How I’m building a Singapore stock portfolio for passive income

Brokerage Account

Powered by

By Nicole Ng • 04 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Learn how to build a passive income portfolio with Singapore dividend stocks and how tools like Longbridge can help you invest smarter and track progress easily.

This post was created in partnership with Longbridge Singapore. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

At this year’s Seedly Personal Finance Festival, I found myself in the audience for a talk by Jaeden Kok, Investment Education Specialist at Longbridge.

He shared how defining your financial goals and building passive income can help you achieve financial independence.

Creating a steady, reliable source of passive income is something I’ve talked about before, and it’s a topic that often comes up within the Beansprout community, too.

But how can we take concrete steps towards this goal?

Here, I’ll delve deeper into how I’m building a passive income portfolio using Singapore stocks, and some practical ways to get started on growing a passive income portfolio using Longbridge.

🧧 Get bonus S$50 FairPrice voucher within 5 working days and 5% p.a. interest boost coupon (worth ~S$100) when you sign up for a Longbridge account via Beansprout. Plus, S$1,380 CapitaVouchers to be won in our Huat Together Lucky Draw! Promo ends on 28 Feb 2026. T&Cs apply. Learn more about the Longbridge promotion here

Why build a passive income portfolio with Singapore stocks?

My goal for a passive income portfolio is to build a steady stream of dividend income, while keeping risk at a manageable level and without requiring me to constantly monitor the market.

The idea is that this dividend income can supplement my future retirement income.

The Singapore market provides a few unique advantages for income investors.

For one, I spend and save mostly in Singapore dollars (SGD).

By focusing on SGX-listed stocks, REITs, and ETFs, I’m able to earn dividends in my home currency, avoiding the hassle and costs of foreign exchange conversions.

Singapore is also dividend-friendly from a tax perspective.

Dividends from Singapore-listed companies are tax-exempt. This means the full amount of your dividend goes directly into your pocket.

That’s an advantage over other markets like the US, which imposes a 30% withholding tax on dividends paid to foreign investors.

The Singapore market also has a strong dividend-paying culture.

Many local companies, from banks and telcos to REITs, have historically maintained regular dividend payouts through different market cycles.

Beyond that, Singapore’s historical dividend yields remain attractive relative to the region.

The Straits Times Index (STI) offers an average dividend yield of 4.45% as of 30 September 2025, higher than its long-term average of 4%, and well above other regional benchmarks such as Hong Kong’s Hang Seng Index (2.99%) and Japan’s Nikkei 225 (1.75%).

Structurally, Singapore's strong and stable economy, transparent regulations, and well-managed currency add to its advantage as a place to build a passive income portfolio.

How I'm building my dividend portfolio using Longbridge

#1 – Access SGX Stocks with Longbridge

With Singapore’s advantages in mind, I’ve started putting my passive income plan into action.

To build a diversified portfolio that generates steady dividends with manageable risk, I may choose to focus on SGX-listed stocks, REITs, and ETFs that offer reliable payouts, complemented by a few lower-risk assets for stability.

I use Longbridge to build my Singapore dividend portfolio as it is MAS-licensed and allows me to trade Singapore stocks easily.

In addition to SGX, Longbridge lets me trade Hong Kong and US stocks (with US stocks also at zero commission) from the same app.

This is helpful if I want to supplement my SGD dividends with exposure to global income names later on.

Longbridge keeps client assets in DBS, Singapore’s largest bank as custodian, and complies with Singapore’s regulations, which gives me confidence that my holdings are secure.

#2 – Keep my cost low

Lower fees are crucial when you’re building a dividend-focused portfolio.

Every dollar saved on brokerage costs goes straight back into my pocket as income.

Longbridge offers lifetime zero-commission trading on Singapore, Hong Kong, and US markets, with a platform fee of 0.03% per trade, capped at a minimum of S$0.99.

For example, if I make a S$10,000 stock purchase, I would pay just S$3 in platform fees with Longbridge, in addition to the prevailing exchange fees.

If I’m investing or reinvesting dividends more frequently, the savings can compound meaningfully over the years.

#3 – Easy way to track my progress

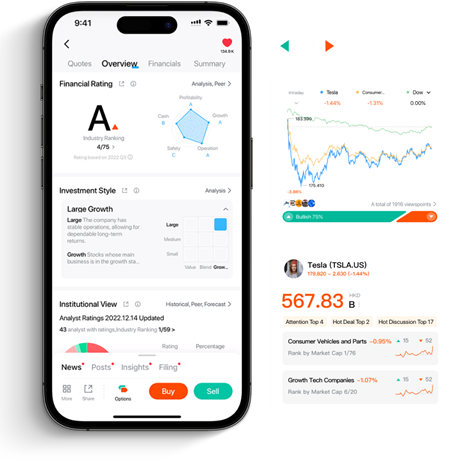

The Longbridge app makes it easy to monitor my holdings and dividend income on the go.

Its clean, mobile-first design lets me track performance, view analyst reports, and read personalised market insights in one place.

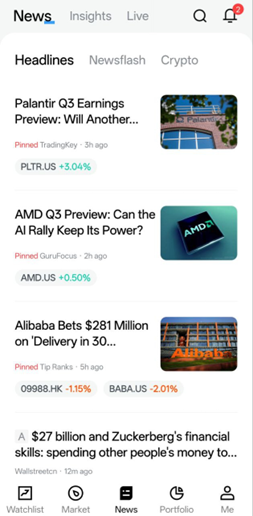

For research, the News tab is great as it pulls together analyst reports, personalised AI-curated news, and market updates in one place.

This convenience keeps me engaged with my portfolio, while still allowing me to stay hands-off most of the time — exactly what I want from a passive income setup.

#4 – Using PortAI for research

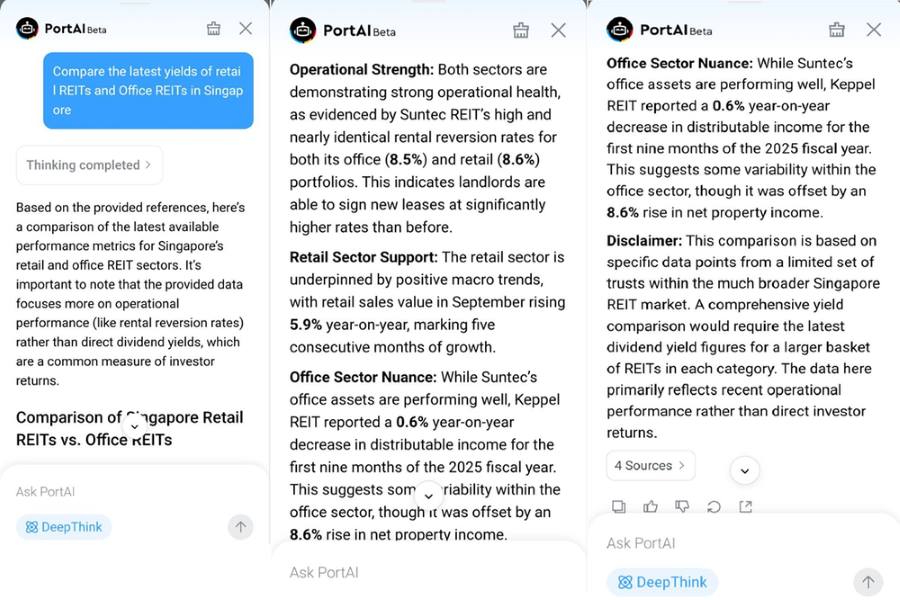

Longbridge’s PortAI is a handy AI assistant built into the app that’s great for beginner investors and seasoned income investors alike.

For example, PortAI’s “One-Click Summary” feature can digest a long earnings report or research note and summarise the key points.

So if I’m unsure about a company’s latest results, PortAI can give me a concise recap of the numbers and management comments without me wading through pages.

In practice, I’ll ask PortAI things like “What did last quarter’s results mean for UOB’s dividend?” or “Compare the latest yields of retail REITs and office REITs in Singapore.”

As seen above, it pulls from real-time data and analysis to explain, so I can make sense of payout news or sector differences.

All in all, PortAI adds clarity and speed to my research, letting me focus on building income.

What would Beansprout do?

Singapore stocks, REITs and ETFs offer opportunities to build a passive income portfolio, allowing me to build a consistent cash stream to support my savings goals or retirement planning.

Singapore’s favourable tax treatment, strong corporate governance, and dividend-friendly culture make this approach accessible for income investors.

While I focused on dividend-paying stocks and REITs to build a passive income portfolio, I also need to be intentional about adding lower-risk assets such as Singapore Savings Bonds, T-bills, and bond ETFs.

One of the key takeaways from Jaeden’s talk at the Seedly Festival was the importance of diversification, which means not relying too heavily on a single income source.

The key is to start small and stay consistent. Even a modest dividend payout, when reinvested, can compound meaningfully over the years.

And if you’re looking to kickstart your own income portfolio, Longbridge makes it easy to begin.

Longbridge Exclusive Promotion

How to qualify for the Longbridge welcome rewards

1. Sign up for Longbridge here (for new users only). To qualify, you must be a Singapore resident who has not opened a Longbridge Singapore (LBSG) account before 28 February 2026.

2. Deposit at least S$2,000 into your Longbridge account and submit your contact information via this Google form after you've funded your account to receive a S$50 FairPrice voucher within 5 working days of meeting the criteria.

3. You can also qualify for the following by reaching a cumulative net deposit of S$2,000:

- Platform Fee Coupons (worth up to ~S$450 equivalent per market)

- 5% p.a. Interest Boost Coupon for 365 days (up to S$100 in value) for funds subscribed in Longbridge Cash Plus, capped on the first, capped on the first S$2,000.

- Up to $S100 Option Cash Coupons that can be used on BUY orders for US options.

- Depending on how much you deposit and maintain, you can receive fractional shares of NVIDIA and Apple worth up to S$1,150.

Terms and conditions of the Longbridge welcome rewards can be found here.

Disclaimer: The above content is for general informational purposes only and not tailored to individual circumstances. It should not be construed as financial advice. All information is provided "as is" without any warranty of accuracy or completeness.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

0 questions