Looking for passive income? Here’s how I’m investing in Singapore with ETFs

ETFs

Powered by

By Gerald Wong, CFA • 21 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Here's how to gain exposure to a diversified portfolio of Singapore-focused investments in a cost-effective, low-hassle way.

This post was created in partnership with Nikko Asset Management. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

With the cost of living climbing year after year, relying only on a single income source through our day jobs may not be enough to achieve our financial goals.

Knowing this, like many investors, I began exploring ways to build a stable passive income stream.

The idea is simple: complement my salary, grow my wealth steadily, and eventually create a reliable income source for retirement.

Passive income can take many forms, such as dividends from stocks, coupons from bonds, or distribution yields from ETFs and funds.

Recently, I’ve been exploring more Singapore dollar (SGD)-denominated investments to avoid currency risk and eliminate one layer of uncertainty from my financial planning.

Singapore-focused investments not only align with my spending and liabilities, but they also offer practical, sustainable opportunities for passive income generation.

Why Singapore For Passive Income?

Singapore is known globally for its political and economic stability.

With a AAA sovereign credit rating as of 31 July 2025 (Bloomberg), strong reserves, and a well-managed monetary policy, it offers a conducive environment for income-focused investors like me.

Because I live and spend in Singapore, investing part of my portfolio in SGD helps avoid exchange rate volatility.

The SGD is managed against a basket of currencies from Singapore’s major trading partners, which helps keep it relatively stable, even in times of global market turbulence.

And while Singapore's market may not be as large as the US or China, in my view, it still provides a wide range of viable investment options from government bonds to blue-chip stocks with consistent dividend yields.

Why I Chose ETFs to Build My Passive Income Portfolio

It’s definitely possible to build a portfolio by picking individual stocks and bonds. But this approach can also be fairly time-consuming.

Tracking earnings reports, bond maturities, new IPOs, and managing diversification manually can quickly become a second job.

One option I’ve turned to is ETFs (exchange-traded funds).

They offer a cost-effective, low-hassle way to gain exposure to a diversified portfolio of assets.

Additionally, they trade like stocks, meaning I can buy and sell them easily to rebalance or free up cash.

I found three SGD-denominated ETFs that allow me to gain exposure to Singapore while building my passive income.

Let me break down each one.

#1 – ABF Singapore Bond Index Fund

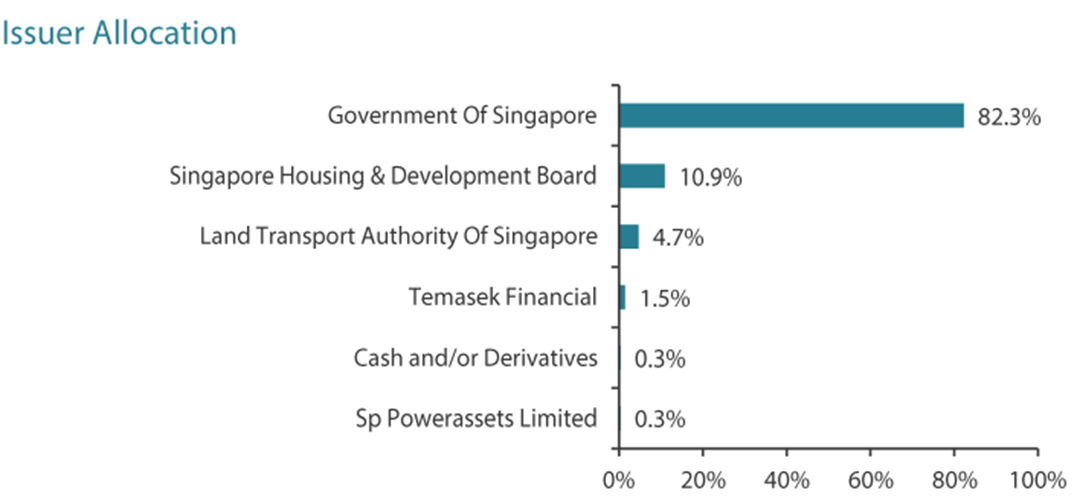

The Nikko AM ABF Singapore Bond Index Fund tracks the iBoxx ABF Singapore Index, which consists primarily of SGD-denominated Singapore government and quasi-government bonds, including those issued by HDB and LTA as of 31 July 2025.

While it allows for regional government bonds, including those from China, Hong Kong, Indonesia, and Malaysia, the current portfolio is 100% Singapore-based as of 30 June 2025.

The ETF has an average credit rating of AAA, the highest possible rating, thanks to the nature of the issuers, which are the Singapore government and government-related entities.

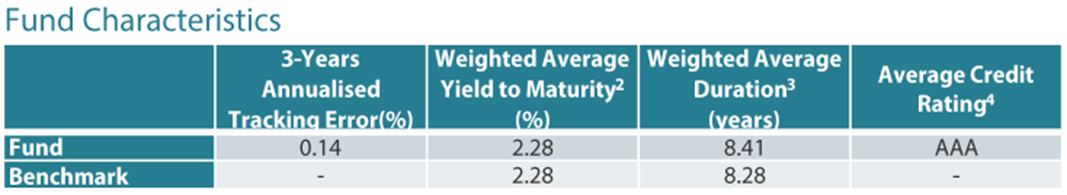

As of 30 June 2025, the ETF has a weighted average duration of 8.41 years (Source: Nikko AM). Duration measures a bond portfolio’s sensitivity to interest rate changes, where the higher the duration, the more sensitive the portfolio.

Its weighted average yield to maturity (the yield for holding all the bonds to maturity) is 2.28%, a reflection of the global shift toward lower interest rates.

The total expense ratio (TER) is 0.25% p.a. (audited as of financial period ended 30 June 2024), and it pays semi-annual distributions (January and July).

Celebrating its 20th anniversary this year, it’s one of the longest-standing SGD bond ETFs, having launched in 2005, and has S$1.12 billion in AUM as of 17 July 2025.

As of 30 June 2025, the ETF delivered an average return of 2.40% p.a. since inception.

Listing Date: 31 August 2025. Benchmark: iBoxx ABF Singapore Index total return series. Returns are calculated on a NAV-NAV basis and assuming all dividends and distributions are reinvested, if any. Returns for period in excess of 1 year are annualised. Past performance is not indicative of future performance.

Learn more about the ABF Singapore Bond Index Fund here.

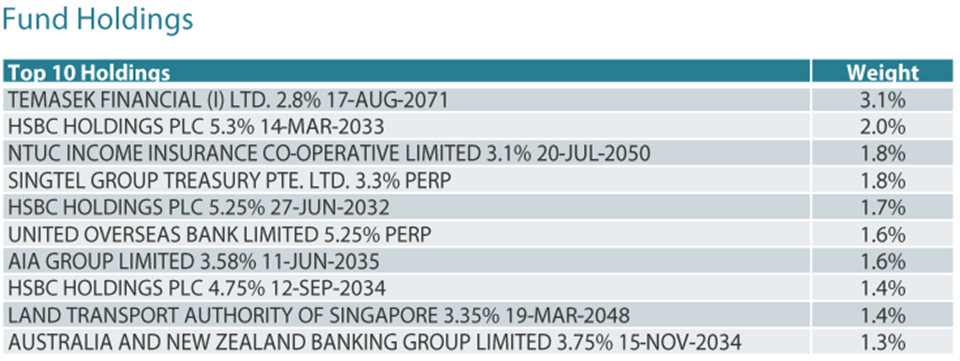

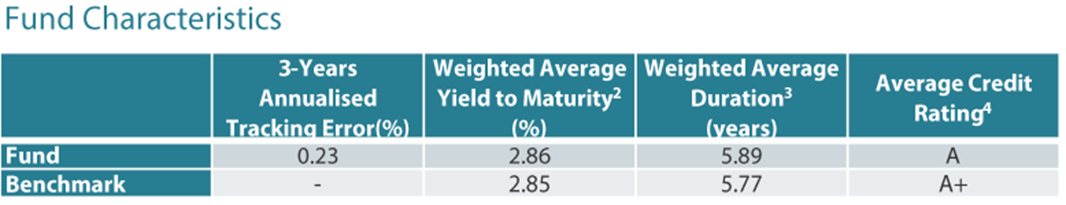

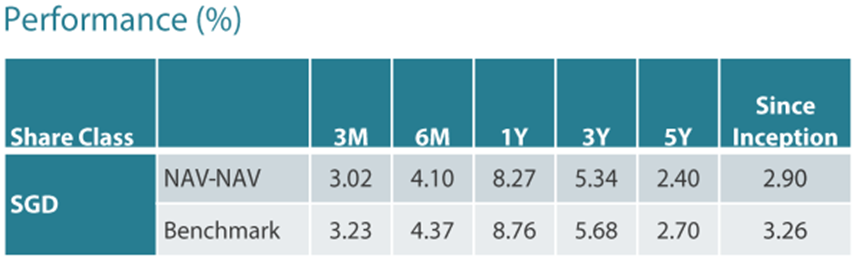

#2 – Nikko AM SGD Investment Grade Corporate Bond ETF

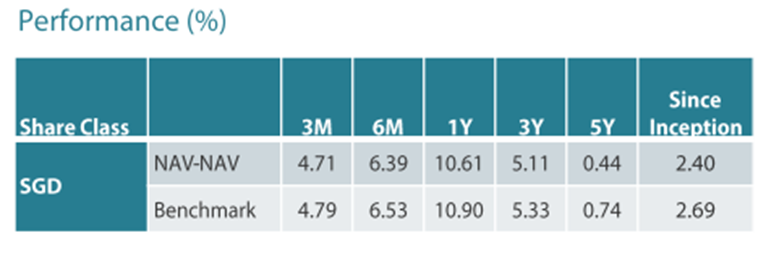

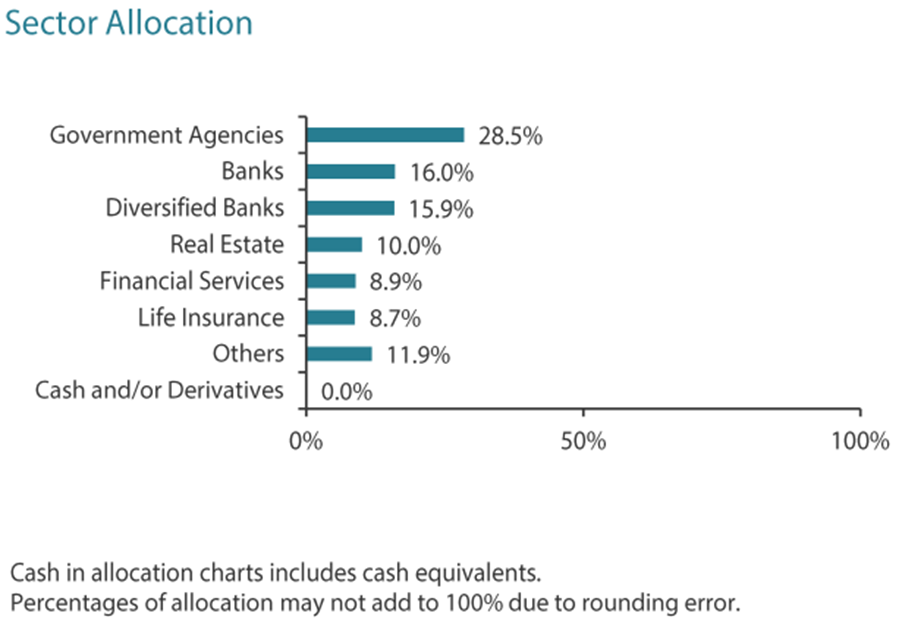

This SGX-listed ETF provides exposure to SGD-denominated corporate bonds and tracks the iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index.

This index aims to track the performance of the iBoxx SGD non-sovereigns large cap investment grade index. The minimum inclusion size of each corp bond is S$300 million. (Source: Nikko AM).

The bonds in the index itself can come from both local and global issuers, as well as sub-sovereign bonds, including entities like Temasek and major banks.

The Nikko AM SGD Investment Grade Corporate Bond ETF has the flexibility to invest up to 20% in SGD-denominated investment-grade bonds that are not in the index, or Singapore Government Securities (SGS).

Currently, the ETF has about 28% in government agencies, with the remaining diversified across sectors, primarily the financial sector.

Top holdings include reputable local names and established global banks.

As of 30 June 2025, the ETF has an average credit rating of A, which is higher than many typical global investment-grade corporate bond funds or ETFs with BBB ratings.

In addition, the ETF has a weighted average duration of 5.89 years and a weighted average yield to maturity of 2.86%.

It has S$826 million in AUM as of 17 July 2025, and pays semi-annual distributions.

The ETF has delivered an annualised return of 2.9% since its inception, and a 3-year annualised return of 5.34%, as of 30 June 2025.

Listing Date: 27 August 2018. Benchmark: iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index. Returns are calculated on a NAV-NAV basis and assuming all dividends and distributions are reinvested, if any. Returns for period in excess of 1 year are annualised. Past performance is not indicative of future performance.

At the same time, its exposure to investment grade bonds presents relative stability compared to equity funds.

Learn more about the Nikko AM SGD Investment Grade Corporate Bond ETF here.

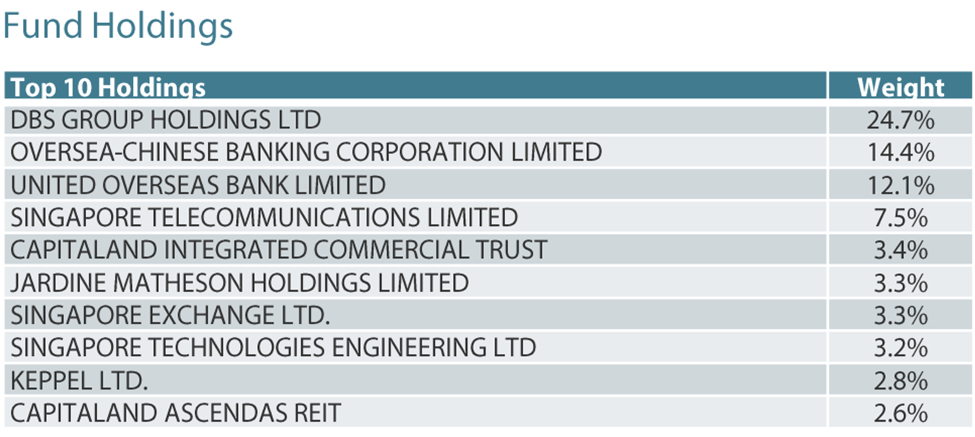

#3 – Nikko AM Singapore STI ETF

The Nikko AM Singapore STI ETF is the classic Singapore equity ETF, tracking the Straits Times Index (STI), a market-cap-weighted index of the top 30 companies listed on SGX, including the three local banks and major Singapore corporates.

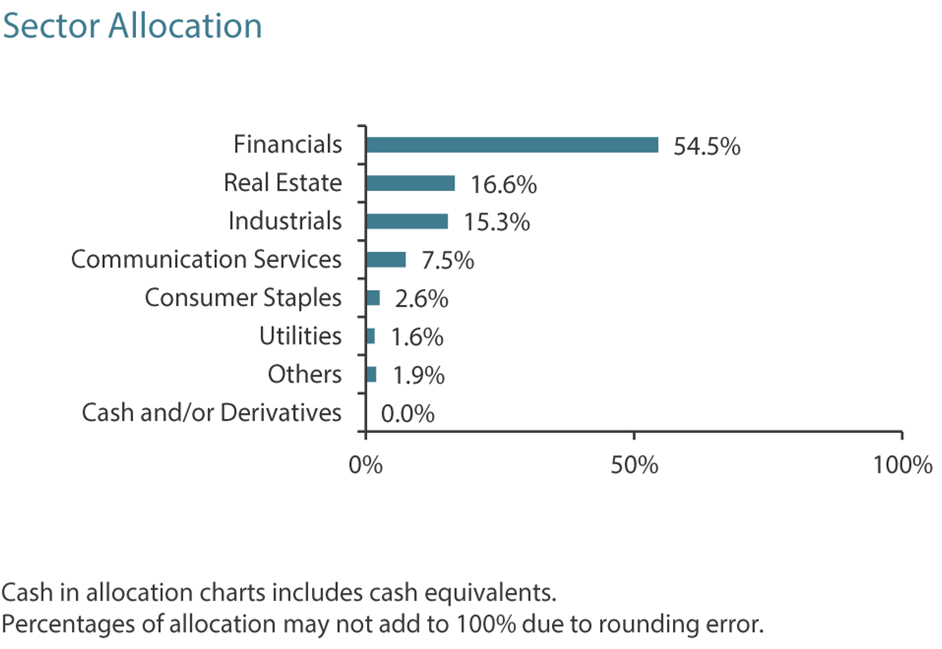

Due to the size of the Singapore banks, the Nikko AM Singapore STI ETF has a heavy tilt toward financials (over 50%).

It’s SGD-denominated, launched in 2009, and on 21 July 2025, the Nikko AM Singapore STI ETF crossed a historic milestone of S$1billion AUM.

The Nikko AM Singapore STI ETF pays semi-annual distributions in January and July.

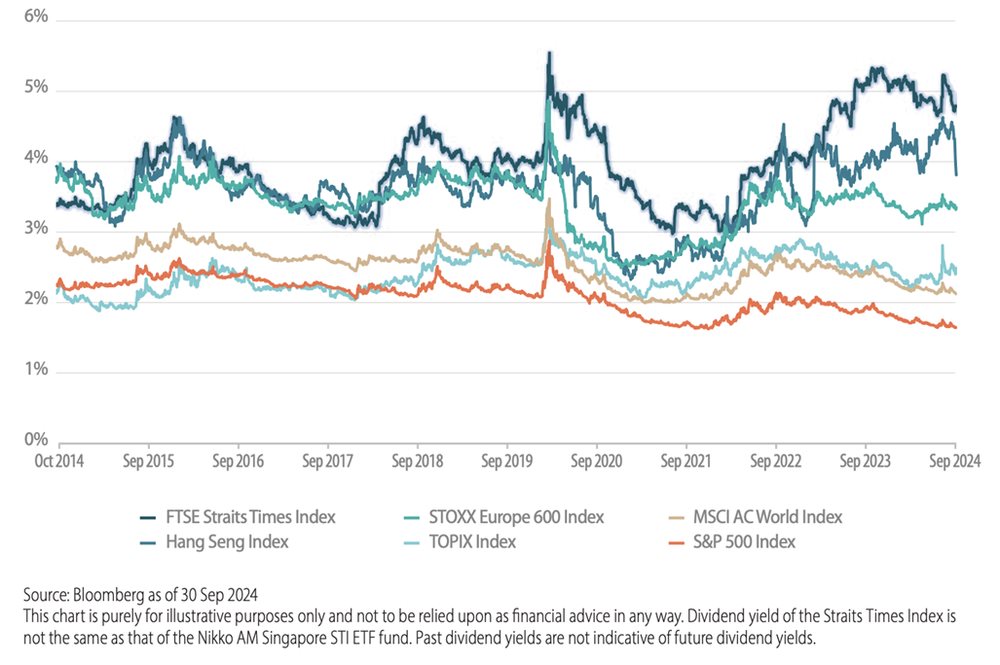

The STI historically has a higher dividend yield than global equity markets (Source: Nikko Asset Management, as of 30 September 2024), as many of the 30 companies in the index tend to declare relatively higher dividend yields.

Dividends aside, the Singapore stock market has performed well in recent years. The STI has a 1-year return of 31.05%, outperforming the S&P 500, which has a 1-year return of 21.73% and the MSCI All World index, which has a 1-year return of 22.6% as of 8 August 2025 (Source: S&P, MSCI, SGX).

Chart: 10-Year Historical Dividend Yields (1 October 2014 - 30 September 2024)

This chart is purely for illustrative purposes only and not to be relied upon as financial advice in any way. Dividend yield of the Straits Times Index is not the same as that of the Nikko AM Singapore STI ETF fund. Past dividend yields are not indicative of future dividend yields.

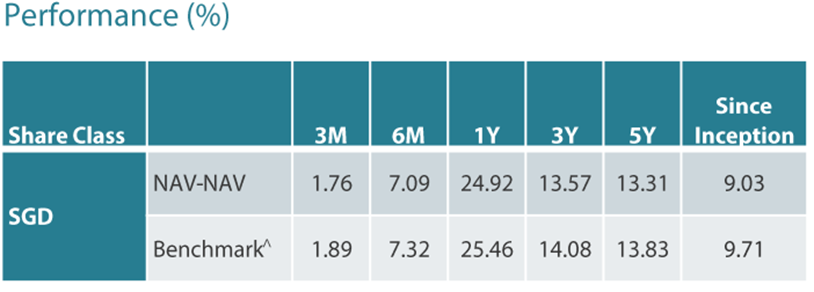

The ETF delivered 13.57% p.a. on a 3-year basis and 13.31% p.a. on a 5-year basis.

Since its inception in 2009, the ETF delivered a respectable 9.03% p.a. as of 30 June 2025.

Listing Date: 24 February 2009. Benchmark = Straits Times Index (STI). Returns are calculated on a NAV-NAV basis and assuming all dividends and distributions are reinvested, if any. Returns for period in excess of 1 year are annualised. Past performance is not indicative of future performance. ^Benchmark returns are calculated on a total return basis.

In summary, the Nikko AM Singapore STI ETF is a way to tap into Singapore’s most prominent companies without having to buy the individual stocks.

Learn more about the Nikko AM Singapore STI ETF here.

Comparing the three Singapore-related ETFs

I’ve summarised the three Singapore-related ETFs from Nikko AM below:

| ABF Singapore Bond Index Fund | Nikko AM SGD Investment Grade Corporate Bond ETF | Nikko AM Singapore STI ETF | |

|---|---|---|---|

| Portfolio exposure | Singapore government and government-affiliated bonds. | SGD large-cap investment-grade corporate bonds. | Top 30 stocks by market cap listed on the Singapore Exchange. |

| Performance (annualised %) as of 30 June 2025 | |||

| 1 year | 10.61 | 8.27 | 24.92 |

| 3 years | 5.11 | 5.34 | 13.57 |

| 5 years | 0.44 | 2.40 | 13.31 |

| Source: As of 30 June 2025. Nikko Asset Management, Yahoo Finance. Returns are calculated on a NAV-NAV basis and assuming all dividends and distributions are reinvested, if any. Past performance is not indicative of future performance. | |||

As of 30 June 2025, the ABF Singapore Bond Index Fund offers a 1-year total return of 10.61%*, which is quite impressive. This is largely supported by the bond market rally amid easing interest rate expectations. However, its longer-term performance has been more modest, reflecting a typically more stable performance of government bonds.

*Note: The past performance is due to circumstances which may not be sustainable.

The Nikko AM SGD Investment Grade Corporate Bond ETF provides a balance of yield and stability. As of June 2025, the ETF has an annualised return of 8.27%, 5.34% and 2.40% over a 1-year, 3-year and 5-year period respectively. While it carries slightly more credit risk than a government bond fund, its investment-grade focus keeps default risk relatively low.

The Nikko AM Singapore STI ETF tracks the top 30 stocks by market cap listed on the SGX. As of 30 June 2025, it has delivered a 1-year return of 24.92%. The ETF delivered the highest 1-year, 3-year, and 5-year returns among the three listed above.

These ETFs are managed by Nikko Asset Management, which has a history of managing Singapore-related funds since the 1980s.

From 1 September 2025, Nikko Asset Management will be rebranded as Amova Asset Management, short for “Asset Management for an Optimistic Vision in Asia.” Learn more about Amova Asset Management here.

While the ABF Singapore Bond Index Fund will retain its name, the other two ETFs will be renamed to:

Find out more about their name change here.

What Would Beansprout Do?

Building passive income is a journey, and it’s never too early or too late to start.

For Singapore-based investors like myself, SGD-denominated ETFs offer a practical, low-maintenance way to begin that journey with confidence.

The three ETFs I’ve highlighted in this article can be considered by investors looking to build a passive income portfolio.

The ABF Singapore Bond Index Fund offers stability through its exposure to Singapore government bonds, especially for those who want a dependable foundation without taking on much risk. Learn more about the ABF Singapore Bond Index Fund here.

The Nikko AM SGD Investment Grade Corporate Bond ETF offers a potential income from investing in investment-grade bonds. Learn more about the Nikko AM SGD Investment Grade Corporate Bond ETF here.

Meanwhile, the Nikko AM Singapore STI ETF offers exposure to top Singapore-listed companies for investors looking to tap into Singapore’s long-term growth potential while enjoying regular dividend payouts. Learn more about the Nikko AM Singapore STI ETF here.

Of course, no investment is risk-free. Singapore’s markets, while stable, can still be affected by global economic conditions, interest rate changes, and shifts in investor sentiment in the short term.

Bond funds may face price declines when interest rates rise, while equity funds are subject to market volatility and fluctuations in dividend payouts.

Even high-quality, SGD-denominated instruments can experience periods of lower returns.

That’s why it’s important to consider your time horizon, risk appetite, and the role each investment plays in your overall portfolio.

Click here to learn more about these funds.

Important Information by Nikko Asset Management Asia Limited:

This document is purely for informational purposes only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. It should not be relied upon as financial advice. Any securities mentioned herein are for illustration purposes only and should not be construed as a recommendation for investment. You should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. Investments in funds are not deposits in, obligations of, or guaranteed or insured by Nikko Asset Management Asia Limited (“Nikko AM Asia”).

Past performance or any prediction, projection or forecast is not indicative of future performance. The Fund or any underlying fund may use or invest in financial derivative instruments. The value of units and income from them may fall or rise. Investments in the Fund are subject to investment risks, including the possible loss of principal amount invested. You should read the relevant prospectus (including the risk warnings) and product highlights sheet of the Fund, which are available and may be obtained from appointed distributors of Nikko AM Asia or our website (www.nikkoam.com.sg) before deciding whether to invest in the Fund.

The information contained herein may not be copied, reproduced or redistributed without the express consent of Nikko AM Asia. While reasonable care has been taken to ensure the accuracy of the information as at the date of publication, Nikko AM Asia does not give any warranty or representation, either express or implied, and expressly disclaims liability for any errors or omissions. Information may be subject to change without notice. Nikko AM Asia accepts no liability for any loss, indirect or consequential damages, arising from any use of or reliance on this document. This advertisement has not been reviewed by the Monetary Authority of Singapore.

The performance of the ETF’s price on the Singapore Exchange Securities Trading Limited (“SGX-ST”) may be different from the net asset value per unit of the ETF. The ETF may also be suspended or delisted from the SGX-ST. Listing of the units does not guarantee a liquid market for the units. Investors should note that the ETF differs from a typical unit trust and units may only be created or redeemed directly by a participating dealer in large creation or redemption units.

The Central Provident Fund (“CPF”) Ordinary Account (“OA”) interest rate is the legislated minimum 2.5% per annum, or the 3-month average of major local banks' interest rates, whichever is higher, reviewed quarterly. The interest rate for Special Account (“SA”) is currently 4% per annum or the 12-month average yield of 10-year Singapore Government Securities plus 1%, whichever is higher, reviewed quarterly. Only monies in excess of $20,000 in OA and $40,000 in SA can be invested under the CPF Investment Scheme (“CPFIS”). Please refer to the website of the CPF Board for further information. Investors should note that the applicable interest rates for the CPF accounts and the terms of CPFIS may be varied by the CPF Board from time to time.

Neither Markit, its Affiliates or any third party data provider makes any warranty, express or implied, as to the accuracy, completeness or timeliness of the data contained herewith nor as to the results to be obtained by recipients of the data. Neither Markit, its Affiliates nor any data provider shall in any way be liable to any recipient of the data for any inaccuracies, errors or omissions in the Markit data, regardless of cause, or for any damages (whether direct or indirect) resulting therefrom. Markit has no obligation to update, modify or amend the data or to otherwise notify a recipient thereof in the event that any matter stated herein changes or subsequently becomes inaccurate. Without limiting the foregoing, Markit, its Affiliates, or any third party data provider shall have no liability whatsoever to you, whether in contract (including under an indemnity), in tort (including negligence), under a warranty, under statute or otherwise, in respect of any loss or damage suffered by you as a result of or in connection with any opinions, recommendations, forecasts, judgments, or any other conclusions, or any course of action determined, by you or any third party, whether or not based on the content, information or materials contained herein. Copyright © 2023, Markit Indices Limited.

The Markit iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index are marks of Markit Indices Lmited and have been licensed for use by Nikko Asset Management Asia Limited. The Markit iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index referenced herein is the property of Markit Indices Limited and is used under license. The Nikko AM SGD Investment Grade Corporate Bond ETF is not sponsored, endorsed, or promoted by Markit Indices Limited.

The units of Nikko AM Singapore STI ETF are not in any way sponsored, endorsed, sold or promoted by FTSE International Limited ("FTSE"), the London Stock Exchange Plc (the "Exchange"), The Financial Times Limited ("FT") SPH Data Services Pte Ltd ("SPH") or Singapore Press Holdings Ltd ("SGP") (collectively, the "Licensor Parties") and none of the Licensor Parties make any warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the Straits Times Index ("Index") and/or the figure at which the said Index stands at any particular time on any particular day or otherwise. The Index is compiled and calculated by FTSE. None of the Licensor Parties shall be under any obligation to advise any person of any error therein. "FTSE®", "FT-SE®" are trade marks of the Exchange and the FT and are used by FTSE under license. "STI" and "Straits Times Index" are trade marks of SPH and are used by FTSE under licence. All intellectual property rights in the ST index vest in SPH and SGP.

The NikkoAM-StraitsTrading Asia ex Japan REIT ETF (the “Fund”) has been developed solely by Nikko Asset Management Asia Limited. The Fund is not in any way connected to or sponsored, endorsed, sold or promoted by the London Stock Exchange Group plc and its group undertakings, including FTSE International Limited (collectively, the “LSE Group”), European Public Real Estate Association ("EPRA”), or the National Association of Real Estate Investments Trusts (“Nareit”) (and together the “Licensor Parties”). FTSE Russell is a trading name of certain of the LSE Group companies. All rights in FTSE EPRA Nareit Asia ex Japan REITs 10% Capped Index (the “Index”) vest in the Licensor Parties. “FTSE®” and “FTSE Russell®” are a trade mark(s) of the relevant LSE Group company and are used by any other LSE Group company under license. “Nareit®” is a trade mark of Nareit, "EPRA®" is a trade mark of EPRA and all are used by the LSE Group under license. The Index is calculated by or on behalf of FTSE International Limited or its affiliate, agent or partner. The Licensor Parties do not accept any liability whatsoever to any person arising out of (a) the use of, reliance on or any error in the Index or (b) investment in or operation of the Fund. The Licensor Parties makes no claim, prediction, warranty or representation either as to the results to be obtained from the Fund or the suitability of the Index for the purpose to which it is being put by Nikko Asset Management Limited.

Nikko Asset Management Asia Limited. Registration Number 198202562H.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments