Best Singapore REIT ETFs: How to choose for your portfolio

ETFs

By Beansprout • 14 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Singapore REIT ETFs allow you to own a diversified basket of REITs in one trade. We compare five Singapore REIT ETFs for dividend investors and find out which might be best for your portfolio in 2025.

What happened?

Singapore REITs are well loved by many investors as they are seen to be one of the ways to earn passive income through the dividends they provide.

However, many may not have the time to analyse each REIT and decide which is the best REIT to own.

In such cases, we can choose to invest in Singapore REIT ETFs, which allow us to own a diversified basket of Singapore REITs in one trade.

Singapore REIT ETFs have grown in popularity.

SGX REIT ETF assets have crossed the S$1.4 billion milestone in September 2025, with combined net inflows of S$155 million in the first half of 2025.

We’re going to take a closer look at Singapore REIT ETFs and uncover how to find the best Singapore REIT ETF for your portfolio.

Why Singapore REIT ETFs?

As with ETFs in general, Singapore REIT ETFs offer instant diversification across various industries and geographies compared to owning single REITs.

This means that the risks are spread out compared to owning single REITs.

Singapore REIT ETFs are also professionally managed, and REITs which have become larger or more liquid are included in the ETF as it is automatically rebalanced.

Lastly, Singapore REIT ETFs are intended to offer a low cost way to own this basket of REITs, while offering the convenience of transacting once via the ETF.

Introducing Singapore REIT ETFs

There are 5 Singapore REIT ETFs listed on the SGX we can consider.

Each of them is benchmarked to a different index, as shown in the table below.

The largest Singapore REIT ETF based on its assets under management (AUM) is the Lion-Phillip S-REIT ETF, with AUM of S$631.4 million as of 31 August 2025.

| REIT ETF | Benchmark | AUM (S$ million) |

| Lion-Phillip S-REIT ETF (SGX:CLR) | Morningstar® Singapore REIT Yield Focus IndexSM | S$631.4M |

| AmovaAM-StraitsTrading Asia Ex Japan REIT ETF (SGX:CFA) | FTSE EPRA Nareit Asia ex Japan REITs 10% Capped Index | S$545.8M |

| CSOP iEdge S-REIT Leaders ETF (SGX: SRT) | iEdge S-REIT Leaders Index | S$106.4M |

| UOB Asia Pacific Green REIT ETF (SGX: GRN) | iEdge-UOB APAC Yield Focus Green REIT Index | S$30.2M |

| Phillip SGX APAC Dividend Leaders REIT ETF (SGX: BYJ) | iEdge APAC ex Japan Dividend Leaders REIT Index | USD$8.0M |

| Source: ETF Manager’s websites and factsheets as of 31 August 2025 | ||

What to consider when buying Singapore REIT ETFs?

With so many Singapore REIT ETFs to choose from, you might be wondering how we can select a Singapore REIT ETF best suited for our portfolios.

There are a few factors we would consider, and these would include:

- Dividend yield

- Frequency of dividend

- Fees and charges

- Geographical exposure

- Sustainability

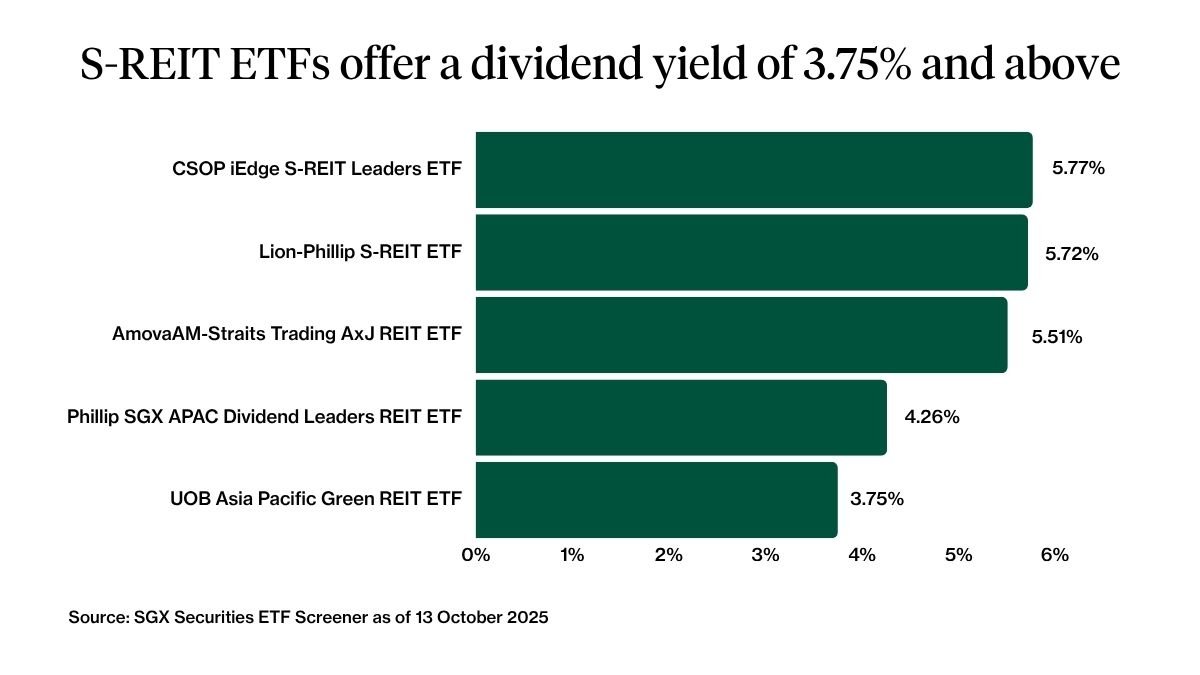

#1 – Dividend yield

As REIT investors, we are naturally interested in the dividend yield we are able to get from the REITs.

Singapore REIT ETFs offer a dividend yield of 3.75% and above as of 13 October 2025.

Amongst the various Singapore REIT ETFs, the dividend yield of the CSOP iEdge S-REIT Leaders ETF is the highest at 5.77%.

This is closely followed by the Lion-Phillip S-REIT ETF with a dividend yield of 5.72%.

| REIT ETF | Dividend Yield (TTM)* |

| CSOP iEdge S-REIT Leaders ETF | 5.77% |

| Lion-Phillip S-REIT ETF | 5.72% |

| AmovaAM-StraitsTrading Asia Ex Japan REIT ETF | 5.51% |

| Phillip SGX APAC Dividend Leaders REIT ETF | 4.26% |

| UOB Asia Pacific Green REIT ETF | 3.75% |

| Source: SGX Securities ETF Screener as of 13 October 2025 *Historical dividend yield over 12-month period (%) as of dividend ex-date. | |

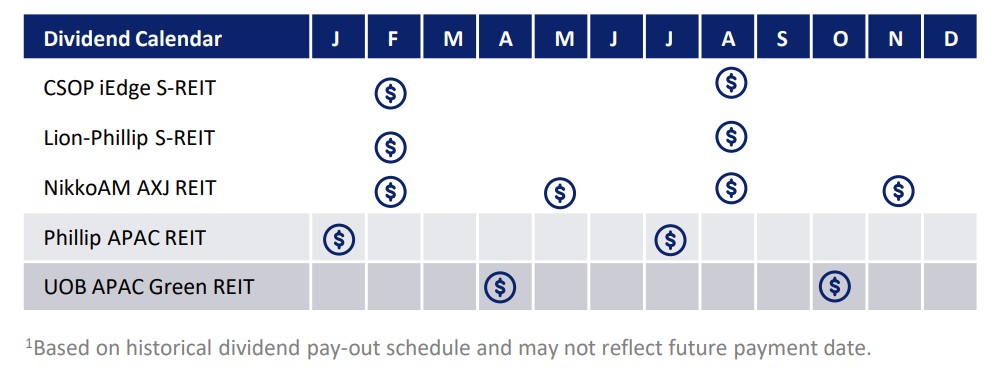

#2 – Dividend frequency

Most of the Singapore REIT ETFs make semi-annual dividend distributions to investors.

The UOB Asia Pacific Green REIT ETF changed to making semi-annual distributions from quarterly distributions in 2022.

Following the change, the AmovaAM–StraitsTrading Asia Ex Japan REIT ETF is the only ETF offering quarterly distributions.

| REIT ETF | Dividend frequency |

| Lion-Phillip S-Reit ETF | Semi-Annual |

| CSOP iEdge S-Reit Leaders ETF | Semi-Annual |

| Phillip SGX APAC Dividend Leaders Reit ETF | Semi-Annual |

| UOB Asia Pacific Green Reit ETF | Semi-Annual |

| AmovaAM-StraitsTrading Asia Ex Japan REIT ETF | Quarterly |

| Source: ETF Manager’s websites and factsheets as of 31 August 2025 | |

It is also important to note that each ETF has different dividend distribution timings.

The chart below shows the months when each REIT ETF has historically paid dividends, depending on its distribution policy.

The CSOP iEdge S-REIT ETF and Lion-Phillip S-REIT ETF typically pay dividends in February and August.

The AmovaAM Asia Ex Japan REIT ETF pays out quarterly, with distributions in February, May, August and November.

The Phillip APAC REIT ETF distributes dividends in January and July, while the UOB APAC Green REIT ETF declares dividends in April and October.

#3 – Expense ratio

As an investor in ETFs, we would want the fees incurred in managing the ETF and other fees such as trustee fees to be kept low.

The expense ratio of the Singapore REIT ETFs range from 0.55-1.64% per annum.

The AmovaAM-StraitsTrading Asia Ex Japan REIT ETF has the lowest expense ratio of just 0.55%.

| REIT ETF | Expense Ratio |

| AmovaAM-StraitsTrading Asia Ex Japan REIT ETF | 0.55% |

| Lion-Phillip S-REIT ETF | 0.60% |

| CSOP iEdge S-REIT Leaders ETF | 0.60% |

| UOB Asia Pacific Green REIT ETF | 0.82% |

| Phillip SGX APAC Dividend Leaders REIT ETF | 1.64% |

| Source: SGX Securities ETF Screener & ETF Manager’s factsheets, as of 31 August 2025 | |

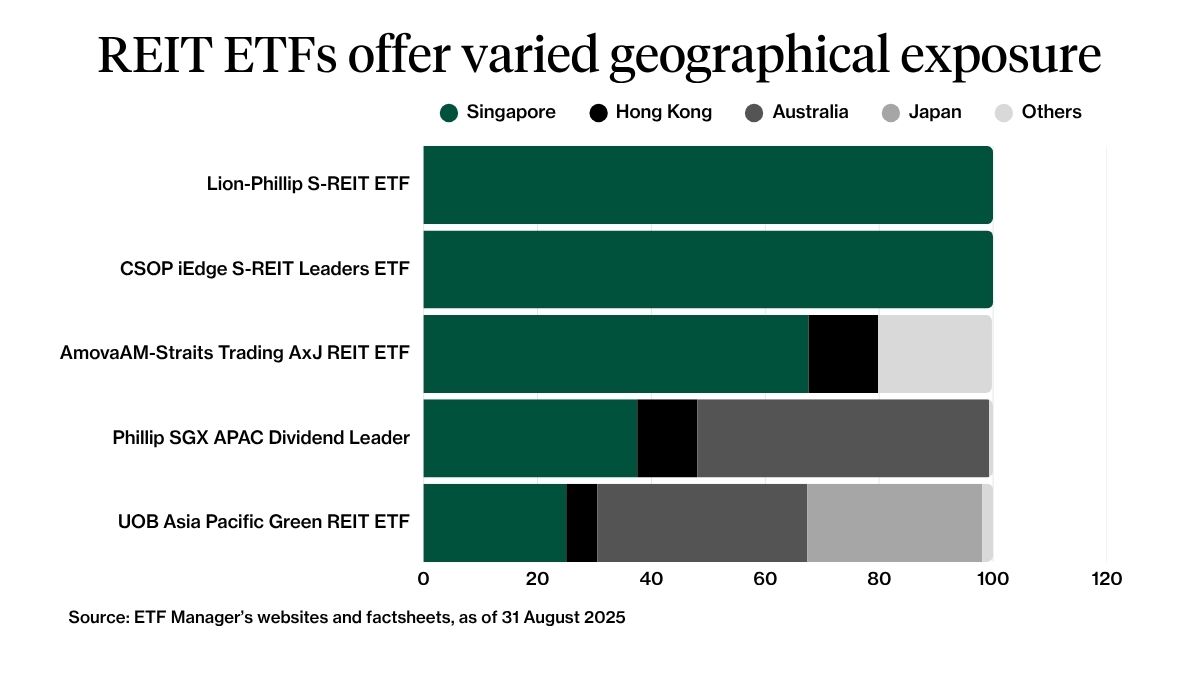

#4 – Geographical exposure

There are two Singapore REIT ETFs which offer pure exposure to S-REITs: the Lion-Phillip S-REIT ETF and the CSOP iEdge S-REIT Leaders ETF.

The other three Singapore REIT ETFs have broader exposure to other regions in the region, including Hong Kong and Australia.

#5 – Sustainability

The UOB APAC Green REIT ETF is the world’s first APAC Green REIT ETF, and offers exposure to REITs with relatively better environmental performance.

How do the Singapore REIT ETFs fare on these measures?

AmovaAM-StraitsTrading Asia Ex Japan Reit ETF (SGX:CFA)

| Dividend yield | 5.51% |

| Frequency of distribution | Quarterly |

| Expense ratio | 0.55% p.a. |

| Geographical exposure | Asia Ex Japan |

| Sustainability | Not sustainability focused |

| SGX Securities ETF Screener & ETF Manager’s website and factsheet, as of 13 October 2025 | |

The objective of the AmovaAM-StraitsTrading Asia Ex Japan Reit ETF is to replicate the performance of FTSE EPRA Nareit Asia ex Japan REITs 10% Capped Price Index.

Close to 67% of the underlying REITs in the ETF are listed in Singapore, while 12% are listed in Hong Kong, as of 31 August 2025.

The AmovaAM-StraitsTrading Asia Ex Japan Reit ETF was formerly known as the NikkoAM-StraitsTrading Asia Ex Japan Reit ETF.

Learn more about the AmovaAM-StraitsTrading Asia Ex Japan Reit ETF here.

Lion-Phillip S-REIT ETF (SGX:CLR)

| Dividend yield | 5.72% |

| Frequency of distribution | Semi-annual |

| Expense ratio | 0.60% p.a. |

| Geographical exposure | Singapore |

| Sustainability | Not sustainability focused |

| Source: SGX Securities ETF Screener & ETF Manager’s website and factsheet, as of 13 October 2025 | |

The objective of the Lion-Phillip S-REIT ETF is to replicate as closely as possible the performance of the Morningstar Singapore REIT Yield Focus Index.

The ETF is the largest pure S-REIT ETF by AUM listed on the SGX.

Learn more about the Lion-Phillip S-REIT ETF here.

CSOP iEdge S-REIT Leaders ETF (SGX: SRT)

| Dividend yield | 5.77% |

| Frequency of distribution | Semi-annual |

| Expense ratio | 0.60% p.a. |

| Geographical exposure | Singapore |

| Sustainability | Not sustainability focused |

| Source: SGX Securities ETF Screener & ETF Manager’s website and factsheet, as of 13 October 2025 | |

The objective of the CSOP iEdge S-Reit Leaders ETF is to track the performance of the iEdge S-REIT Leaders Index.

The index is adjusted for liquidity, where constituents with a higher free-float market capitalisation are given a higher weightage.

Learn more about the CSOP iEdge S-Reit Leaders ETF here.

UOB Asia Pacific Green REIT ETF (SGX: GRN)

| Dividend yield | 3.75% |

| Frequency of distribution | Semi-annual |

| Expense ratio | 0.82% p.a. |

| Geographical exposure | Asia Pacific |

| Sustainability | Green REIT |

| Source: SGX Securities ETF Screener & ETF Manager’s website and factsheet, as of 13 October 2025 | |

The objective of the UOB Asia Pacific Green REIT ETF is to track the iEdge-UOB APAC Yield Focus Green REIT index.

Learn more about the UOB Asia Pacific Green REIT ETF here.

Phillip SGX APAC Dividend Leaders Reit ETF (SGX: BYJ)

| Dividend yield | 4.26% |

| Frequency of distribution | Semi-annual |

| Expense ratio | 1.64% p.a. |

| Geographical exposure | Asia Ex Japan |

| Sustainability | Not sustainability focused |

| Source: SGX Securities ETF Screener & ETF Manager’s website and factsheet, as of 13 October 2025 | |

The objective of the Phillip SGX APAC Dividend Leaders REIT ETF is to track the SGX APAC Ex-Japan Dividend Leaders REIT Index.

The index measures the performance of 30 REITs that pay the largest total dividends while observing size, representation, free-float and liquidity constraints.

Learn more about the Phillip SGX APAC Dividend Leaders REIT ETF here.

Which is the best performing REIT ETF?

Among the five REIT ETFs listed on SGX, UOB APAC Green REIT ETF has the highest year-to-date returns as of 13 October 2025.

This is followed by the CSOP iEdge S-Reit Leaders ETF and the AmovaAM-StraitsTrading Asia Ex Japan Reit ETF.

What would Beansprout do?

If you’re keen to build your passive income by building a REITs portfolio but intimidated by having to analyse individual REITs, then it might be worthwhile to start looking at Singapore REIT ETFs.

After reading this, you’re probably wondering which Singapore REIT ETF is the best.

The answer is, it depends what you are looking for.

If you’re looking for the Singapore REIT ETF with the largest AUM, then it’s the Lion-Phillip S-REIT ETF.

If you’re looking for the Singapore REIT ETF which can offer you quarterly dividends, then it’s the AmovaAM-StraitsTrading Asia Ex Japan REIT ETF.

If you’re looking for the Singapore REIT ETF which has the lowest expense ratio, then it’s the AmovaAM-StraitsTrading Asia Ex Japan REIT ETF.

If you’re looking for the Singapore REIT ETF which offers the highest dividend yield, then it’s currently the CSOP iEdge S-REIT Leaders ETF, followed closely by Lion-Phillip S-REIT ETF.

If you’re looking for the Singapore REIT ETF which owns REITs with better environmental performance, then it’s the UOB Asia Pacific Green REIT ETF.

If you want to limit your exposure to REITs listed in Singapore, then it’s the CSOP iEdge S-REIT Leaders ETF or Lion-Phillip S-REIT ETF.

How to buy the Singapore REIT ETFs?

You can buy Singapore REIT ETFs through a regulated broker that offers access in the Singapore stock market, such as Moomoo Singapore, Longbridge Singapore and Tiger Brokers.

Check out our guide to the best online brokerage and stock trading platform in Singapore.

What other ETFs to consider?

If you prefer to invest in a familiar market like Singapore, you can read our guide to STI ETF here.

If you prefer to invest in the US market, find out more about the best S&P 500 ETFs for Singapore investors here.

If you prefer to invest in a portfolio of global stocks, learn about the VWRA ETF that offers you exposure to the global equity market here.

Find out more about Exchange Traded Funds (ETFs) in Singapore here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments