Soilbuild Construction - Improving operations with multi-year visibility

By Ng Hui Min • 29 Jan 2026

Why trust Beansprout? We're licensed by the Monetary Authority of Singapore (MAS).

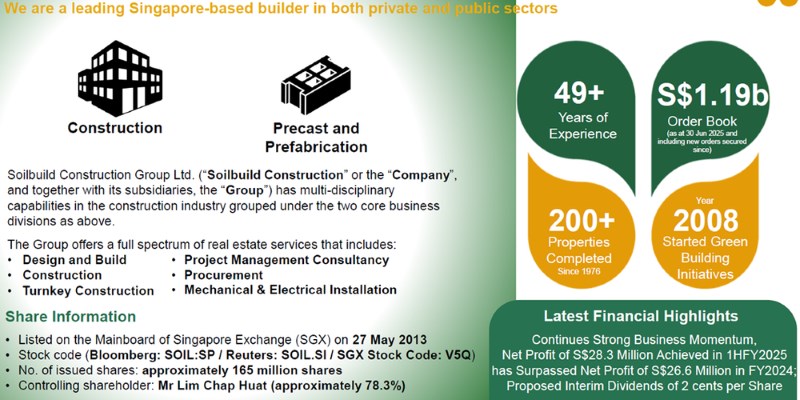

Soilbuild is a Singapore-based construction and precast manufacturing group with nearly five decades of operating history.

Established construction and precast manufacturing group in Singapore

About Soilbuild

Soilbuild Construction Group is a Singapore-based construction and precast manufacturing company with nearly five decades of operating history.

Incorporated in 1976, the Group has completed more than 200 projects across industrial buildings, business parks, logistics facilities, residential developments, conservation properties, educational institutions and churches.

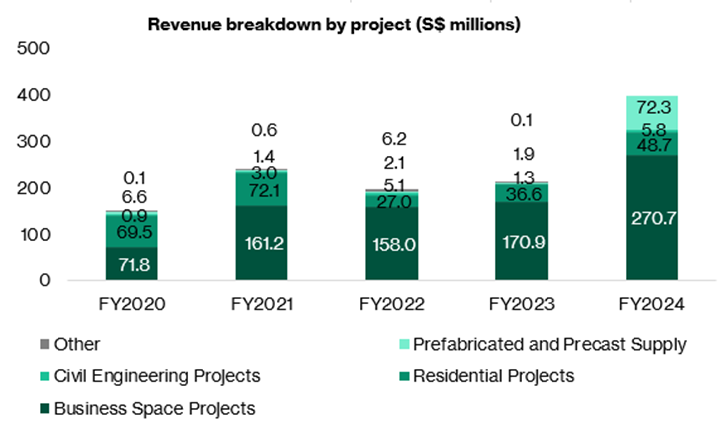

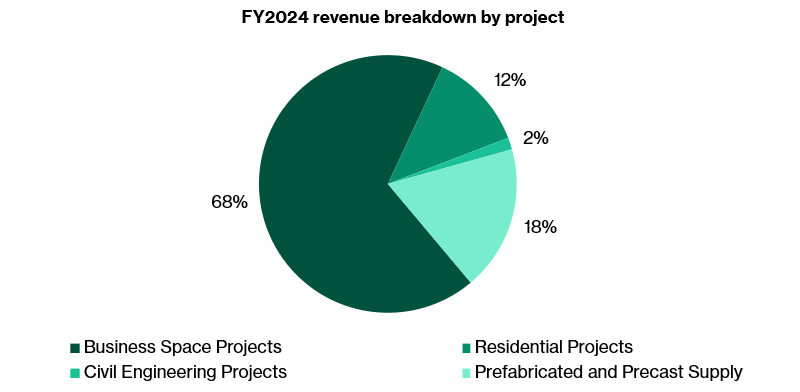

In FY2024, Soilbuild reported total revenue of S$391.8 million. Business space projects, comprising industrial, logistics and business park developments, contributed approximately S$270.7 million, or about 69% of total revenue, while residential projects accounted for S$48.7 million.

The remaining revenue was derived from civil engineering works, prefabricated and precast supply, and other project categories.

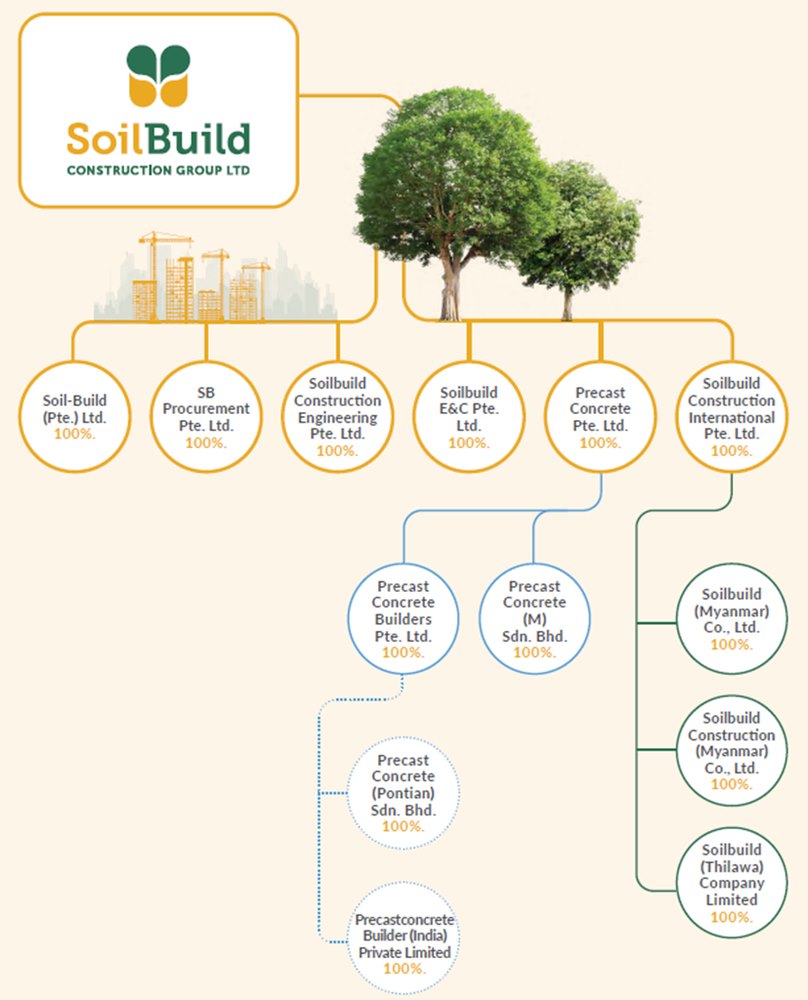

Core business structure and regulatory credentials

The Group’s principal contracting entities, Soil-Build (Pte.) Ltd and SB Procurement Pte. Ltd, hold an A1 grading under the Building and Construction Authority’s (BCA) CW01 category, enabling them to tender for public-sector general building projects of unlimited contract value, as noted in corporate disclosures.

In addition, Soil-Build (Pte.) Ltd holds an A2 grading under CW02 (Civil Engineering), which allows bidding for civil contracts of up to S$105 million.

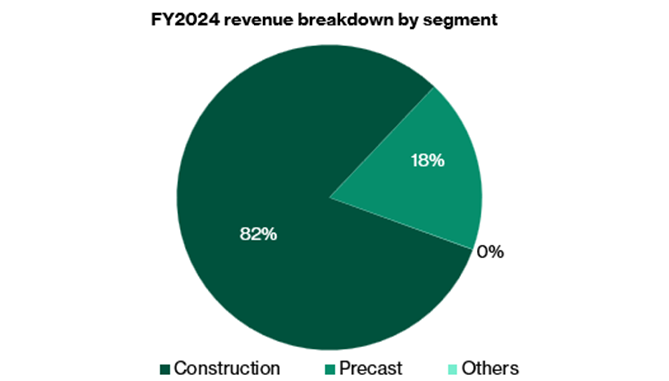

Construction as the primary revenue contributor

Within its business structure, the construction division remains the primary income generator. In FY2024, construction activities accounted for approximately 82% of total Group revenue, with the precast and prefabrication division contributing the remaining 18%.

In terms of client mix, related-party projects represented about 26.8% of FY2024 revenue (S$105.0 million), while external customers accounted for approximately 73.2% (S$286.8 million), reflecting Soilbuild’s mix of internal and third-party projects.

Precast & PPVC operations anchored by ICPH and supported by Malaysia facilities

Soilbuild’s Precast & PPVC division operates from the Integrated Construction and Prefabrication Hub (ICPH) in Singapore, which was commissioned in 2019 and built according to Design for Manufacturing and Assembly (DfMA) principles.

The facility houses automated sites for concrete circulation, hollow-core slab production, steel fabrication and stockyard operations.

Complementary manufacturing facilities in Johor, Malaysia support the production of precast building components, including Prefabricated Prefinished Volumetric Construction (PPVC) modules and other off-site manufactured elements.

In FY2024, the precast and prefabrication segment generated S$72.3 million in revenue, up from S$38.7 million in FY2023, contributing approximately 18.5% of total Group revenue.

Competitive positioning

Strong track record in complex and sustainability-focused projects

Soilbuild holds a favourable competitive position in an industry where tender outcomes are increasingly driven by a combination of price, quality, safety and sustainability rather than lowest bid alone.

Under the BCA’s Price-Quality Method (PQM) framework, public-sector construction tenders are evaluated not only on bid price but also on contractors’ track record, safety performance, environmental sustainability profile and technical proposals.

From 2024, up to 5 per cent of evaluation points for tenders will be allocated to sustainability-related considerations.

This will apply to construction projects with an estimated minimum value of $50 million and Information and Communications Technology (ICT) projects of at least about $10 million.

Soilbuild has consistently scored well on quality criteria thanks to its long track record and safety culture. Both Soil-Build (Pte.) Ltd and SB Procurement Pte. Ltd have received the Green & Gracious Builder certification for more than a decade, and Soilbuild regularly wins workplace safety and environmental awards.

These credentials, together with strong project references, enhance its scoring under the “past performance” and “safety-related attributes” components of PQM, which together can account for a mid-teens percentage of the evaluation weightage.

Soilbuild’s own sustainability initiatives, such as deploying battery energy storage systems on sites to reduce reliance on diesel generators, also boost its performance against the newer environmental sustainability metrics.

The RedLion2 positive energy logistics facility in Tampines LogisPark, Singapore, a project supported by the Singapore Economic Development Board (EDB), which Soilbuild was the main contractor of the project was recognised as the country’s first large-scale positive energy logistics building with BCA Green Mark Platinum PEB certification.

Digitalisation and technology adoption

Soilbuild’s Executive Director and CEO, Lim Han Ren, has emphasised the importance of digitalisation in the Group’s operations. He believes that the construction industry is one of the last industries to transform digitally and saw the need to digitalize both internally and externally to streamline their processes and become more efficient in what they do.

This digitalisation includes the use of Building Information Modelling (BIM) to create three-dimensional visualisations and fly-throughs for clients, improving engagement during tender presentations and execution planning. BIM models are used not only for tender visualisation but also for regular project progress meetings and safety planning.

Soilbuild also deployed technology to improve safety standards. One example is the implementation of AI-enabled CCTV systems at construction sites. These systems operate continuously and are designed to identify potential safety risks, with alerts transmitted to site personnel through mobile applications.

Integrated precast, PPVC and BIM capabilities underpin differentiation in complex industrial projects

The Group integrates design, BIM-enabled project planning and off-site manufacturing through its ICPH. BIM models are linked to precast and PPVC fabrication processes, enabling coordination between design and production. This integrated approach supports the execution of complex industrial and logistics projects.

Soilbuild has completed technically demanding projects including the DB Schenker logistics facility at Greenwich Drive, described by the Group as a large-scale logistics development with sustainability features and a contract value in excess of S$100 million, as well as the Soitec high-tech manufacturing facility at Pasir Ris.

The Group has also completed large public-sector residential projects such as the Toa Payoh HDB Neighbourhood 1 Project (Contract 27), with a disclosed contract value of approximately S$140 million.

Strong rebound from prior-year losses with rising margins and returns

Soilbuild’s financial results improved over the past two financial years following losses recorded between FY2020 and FY2022.

The Group returned to profitability in FY2023, reporting net profit after tax of S$7.3 million, compared with a net loss in FY2022.

In FY2024, profitability increased further. Revenue rose 58.4% year-on-year to S$391.8 million, while gross profit increased to S$46.5 million from S$22.1 million in FY2023. Gross margin expanded to 11.9% in FY2024, compared with 8.9% in the prior year.

Earnings before interest, tax, depreciation and amortisation (EBITDA) for FY2024 amounted to S$44.8 million, while net profit after tax increased to S$26.6 million. Return on equity was reported at 41.6% in FY2024, compared with 23.4% in FY2023.

Continued earnings growth in 1H25

For the first half of FY2025, Soilbuild reported revenue of S$272.8 million, representing a 77.3% year-on-year increase.

Net profit after tax for the period amounted to S$28.3 million, compared with S$7.4 million in 1H24. Net profit margin for 1H25 was 10.4%, up from 4.8% in the corresponding prior-year period.

During 1H25, revenue from the construction segment increased 76.1% year-on-year, while revenue from the precast and prefabrication segment increased 77.2% year-on-year.

Operating margins have improved meaningfully, with construction segment’s margin improved from 5.5% in 1H24 to 11.0% in 1H25, and precast and prefabrication segment similarly from 7.2% in 1H24 to 11.7% in 1H25, which can be largely attributed to production efficiency and operating leverage.

Balance sheet position strengthened

Soilbuild’s balance sheet position improved alongside the increase in earnings. As at 31 December 2024, total assets were S$333.0 million, with cash and cash equivalents of S$30.6 million.

As at 30 June 2025, total assets increased to S$337.2 million, while cash and cash equivalents rose to S$58.4 million.

Over the same period, total borrowings declined, and net debt decreased from approximately S$45 million at end-FY2024 to approximately S$3.4 million as at 30 June 2025 following the repayment of shareholder and bank loans.

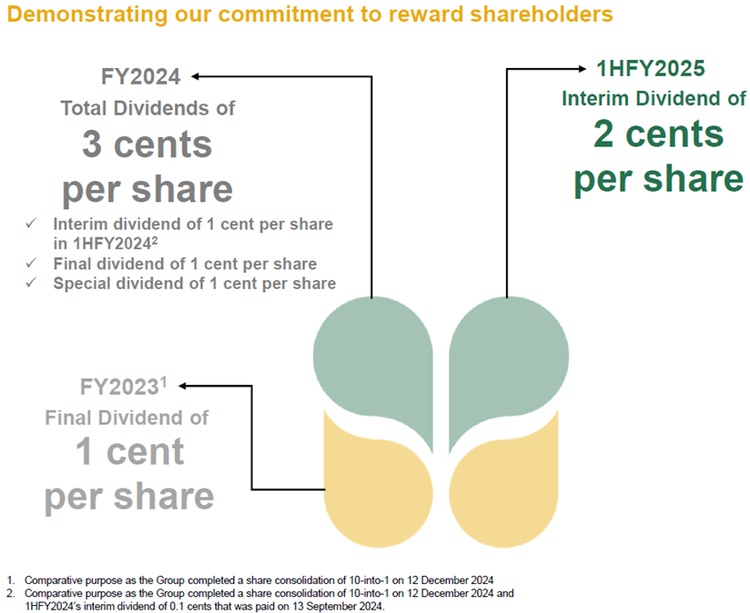

Doubled interim dividend in 1H25

Soilbuild has also resumed meaningful dividend distributions. Following the strong FY2024 results, the board proposed a final dividend of 1 cent per share and a special dividend of 1 cent per share, and in 1H25, Soilbuild doubled its interim dividend to 2 cents from 1 cent a year earlier. The management has guided for a 20% payout ratio.

Recent project deliveries and order book: visibility from S$1.2 billion of contracted work

Over the past 18 months, Soilbuild has completed several major projects across both public and private sectors. These include the DB Schenker logistics facility at Greenwich Drive, which Soilbuild has described as a large-scale logistics development incorporating sustainability features, with a contract value stated to be in excess of S$100 million. Soilbuild has also completed the Toa Payoh HDB Neighbourhood 1 Project (Contract 27), with a disclosed contract value of approximately S$140 million, as well as a high-tech manufacturing facility for Soitec at Pasir Ris.

As at 30 June 2025, Soilbuild reported an order book of approximately S$1.19 billion, representing contracted work yet to be recognised as revenue.

Ongoing projects disclosed by the Group include a multiple-user industrial development at Tampines North, a transportation hub in Ubi, an industrial development at Loyang Way, and various alteration, addition and redevelopment projects in Changi North and Tuas.

The largest project in the current order book is the PSA Supply Chain Hub @ Tuas, with a disclosed contract value of S$647.5 million, which forms a significant portion of the Group’s outstanding contracted work.

Strong construction demand outlook

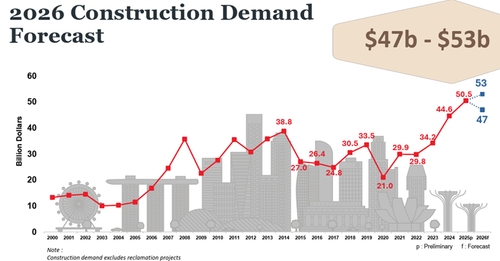

The outlook for Singapore’s construction sector is broadly positive and structurally supported. BCA estimated total construction contracts awarded increased 13.2% in 2025 to S$50.5 billion.

The Ministry of Trade and Industry reported that the construction industry expanded by 4.5% in 2024, following a 5.8% expansion in 2023, underpinned by both public and private sector demand.

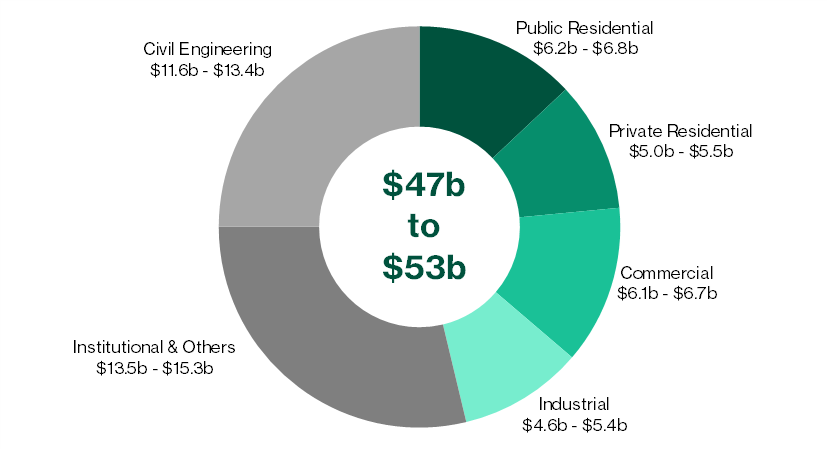

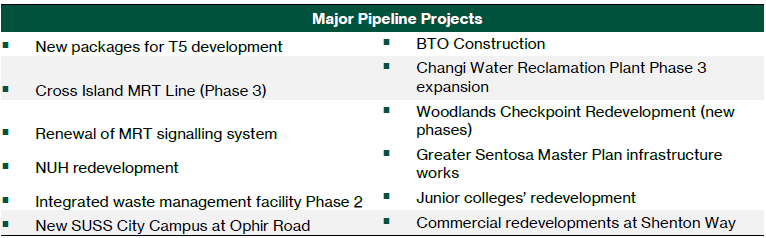

According to BCA projections, total construction demand is expected to reach between S$47 billion and S$53 billion in 2026 in nominal terms, and to average S$39–46 billion per year from 2027 to 2030 in constant prices.

Major contributors include the Changi Airport Terminal 5 development, new MRT lines and extensions, healthcare facilities and high-specification industrial buildings.

National sustainability objective target supports sustainable construction demand

Singapore has established a national sustainability objective to green at least 80% of its building stock (by gross floor area) by 2030, a key target under the Singapore Green Building Masterplan and Green Plan 2030.

This “80-80-80” framework aims not only to increase the share of green buildings to 80% by 2030 but also to drive broader industry adoption of energy-efficient and sustainable construction practices, including higher standards for new developments and retrofits.

Such policy emphasis is translating into demand for projects that meet higher environmental and energy performance thresholds, which aligns with Soilbuild’s ongoing investment in sustainability and its track record in environmentally certified projects.

This sustainability agenda creates a competitive backdrop for contractors with green execution capabilities. Soilbuild has participated in green and energy-efficient projects, for instance, serving as the main contractor for RedLion2, Singapore’s first large-scale positive energy logistics facility recognised with BCA Green Mark Platinum PEB certification, demonstrating its ability to deliver and support the government’s sustainability objectives. These credentials can positively influence tender evaluations under Singapore’s Price-Quality Method (PQM), which incorporates environmental performance as part of bid assessments.

Proxy to fast-growing Singapore’s advanced manufacturing build-out

Separately, Singapore’s push to grow its advanced manufacturing cluster, including high-spec industrial facilities and semiconductor production, provides additional structural demand for construction capacity. The expansion of these advanced manufacturing sectors, backed by government initiatives such as Manufacturing 2030 and targeted industry support measures, is expected to sustain demand for specialised construction of high-specification facilities. Soilbuild’s experience in delivering complex industrial projects (including logistics hubs and advanced manufacturing facilities) positions it as a relevant participant in this segment of the market.

Residential construction another demand tailwind

Residential construction provides an additional demand tailwind. The government has announced plans to launch about 55,000 Build-To-Order (BTO) flats between 2025 and 2027, an increase from an earlier plan of 50,000 units, reflecting sustained demand for public housing. In addition, the authorities have indicated that supply could be increased further if demand remains strong.

Initiate with Buy

We initiate coverage on Soilbuild Construction Group with a BUY rating. The Group’s strong project execution, integrated precast capabilities and record S$1.19 billion order book provide multi-year earnings visibility through FY2027. Soilbuild’s improving margins, asset-light balance sheet, and expanding precast operations position it as one of the beneficiaries of Singapore’s construction upcycle.

Soilbuild has delivered a sharp turnaround over the past two years, underpinned by a healthier project mix, rising adoption of DfMA solutions, and tight cost discipline.

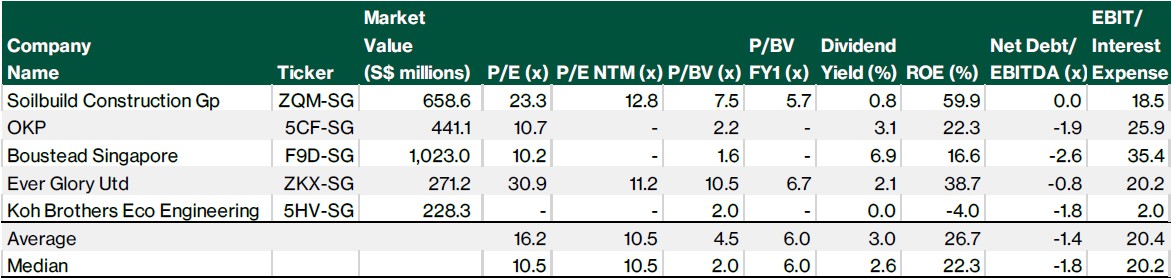

Soilbuild is trading at 23.3x 2024 P/E, above its peer average and median of 16.2x and 10.5x. Its 2024 dividend yield is 0.8%. It is trading at 7.5x P/B which is higher than its industry peers, though with a much superior ROE profile than its peers. Most of its peers are in net cash position while Soilbuild has improved its own net gearing position significantly in the last few years.

Target price of S$1.15

Our discounted cash flow (DCF) valuation yields a fair value of S$1.15 per share, implying 16.2% upside from the current price of S$0.99. The valuation is based on a 10.9% WACC, reflecting an 11.3% cost of equity (beta of 1.2, risk-free rate of 3.5% and market return of 10.0%) and a cost of debt of 4.0%, assuming a 5% debt ratio and a 20% tax rate.

The DCF also incorporates a 3.0% terminal growth rate, consistent with long-term construction sector growth, and captures Soilbuild’s improving free cash flow profile as major projects progress into higher-margin phases.

At S$1.15, this would imply 12.6x 2026 P/E and 1.6% 2026 dividend yield.

Key risks

Despite its improving fundamentals, several key risks remain for Soilbuild.

Execution risk

The foremost is project execution risk. Construction projects are inherently complex and subject to uncertainties in design changes, subcontractor performance, material costs, labour availability and site conditions. A material cost overrun or delay on a single large project could significantly impact margins and earnings, given the size of individual contracts relative to Soilbuild’s revenue base.

Contract concentration risk

Contract concentration is another risk, given that the PSA Supply Chain Hub represents a substantial share of the current order book. While PSA is a high-quality client and the project is progressing as planned, any delay, scope change or contractual dispute could affect both short-term revenue recognition and profitability.

Cyclical nature of precast demand tied to public-sector construction cycles

The precast segment, although a growth driver, is cyclical and heavily dependent on public-sector housing and infrastructure plans. A slowdown in HDB launches, delays in major public housing projects or disruptions in the broader construction pipeline could reduce precast utilisation and pressure margins.

Residual exposure to Myanmar poses geopolitical and credit risks

Finally, Soilbuild maintains some exposure to Myanmar through residential development projects such as Rosehill and 68 Residences. Soilbuild has already recognised impairments on Myanmar trade and other receivables, particularly in FY2024 when an allowance for expected credit losses of around S$4.3 million was recorded, reflecting challenging macro and political conditions. Further deterioration in Myanmar’s operating environment could lead to additional write-downs or delays in cash collection, though the absolute scale of this exposure relative to the overall Group has diminished.

Click here to download the full report.

Related links:

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in Soilbuild Construction.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments