How to position for volatile markets? DBS CIO team shares key tips

Private Wealth

Powered by

By Nicole Ng • 02 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Discover DBS Treasures’ CIO insights on navigating 2025’s market volatility and learn how investors can stay anchored with structured wealth strategies.

This post was created in partnership with DBS Treasures. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

2025 has been anything but predictable.

From renewed tariff tensions to abrupt policy changes from President Trump, to falling yields on short-term instruments and concerns about the ballooning US fiscal deficit, investors have had every reason to feel rattled.

Yet in the face of this uncertainty, global equities staged a remarkable rebound in the second quarter, defying expectations.

This tells us that it’s becoming a real challenge for investors to identify opportunities and stay committed through the noise.

To help make sense of it all, we spoke to Daryl Ho, Senior Investment Strategist with the DBS Chief Investment Office (CIO) team, the minds behind the investment strategy that guides some of Asia’s most affluent investors.

Mr Ho shared his perspectives on how to stay anchored amid volatility, the role of Artificial Intelligence (AI) and tech in the new world order, and why a structured investment approach matters now more than ever.

Here’s what we learned.

Staying the course in a volatile year

“The speed and scale of the rebound — a textbook V-shaped recovery — caught many investors off guard,” shares Mr Ho.

“This unfolded despite ongoing tariff turbulence, unpredictable policy swings from President Trump, and growing unease over the United States’ ballooning fiscal deficit.”

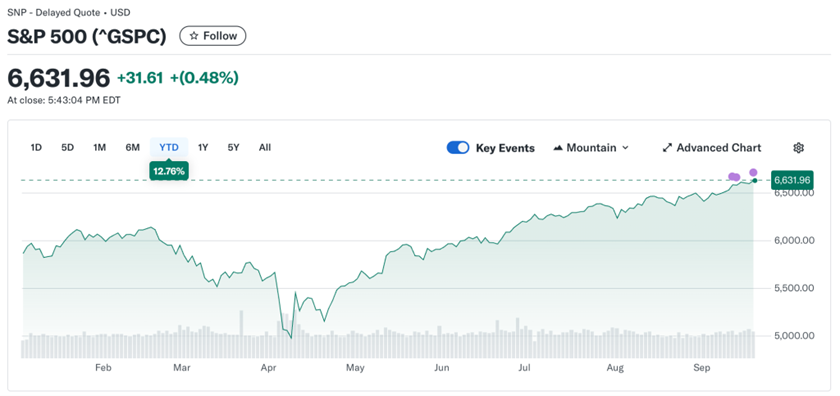

Indeed, the S&P 500 rose to a record high of 6,631.96 as of 18 September 2025, surpassing its previous peak from July 2025.

This is in stark contrast to April 2025, when the S&P had officially entered a bear market, falling 20% from its earlier high after the US President Donald Trump imposed sweeping tariffs on nearly all US imports.

That swift reversal highlights just how difficult it is to time the market.

“At this juncture, it is worth reiterating an old investment maxim: time in the market beats timing the market,” Mr Ho said.

“Attempting to exit and re-enter at more favourable levels often proves elusive,” Mr Ho adds.

One common behavioural trap is anchoring, where investors rely too heavily on past information, such as the price they previously paid for an asset, hesitate to re-enter at higher levels than where they exited, potentially missing out on gains.

Instead, Mr Ho advocates for patience and conviction in navigating market cycles.

“In volatile markets, the ability to stay the course is what distinguishes enduring value from short-term noise.”

One strategy the DBS CIO team continues to endorse is dollar cost averaging.

“It’s a simple yet powerful strategy that smooths out market volatility by investing consistently over time, regardless of market conditions. Imitating Warren Buffett’s strategy is easy in theory — but far fewer have the discipline to follow it through in practice,” says Mr Ho.

Learn more about DBS Treasures and DBS CIO team's strategy here.

Are tech stocks still worth a look?

With all the macro headwinds, investors may wonder if tech stocks still have room to grow. The CIO team’s answer: yes, especially those driven by AI.

Mr Ho shares, “While we are entering a new world order defined by self-sufficiency, protectionist trade policies, and driven by apprehension over US debt sustainability — AI-powered technologies continue to revolutionise the way we live, work, and play,”

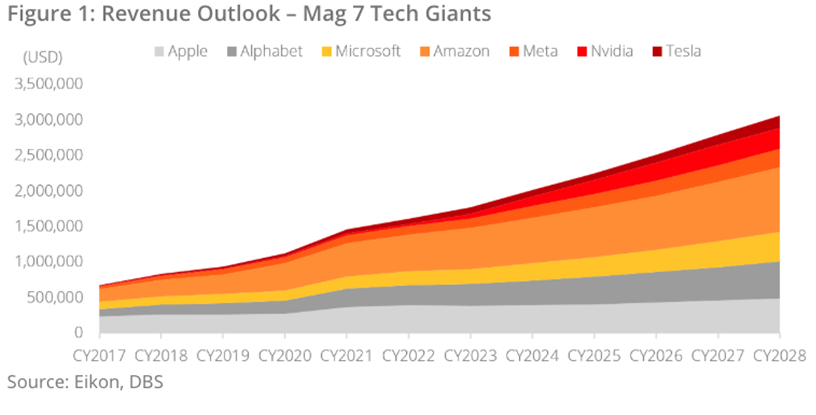

The DBS CIO team remains structurally overweight on the technology and AI themes, citing strong momentum and investment.

And this isn’t just a US story.

“Big Tech companies will be investing a combined USD250 billion in 2025 on AI-related infrastructure. On the sovereign front, the Middle East will also be investing around USD100 billion in AI-driven investments within this decade.”

Even China is back on the radar.

As shared by Yeang Cheng Ling, Chief Investment Officer (North Asia) at DBS Bank, China remains massively under-owned by institutional investors, and the resurgent domestic tech industry provides ample opportunities for stock pickers.

With global giants doubling down on infrastructure and innovation, and emerging players like China re-entering the spotlight, the tech sector still offers long-term potential for discerning investors.

Anchoring portfolios with the CIO Barbell Strategy

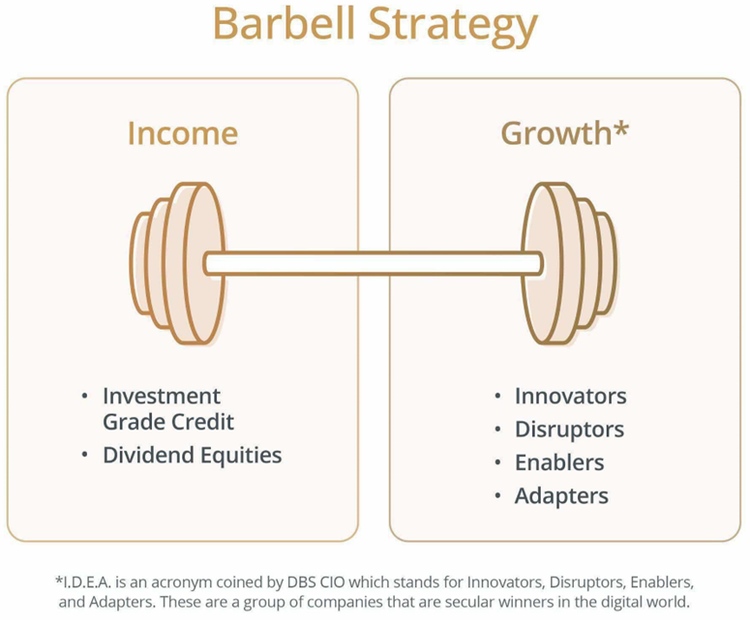

At the heart of the CIO Barbell Strategy is a disciplined portfolio construction framework that helps investors stay the course during unpredictable markets such as the one we’re facing today.

You don’t have to choose between growth and stability; you get both.

Unlike traditional balanced portfolios that diversify across asset classes without strong conviction, the Barbell Strategy encourages investors to be intentional by leaning into opportunities where there's potential for outperformance, and to actively buffer against volatility on the other end.

“Our asset allocation strategy is informed by our CIO Barbell Strategy and the ability to stay ahead of structural shifts,” Mr Ho explains. “Three core pillars guide our allocations: income generators, secular growth equities, and alternatives such as gold as a portfolio risk diversifier.”

Importantly, the Barbell Strategy isn’t a one-size-fits-all model.

For investors seeking to accumulate their wealth, a greater allocation to growth-oriented assets may help capture long-term capital appreciation.

Meanwhile, those approaching retirement or with preservation goals may prefer a tilt towards income-generating and capital-stable investments to safeguard wealth and maintain liquidity.

The strength of the strategy lies in its flexibility because it evolves with your goals, risk tolerance, and market conditions.

On the growth end of the Barbell, the CIO team focuses on sectors and companies poised to benefit from long-term, irreversible trends, such as AI and healthcare innovation.

These are typically resilient, profitable firms with strong earnings potential.

To balance this, the Income side of the strategy includes dividend-paying stocks, and investment-grade bonds, particularly short-duration corporate bonds with higher yields, which offer capital preservation and recurring income.

This dual focus allows investors to ride growth cycles while having a safety net in place.

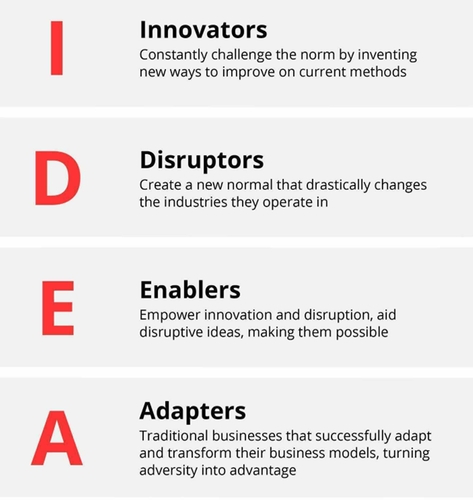

Identifying long-term growth with the I.D.E.A. framework

Many of the growth opportunities in the market are filtered through the CIO team’s I.D.E.A. framework:

While many are in tech, others include leaders in healthcare, insurance, and automotives.

The I.D.E.A. framework shapes where to find compelling growth ideas, ensuring portfolios are aligned with structural trends and future-ready themes.

Investors still value personalised guidance

With the rise of robo-advisors and DIY platforms, it’s easier than ever to invest online.

But for many affluent investors, convenience alone isn’t enough.

When portfolios grow more complex, spanning retirement planning, business succession, or multi-generational wealth, personalised guidance becomes not just helpful, but essential.

As the wealth management offering from DBS Bank, DBS Treasures serves affluent individuals seeking personalised wealth management and Accredited Investors with S$350,000 or more in investible assets.

From estate and tax planning to retirement strategies and support through major life events, your Relationship Manager, backed by a team of Investment Counsellors and Bancassurance Specialists, is well-placed to address complex and evolving needs.

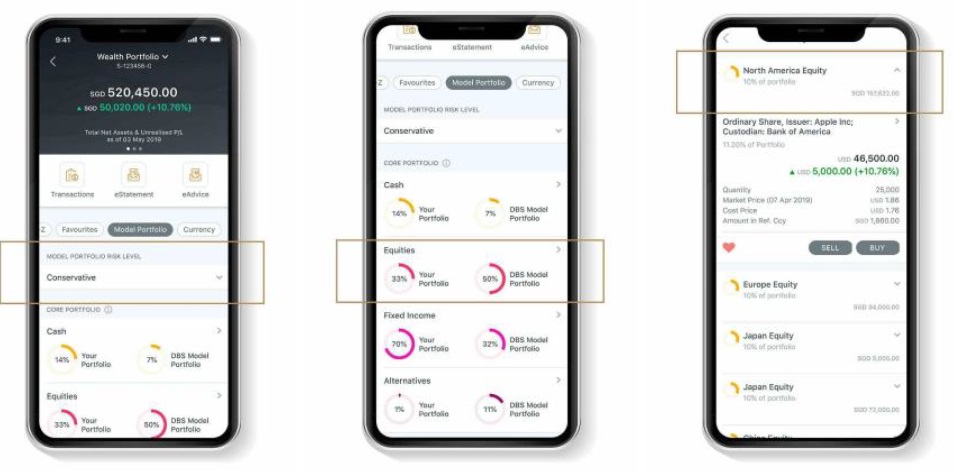

Beyond the human touch, DBS Treasures also complements its offerings with digital tools such as the Wealth Management Account on digibank to provide wealth clients with a seamless investment experience and real-time insights.

The app provides a consolidated view of portfolios, spanning equities, funds, currencies, and fixed deposits.

Alongside the consolidated portfolio view, you’ll also have smart tools like watchlists, price alerts, and real-time trading capabilities.

What sets it apart is its integration of curated insights from the bank’s Chief Investment Office, including personalised investment ideas and quarterly model portfolios tailored to various risk profiles.

With support for up to nine currencies, the account enables investors to act quickly on global opportunities, combining smart technology with expert guidance for a more intuitive wealth management experience.

For affluent investors, the integration of digital tools with personalised support from a dedicated Relationship Manager makes it easy to stay on top of their portfolios anytime, anywhere.

Accredited Investors enjoy the added advantage of exclusive access to private market opportunities and tailored strategies.

With its strong regional expertise in the wealth management team as well as in the DBS Chief Investment Office, and the backing of Asia’s Safest Bank, DBS Treasures offers a trusted foundation through every market cycle.

Learn more about DBS Treasures here.

Disclaimers and Important Notice

The information and opinions contained in this article has been obtained from sources believed to be reliable, but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose.

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

It is provided in Singapore by DBS Bank Ltd (Company Registration. No.: 196800306E), an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments