How Skylink APAC went from leasing to a one-stop commercial vehicle ecosystem

Stocks

Powered by

By Julian Wong • 24 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Skylink’s CEO Wesley Shen once borrowed money to further his studies. Now he runs a commercial vehicle business ecosystem serving customers' mobility, transportation and logistics needs.

It was the year 2022. As the world began to enter the post-COVID-19 era, and as commercial vehicle COE prices surged past $80,000, Wesley Shen – CEO of commercial vehicle-leasing company Skylink APAC – made the call to sell off more than 300 vehicles from its leasing fleet.

What might have looked to others like a panic move was in fact a calculated decision, taking into account both risk management and business foresight. As Shen describes: the sale unlocked resources that could be immediately redeployed into expanding Skylink’s in-house financing arm.

Within two years, Skylink APAC’s loan book grew from $24 million to approximately $66 million, cementing financing as one of its strongest growth engines. It was a reinvestment that transformed the company’s balance sheet.

"This was about using a moment of uncertainty to capture opportunity," Wesley says.

What drives Skylink’s decision-making

To understand that decision, one has to go back to Wesley's roots.

Born in rural Guangxi, China, Wesley grew up in a household where luxuries like cooking oil were scarce. His parents instilled in him two simple mottos, he tells us: "Knowledge is power,” and “Study hard to change your fate.”

These mottos carried him through a gruelling path. He borrowed heavily from relatives to pursue a university degree, working part-time jobs to survive, and eventually made the decision to disrupt his university studies in Chang Chun city to study in a Singapore polytechnic.

His career started in aircraft engineering at SIA Engineering, where he encountered colleagues who spoke daily about pursuing financial freedom.

This sparked his ambition, eventually prompting his pivot into truck sales.

Later, feeling constrained doing sales only for individual brands, he took the leap into entrepreneurship, starting Skylink which specialised in multi-brand vehicle trading.

Wesley shares that each stage of his journey reflected the same pattern: making the difficult choice, betting on himself, and building from limited resources.

Disposing of 300 vehicles at the height of the COE surge was not unlike his decision years ago to leave university in China for a diploma in Singapore, or to leave behind a stable engineering career for the uncertainty of sales. These were all acts of conviction, grounded in the belief that survival comes from adaptation and not staying in one's comfort zone.

"Singapore’s role as a logistics and infrastructure hub ensures consistent demand for commercial vehicles," Wesley says.

From one-man shop to integrated ecosystem

One of today’s largest commercial leasing companies in Singapore started with Wesley’s entrepreneurial mindset and his humble beginnings.

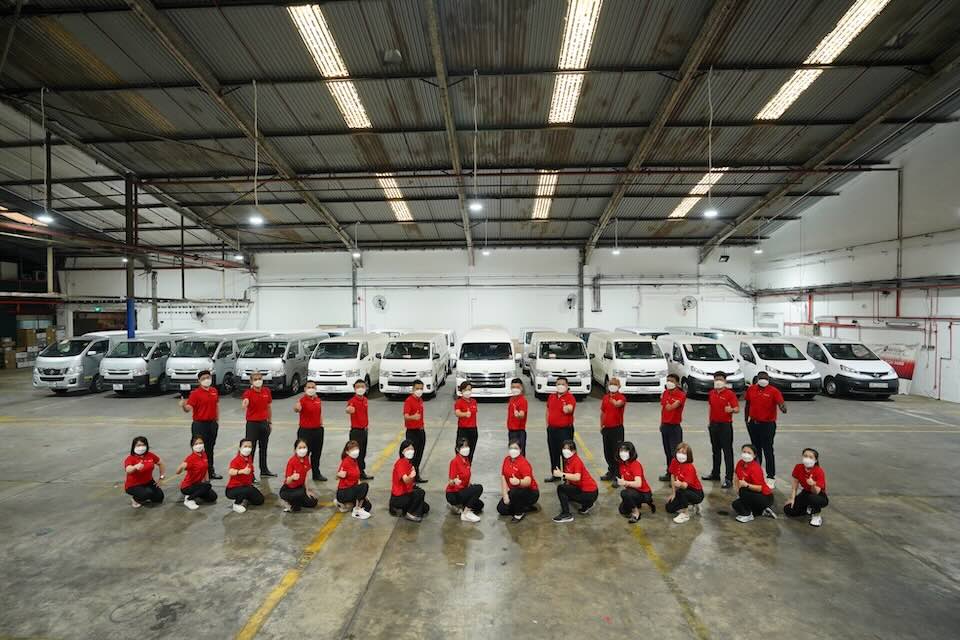

Today, the larger Skylink Group, which includes the trading arm which Wesley first set up back then, has since expanded into in-house financing, leasing, insurance, and even operates its own workshops – all geared towards building a one-stop ecosystem.

It employs more than 110 employees, and some 75% are employed by Skylink APAC, which most recently made its debut on the SGX Catalist Board.

"This was about using a moment of uncertainty to capture opportunity."

As Wesley explains, this ecosystem is what differentiates Skylink in a crowded market.

Under one roof, customers can buy, lease, finance, insure, or even cash out their fleets through sale-and-leaseback arrangements. For small- and medium-sized enterprises navigating high COE costs and razor-thin margins, such flexibility is invaluable.

The listing on the Catalist board is not the endgame, but the start of Skylink APAC’s next chapter, which also provides a platform to communicate the value of its business perspectives more effectively to investors while attracting top talent.

Wesley lays out three clear priority areas.

The first is organic growth. This means stabilising the existing leasing fleet with a much more moderate growth target after a period of rapid expansion, while aggressively scaling the loan book over the next 18 months. By expanding engineering capabilities, Skylink will also turn what was once a cost centre into a profit driver.

The second is mergers and acquisitions. With many family-owned logistics and automotive businesses struggling with succession, Wesley sees an opening for “friendly market consolidation.” He shares that Skylink is already in discussions with several industry players, which have been constructive so far.

The third is digital transformation. Skylink APAC is modernising its IT systems, including ERP and CRM, to improve operational efficiency, facilitate fleet management and enhance customer experience.

Wesley says that for investors, this sets the tone for how Skylink has positioned itself not merely as a leasing company, but as a diversified financial and engineering solutions provider in an evergreen industry.

How investors should weigh Skylink’s opportunities

But what exactly is it that makes Skylink's business evergreen?

"Singapore’s role as a logistics and infrastructure hub ensures consistent demand for commercial vehicles," Wesley says. With Skylink’s integrated model and multiple revenue streams, it offers resilience against periodic business cycle fluctuations and market volatility.

Since starting its financing arm, its loan book has, since inception, grown from $3 million to $24 million as of 31 March 2023, and then approximately $65 million as of August 2025. Its leasing fleet has also since expanded to over 1,200 vehicles.

From Wesley’s perspective, this track record – doubling fleet size post-COVID, tripling its loan book in two years – shows both execution capability and agility in navigating industry cycles.

Skylink's revenue for FY2025 was reported at $26 million, up from $15 million in FY2024. Gross profit also increased to $6.8 million in FY2025, compared to $5.1 million in FY2024.

For Wesley, this Catalist listing creates access to new pools of capital, enabling faster scaling of its financing arm and pursuing potential accretive acquisitions. Being able to pivot, adapt, and grow in the toughest of environments differentiates Skylink APAC's value proposition and its pitch to investors.

His parents instilled in him two simple mottos, he tells us: "Knowledge is power,” and “Study hard to change your fate.”

Wesley’s leadership and ambition

Today, many of his employees have been with him since the company’s early days. He holds regular town halls where anyone can share feedback, and is proud to have built a culture that emphasises anti-politics, career growth, and collective ownership of success.

As Wesley puts it, he is no longer steering just for himself. Behind him are employees, their families, and the customers who depend on Skylink’s entire eco-system services.

With macro tailwinds driving Singapore's ongoing infrastructure projects and logistics expansion, he is taking his role seriously as "captain of the ship", keeping his eye on the next opportunity.

As the origin of the name 'Skylink' suggests – referencing a mountain range rising and connecting to the sky – there is still room for further growth and ambition.

About Skylink Holdings Limited

Skylink Holdings Limited is a one-stop customer-centric commercial vehicle specialist, with core businesses spanning vehicle leasing, hire-purchase financing, and engineering services.

The Group owns and operates one of the largest fleets of commercial vehicles in Singapore, serving a wide range of B2B customers. Through its integrated ecosystem, the Group delivers differentiated value and quality customer service throughout the lifecycle of a vehicle.

The Group is listed on the Catalist Board of the SGX-ST, following the completion of the RTO exercise of Skylink APAC Pte Ltd in September 2025.

About kopi-C: the Company brew

kopi-C is a regular column by SGX Research in collaboration with Beansprout, a MAS-licensed investment advisory platform, that features C-level executives of leading companies listed on SGX. These interviews are profiles of senior management aimed at helping investors better understand the individuals who run these corporations.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

1 comments

- Victor Tan • 24 Sep 2025 07:39 PM