monetary Authority of Singapore (MAS).

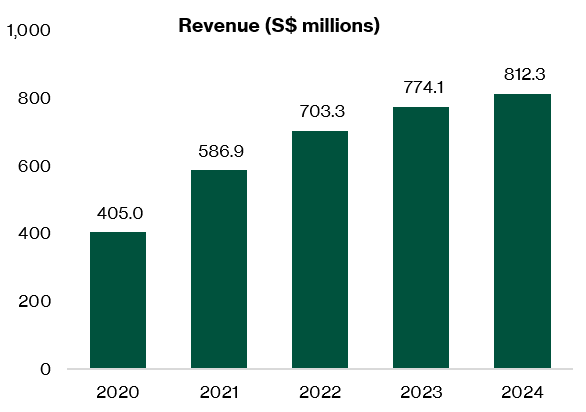

Pan-United (PanU) is Singapore’s largest ready-mix concrete (RMC) supplier and a growing digital solutions provider.

Largest concrete provider with technology edge

Pan-United Corporation (PanU) is Singapore’s largest provider of ready-mixed concrete (RMC) and a fast-emerging digital solutions player.

With more than 70 years of operating history, the company has transformed from a traditional building-materials supplier into a technology-enabled, low-carbon concrete specialist with an expanding regional footprint.

Pan-United is uniquely positioned to benefit from Singapore’s multi-year construction upcycle, driven by major public infrastructure projects, strong public housing demand, and rising sustainability requirements within the built environment.

Its strong balance sheet, industry leadership, and accelerating digital strategy provide an attractive platform for medium-term growth.

The company supplies concrete to virtually all major public and private developments in Singapore, including MRT lines, the North–South Corridor, Changi Airport, Tuas Port, and large residential and commercial projects.

Beyond Singapore, PanU operates concrete and aggregates businesses in Malaysia and Vietnam and exports specialty concrete products to regional markets.

In recent years, PanU has also pushed into technology. It now develops its own sustainable concrete technologies like PanU CMC+ besides creating a large range of specialised low-carbon concrete mixes, while its AiR Digital platform helps manage batching, logistics and real-time production.

This supply-chain optimisation system is used to manage concrete production, delivery logistics, and batching operations. The combination of advanced materials and digital platforms differentiates PanU from regional peers and enhances recurring revenue visibility.

Resilient 1H25 results with higher dividend

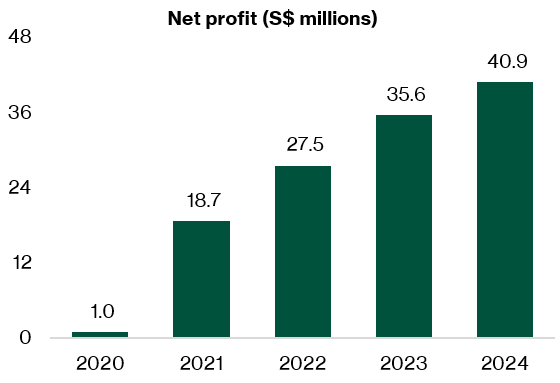

Pan-United reported a solid set of results for 1H25, helped by increased activity across public housing, transport projects and new institutional developments.

Revenue rose 4.3% year-on-year to S$401.1 million, driven by higher concrete volumes and better demand for its specialty products.

Operating profit increased 17.4% YoY to S$41.1 million thanks to improved plant usage, more efficient truck routing, and a better product mix.

While costs such as labour, energy and materials remained high, PanU’s pricing discipline and productivity gains helped keep margins stable.

Profit after tax and minority interests (PATMI) grew 11.0% YoY to S$20.6 million.

The improvement came from both the core concrete business and growing contributions from the AiR Digital logistics platform, which is now gaining traction through external licensing.

PanU ended the half year with S$69.8 million in net cash, giving it strong flexibility to fund expansion without taking on high debt.

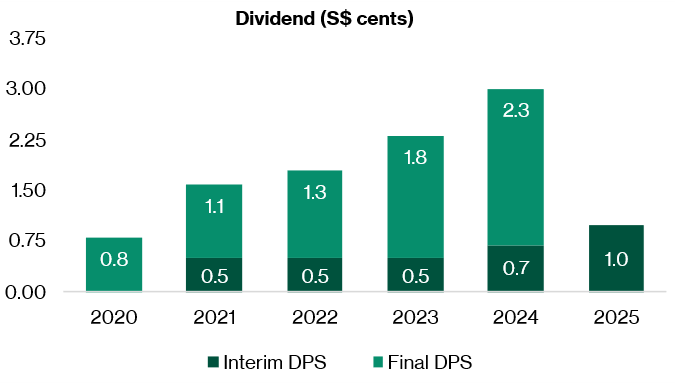

The company also raised its interim dividend by 43% to 1.0 cent per share (vs. 0.7 cent in 1H24), continuing its steady track record of dividend increases.

This strong financial position supports PanU’s ongoing investments in low-carbon technology, digital systems, and new production plants. Consistent free cash flow also helps the company maintain dividend stability through economic cycles.

Visibility from major infrastructure wins

Earnings visibility has improved with PanU securing S$430 million of ready-mix concrete contracts for Changi Airport Terminal 5, providing an average S$86 million of annual revenue through 2030—about 11% of FY24 revenue.

Beyond T5, PanU remains deeply involved in public housing launches, healthcare facilities, mixed-use developments and MRT projects.

Its strong track record and customer relationships reinforce its position as the preferred partner for both public and private sector developers.

Stronger earnings visibility with major project wins such as Changi Airport Terminal 5

Pan-United’s future earnings visibility looks firm, helped by major contract wins. A key example is its S$430 million ready-mix concrete supply contract for Changi Airport Terminal 5, which runs for five years until 2030.

This alone brings in an average of about S$86 million per year — roughly 11% of FY2024 revenue.

Beyond T5, PanU continues supplying to a wide mix of public and private projects, including new public housing estates, healthcare buildings, mixed-use developments, and MRT expansions.

Its scale, technical capabilities and long-standing customer relationships make it a preferred supplier for major developers and contractors.

Capacity expansion to capture rising demand

To support the rising demand ahead, Pan-United is investing heavily in capacity. The group plans around S$60 million of capex in 2025, mainly for a new batching plant at the Jurong Port Integrated Construction Park.

Expected to begin operations by end-2025 or early-2026, the plant will help improve supply reliability, reduce costs, and strengthen PanU’s market position.

Together with ongoing digitalisation and product innovation, the company is well placed to capture the next phase of Singapore’s multi-year construction boom.

Supportive construction outlook

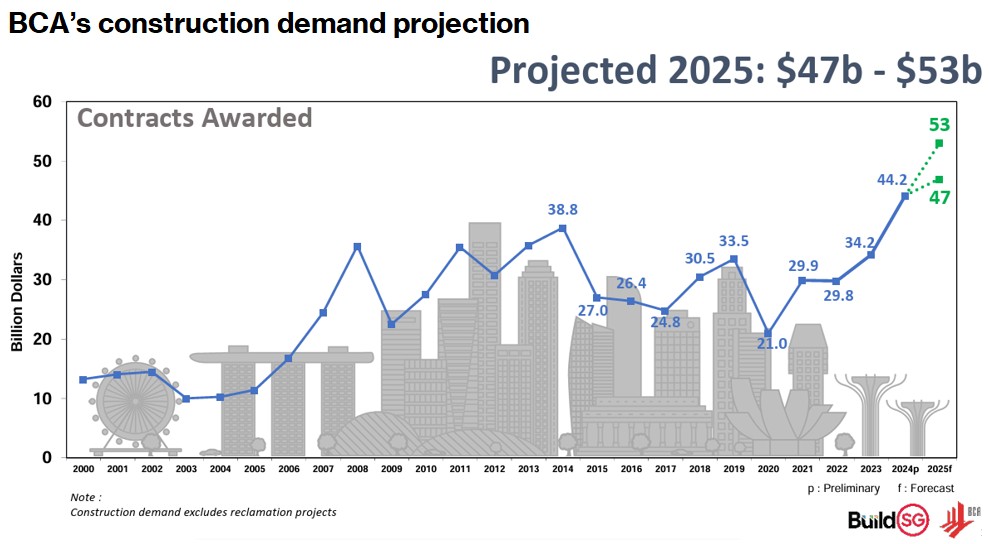

Singapore’s construction outlook remains strong. According to the Building and Construction Authority (BCA), total construction demand is expected to reach S$47–53 billion in 2025, up from S$44.2 billion last year.

Demand for ready-mix concrete is forecast at 13.0–14.5 million m³, representing a modest 3–8% increase year-on-year.

Public-sector projects — which now account for about 60% of total construction — will remain the key driver. Major upcoming works, including Changi T5, MRT lines, new healthcare campuses and a ramp-up in public housing, provide a strong pipeline into 2H25 and beyond.

With its leading market share and growing production capacity, PanU is well positioned to benefit.

Scaling AiR Digital — a growing contributor to margins

AiR Digital, Pan-United’s technology arm, is becoming an increasingly important part of its business. The platform helps construction players digitalise operations, optimise truck routes, reduce waste and boost productivity.

It is already being used by companies in Singapore, Malaysia, Vietnam and New Zealand.

While digital revenue is still relatively small, it carries significantly higher margins and is growing quickly as more companies adopt digital tools.

As AiR Digital scales further, it is expected to play a bigger role in lifting PanU’s margins over the medium term.

The long-term vision is for AiR Digital to develop into a broader ecosystem for the construction and logistics sector.

This would include aggregates, precast, cement hauling and fleet management. The platform’s SaaS model also provides recurring revenue and helps reduce exposure to raw-material price swings.

Medium-term roadmap: technology, sustainability, regional growth and disciplined capital allocation

Pan-United’s strategic roadmap resembles the multi-pillar transformation pursued by leading industrials.

The first pillar centres on advancing low-carbon and specialty concrete technologies. PanU continues to expand its suite of green products, supported by R&D collaborations with global technology partners.

The second pillar is digitalisation. AiR Digital will scale to new geographies and industries, supported by cloud infrastructure, automation, and expanding software capabilities.

The third pillar focuses on regional expansion. PanU aims to replicate its Singapore success model in high-growth ASEAN markets, particularly Malaysia and Vietnam, where urbanisation and infrastructure investment continue to accelerate.

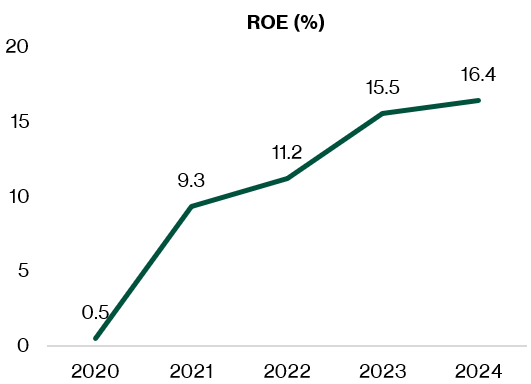

The fourth pillar emphasises disciplined capital allocation and ESG leadership. PanU maintains a strong net-cash balance sheet, invests strategically in technology and plant upgrades, and aligns sustainability metrics with long-term value creation.

Together, these pillars support rising margins, stronger cash flows, and long-term ROE improvement.

Initiate with Buy

We initiate coverage on Pan-United with a BUY rating.

The company’s strong market position, solid balance sheet, and multi-year earnings visibility make it an attractive way to gain exposure to Singapore’s construction cycle.

The growing adoption of low-carbon concrete and the expansion of AiR Digital add further growth engines beyond the traditional materials business.

With clear catalysts, improving free-cash-flow potential and rising dividends, we believe PanU is well positioned for the next phase of its growth.

Target price of S$1.26

Our discounted cash flow (DCF) valuation yields a fair value of S$1.26 per share for Pan-United, implying 16.7% upside from the current market price of S$1.05.

The valuation is based on a 10.3% WACC, incorporating a cost of equity of 10.7% (beta of 1.1, risk-free rate of 3.5% and market return of 10.0%) and a cost of debt of 4.0%, assuming a conservative 5% debt ratio and a 20% tax rate.

At S$1.26, this would imply 19.1x 2026 P/E and 2.8% forward dividend yield.

Key risks include construction-sector cyclicality, exposure to raw-material and energy cost inflation, competition from regional RMC suppliers, delays in major public projects, and slower-than-expected adoption of PanU’s digital solutions.

Download the full report here.

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in Pan-United Corporation Ltd.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments