What’s Next for Singapore REITs? Key Takeaways from Our Latest Webinar

REITs

By Gerald Wong, CFA • 18 Apr 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We recently held a webinar to share our thoughts on Singapore REITs. Here's what you need to know about their outlook.

What happened?

The share prices of Singapore REITs have been very volatile in recent weeks.

Following the announcement of US trade tariffs, Singapore REITs initially saw a slight bounce as some investors perceived the sector as a safe place to hide.

Thereafter, their share prices fell as government bond yields spiked and the trade war escalation led to rising recession concerns.

This led to some Singapore REITs falling to multi-year lows.

I have seen some questions in the Beansprout Telegram community asking what we should look out for when investing in Singapore REITs.

To address these inquiries, we held a webinar this week to explore the fundamentals and future outlook of Singapore REITs.

During the session, I highlighted the key factors I am monitoring to assess the potential direction of REIT share prices.

For those who couldn’t attend, here is the presentation I shared during the webinar.

Transcript of Webinar on "What's Next For Singapore REITs?"

Summary of Key Points

- Volatility in REITs is being driven by global economic uncertainty, tariff tensions, and fluctuating bond yields.

- Retail and healthcare REITs with Singapore assets are perceived to be most resilient amid macro headwinds.

- REITs with overseas exposure (e.g., China) face additional risks from weak local demand and currency depreciation.

- Investors should focus on REITs with strong fundamentals, low gearing, and sustainable distributions.

3:03 How do trade tariffs and economic uncertainty affect Singapore REITs?

Trade tensions and macroeconomic uncertainty have led to significant volatility in Singapore REITs:

- Tariff shocks: Announcements of tariffs by the US (e.g., on China, EU, Vietnam) triggered initial safe-haven demand for REITs, followed by sharp sell-offs as recession fears grew.

- Bond yield volatility: Global uncertainty led to sharp swings in long-term government bond yields, reducing the relative attractiveness of REITs when yields spiked.

- Economic policy uncertainty: The global uncertainty index has surged to levels last seen during COVID-19, fueling risk-off sentiment and erratic REIT price movements.

- Sector impact: Trade-sensitive sectors like logistics and office REITs are more exposed to demand slowdowns.

16:00 Investing Checklist for REITs

Beansprout’s checklist for evaluating Singapore REITs includes:

- Fundamental Strength: Asset quality, sponsor reputation, occupancy rate, and rental reversions.

- Financial Strength: Gearing levels, interest cost exposure, refinancing capability.

- Valuation: Price-to-book ratio and dividend yield relative to historical and sector averages.

17:12 Fundamental Strength of REITs

REITs with strong fundamentals are better positioned to maintain or grow distributions. Performance varies across subsectors:

Retail

- Retail sales were stable in early 2025, with seasonal fluctuations due to Chinese New Year.

- Rents have recovered post-COVID and remained stable.

- Vacancy rates are low; CICT’s retail occupancy is 99.3% with positive rental reversions of ~9%.

Retail REITs with Singapore exposure are seen as the most resilient.

Singapore's retail sales rental index has been stable

Source: URA

Hospitality

- Continued recovery in tourist arrivals, especially from China due to visa exemptions.

- Revenue per available room (RevPAR) remains stable; STB projects 17–18.5 million tourist arrivals in 2025.

- Sector benefits from ongoing global travel recovery and event-driven tourism.

Office

- Office rents fell ~1% QoQ in Q4 2024.

- Demand has softened while new supply is expected to increase in 2025.

- Vacancy rates are ~10%, with premium spaces in downtown areas holding up better.

Tenants are increasingly selective, preferring newer and better-located properties.

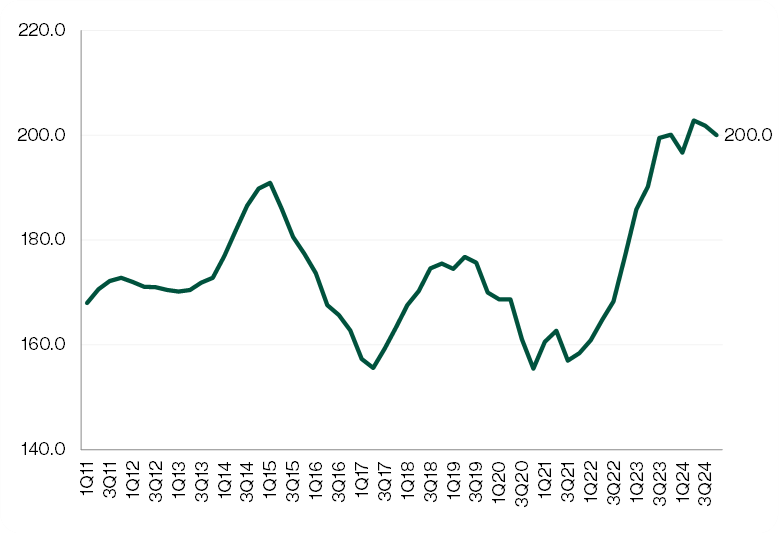

Singapore's office space rental index fell in 4Q24

Source: URA

Industrial

- Rents have grown steadily post-COVID but growth is now moderating.

- Q4 2024 saw the slowest rental growth in 4 years at just 0.5% QoQ.

- Business parks show the most weakness with a high vacancy rate (~22%).

- Industrial REITs with Singapore logistics exposure are stronger than those with business park exposure.

| Singapore industrial rental growth has slowed down |

|

35:04 Overseas Exposure and FX Impact

- REITs with foreign assets face headwinds from weak demand in markets like China and currency depreciation.

- Example: Mapletree Logistics Trust had strong Singapore performance (+7.5% rental reversions), but China assets dragged (-10.2%).

- Strong Singapore dollar reduces translated income and distributions from overseas properties (e.g., AUD, IDR, JPY).

37:49 Interest Rate Expectations

- US Federal Reserve expected to cut rates four times in 2025.

- Rate cut expectations remain uncertain, contributing to depressed REIT valuations.

- Investors remain cautious until there is more clarity on bond yield movements.

39:46 Divergence in REIT Distributions

- More REITs cut distributions than raised them in recent quarters.

- REITs with stable or growing DPU are typically those with:

- Singapore-focused assets (e.g., Fraser Centrepoint Trust, CICT).

- Lower gearing and better debt management.

- REITs with overseas exposure or high leverage saw DPU declines.

54:00 REIT Screener Tool

Beansprout’s Singapore REIT screener helps compare REITs by:

- Price-to-book valuation

- Dividend yield

- Gearing level

- Distribution trends

56:00 Summary

- Continued macroeconomic and interest rate uncertainty will drive REIT volatility.

- Focus on REITs with:

- Strong fundamentals and Singapore-based assets.

- Low gearing and resilient distributions.

- Attractive valuations and high sustainable yields.

Read more: Time to look at Singapore REITs?

Resources mentioned in the video

Best Singapore REITs Screener Tool: Compare Singapore REITs to find the best REIT for your portfolio

Singapore REIT ETFs: How to choose the best one for your portfolio

Join the Beansprout Telegram group get the latest insights on Singapore REITs, stocks, bonds, and ETFs.

Sign up for our free newsletter to stay updated on our next webinar coming up!

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments